bankruptcy

Arthur Hayes: Bitcoin bottomed as ‘everyone who could go bankrupt has gone bankrupt’

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, thinks the worst might be over for Bitcoin (BTC) this cycle as the “largest most irresponsible entities” have run out of BTC to sell. “Looking forward, pretty much everyone who could go bankrupt has gone bankrupt,” he said in the Dec. 11 interview with crypto advocate and podcaster Scott Melker. Hayes elaborates on his stance by explaining that when centralized lending firms (CELs) have financial troubles, they will often call in loans first, then sell BTC first because it operates as the “reserve asset of crypto” and “the most pristine asset and the most liquid.” “When you look at the balance sheet of any of these of the heroes, there’s no Bitcoin on it because what do they do, they sold...

Former top SEC crypto regulator hired by Caroline Ellison

A former top crypto regulator with the United States Securities and Exchange Commission (SEC) will represent Caroline Ellison, the ex-Alameda Research CEO, in an ongoing federal probe, according to a Dec. 10 report from Bloomberg. Ellison will be represented by Stephanie Avakian and a team of attorneys from WilmerHale. Avakain is currently chair of the Securities and Financial Services department at the law firm. At the SEC, she was a director at the Enforcement Division, where she expanded cryptocurrency oversight, bringing cases against Robinhood and Ripple Lab. According to the law firm’s website, “Ms. Avakian oversaw the Division’s approximately 1,400 professionals and staff. During her four years leading the Division, the SEC brought more than 3,000 enforcement actio...

Crypto lender Genesis has no solution yet for withdrawal halts

Crypto lending platform Genesis has informed its customers that its withdrawal freeze is likely to last “additional weeks” amid efforts to stave off a potential bankruptcy filing. In a Dec. 7 letter to its customers shared by Genesis to Cointelegraph, interim CEO Derar Islim — who took the temporary helm of the company in August — said it will be weeks for them to formulate a recovery plan that could see withdrawals reopened, stating: “At this point, we anticipate that it will take additional weeks rather than days for us to arrive at a path forward.” The letter also stated that Genesis is “working in consultation with highly experienced advisors” and are “evaluating the most effective path to preserve client assets, strengthen our liquidity, and ultimately move our business forward.” “All...

3AC subpoenas issued as dispute grows over claims of Terraform dump

A federal judge overseeing Three Arrows Capital’s (3AC’s) bankruptcy proceedings has signed an order approving subpoenas to be delivered to 3AC’s former leadership, including co-founders Su Zhu and Kyle Davies. The subpoenas require the founders to give up any “recorded information, including books, documents, records, and papers” in their custody that relates to the firm’s property or financial affairs. The infamous hedge fund, worth $10 billion at its peak, filed for Chapter 15 bankruptcy on Jul. 1 with its troubles tied up in too much leverage and the collapse of Terra Luna (LUNA), known now as Terra Classic (LUNC), and its algorithmic stablecoin formerly known as TerraUSD (UST). Since then, the liquidators — advisory firm Teneo — have been trying to hunt down the firm’s assets and pin ...

3AC bankruptcy process faces challenges amid unknown whereabouts of founders

Liquidators for Three Arrows Capital (3AC) will have to present further documents in order to be granted permission to subpoena the now-bankrupt crypto hedge fund’s founders through Twitter, according to a decision from Judge Martin Glenn during a virtual hearing for the Southern District of New York Bankruptcy Court on Dec. 2. Lawyers representing the liquidators claimed that Zhu Su and Kyle Davies, co-founders of the hedge fund, have repeatedly failed to engage with liquidators over the recent months. “A communication protocol was agreed between the liquidators and founders but has not yielded satisfactory cooperation,” according to a hearing presentation. The liquidators claimed that the founders of the company are located in Indonesia and the United Arab Emirates, where it is difficult...

Crypto trading firm Auros Global misses DeFi payment due to FTX contagion

Crypto trading firm Auros Global appears to be suffering from FTX contagion after missing a principal repayment on a 2,400 Wrapped Ether (wETH) decentralized finance (DeFi) loan. Institutional credit underwriter M11 Credit, which manages liquidity pools on Maple Finance, told its followers in a Nov. 30 Twitter thread that the Auros had missed a principal payment on the 2,400 wETH loan, which is worth in total around $3 million. M11 Credit suggests that it is always in close communication with its borrowers, particularly after events in the last month, and said Auros is experiencing a “short-term liquidity issue as a result of the FTX insolvency.” We remain committed to providing transparent updates whenever possible, and are working with Auros to provide a joint statement that provides fur...

Alameda Research withdrew $204M ahead of bankruptcy filing – Arkham Intelligence

According to analysis from blockchain firm Arkham Intelligence, over 50% of the funds transferred after Nov. 6 were in US pegged stablecoins. Alameda Research withdrew over $200 million from FTX.US before it filed for bankruptcy, according to analysis from blockchain firm Arkham Intelligence disclosed on Nov. 25. In a Twitter thread, Arkham revealed that Alameda Research, FTX’s sister company, pulled $204 million from eight different addresses of FTX US in a variety of crypto assets, the majority of them stablecoins, in the final days before the collapse. Arkham analysed flows from FTX US in the final few days before the collapse, finding that Alameda withdrew the most funds, at $204M. Below is a diagram of withdrawals to Arkham-identified entities from FTX US. n.b. this thread rega...

American regulators to investigate Genesis and other crypto firms

Cryptocurrency lending firm Genesis Global Capital and other crypto firms are under investigation by securities regulators in the United States, according to reports on Nov. 25. Joseph Borg, director of the Alabama Securities Commission, confirmed that its state and several other states are participating in inquiries regarding Genesis’ alleged ties to retail investors, including if Genesis and other crypto firms might have violated securities laws, Barron’s reported. It is still unclear what other companies are being investigated. Borg noted that the investigation focuses on whether Genesis and other crypto companies influenced investors on crypto-related securities without obtaining the proper registration. The investigation is another chapter in the Genesis saga since the company r...

CrossTower eyeing further crypto acquisitions outside of Voyager bid

Crypto exchange CrossTower Inc., which is currently bidding for the assets of Voyager Digital, is reportedly window shopping for other crypto company acquisitions. In a Nov. 24 Bloomberg report, CrossTower CEO Kapil Rathi revealed that the company is looking to pick up firms with a “good set of customers” and a “good balance sheet” despite the current bear market, stating: “We’re in a great place to either acquire entities who have a good set of customers with them and a good balance sheet […] so we are openly looking at different types of companies from an organic growth perspective.” In September, CrossTower was one of the companies reported to be competing to acquire the assets of bankrupt crypto lender Voyager Digital, along with FTX and Binance. FTX Trading eventually...

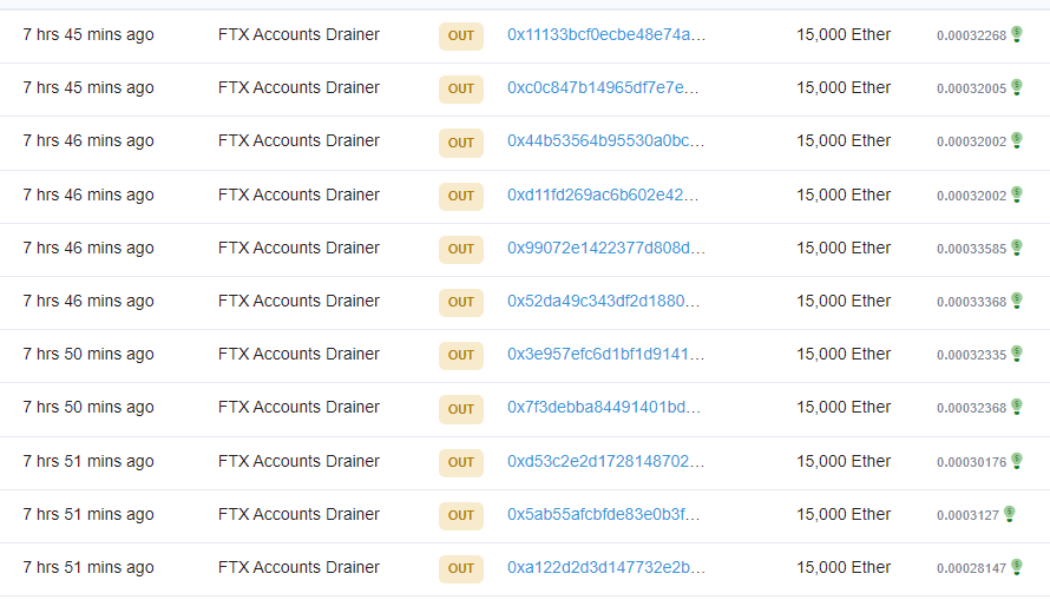

On the move: FTX hacker splits nearly $200M in ETH across 12 wallets

The hacker behind the theft of more than $447 million of crypto from the crypto exchange FTX has been again spotted moving their ill-gotten funds. According to Etherscan data, between 4:11 to 4:17 pm UTC on November 21, the attacker moved a total of 180,000 Ether (ETH) across 12 newly created wallets — each receiving 15,000 ETH. The total amount moved totaled $199.3 million at current prices. Recent transactions from wallet labeled “FTX Accounts Drainer” — Source: Etherscan At the time of publication, the ETH has not moved from any of the 12 wallets. Some in the crypto community suggest the attacker may be planning to subdivide it into smaller and smaller amounts in order to confuse investigators, a process known as “peel chaining,” or they may be planning to use a mixing...

Genesis denies ‘imminent’ plans to file for bankruptcy

Cryptocurrency lending company Genesis has refuted speculation that it is planning an “imminent” bankruptcy filing should it fail to cover a $1 billion shortfall caused by the fall of crypto exchange FTX. The firm has reportedly faced difficulties raising money for its lending unit and told investors it would have to file for bankruptcy, according to a Nov. 21 Bloomberg report citing people familiar with the matter. A spokesperson for Genesis told Cointelegraph that there were no plans to file for bankruptcy “imminently” and that it continued to have “constructive” discussions with creditors. “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. G...