Bitcoin

Price analysis 6/27: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin’s (BTC) current bear market is one of the worst, according to a report by on-chain analytics firm Glassnode. This was the first time in history that the Mayer Multiple slipped below the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the biggest loss ever booked by investors in a single day at $4.23 billion. Considering the above factors and a few other events, Glassnode believes that the capitulation in Bitcoin may have started. Bitcoin whales seem to have started their purchasing, suggesting that the bottom may be close and on June 25, analytics resource “Game of Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin witnessed a sharp spike in demand. Daily cryptocurrency market performance. Source: Coin360 Another sign t...

Grayscale reports 99% of SEC comment letters support spot Bitcoin ETF

Digital asset manager Grayscale reported overwhelming support in public comments for its application to launch a spot Bitcoin exchange-traded fund. In a Monday letter to investors, Grayscale said that of the more than 11,400 letters the United States Securities and Exchange Commission, or SEC, had received in regards to its proposed Bitcoin (BTC) investment vehicle, “99.96 percent of those comment letters were supportive of Grayscale’s case” as of June 9. According to Grayscale, roughly 33% of the letters questioned the lack of a spot BTC ETF in the U.S., given the SEC had already approved investment vehicles linked to Bitcoin futures, as was the case for ProShares and Valkyrie. “The SEC’s actions over the past eight months […] have signaled an increased recognition of and comfort wi...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

What are Bitcoin covenants, and how do they work?

Various prominent Bitcoin experts, including Adam Back, Jimmy Song and Andreas Antonopoulos, have raised some concerns over the implementation of restrictive covenants, in particular with the BIP119. In particular, Antonopoulos has voiced concerns over “recursive covenants” that the new update could convey, thereby deteriorating the network. A recursive covenant occurs when a programmer restricts a transaction, but he does it in a way that restricts another transaction after that, starting a domino effect resulting in future limitless recursive covenants. Blacklisting and risks of censorship and confiscation While locking up where a Bitcoin can be spent is advantageous to ensure more security, it also provides grounds for censorship, and control by governments, which would hind...

BTC price tops 10-day highs as Bitcoin whale demand sees ‘huge spike’

Bitcoin (BTC) made the most of weekend volatility on June 26 as a squeeze saw BTC/USD reach its highest in over a week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Unusual whale activity” flagged Data from Cointelegraph Markets Pro and TradingView followed the largest cryptocurrency as it hit $21,868 on Bitstamp. Just hours from the weekly close, a reversal then set in under $21,500, Bitcoin still in line to seal its first “green” weekly candle since May. The event followed warnings that volatile conditions both up and down could return during low-liquidity weekend trading. On-chain data nonetheless fixed what appeared to be buying by Bitcoin’s largest-volume investor cohort prior to the uptick. “Unusual whale activity detected in B...

Top 5 cryptocurrencies to watch this week: BTC, UNI, XLM, THETA, HNT

The United States equities markets witnessed a sharp comeback last week, led by the Nasdaq Composite which gained 7.5%. The S&P was up about 6.5% for the week while the Dow Jones Industrial Average managed a gain of 5.4%. Continuing its tight correlation with the equities market, the crypto markets are also attempting a relief rally. Bitcoin (BTC) has seen a modest recovery but some altcoins have risen sharply in the past week. This suggests that investors are taking advantage of the sharp fall in the price to accumulate altcoins at lower levels. Crypto market data daily view. Source: Coin360 Smaller-sized investors have been using the decline in Bitcoin to build their position to at least one Bitcoin. Glassnode data shows that the number of Bitcoin wallet addresses having more than on...

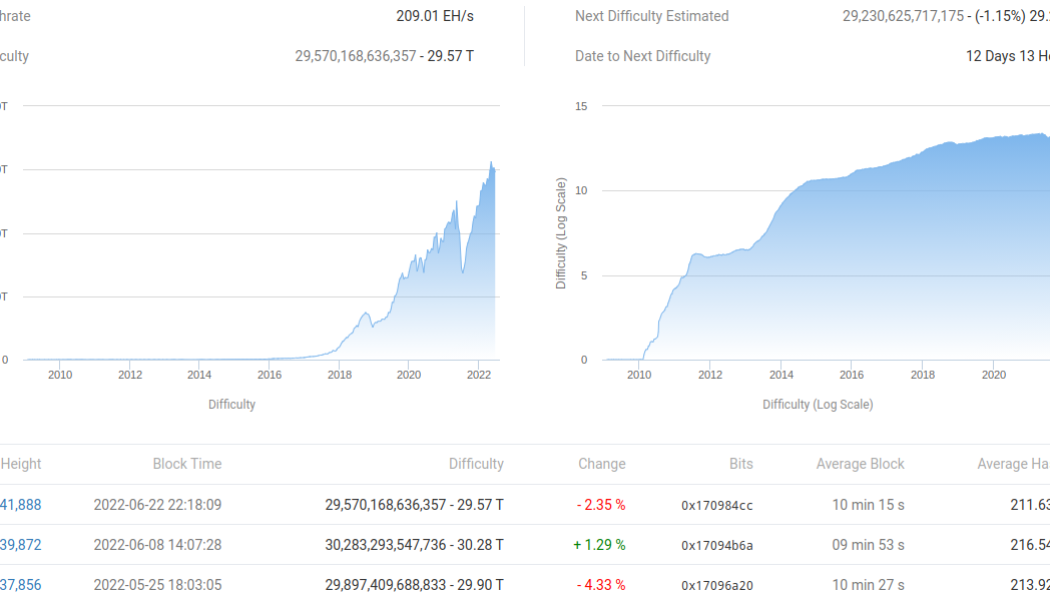

Bitcoin miner ‘capitulation event’ may have already happened — Research

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded. In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due. BTC price bottom “typically” follows miner capitulation Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed. The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges. This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent. “Our data demonstrate a miner capitulation event that has...

Bitcoin gives ‘encouraging signs’ — Watch these BTC price levels next

Bitcoin (BTC) headed toward the upper end of its trading range on June 24 as optimism crept back into traders’ forecasts. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price “ready for $23,000” Data from Cointelegraph Markets Pro and TradingView tracked a broadly stable BTC/USD as it hit local highs of $21,425 on Bitstamp. The pair had shifted higher since wicking below the $20,000 on June 22, with United States equities similarly cool going into the weekend. “Bitcoin ready for $23,000,” Cointelegraph contributor Michaël van de Poppe announced to Twitter followers on the day. At just above the crucial 200-week moving average (WMA), $23,000 formed a popular upside target for commentators — and sellers. As noted by trading suite Decentrader, whales on exchan...

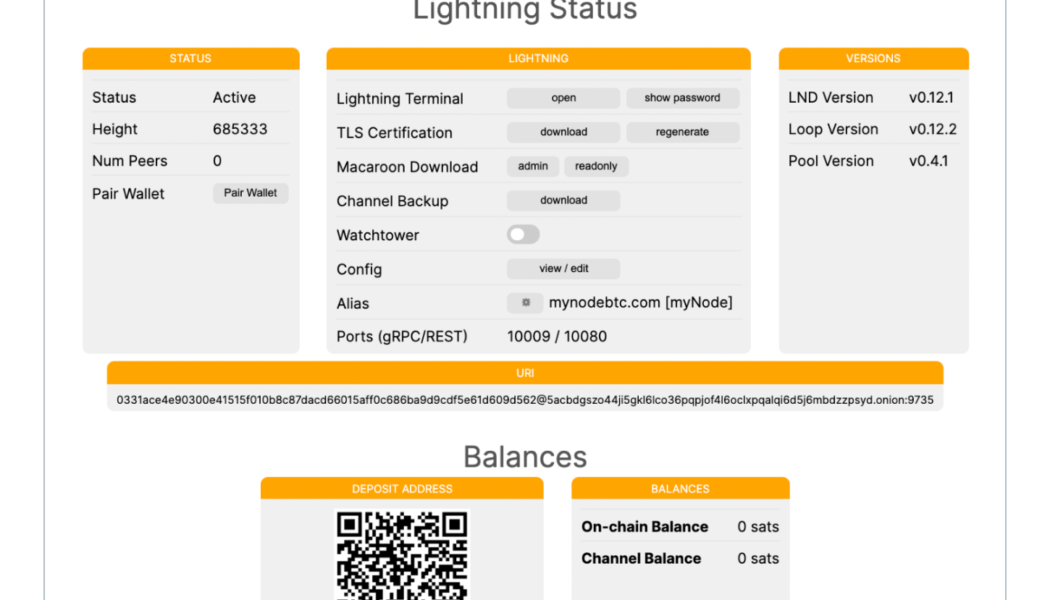

Can you earn passive income running a Lightning node?

The prerequisites to run a Bitcoin Lightning node include an amount of Bitcoin to fund your Lightning channel, fiat money to buy the hardware equipment(s), and a Lightning-compatible wallet. Remember that Lightning nodes are non-mining nodes, which means you aren’t mining Bitcoin but are vital to validating Bitcoin blocks. Validation Nodes are the most common name for these. MyNode and Umbrel are two of the most popular specialized hardware options for validation nodes. In just a few simple steps, you can set up a new myNode device. To begin, download the myNode image for your device type and follow the instructions on the download page to flash it to an SD card. After that, turn on the device and connect an external SSD. You’ll be asked to type in your product key. You can sel...

Price analysis 6/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

A handful of on-chain metrics suggest that Bitcoin could be close to bottoming, and if true, the eventual relief rally could induce sharp gains from altcoins. The United States equity markets and the cryptocurrency space are witnessing a relief rally this week. Supporting the rise in risky assets is the U.S. dollar index (DXY), which retreated from its multi-year high. Generally, cryptocurrencies move inverse to the price of the U.S. dollar, but this week’s bounce does not necessarily mean that bulls’ grip over the market has come to an end. Citing on-chain data, CryptoQuant senior analyst Julio Moreno, said that Bitcoin (BTC) miners may have already capitulated. Historical data suggests that miner capitulation usually precedes market bottoms. Daily cryptocurrency market perfor...

Bitcoin may still see ‘wild’ weekend as BTC price avoids key $22K zone

Bitcoin (BTC) focused on $21,000 into the weekend amid warnings that volatility could still consume the market before Monday. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView S&P 500 sees second best week of 2022 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD broadly higher in its recent trading range after U.S. stocks ended the week strong. As noted by markets commentators Holger Zschaepitz, the S&P 500 sealed its second best week of 2022, indicative of modest relief across risk assets. In case you missed it: S&P 500 has gained >6% in 2nd-best week of 2022 as disinflationary forces gather steam & #Fed tightening expectations recede. Investors now see the key interest rate at only 3.4% at the end of 2022, a full 35bps lower than at the...

Crypto Stories: YouTuber Paco de la India explains his travels using Bitcoin

A YouTuber started traveling the world to see whether he could survive solely on Bitcoin as a means of payment. In the latest episode of Cointelegraph’s ‘Crypto Stories’ series, Paco from India explained how he started his journey from the city of Bengaluru and learned from the example of travel pioneers who came before him, including Nellie Bly, who circumnavigated the globe in the late 19th century in less than 73 days. Paco worked a variety of jobs before reading up on Bitcoin (BTC) and made a big decision. “This is 2021,” said Paco. “I will travel the world by using Bitcoin.” The YouTuber added: “When my journey started, I had zero dollars. I sold my furniture, got $200 of Bitcoin, and as soon as I started on day one, the first Bitcoin meetup we had in Bengaluru, one guy came and gave ...