Bitcoin

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

Bitcoin drops below $21.8K realized price as FOMC spooks markets

Bitcoin (BTC) stuck to its realized price just below $22,000 on July 25 as Wall Street opened with a flat performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin gives up more key levels Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it consolidated after falling from $23,000 overnight. The pair echoed equities in cool trading prior to the July 27 United States Federal Reserve decision on interest rates. Analysts were expecting several days of volatility, and despite buyer interest in Bitcoin being strong below spot price, everything could still change. No guarantee any support holds after Wednesday’s #FED announcement, but for now #FireCharts shows a ladder of #Bitcoin bids around these next technical support levels. https://t.co/Ng2R...

Bitcoin heads into FOMC day on 24-hour highs amid concern over $24.3K top

Bitcoin (BTC) attempted to claw back losses on July 27 as a macro day of reckoning arrived for risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analysis: $24,300 resistance “not a good sign” Data from Cointelegraph Markets Pro and TradingView confirmed a 24-hour high for BTC/USD prior to the Wall Street open on July 27. The pair had sunk below $21,000 in the first portion of the week, heightening nervousness among traders already wary of potential headwinds from the United States Federal Reserve. Likely chop for equities going into FOMC which expected $BTC and crypto chop around also today pic.twitter.com/GDj0GwlDXy — Rager (@Rager) July 26, 2022 July 27 is set to reveal the Federal Open Markets Committee‘s (FOMC) next base rate hike, expectations flitting between 7...

The Latest Trends of Bitcoin Trading in Morocco

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Crypto user who lost $163M in Bitcoin wants to deploy robot search party — Report

James Howells, a British man who mistakenly discarded a hard drive containing roughly 7,500 Bitcoin (BTC) in 2013, has reportedly started looking at having robots and humans work together to retrieve his crypto from a local landfill. According to a Sunday report from Business Insider, Howells has pitched an $11-million idea to locate and recover the lost hard drive, which may be surrounded by up to roughly 110,000 tons of garbage. Backed by a few venture capitalists, the proposal involved people, robot dogs and other machines picking up and sorting through the landfill’s trash for up to three years until the lost Bitcoin is found, while another version of Howells’ plan would cost $6 million and take 18 months. Many crypto users recognize Howells’ actions as a telltale story of the importan...

3 signs Bitcoin price is forming a potential ‘macro bottom’

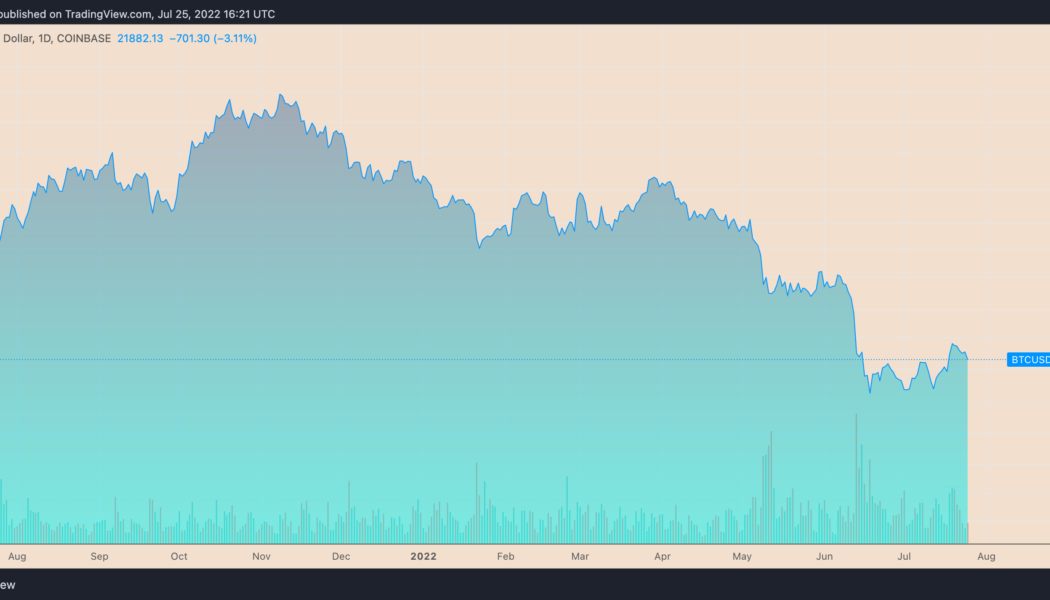

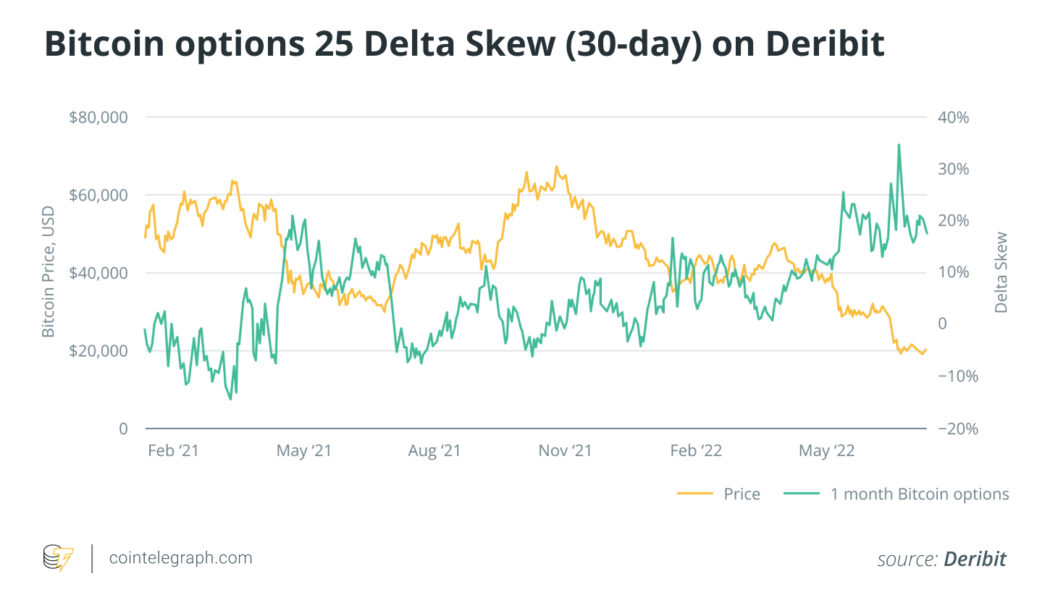

Bitcoin (BTC) could be in the process of bottoming after gaining 25%, based on several market signals. BTC’s price has rallied roughly 25% after dropping to around $17,500 on June 18. The upside retrace came after a 75% correction when measured from its November 2021 high of $69,000. BTC/USD daily price chart. Source: TradingView The recovery seems modest, however, and carries bearish continuation risks due to prevailing macroeconomic headwinds (rate hike, inflation, etc.) and the collapse of many high-profile crypto firms such as Three Arrows Capital, Terra and others. But some widely tracked indicators paint a different scenario, suggesting that Bitcoin’s downside prospects from current price levels are minimal. That big “oversold” bounce The...

The battle between crypto bulls and bears shows hope for the future

The blockchain space is seeing some areas of strength despite the perceived downturn in the market. The perpetual futures funding rates for Bitcoin (BTC) and Ether (ETH) have flipped back to positive on major exchanges, which shows bullish sentiment among derivatives traders. In addition, Bitcoin started trading below its cost basis, which has marked previous areas of market bottoms. In contrast, June saw decentralized finance (DeFi) experience a 33% decrease in total value locked and crypto stocks provide a -42.7% average month-over-month return. There is an ongoing battle between bullish and bearish sentiments in different areas of the market. To help cryptocurrency traders maneuver through the battlefield, Cointelegraph Research recently launched its monthly “Investor Insights Rep...

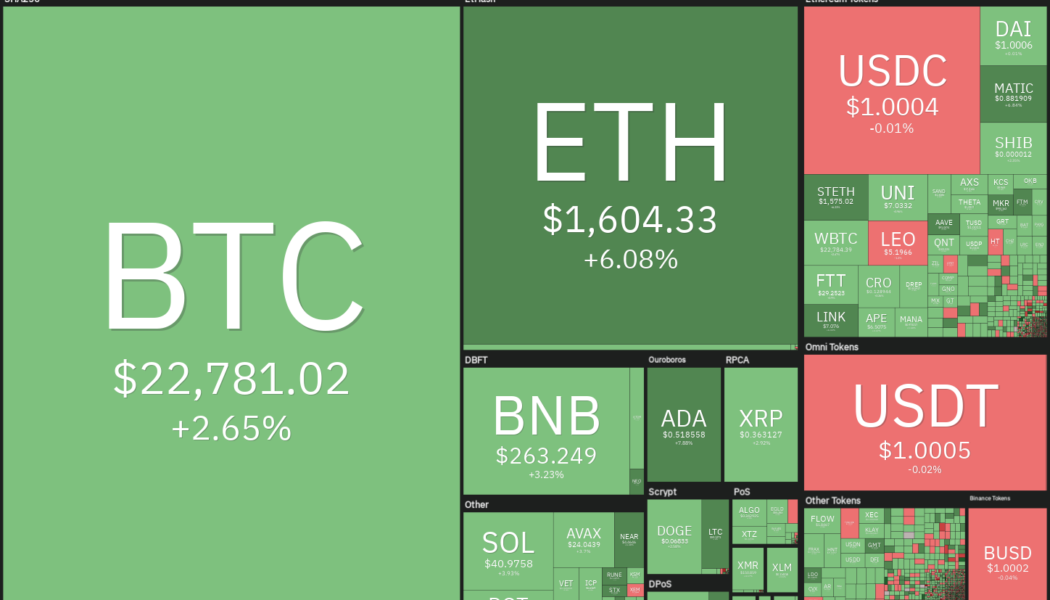

Price analysis 7/25: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) and most major altcoins are witnessing profit-booking on July 25 as the bulls scale back their positions before the Federal Open Market Committee meeting on July 26 through July 27. This indicates that the sentiment remains fragile and that bulls are not confident about carrying long positions into the event. Several analysts have retained their bearish view after Bitcoin failed to sustain above the 200-week moving average at $22,780. CryptoQuant contributor Venturefounder expects the selling to resume and Bitcoin to fall as low as $14,000 before a macro bottom is confirmed. Daily cryptocurrency market performance. Source: Coin360 The institutional investors seem to be absent from the markets and the recovery is being driven by the retail investors. Data from on-chain analyti...

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

The bulls are attempting to achieve a strong weekly close for Bitcoin (BTC), while the bears are attempting to regain their advantage. Analysts are closely watching the 200-week moving average which is at $22,705 and BTC’s current setup suggests that a decisive move is imminent. Many analysts expect a weekly close above the 200-week MA to attract further buying but a break below it could signal that bears are back in the game. Although the short-term picture looks uncertain, analyst Caleb Franzen said that Bitcoin has been in an accumulation zone since May. Crypto market data daily view. Source: Coin360 Meanwhile, on-chain analytics firm CryptoQuant highlighted increasing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on July 22. Usually, outflows fr...

Bitcoin must close above $21.9K to avoid fresh BTC price crash — trader

Bitcoin (BTC) found strength at $22,000 into July 24 with bulls still aiming for a solid green weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Classic levels for end-of-week price focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD halting a weekend drop at $21,900 to return towards the $23,000 on the day. The pair held a trading range closely focused on key long-term trendlines, which analysts had previously described as essential to reclaim. These included the 50-day and 200-week moving averages (MAs), the latter particularly important as support during bear markets but which had acted as resistance since May. “Bullish that we perfectly held the 13d ema + horizontal 21.9k,” popular Twitter trading account CryptoMellany argued in part of her ...

Bitcoin wobbles on Wall Street open as Ethereum hits $1.6K in 6-week high

Bitcoin (BTC) took a step back as Wall Street trading began on July 22 after recovering most of its previous losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls fail to sustain assault on multi-week high Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD encountering fresh resistance near $24,000. The pair had spent the past 24 hours slowly clawing back lost ground after news that Tesla had sold most of its BTC holdings. With the pre-announcement high of $24,280 still in force, bulls saw something of a setback as Wall Street opened on the day, with BTC/USD losing around $400. Analyzing the current order book structure on major exchange Binance, on-chain monitoring resource Material Indicators warned that the overall bear market structure re...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...