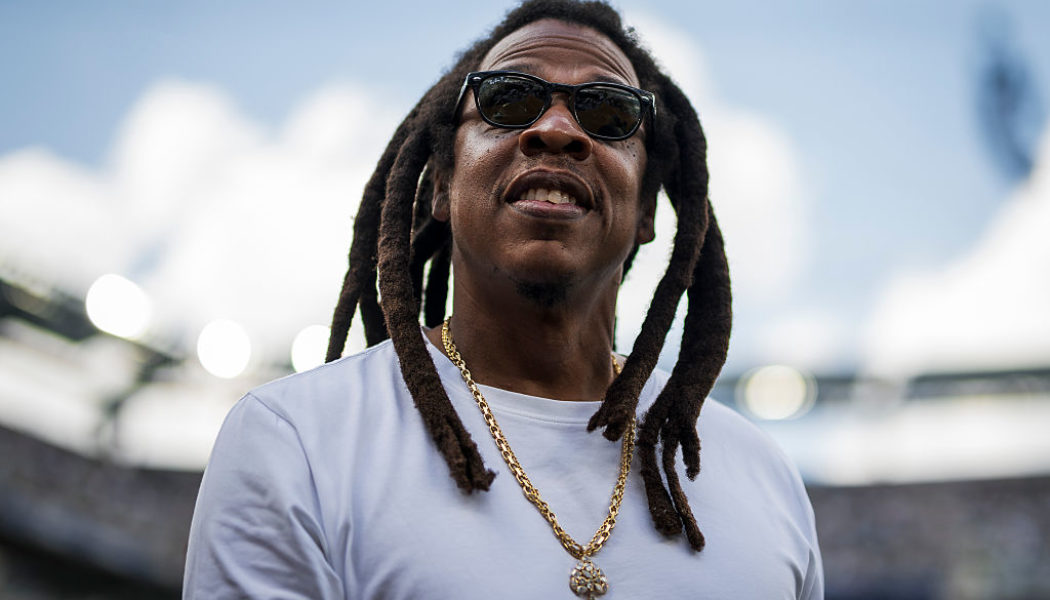

Let’s be clear…Jay-Z didn’t just make hits; he made headway. We’ve watched him turn a street story into a global business narrative, one wise decision after another. From co-founding Rocawear and selling it for big money to launching Roc Nation, which became a powerhouse entertainment and management brand, Hov has always been two moves ahead. He acquired TIDAL, reimagined artist ownership, and secured major deals with the likes of Live Nation that leveraged touring, merchandise, and publishing into long-term revenue streams. Along the way, he’s built a diverse portfolio – from luxury liquor like Armand de Brignac (Ace of Spades) to strategic stakes in companies like Uber and others – all of which pushed him past billionaire status and cemented his reputation not just as an artist, but as a cultural and financial powerhouse.

Now, Jay-Z is opening a new chapter with a $500 million investment fund aimed at K-Pop culture and lifestyle brands. Through MarcyPen Capital Partners – the investment firm created from the merger of Marcy Venture Partners and Pendulum’s investment arm – Jay-Z is partnering with South Korea’s Hanwha Asset Management to form a private equity vehicle focused on the Korean cultural wave. Announced at Abu Dhabi Finance Week, this partnership isn’t just about music. It’s about entertainment, beauty, food, fashion – the full spectrum of what’s now globally known as hallyu (the Korean Wave). The goal is to identify Korean companies with traction at home and help them scale worldwide.

K-Pop isn’t a fad – it’s power. BTS filling arenas, Blackpink breaking streaming records, Korean beauty routines reshaping global cosmetics trends – this is cultural influence turned economic force. Korean media and lifestyle exports now generate tens of billions in global revenue, second only to tech and autos out of Korea. Western private equity hasn’t moved at this scale into Asia’s cultural industries before. But Jay-Z’s fund changes that. With MarcyPen serving as the majority investor and Hanwha bringing the necessary local expertise, this isn’t just capital – it’s strategic muscle backing a cultural export that’s already proven itself.

For Hov, this fund is both a statement and a strategy. It signals that Black capital can compete globally in spaces often dominated by institutional Western money. He’s always made money where culture thrives – from streetwear to spirits, from streaming disruption to sports and entertainment – and now, he’s placing a big bet on the next world culture engine. For Korean creators and brands, this opens a pathway toward deeper global expansion, backed by someone who understands both brand building and cultural relevance. Traditional venture capital looks at metrics; Jay-Z looks at culture plus metrics and that’s a powerful combination.

Looking ahead, this Jay-Z investment could change how K-Pop and Korean cultural products are positioned on the world stage. It’s not just about distribution or marketing – it’s about ownership, equity, and narrative influence. Jay-Z’s track record shows that when he puts his name behind something, it gets serious attention and serious resources. This fund could help the next generation of Korean brands break into markets that have historically been harder to reach, while also giving Black investors and entrepreneurs a front row seat to one of the most significant cultural movements of the 21st century. The global music and lifestyle game just got a new kind of player – and it’s one built on culture, capital, and connection.