Crypto

Wazupnaija – Naija Entertainment blogs & Forums – Business – Crypto

Pro traders look for this classic pattern to spot Bitcoin price reversals

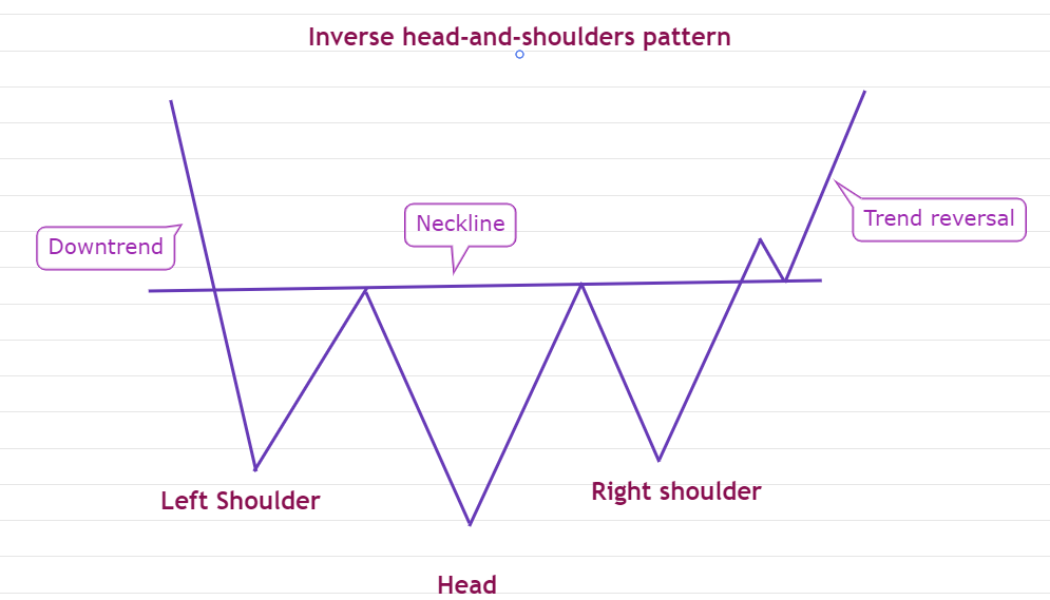

Every trader aims to buy low and sell high, but only a few are able to muster the courage to go against the herd and purchase when the downtrend reverses direction. When prices are falling, the sentiment is negative and fear is at extreme levels, but it’s at times like these that the inverse head and shoulders (IHS) pattern can appear. The (IHS) pattern is similar in construction to the regular H&S top pattern, but the formation is inverted. On completion, the (IHS) pattern signals an end of the downtrend and the start of a new uptrend. Inverse head and shoulders basics The (IHS) pattern is a reversal setup that forms after a downtrend. It has a head, a left shoulder and a right shoulder that are upside down and placed below a neckline. A breakout and close above the neckli...

3 reasons why Ethereum price might not hit $5,000 anytime soon

Ether (ETH) price has been in a downward spiral ever since the Ethereum co-founder Vitalik Buterin presented at the StartmeupHK Festival 2021. In a fireside chat session on May 27, Vitalik stated that several internal team conflicts caused the Proof-of-Stake migration to delay its launch. As reported by Cointelegraph, ‘Phase One,’ which introduces scalability through sharding, has been postponed to 2022. Furthermore, DeFi’s inherently decentralized nature might not be entirely beneficial because the sharding-style processing would need to run transactions through a relay chain. Ether price in USD at Coinbase. Source: TradingView It’s impossible to pinpoint the reason behind Ether’s sharp fall from its all-time high, but the surging gas fees certainly impacted investors’ expectations. Not o...

Bitcoin for cash: Do crypto ATMs make buying BTC easier for the mainstream?

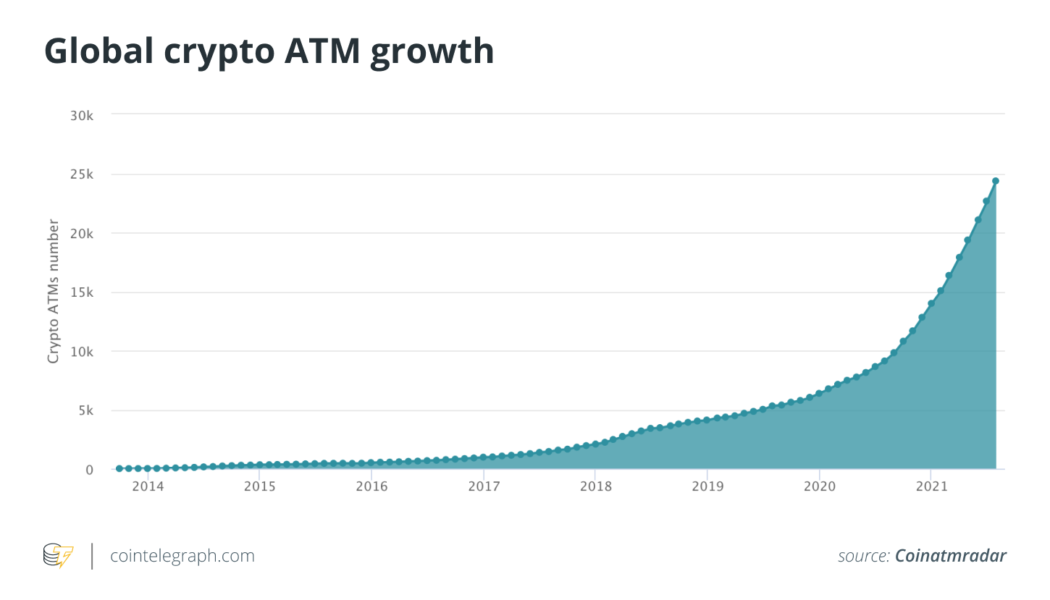

Cash may be king when it comes to purchasing Bitcoin (BTC), as recent data states that there has been a spike in crypto ATM installations during 2021, showing a 71.3% increase from Jan. 1, 2021, until the time of reporting. Specifically speaking, there are currently over 24,000 crypto ATMs located across the globe. Data further suggests that crypto ATMs are being installed at a rate of about 52.3 machines per day. While growth is clearly underway for the cryptocurrency sector, the reason behind the surge in crypto ATMs may be due to a demand for using cash to buy Bitcoin. Alona Lubovnaya, director of product operations for Bitcoin Depot — a Bitcoin ATM operator — told Cointelegraph that more people from all walks of life are becoming interested in crypto, particularly ...

If you have a Bitcoin miner, turn it on

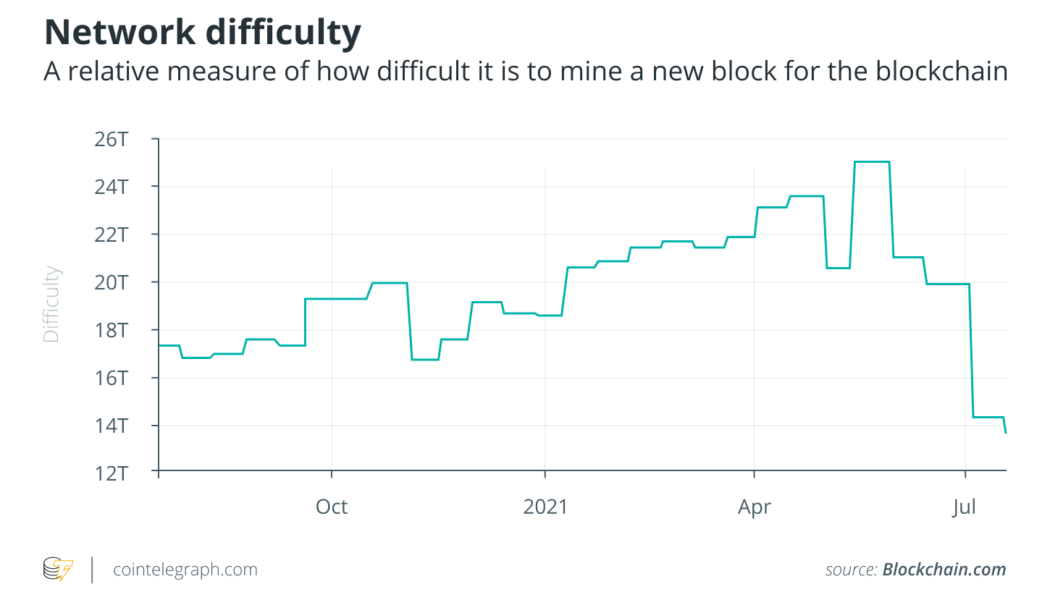

In the last few weeks, the Bitcoin (BTC) mining market has experienced a black swan event, leading to a lot of uncertainty and confusion surrounding the future of the market. This is why I felt it was right to give the public a quick update and explain why it’s a fantastic time for Bitcoin mining in the United States. Bitcoin miners are rewarded Bitcoin for securing the network and for each block they mine. As more miners participate, the difficulty rate increases and the reward for each individual miner’s security contribution decreases. And vice versa, when fewer miners are participating, the difficulty rate decreases and the reward for each miner’s contribution increases. Understanding this is key as to why this is an exciting time to get into mining. Related: A trade war misstep?...

Bitcoin ‘supercycle’ sets up Q4 BTC price top as illiquid supply hits all-time high

Bitcoin (BTC) is gearing up for a comeback which should lead it to repeat classic bull run years 2013 and 2017, analysts are arguing. As $42,400 local highs appeared on July 31, narratives around the market are flipping back to a bullish Bitcoin “supercycle.” Bulls come out for 2021 close Bitcoin has been busy repairing the impact of the China miner rout since mid May, but last week’s price advances were stronger than most anticipated Related: Bitcoin open interest mimics Q4 2020 as new report ‘cautiously optimistic’ on BTC rally Rather than suffer a serious dip, BTC price action has held onto its gains, which at the time of writing total 23% in a week. What seemed all but impossible just seven days ago is now flavor of the month among an increasing portion of the an...

German law allowing institutional funds to hold crypto comes into effect Aug. 2

Beginning on August 2, 2021, German institutional funds will be able to hold up to 20% of their assets in cryptocurrencies, possibly setting the stage for wider mainstream acceptance of Bitcoin (BTC) and other crypto assets by the nation’s pension funds. As Bloomberg reports, the new law alters fixed investment rules governing Spezialfonds, also known as special funds, which are only accessible to institutional investors such as pension funds and insurers. Spezialfonds currently manage about $2.1 trillion, or 1.8 trillion euros, worth of assets. Related: Hedge funds see the crypto market decline as an investment opportunity Tim Kreutzmann, who works for German investment fund association BVI, told Bloomberg that most funds will likely stay well below the 20% mark initially, explainin...

Ukraine central bank now officially allowed to issue digital currency

The Ukrainian government is moving forward with its central bank digital currency (CBDC) plans, as the National Bank of Ukraine (NBU) is now officially authorized to issue a digital currency. Ukrainian President Volodymyr Zelenskyy has signed a law titled On Payment Services, officially enabling the country’s central bank to issue a CBDC, the digital hryvnia, according to a Thursday announcement. The new law authorizes the NBU to set up regulatory sandboxes for testing payment services and instruments based on emerging technologies. The new legislation also requires close collaboration between the Ukrainian central bank and local startups in the payment market, taking into account the demand of the private sector, the announcement reads. Initially approved by the Ukrainian parli...

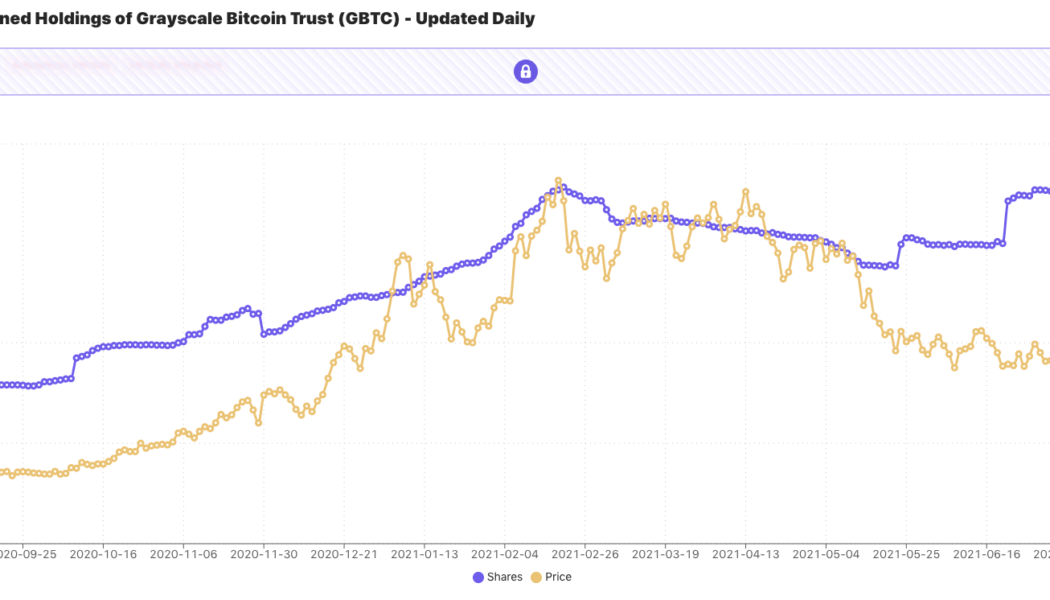

$25B investment firm adds ‘riskier’ Grayscale GBTC and ETHE for clients

Bitcoin (BTC) and Ether (ETH) exposure has come to one of the world’s biggest automated investment firms. In a blog post on July 29, Wealthfront, which has $25 billion in assets, confirmed that it had added two Grayscale funds to its suite of investment options. GBTC buzz returns The recent rise in cryptocurrency prices has kept institutional products such as Grayscale’s various funds in the spotlight. Wealthfront, an example of a so-called “robo advisor” in the investments space, will now allow its clients exposure to the Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE). “Buying cryptocurrency can feel intimidating — it takes time and effort to research all of the options, set up a wallet, and monitor an additional account. That’s why we’ve ...

Binance completes Polygon wallet integration

Binance has fully integrated the Polygon (MATIC) mainnet onto its platform, according to a press release. From now on, Binance traders can deposit and withdraw MATIC through their Binance accounts while also interacting with decentralized applications, or DApps, like Sushiswap, Balancer, Aave, and more. This integration is meant to ensure that traders can utilize said DApps cheaply and efficiently without using the existing Polygon bridge. Related: Polygon announces scalable data availability infrastructure Avail While this announcement specifically focuses on the MATIC mainnet token, Binance also intends to support ERC20, BEP2, and BEP20 MATIC associated tokens. Binance marks Polygon’s latest integration, as the network has already worked with Huobi and Coinbase Wallet, among o...

The future of DeFi is spread across multiple blockchains

Long stuck in the shadows of Bitcoin (BTC), Ethereum (ETH) finally took hold of the market in 2020 during the decentralized finance summer. Designed to recreate traditional financial systems with fewer middlemen, DeFi is now being used across lending, borrowing, and the buying and selling of tokens. The majority of these decentralized applications (DApps) are run on Ethereum, which saw activity on the network increase during 2020. This activity also trended upwards due to yield farming, also known as liquidity mining, which enables holders to generate rewards with their crypto capital. But as activity on Ethereum increased, so too did the network’s transaction fees. In May, it was reported that Ethereum gas fees were skyrocketing. It’s intuitive that engaging in DeFi is only worthwhile whe...

GoldenTree Asset Management is reportedly investing in Bitcoin

New York-based asset management firm GoldenTree has reportedly added Bitcoin to its balance sheet, though the amount of this supposed investment remains unknown. According to a Friday report from financial news outlet The Street, the firm with roughly $45 billion in assets under management has purchased some Bitcoin (BTC) but has seemingly shied away from other cryptocurrency investments. Citing two sources with knowledge of the matter, the publication reported the BTC purchase followed discussions between executives regarding hiring staffers familiar with crypto investments. Executives at the firm, including founder Steven Tananbaum and partners Deeb Salem and Joseph Naggar invested in a funding round this month for Borderless Capital, which previously helped launch an accelerator program...

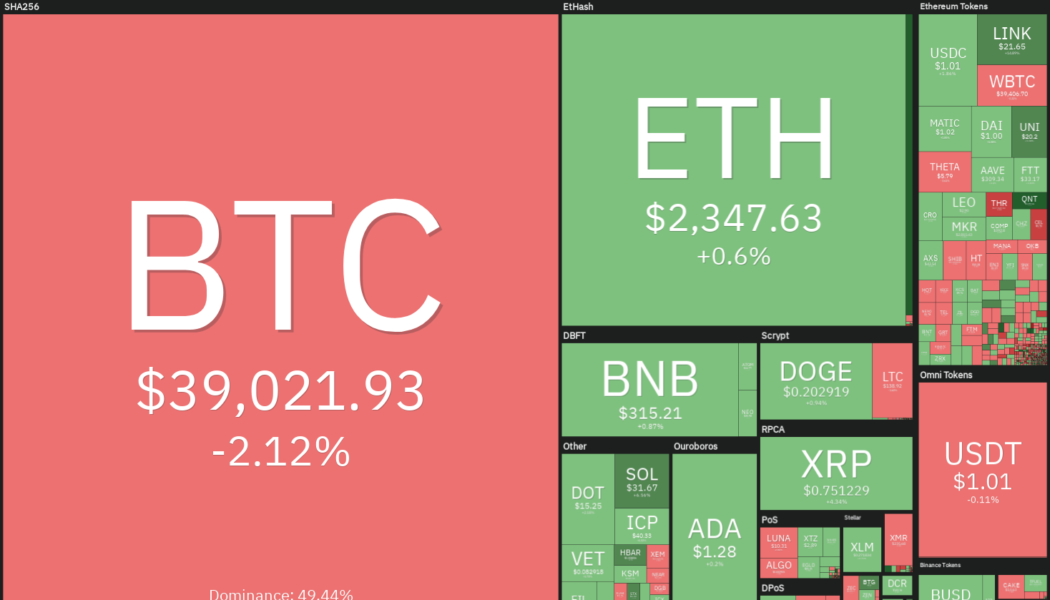

Price analysis 7/30: BTC, ETH, BNB, ADA, XRP, DOGE, DOT, UNI, BCH, LTC

Bitcoin (BTC) and most major altcoins seem to be faltering near their respective overhead resistance levels. This suggests that some investors are continuing to sell at higher levels. However, 21st Paradigm co-founder Dylan LeClair said that on-chain data shows “big transfer volumes from over-the-counter (OTC) desks over the last week.” Cointelegraph also recently highlighted a historic 57,000 BTC outflow from exchanges on July 28. Ecoinometrics also cited on-chain data to show that “whales” and “small fish” accumulated Bitcoin when the price recovered from $29,400 to over $40,800 this week. Daily cryptocurrency market performance. Source: Coin360 Institutional investors are also not to be left behind in their plans to accumulate more Bitcoin. MicroStrategy, which holds a...