Bitcoin

What determines the Bitcoin price?

Various factors impacting Bitcoin’s price include the supply and demand of BTC, competition from other cryptocurrencies and news, cost of production and regulation. Supply and demand Those with a background in economics are aware of the law of supply and demand. However, if you are unfamiliar with this concept, let’s help you to understand. As per this law, supply and demand market forces work together to determine the market price and the quantity of a specific commodity. For instance, the demand for an economic good declines as the price increases, and sellers will produce more of it or vice-versa. An event called Bitcoin halving impacts the Bitcoin’s price like the situation in which the supply of BTC decrease whereas the demand for BTC increases. As a result of the hi...

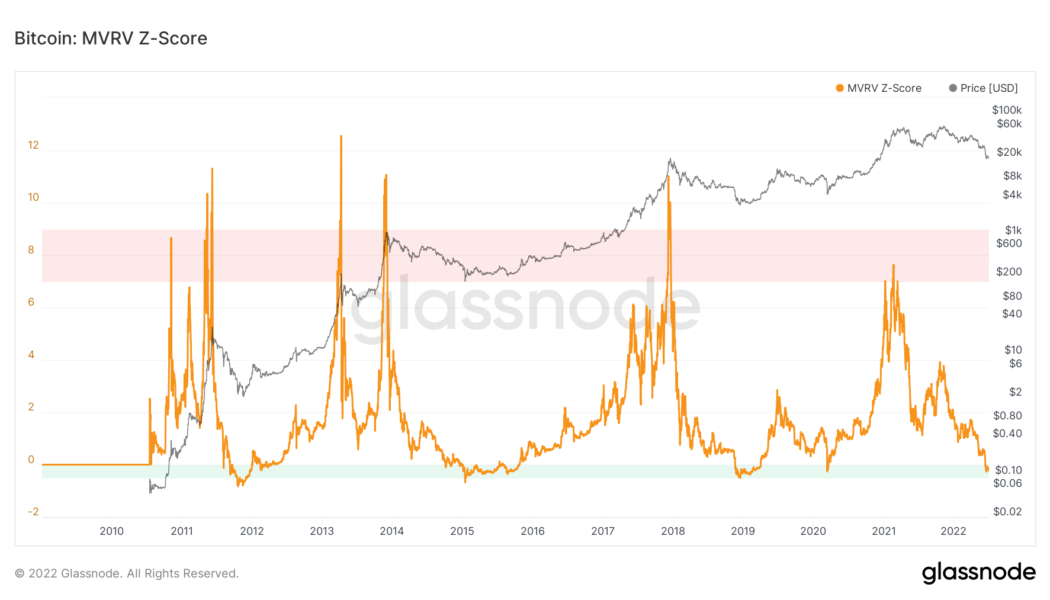

Bitcoin indicator that nailed all bottoms predicts $15.6K BTC price floor

Bitcoin (BTC) needs to go lower before putting in a macro bottom, one of the market’s most accurate indicators shows. Data from sources including on-chain analytics firm Glassnode shows Bitcoin’s MVRV-Z Score is almost — but not quite — signaling a price reversal. MVRV-Z Score inches towards macro bottom Amid ongoing debate whether if, or when, BTC/USD will go beyond its current macro lows of $17,600, new figures suggest that the market easily has further to fall. As noted by Filbfilb, co-founder of trading suite Decentrader, the MVRV-Z score is now in its classic green zone, but not yet at the point which has accompanied price bottoms in the past. MVRV-Z measures how high or low the Bitcoin spot price is relative to what is referred to as its “fair value.” It uses market cap and realized ...

Bitcoin will see ‘long bear market’ says trader with BTC price stuck at $19K

Bitcoin (BTC) failed to reclaim recent losses into July 2 as traders prepared for stagnant price action to continue. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Downtrend acceleration” still in force Data from Cointelegraph Markets Pro and TradingView tracked a limp BTC/USD as it chopped around the $19,000 mark into the weekend. The Wall Street trading week had finished without surprises, with United States equities practically stagnant — providing little impetus for crypto volatility. The U.S. dollar index, or DXY, fresh from a retest of twenty-year highs, ran out of steam to circle 105 points. U.S. dollar index (DXY) 1-hour candle chart. Source: TradingView Order book data from largest global exchange Binance showed BTC/USD caught between buy and sell liquidi...

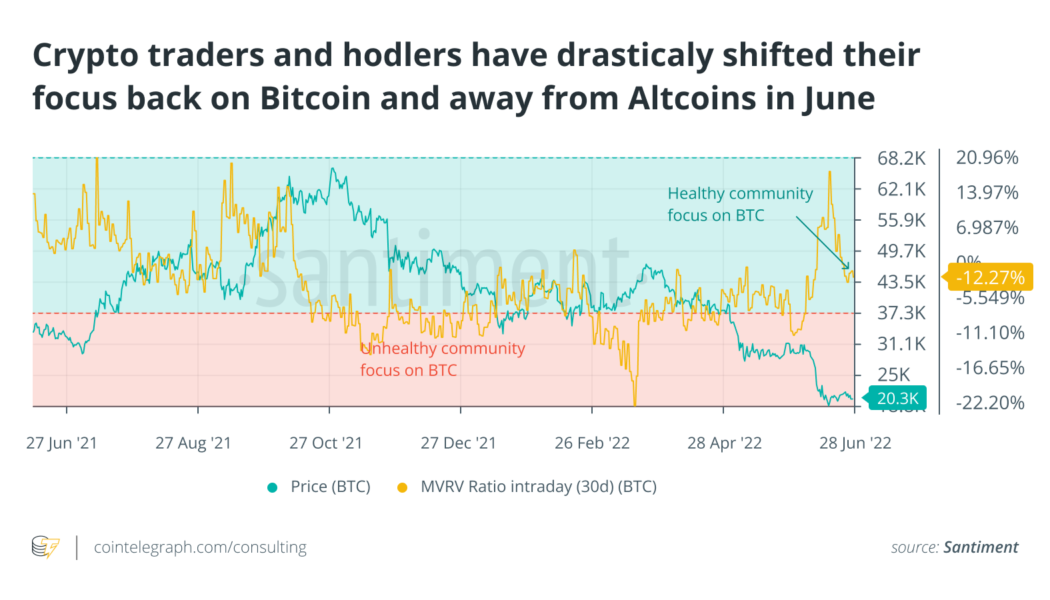

June gloom takes on a new meaning in another 2022 down month

The market cap of Bitcoin (BTC) dropped another 33% in June, which is now beginning to numb the Twitter community. On the upside, many crypto traders who wanted out did so fairly aggressively from March to May. But, the less optimistic news is that the stagnancy in address activity may need to change for prices to get a running start on recovery. Unlike April and May, the altcoin pack didn’t struggle tremendously more than Bitcoin. BTC’s 33% drop was pretty middle of the road in terms of corrections. In a vacuum, crypto bulls would prefer seeing altcoins continuing to lag, pushing more traders back toward Bitcoin as a relative “safe haven.” Nevertheless, June was a tale of two halves. June 1-15 saw a massive 25% further downswing for Bitcoin. Comparatively, June 16-30 was looking up until ...

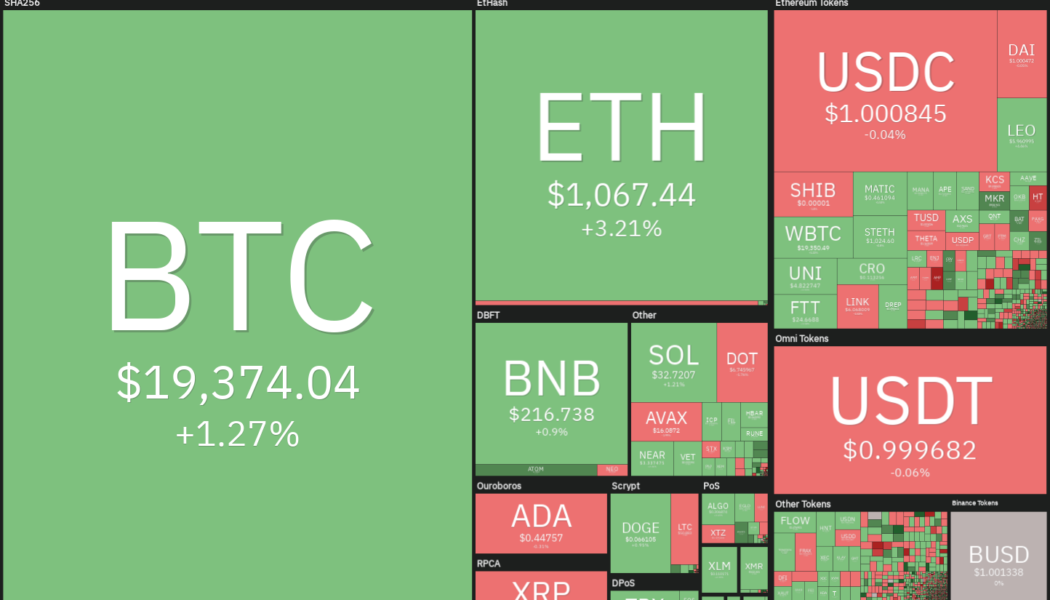

Price analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

Bitcoin dropped 56.2% in the second quarter of 2022, according to crypto analytics platform Coinglass. That makes it Bitcoin’s worst quarter since the third quarter of 2011 when BTC price fell by 67%. A large part of the damage was done in the month of June when Bitcoin plunged 37%, the worst monthly drawdown since September 2011. It is not all gloom and doom for crypto investors. On June 29, JPMorgan strategist Nikolaos Panigirtzoglou said that the “Net Leverage metric” suggests that crypto’s deleveraging may be on its last legs. The eagerness of crypto companies with stronger balance sheets to bail out crypto firms in distress is also a positive sign. Daily cryptocurrency market performance. Source: Coin360 Another positive view on Bitcoin came from Deutsche Bank analysts. In a recent re...

Bitcoin price: June close barely beats 2017 high as Coinbase Premium flips positive

Bitcoin (BTC) finished June 2022 just below $20,000 after a last-minute pump saw bulls escape 40% monthly losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: Bitcoin could stay “boring” for months Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking higher into the monthly close, which came in at $19,924 on Bitstamp. With that, the pair narrowly avoided its first-ever monthly close below a previous halving cycle’s all-time high. On Bitstamp in November 2017, Bitcoin reached approximately $19,770. Right on time. #BTC pic.twitter.com/KxZiOF0kF8 — Material Indicators (@MI_Algos) June 30, 2022 The success was, at best, touch-and-go for a market that nonetheless sealed its worst monthly losses since September 2011, these coming in at around 37.3%. ...

Worst quarter in 11 years as Bitcoin price and activity plunges

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months. The second quarter ending June 30 saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight ET on June 30 according to CoinGecko, representing a 56.2% loss according to crypto analytics platform Coinglass. It’s the steepest price fall since the third quarter of 2011, when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018, when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively. The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a draw down of over 37%, the heaviest monthly losses sin...

Bitcoin price limps under $20K as Asia extends global stocks weakness

Bitcoin (BTC) returned under $20,000 on June 29 as analysts stayed hopeful of a trip higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders looks to $19,500 for support Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it crossed below the $20,000 mark for the first time in nearly a week in Asian trading hours. The weakness followed rangebound behavior near $21,000, this characterizing a market still in tune with moves in global equities. The S&P 500 had finished its previous session down 2%, while the Nasdaq Composite Index lost 3%. On the day, Hong Kong’s Hang Seng was likewise 2.1% lower, while China’s Shanghai Composite Index traded down 1.4%. With few bullish cues coming from macro, Bitcoin thus had little stopping it from revisiting the ...

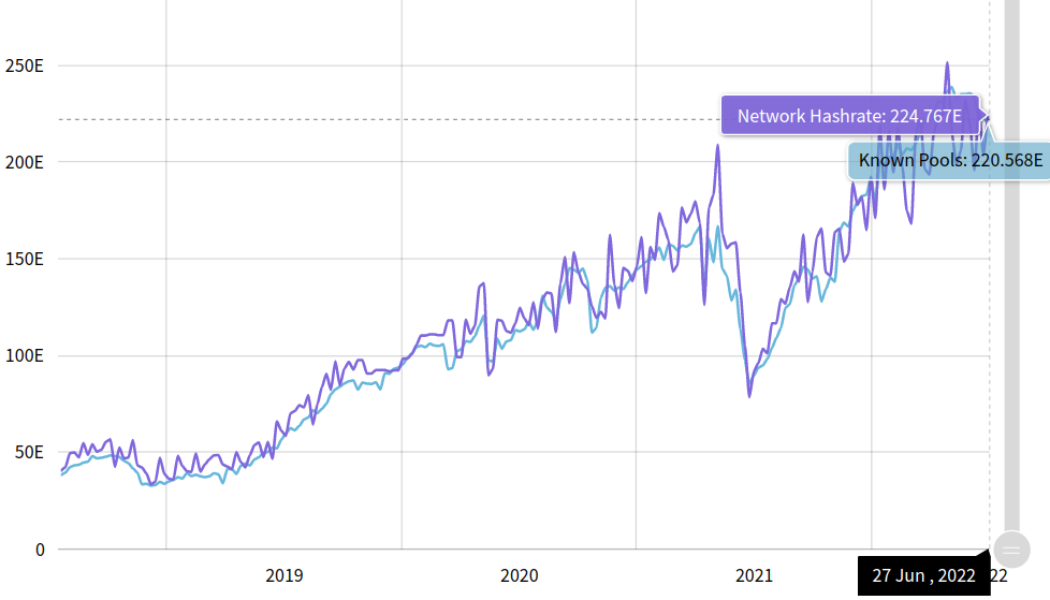

3 charts showing this Bitcoin price drop is unlike summer 2021

Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic. BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks. Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last. Hash rate Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas. While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of week...

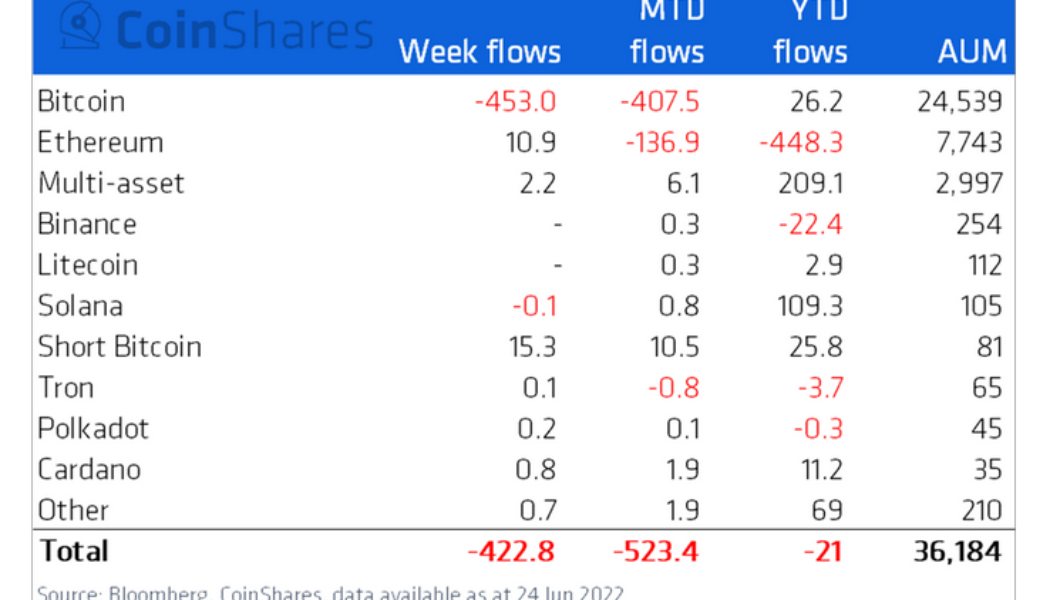

Institutional crypto asset products saw record weekly outflows of $423M

Digital asset investment products saw record outflows totaling $423 million last week, with institutional investors from Canada representing nearly all of the carnage. According to the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Canadian investors offloaded a whopping $487.5 worth of digital asset products between June 20 and June 24. The total outflows for the week were partially offset by $70 million worth of inflows from other countries, with U.S.-based investors accounting for more than half of the inflows with $41 million. Outside of the U.S., investors from Germany and Switzerland accounted for inflows totaling $11 million and $10.4 million apiece. In comparison, Brazilians and Australians also pitched in with minor inflows of $1.6 million and $1.4 million...

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...