Bitcoin

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% loss

Bitcoin (BTC) saw further losses on June 12 as thin weekend trading volumes fueled an ongoing sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst likens risk asset ‘pump’ to 1929 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $27,150 on its sixth straight day of downside. With hours to go until the weekly close, the pair was in danger of resuming the losing streak, which had previously seen a record nine weeks of red candles in a row. To avoid that outcome and put in a second “green” close, BTC/USD needed to gain over $2,000 from current spot price, which at the time of writing was $27,400. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView With support levels failing to change the mood thanks to the thinner...

What are Bitcoin improvement proposals (BIPs), and how do they work?

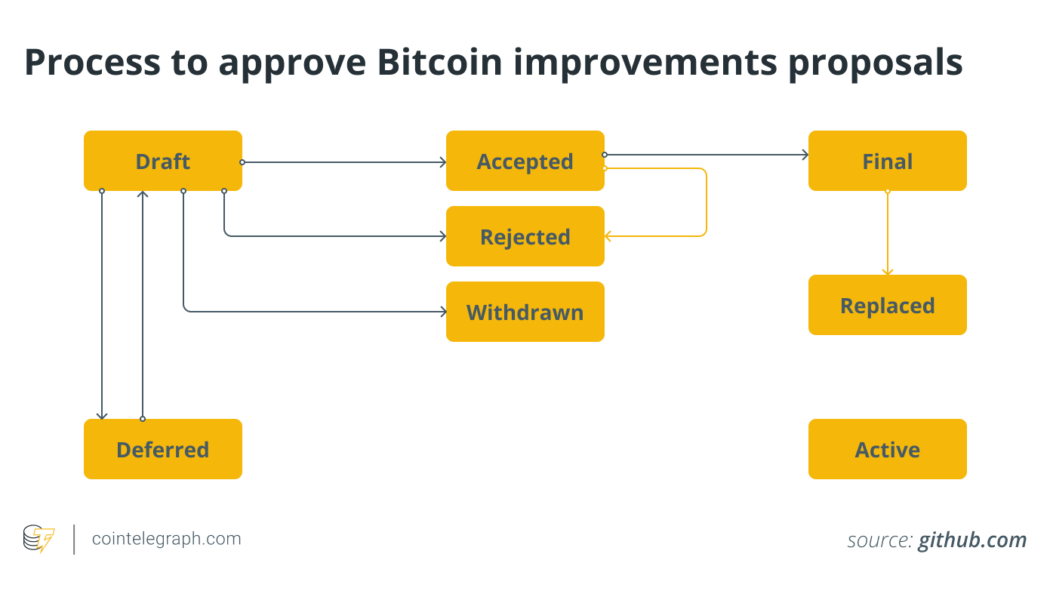

Gathering significant consensus within the community is the first step of the process. Sometimes, even the most valuable proposals can take years before they are approved or rejected because the community can’t find an agreement. Once a BIP is submitted as a draft to the BIP GitHub, the proposal gets reviewed and worked on transparently so that everyone can view its progress and consequent testing outcomes. As Bitcoin blockchain is based on code, protocol changes will have to be reflected in the code, and miners will have to add a reference to their hashed block to signal that they accept or reject their implementation. Because of the severe implications some changes might inflict on miners, a modification in the code requires acceptance by a vast majority of around 95% unless a ...

Bitcoin price threatens lowest weekly close since 2020 as inflation spooks markets

Bitcoin (BTC) dropped to two-week lows on June 11 as the week’s Wall Street trading ended with bears in control. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. inflation print proves setback Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it reached $28,528 on Bitstamp, its lowest since May 28. The pair had fallen in step with stock markets on June 10, these finishing the week noticeably down — the S&P 500 and Nasdaq Composite lost 2.9% and 3.5% respectively. This was on the back of surprisingly high inflation data from the United States, which took a turn for the worst in stark contrast to expectations. As Cointelegraph reported, at 8.6%, annual inflation came in at the highest since December 1981. Reacting, market commentators were thus firml...

Ethereum eyes fresh yearly lows vs. Bitcoin as bulls snub successful ‘Merge’ rehearsal

Ethereum’s native token Ether (ETH) resumed its decline against Bitcoin (BTC) two days after a successful rehearsal of its proof-of-stake (PoS) algorithm on its longest-running testnet “Ropsten.” The ETH/BTC fell by 2.5% to 0.0586 on June 10. The pair’s downside move came as a part of a correction that had started a day before when it reached a local peak of 0.0598, hinting at weaker bullish sentiment despite the optimistic “Merge” update. ETH/BTC four-hour price chart. Source: TradingView Interestingly, the selloff occurred near ETH/BTC’s 50-4H exponential moving average (50-4H EMA; the red wave) around 0.06. This technical resistance has been capping the pair’s bullish attempts since May 12, as shown in the chart above. Staked Ether behind ...

Price analysis 6/10: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, AVAX, SHIB

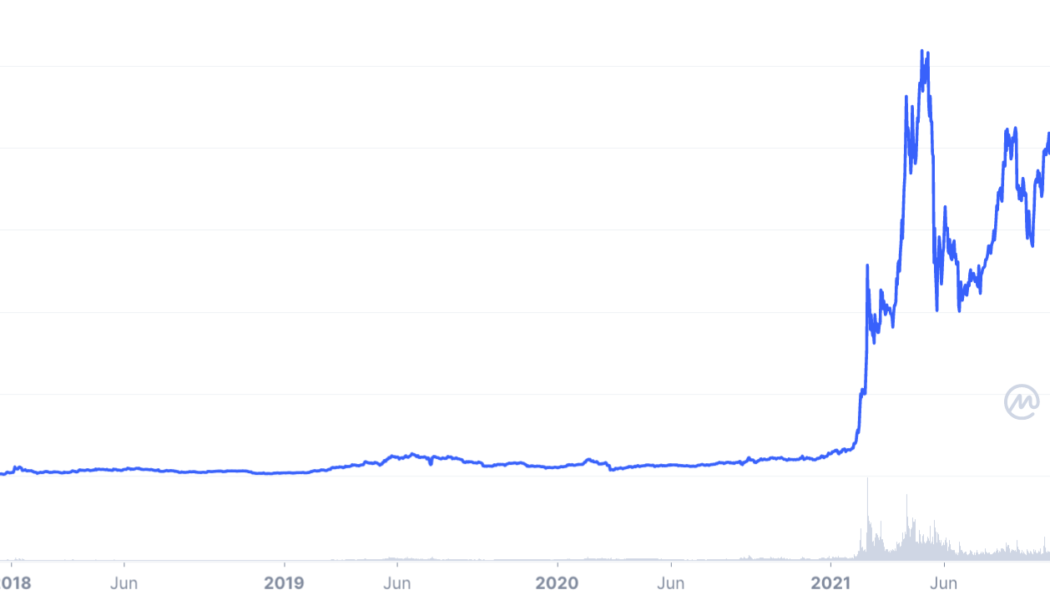

The United States equities markets tumbled on June 10 after the Consumer Price Index (CPI) report showed inflation soaring 8.6% from a year ago, the highest increase since 1981. The latest figures show that talks of inflation having peaked were premature and according to Bloomberg, investors are pricing in the key interest rate of 3% by the end of the year. Continuing its tight correlation with the S&P 500, Bitcoin (BTC) dipped below $30,000 on June 10. Analysts are still divided about the near-term price action but Fundstrat co-founder Tom Lee said in an interview with CNBC that Bitcoin may have already bottomed. However, Lee seems to have toned down his expectations as he said that Bitcoin could “remain flat for the year, possibly up.” Daily cryptocurrency market performance. So...

Is It Profitable to Swap ETH to XNO?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Wall Street sends BTC price to $30.8K as latest US dollar uptick fails

Bitcoin (BTC) showed strength at the June 8 Wall Street open as impatient traders waited for a trend to emerge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin still in “no trade zone” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD jumping to near $30,850 after the opening bell, helping claw back some of the ground lost in an overnight correction. Choppy trading conditions prevailed within a familiar range on the day, however, leading to both long and short traders seeing increased risk on low timeframes. For popular trader Crypto Chase, this was a prime period for the transfer of value to “smart money” — away from small-volume speculators and those with “weak hands.” A prior Twitter post had argued for a hands-off approach until a decisiv...

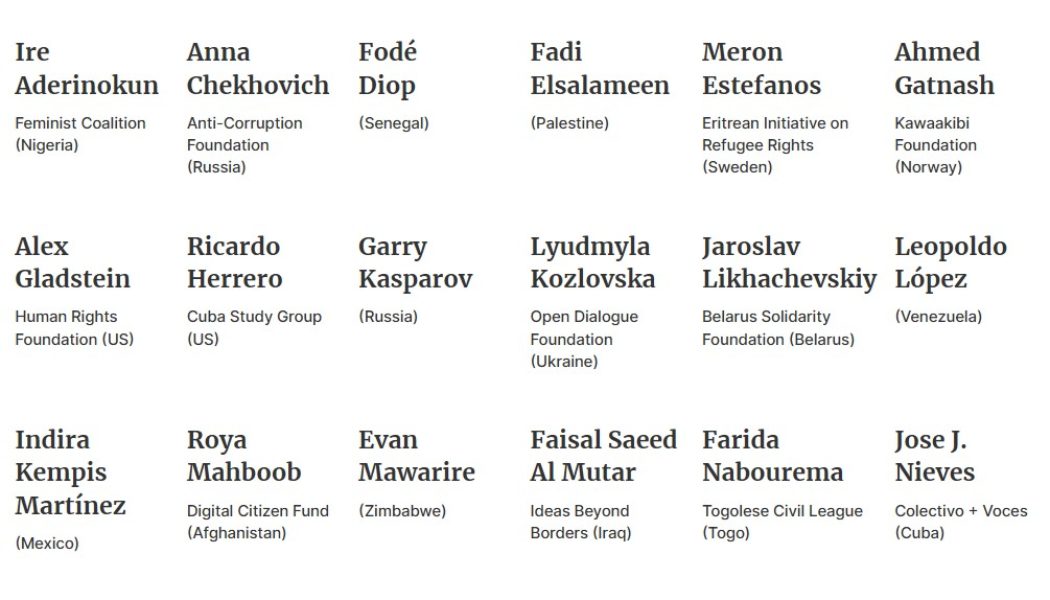

Human rights activists take aim at privileged crypto critics in letter to Congress

Human rights activists from 20 countries have submitted an open letter to the United States Congress in support of a “responsible crypto policy” and praising Bitcoin and stablecoins as essential tools aiding democracy and freedom for tens of millions. The letter comes just a week after an anti-crypto open letter was sent to Congress purporting to be from the scientific community but whose lead signatures included well known crypto critics and authors from high income, democratic countries. The group of 21 activists clapping back include those from countries which have either seen recent conflict or have otherwise unstable economies such as Ukraine, Russia, Iraq, Nigeria, Venezuela, Cuba and even North Korea. The letter states: “We write to urge an open-minded, empathetic approach toward mo...

BNB price risks 40% drop as SEC launches probe against Binance

Binance Coin (BNB) price dropped by nearly 7.3% on June 7 to below $275, its lowest level in three weeks. What’s more, BNB price could drop by another 25%–40% in 2022 as its parent firm, Binance, faces allegations of breaking securities rules and laundering billions of dollars in illicit funds for criminals. Bad news twice in a row BNB was issued as a part of an initial coin offering (ICO) in 2017 that amassed $15 million for Binance. The token mainly behaves as a utility asset within the Binance ecosystem, primarily enabling traders to earn discounts on their trading activities. Simultaneously, BNB also functions as a speculative financial asset, which has made it the fifth-largest cryptocurrency by market capitalization. BNB market capitalization was $45.42 billion as of June ...