3AC

3AC subpoenas issued as dispute grows over claims of Terraform dump

A federal judge overseeing Three Arrows Capital’s (3AC’s) bankruptcy proceedings has signed an order approving subpoenas to be delivered to 3AC’s former leadership, including co-founders Su Zhu and Kyle Davies. The subpoenas require the founders to give up any “recorded information, including books, documents, records, and papers” in their custody that relates to the firm’s property or financial affairs. The infamous hedge fund, worth $10 billion at its peak, filed for Chapter 15 bankruptcy on Jul. 1 with its troubles tied up in too much leverage and the collapse of Terra Luna (LUNA), known now as Terra Classic (LUNC), and its algorithmic stablecoin formerly known as TerraUSD (UST). Since then, the liquidators — advisory firm Teneo — have been trying to hunt down the firm’s assets and pin ...

Why is Bitcoin price down today?

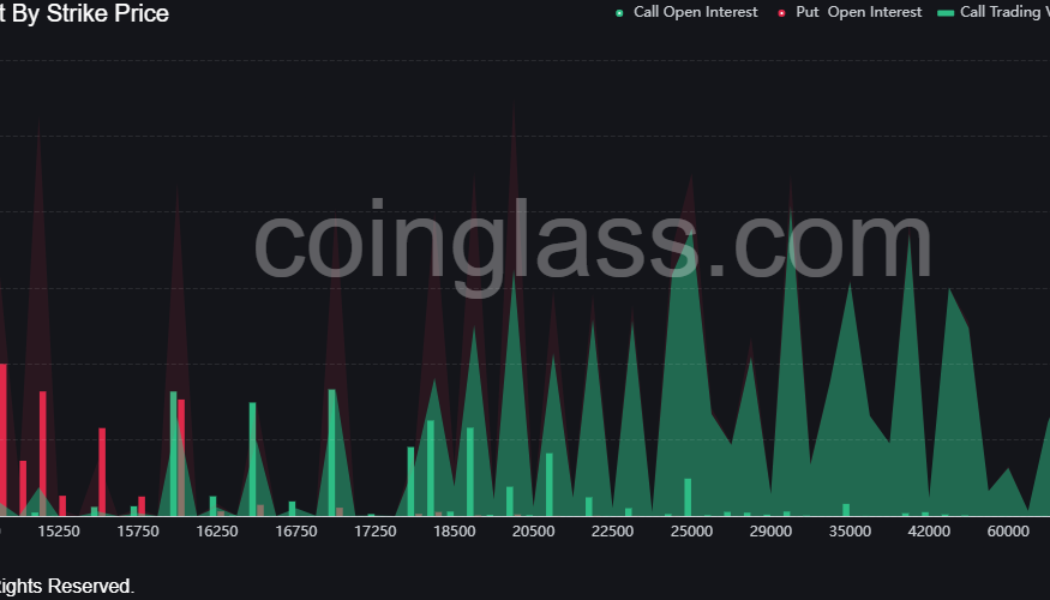

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

Voyager customers could recover 72% of frozen crypto under FTX deal

Customers of bankrupt crypto lender Voyager Digital may be able to recover 72% of the value of their accounts under a tentative deal with FTX US, according to court documents. However, United States bankruptcy judge Michael Wiles during a court hearing said the tentative sale would not be final until it receives the approval of Voyager’s creditors and he approves the bankruptcy payout plan, saying during the court hearing: “If the plan falls apart, there’s no part of this agreement that survives.” There is also the inclusion of a clause called a “fiduciary out,” which allows Voyager to cancel the deal with FTX should any offers be presented that offer a better outcome for creditors. The clause is often included in bankruptcy cases, allowing companies to consider highe...

Three Arrows Capital fund moves over 300 NFTs to a new address

Starry Night Capital, a nonfungible-token (NFT)-focused fund launched by the co-founders of the now-bankrupt hedge fund Three Arrows Capital (3AC), has moved over 300 NFTs out of its address, according to reports. The Starry Night Capital was founded last year by Su Zhu and Kyle Davies, and pseudonymous NFT collector Vincent Van Dough. At the time, the fund planned to exclusively invest in “the most desired” NFTs on the market. Blockchain data provider Nansen on Oct. 4 on Twitter noted that the NFTs were reportedly shifted from a wallet associated with the fund, including “Pepe the Frog NFT Genesis,” which sold for 1,000 Ether (ETH) in October last year, worth $3.5 million at the time. Nansen said the NFTs previously collected by Starry Night Capital are...

Tired of losing money? Here are 2 reasons why retail investors always lose

A quick flick through Twitter, any social media investing club, or investing-themed Reddit will quickly allow one to find handfuls of traders who have vastly excelled throughout a month, semester, or even a year. Believe it or not, most successful traders cherry-pick periods or use different accounts simultaneously to ensure there’s always a winning position to display. On the other hand, millions of traders blow up their portfolios and turn out empty-handed, especially when using leverage. Take, for example, the United Kingdom’s Financial Conduct Authority (FCA) which requires that brokers disclose the percentage of their accounts in the region that are unprofitably trading derivatives. According to the data, 69% to 84% of retail investors lose money. Similarly, a study by the U.S. ...

Liquidators can subpoena 3AC founders despite ‘tricky issues’ with crypto assets

A United States (U.S.) court has given liquidators permission to subpoena the founders of crypto investment firm Three Arrows Capital (3AC), including Su Zhu and Kyle Davies. According to a report by Law360 on July 12, U.S. Bankruptcy Judge Martin Glenn issued an order on Tuesday allowing the subpoenas after being told by the counsel for the liquidators that the founders’ whereabouts are unknown and there were fears they could be selling off tens of millions in assets. The counsel, Adam Goldberg, said he didn’t know the current location of Zhu or Davies, alleging the duo have not provided “meaningful cooperation” with the liquidators. Goldberg raised concerns that 3AC may be selling assets by pointing to media reports that a Singapore property worth “tens of millions” was...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

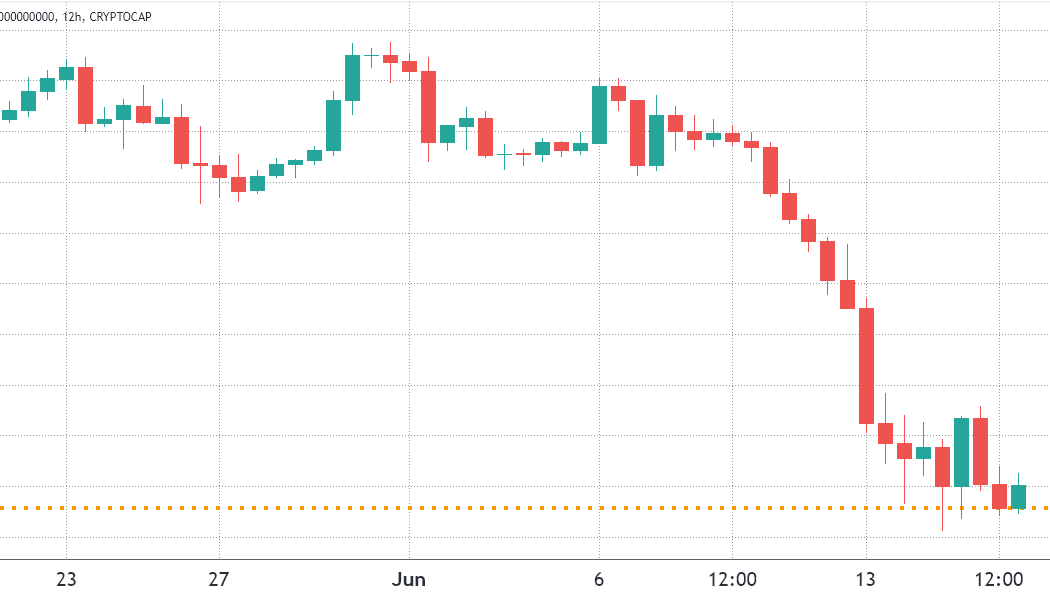

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...