Bitcoin

Aussie asset manager to offer crypto ETF using unique license variation

Australian asset manager Monochrome Asset Management has landed the country’s first Australian financial services license (AFSL) for a spot crypto exchange-traded fund (ETF). Speaking to Cointelegraph, Jeff Yew, CEO of Monochrome Asset Management, said the AFSL approval is significant, as until this point, approved crypto ETFs in Australia only operate under general financial asset authorization and only indirectly hold crypto-assets. Yew noted that Monochrome’s crypto ETFs, on the other hand, will directly hold the underlying crypto-assets and is specifically authorized by the Australian Securities & Investments Commission (ASIC) to do so. The Monochrome executive said the approval represents a significant step forward for both the advice industry and retail investors: “We see c...

EOS price jumps 20% for biggest gain in 15 months — What’s fueling the uptrend?

EOS rose approximately 20% to reach $1.66 on Aug. 17 and was on track to log its best daily performance since May 2021. Initially, the EOS rally came in the wake of its positive correlation with top-ranking cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which gained over 2% and 3.75%, respectively. But, the upside move was also driven by a flurry of uplifting updates emerging from the EOS ecosystem. EOS/USD daily price chart. Source: TradingView EOS incentive program launch On Aug. 14, the EOS Network Foundation (ENF), a nonprofit organization that oversees the growth and development of the EOS blockchain, opened registrations for its upcoming Yield+ incentive program. The Yield+ is a liquidity incentive and reward program to attract decentralized finance (DeFi) application...

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

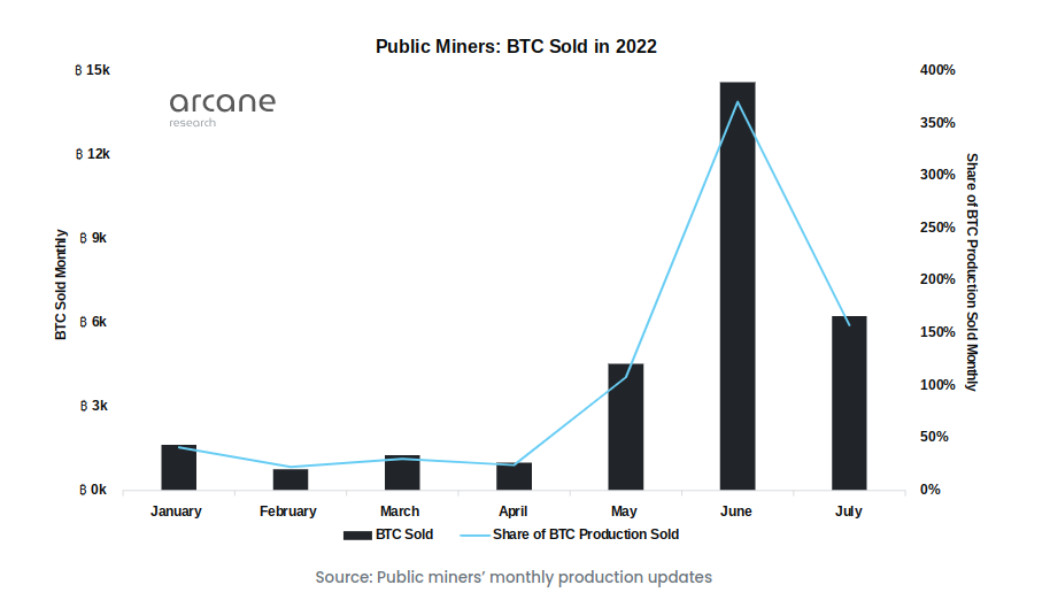

Bitcoin miners hodl 27% less BTC after 3 months of major selling

According to a fresh prediction from crypto analysis firm Arcane Research, miners will continue to sell more BTC than they earn. Miners sold nearly 30% of record BTC stash since May The trip to $25,000 this month decreased pressure on a Bitcoin mining sector which has struggled throughout 2022. At one point, fears abounded that miners’ production cost was far higher than the Bitcoin spot price, and that heavy sales would result in order for miners to stay in business. Worse still, many may have to retire altogether due to their activities no longer being financially viable. Data from the period since May appeared to confirm that major upheaval was taking place. As Arcane notes, one public miner alone — Core Scientific — sold around 12,000 BTC in the period from May to July. While the trend...

Price analysis 8/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) has been witnessing a tough battle between the bulls and the bears near the $25,000 level. A clear winner may not emerge in the short term due to a lack of a catalyst and because there is no major macroeconomic data scheduled for this week in the United States. Data points from Asia or Europe may increase volatility, but they are unlikely to start a new directional move. Anthony Scaramucci, founder and managing partner of Skybridge Capital, in an interview with CNBC, advised investors to ride out the current uncertainty in cryptocurrencies and “stay patient and stay long term.” He expects Bitcoin to reward investors immensely with a sharp uptrend over the next six years. Daily cryptocurrency market performance. Source: Coin360 Along with the focus on Bitcoin, investors are al...

Could Bitcoin Ever Hit a New All-Time High?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Top 5 cryptocurrencies to watch this week: BTC, ADA, UNI, LINK, CHZ

The S&P 500 rose for the fourth successive week as investors cheered on signs that inflation may have peaked. Bitcoin (BTC) and select altcoins also extended their recovery, suggesting that investors are increasing their exposure to risk assets. A similar trend has played out in the cryptocurrency markets. Altcoins, led by Ether (ETH), have outperformed Bitcoin after clarity on Ethereum’s Merge, according to analysts at Glassnode. Crypto market data daily view. Source: Coin360 However, trading firm QCP Capital is cautious about the momentum in the altcoin market. They highlighted that the open interest on Ether options had surged to $8 billion, exceeding Bitcoin option OI which was at $5 billion. Glassnode suggested that traders have been booking profits on the spread between their spo...

Bitcoin hits $25K as bearish voices call BTC price ‘double top’

Bitcoin (BTC) spiked through $25,000 for the first time in months on Aug. 14, but traders refused to take any chances on a bull run. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Weekend produces brief $25,000 tap for BTC Data from Cointelegraph Markets Pro and TradingView tracked a sudden run-up on BTC/USD, which hit $25,050 on Bitstamp in a $350 hourly candle. The move took the pair to a new personal best since June 13, erasing more of the losses seen that day in what remains a significant BTC price correction. Analyzing the market setup, however, familiar bearish tones remained. For popular Twitter account Il Capo of Crypto, the latest highs appeared to provide the last piece of the puzzle before a new downtrend set in. Il Capo had previously called for a peak o...

Here are Bitcoin price levels to watch as BTC dips 5% from highs

Bitcoin (BTC) headed lower on Aug. 12 as a broadly expected comedown from two-month highs began to take shape. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 200-week moving average becomes pivot Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $23,615 on Bitstamp prior to the day’s Wall Street open, marking 24-hour losses of around 5.2%. The pair had seen its highest levels since June 13 as enthusiasm over declining United States inflation combined with news that the world’s largest asset manager, BlackRock, was launching a Bitcoin private fund. While some commentators hoped for Bitcoin to tackle resistance closer to $30,000 as a result, others remained cautious, with suspicions that a fresh downtrend could ensue remaining. Target...

Countries where Bitcoin (BTC) is legal

Typically there are macroeconomic factors that a country is looking to manage through the adoption of a currency as legal tender. In order to make Bitcoin legal tender, these factors should coincide with visionary leadership. Despite that, central banks are getting into digital currencies. There are countries with more fundamental problems that just a digital version of a fiat currency may not solve. For instance, countries like Argentina and Venezuela have suffered from hyperinflation for years and can do with a form of currency that derives value from much beyond their own economies. There are also countries like El Salvador, Panama, Guatemala and Honduras, where a big percentage of the GDP is contributed by remittances. This paves the way for a form of value exchange that is not restric...

Ethereum hits 8-month highs in BTC as money heads for ‘riskier’ altcoins

Ether (ETH) is worth more in Bitcoin (BTC) than at any time since the start of the year amid renewed appetite for altcoins. ETH/BTC 1-day candle chart (Binance). Source: TradingView Altcoin market cap returns to $700 billio Data from Cointelegraph Markets Pro and TradingView confirms that ETH/BTC has cleared key resistance to pass 0.08 BTC on Aug. 13. The move is impressive for largest altcoin Ethereum, as the area around 0.075 represented a troublesome sell zone which had previously kept bulls in check for since January. At the time of writing, ETH/BTC is working to retain the newly-won level, as traders query how long its strength might last. As Cointelegraph reported earlier, ETH/USD passed $2,000 overnight, a significant psychological boundary in itself unseen since May. Not for l...