Bitcoin

Ethereum price ‘cup and handle’ pattern hints at potential breakout versus Bitcoin

Ethereum’s native token Ether (ETH) has rebounded 40% against Bitcoin (BTC) after bottoming out locally at 0.049 on June 13. Now, the ETH/BTC pair is at two-month highs and can extend its rally in the coming weeks, according to a classic technical pattern. ETH paints cup and handle pattern Specifically, ETH/BTC has been forming a “cup and handle” on its lower-timeframe charts since July 18. A cup and handle setup typically appears when the price falls and then rebounds in what appears to be a U-shaped recovery, which looks like a “cup.” Meanwhile, the recovery leads to a pullback move, wherein the price trends lower inside a descending channel called the “handle.” The pattern resolves after the price rallies to an approximately equal size to ...

Bitcoin traders eye levels to hold as ‘decision time’ looms for BTC price

Bitcoin (BTC) recovered above $23,000 into July 22 as attention increasingly focused on the upcoming weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price needs to preserve at least $22,400 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD finding renewed strength after briefly dipping towards $22,000. The pair traded in a critical zone for bulls on the day, with the 50-day and 200-week moving averages (MAs) still yet to flip from resistance to support. Analysts were holding out for the weekly candle close to determine the strength of Bitcoin’s latest uptrend which at one point delivered weekly gains of up to 25%. “To perform a reclaim of the 200-week MA as support, $BTC needs to Weekly Close above $22800,” popular trader and analyst Rekt Capi...

Price analysis 7/20: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) briefly extended its recovery above $24,000 and the altcoins continued to make smart gains on July 20, but the bullish momentum of the week experienced a brief setback after Tesla’s earnings report showed the company had sold 75% of its BTC position. Although the sharp breakout of this week is a positive sign, analysts were quick to point out that a sustained recovery depends on a strong performance from Wall Street. Analyst Venturefounder pointed out that the rally was largely macro-driven and Bitcoin’s correlation with NASDAQ remained at a historical high of 91%. Bitcoin’s sharp rally in the past few days has awakened hibernating bulls who are dishing out lofty targets. Analyst TechDev projected a target of $120,000 in 2023, while Galaxy Digital CEO Mike Novogratz tol...

US Justice Department seized $500K in fiat and crypto from hackers connected to DPRK government

The United States Department of Justice has seized and returned roughly $500,000 in fiat and crypto from a hacking group tied to the North Korean government, which included two crypto payments made by U.S. health care providers. In a Tuesday announcement, the Justice Department said in conjunction with the FBI it had investigated a $100,000 ransomware payment in Bitcoin (BTC) from a Kansas hospital to a North Korean hacking group in order to regain access to its systems, as well as a $120,000 BTC payment from a medical provider in Colorado to one of the wallets connected to the aforementioned attack. In May, the FBI filed a seizure warrant for funds from the two ransom attacks and others laundered through China, which the Justice Department reported as worth roughly $500,000 total. “These ...

Bitcoin lurks by $22K as US dollar falls from peak, Ethereum gains 20%

Bitcoin (BTC) hugged $22,000 on July 19 as macro conditions slowly turned to favor risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto rise as dollar weakens Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cooling volatility immediately below the crucial 200-week moving average (WMA). The Wall Street open saw further gains for United States equities in the face of a declining U.S. dollar, which extended its retracement after hitting its latest two-decade peak. The U.S. dollar index (DXY) stood at around 106.5 at the time of writing, down 2.6% from the high seen July 14. For Bitcoin analysts, it was thus a case of wait and see as markets bided their time between buy and sell levels. $BTC / $USD – Update These are the op...

100X Bitcoin energy use would mean ‘absurd’ $20M BTC price — developer

A new contributor to the Bitcoin (BTC) energy debate says that 1 BTC would have to cost $20 million to use 100 times its current energy demands. In a Twitter debate on July 18, Sjors Provoost, a Bitcoin developer and author of “Bitcoin: A Work in Progress,” cast doubt on the largest cryptocurrency’s future energy use. Bitcoin could survive on “waste energy breadcrumbs” How much energy Bitcoin uses to survive has become a topic of friction which has gone from within the industry to global government. Throughout the process, Bitcoin proponents have complained that a combination of bias and lack of understanding of network principles are leading those in power to make incorrect conclusions about how and why Bitcoin uses the energy it does. While critics argue that Bitcoin must red...

Price analysis 7/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

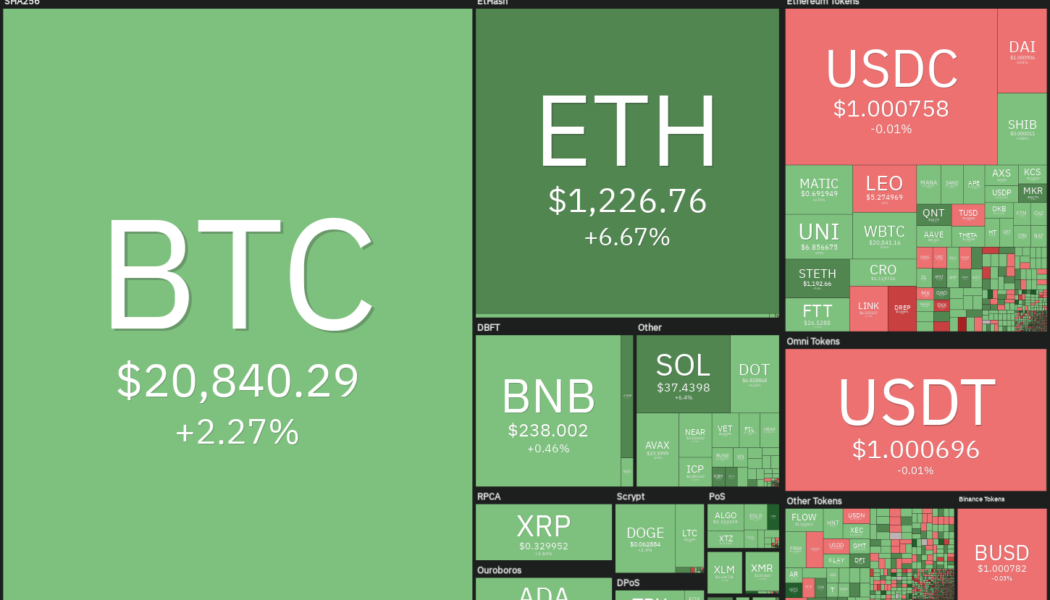

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on July 18, indicating that bulls are gradually returning to the cryptocurrency markets. This pushed the total crypto market capitalization above $1 trillion for the first time since June 13, raising hopes that the worst of the bear market may be behind us. In another positive sign, more than 80% of the total Bitcoin supply denominated in the United States dollar has been dormant for at least three months, according to crypto intelligence firm Glassnode. During previous bear markets, such an occurrence preceded the end of the bear phase. Daily cryptocurrency market performance. Source: Coin360 However, a report by Grayscale Investments voices a different opinion. It suggests that the current bear market in Bitcoin started...

Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The recovery in the cryptocurrency markets is being led by Bitcoin (BTC), which has risen above the $21,000 level. However, BlockTrends analyst Caue Oliveira said that on-chain data shows a decline in “whale activity” since the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse. A survey conducted in China shows that most participants believe that Bitcoin could fall much further. About 40% of the participants said they would buy Bitcoin if the price dropped to $10,000. Only 8% of the voters showed interest in buying Bitcoin if it drops to $18,000. Daily cryptocurrency market performance. Source: Coin360 Millionaire investor Kevin O’Leary told Cointelegraph that crypto markets are likely to witness “massive volatility” and en...

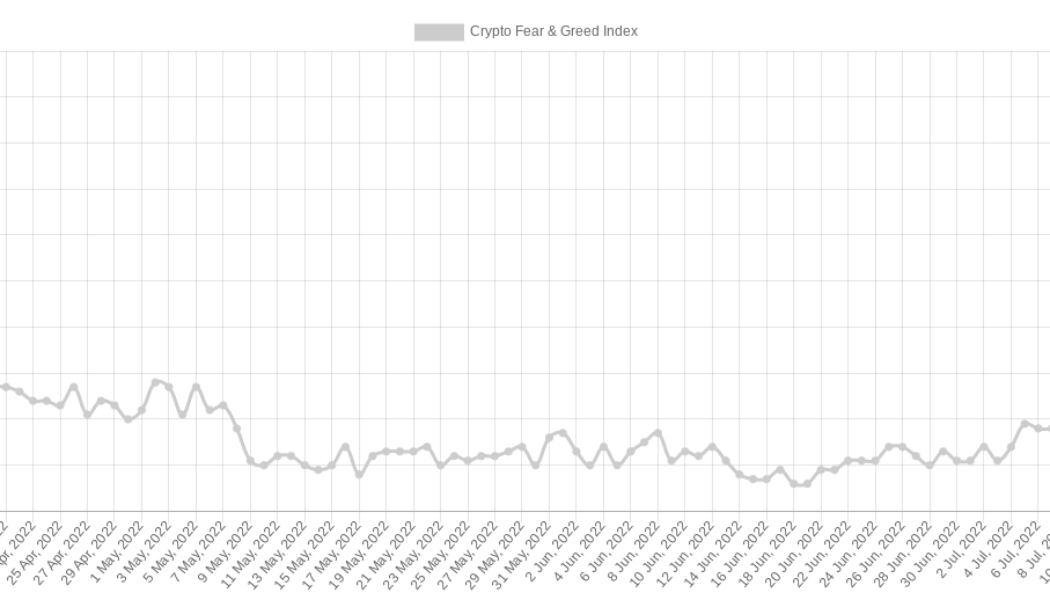

Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

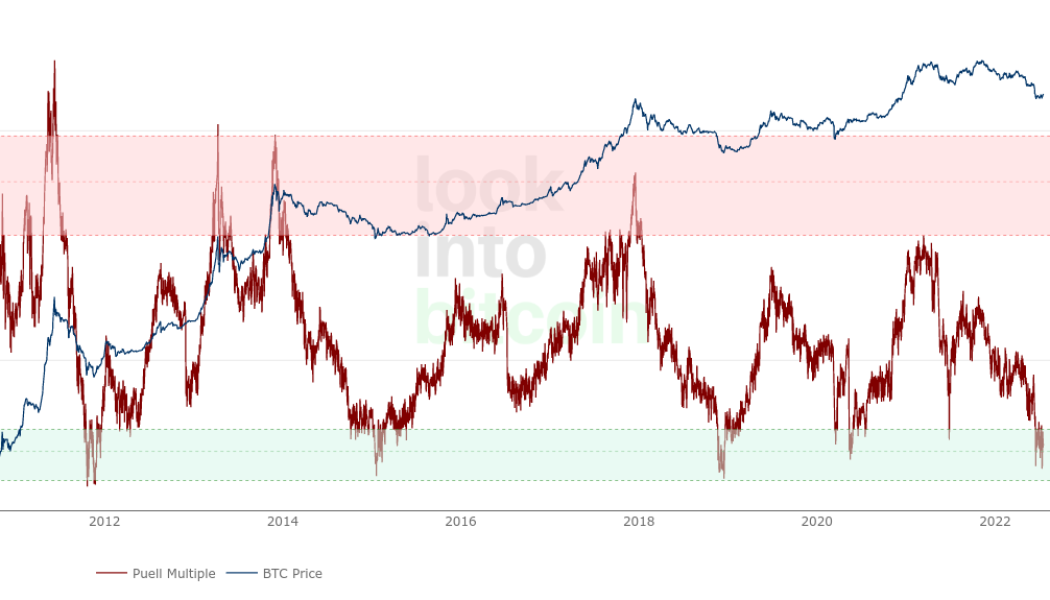

The United States equities markets recovered from their intra-week lows last week, suggesting demand exists at lower levels. On similar lines, Bitcoin (BTC) also recovered from $18,910 last week, indicating that traders may be getting back into risky assets. However, analysts remain divided in their opinion on the recovery in Bitcoin. While some believe that the relief rally is a bull trap, others expect the up-move to retest the crucial resistance at the 200-week moving average ($22,626). Crypto market data daily view. Source: Coin360 The current bear phase has damaged sentiment as seen from the Crypto Fear and Greed Index, which has remained in the “extreme fear” zone since May 6. According to Philip Swift, creator of on-chain analytics platform LookIntoBitcoin, the time spent...

Bitcoin hodlers will ‘soon see why’ $21.6K BTC price pump is fake — trader

Bitcoin (BTC) spiked to one-week highs on July 17 amid warnings that traders should not trust current BTC price action. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Binance inflows see multi-week high Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $21,600 on Bitstamp, its best performance since last Sunday. The pair saw a fresh leg up during the weekend, this nonetheless coming on the back of thin, retail-driven “out-of-hours” liquidity with institutions out of the picture. Weekend pumps typically are not to be trusted Let’s see how this one holds going into the weekly close tomorrow — Rager (@Rager) July 16, 2022 With Bitcoin prone to “fakeout” moves both up and down in such conditions, there was thus lit...

Bitcoin ready to attack key trendline, says data as BTC price holds $20K

Bitcoin (BTC) consolidated higher on July 16 after the Wall Street trading week finished with modest gains for United States equities. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Can Bitcoin bulls reclaim the 200-week moving average? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD ranging between $20,500 and $21,000 into the weekend. The pair thus preserved the majority of its comeback from the week’s lows, these following shock U.S. inflation data and sparking weakness across risk assets. Now, out-of-hours trading meant that the classic scenario of breakouts and fakeouts on thin liquidity could accompany Bitcoin into the weekly close. Eyeing order book data from Binance, the largest global exchange by volume, showed key resistance clustered ar...

Bitcoin is now in its longest-ever ‘extreme fear’ period

Bitcoin (BTC) may have avoided fresh losses since falling to $17,600 last month, but the sentiment is on the floor. Now, one classic crypto market mood gauge is showing just how long and hard the average investor has suffered. 70 days of “extreme fear” While crypto market sentiment was already “comparable to funeral” before the start of 2022, the subsequent price drawdown in Bitcoin and altcoins produced cold feet like never before. This has now been quantified by the Crypto Fear & Greed Index, a tool that takes multiple sources into account to create an overall score of how the markets are feeling. As of July 15, Fear & Greed has spent 70 days in its lowest bracket — “extreme fear” — marking of a new bearish record. The Index consists of f...