Bitcoin

Coinbase balance drops by 30K BTC as Bitcoin price nurses 6% losses

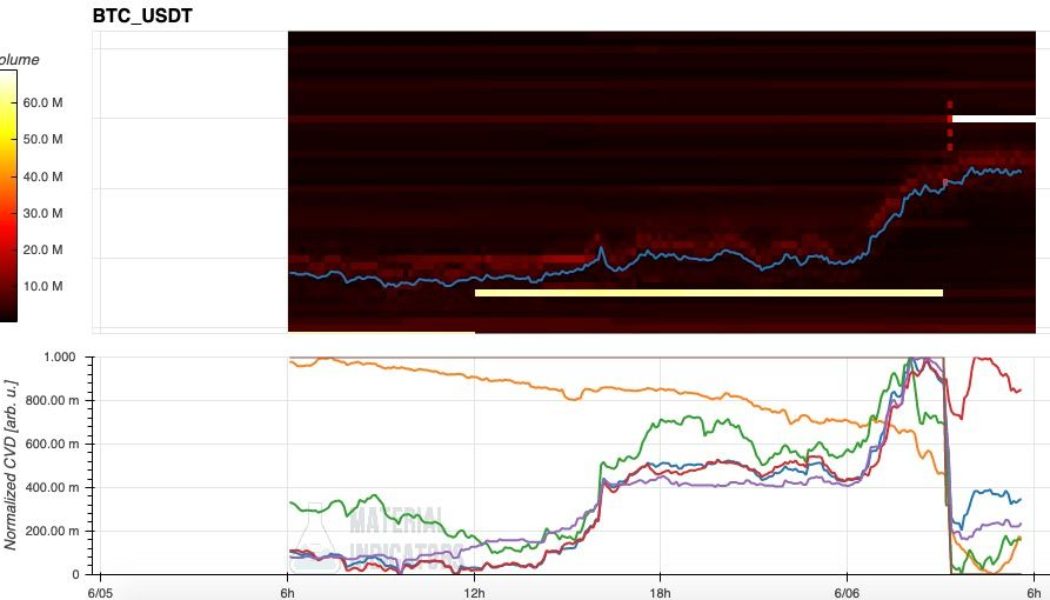

Bitcoin (BTC) held steady at the June 7 Wall Street open after a night of losses cost bulls heavily. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Coinbase sees conspicuous outflows Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged near $30,000, still down 6% versus its prior highs. After underperforming versus United States equities on June 6, the pair nonetheless managed to avoid falling further in step with stocks. At the time of writing, the S&P 500 was down 0.6% from the open, with the Nasdaq Composite Index 0.5% lower. Analyzing order book data, on-chain analytics resource Material Indicators noted that a wall of bids from a whale “spoofing” the market in recent days had finally dissipated. Earlier, that entity had posted a support li...

Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours

Bitcoin (BTC) firmly recommitted to its trading range on June 7 after a fresh move higher was met with a swift sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Some of the best chop we’ve seen” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rejecting decisively at resistance it last encountered on June 1. The pair had delivered daily gains in excess of 6%, but the approach to $32,000 changed the mood, and Bitcoin gave back almost $2,500 in a matter of hours. A classic “Bart Simpson” structure thus formed on hourly timeframes as frustrated traders came to terms with the existing paradigm remaining unchallenged. “Standard price action again on Bitcoin in which all the lows are swept,” Cointelegraph contributor Michaël van de Poppe wrote in a Twitter ...

Will Bitcoin Be Able to Bounce Back?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

BTC price snaps its longest losing streak in history — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with some fresh hope for hodlers after halting what has been the longest weekly downtrend in its history. After battling for support throughout the weekend, BTC/USD ultimately found its footing to close out the week at $29,900 — $450 higher than last Sunday. The bullish momentum did not stop there, with the pair climbing through the night into June 6 to reach multi-day highs. The price action provides some long-awaited relief to bulls, but Bitcoin is far from out of the woods at the start of what promises to be an interesting trading week. The culmination will likely be United States inflation data, this itself a yardstick for the macroeconomic forces at world globally. As time goes on, the impact of anti-COVID policies, geopolitical tensions and supply shor...

Top 5 cryptocurrencies to watch this week: BTC, ADA, XLM, XMR, MANA

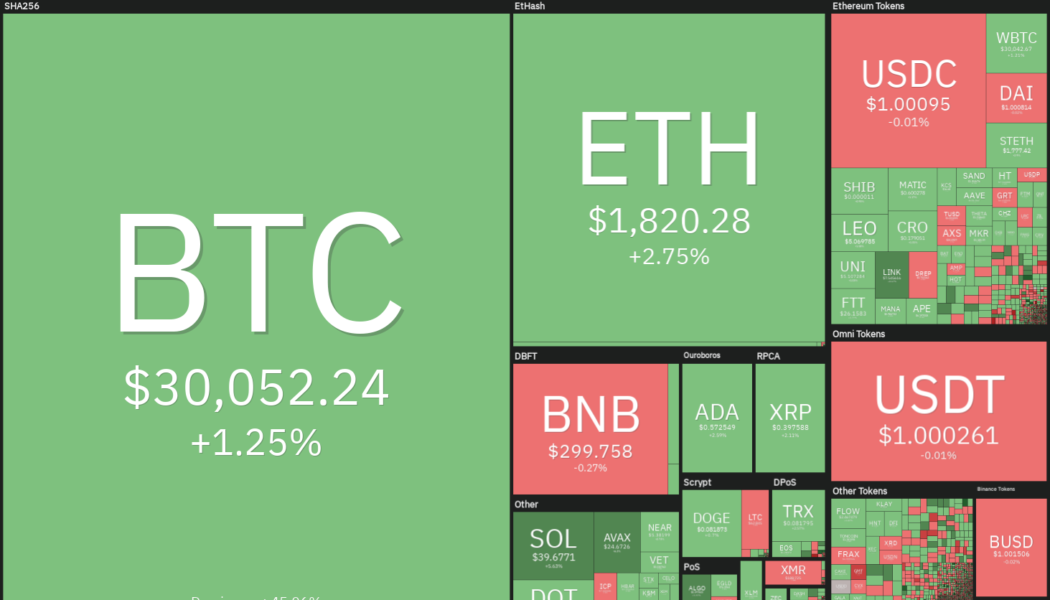

The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000. On-chain data from Glassnode shows that smart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14. Crypto market data daily view. Source: Coin360 Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The...

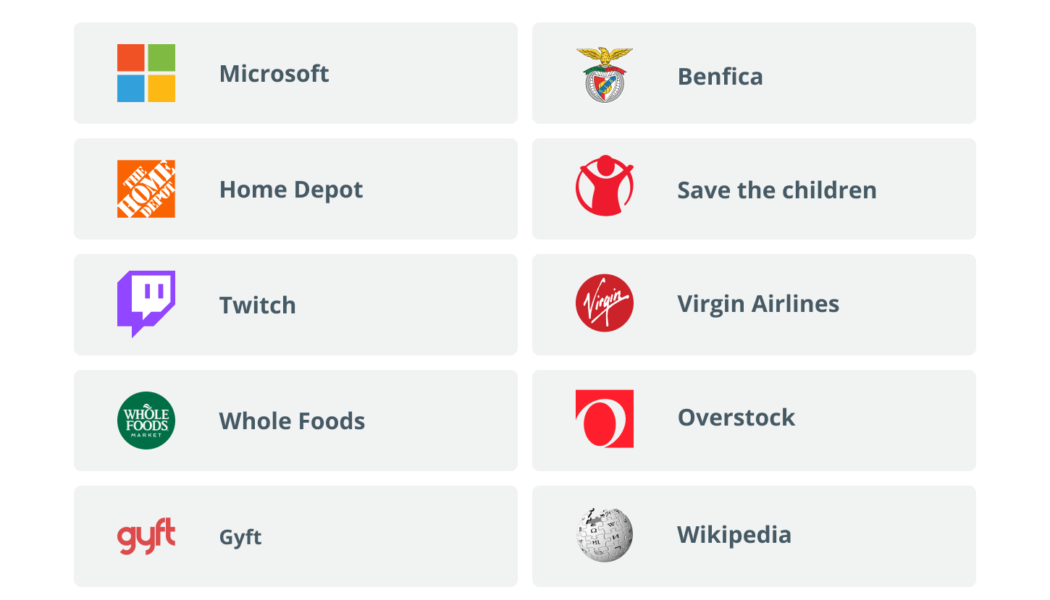

Who accepts Bitcoin as payment?

This is a list of some of the biggest places that accept Bitcoin, such as Microsoft and Whole Foods. First, we’re going to take a look at businesses that accept Bitcoin. There are some early adopters, but most of them recently started to accept payments using this digital currency. These major companies are the ones where you can pay via Bitcoin: Microsoft Microsoft is one of the early adopters of BTC, as they started accepting payments with Bitcoin in 2014. Users could buy games and applications with digital currencies, but digital coins were far from usual back then, so Microsoft stopped accepting BTC in 2016 and once again in 2018 due to high volatility. We’re eight years into the future, and now it’s way more usual and trustworthy to pay with dig...

Bitcoin price needs to close above $29,450 for its first green weekly candle since March

Bitcoin (BTC) kept traders guessing into the June 5 weekly close as BTC price action closely mimicked last weekend. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView BTC price traders $300 in the gree Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling its May 30 opening level at the time of writing, just $300 higher than seven days ago. With hours to go before the weekly candle closed, the pair thus retained the threat of sealing yet another lower low. This would take Bitcoin to a new record in terms of consecutive “red” weeks. Discussing the potential outcomes, traders had mixed opinions. Very hard to tell, again all about daily trend and the recent highs put @ 32k. Gaps above big enough to be interesting to play even > 32. A close li...

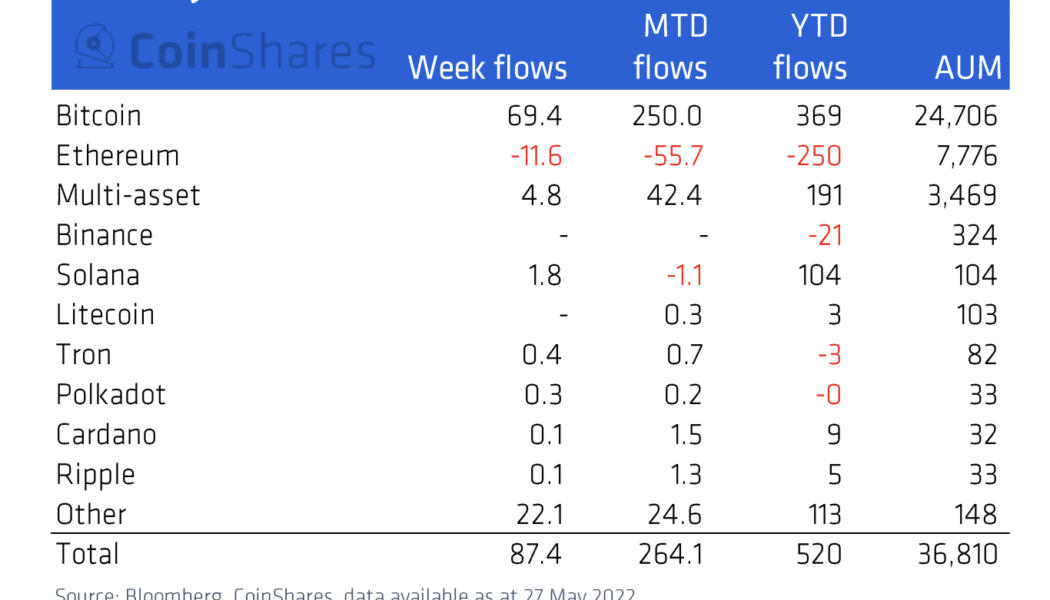

3 reasons Ethereum price risks 25% downside in June

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

Weekly Report: New York passes bill limiting Bitcoin mining, El Salvador delays Bitcoin bonds again, Japan limits stablecoin issuance, and more

Here are this week’s most intriguing stories in the cryptocurrency sector: Not yet Bitcoin bonds, El Salvador’s Finance minister says When El Salvador adopted Bitcoin for use as an official tender in September last year, it also set out on several Bitcoin ambitions. Among them; are building a Bitcoin city and establishing Bitcoin bonds worth $1 billion. The bonds, having been postponed earlier in the year, seem set for another delay as Finance Minister Alejandro Zelaya confirmed that the nation would not venture into offering them in the current bear market. Speaking during a recent interview with a local news outlet, the finance minister was queried on the state of the $1 billion bonds that were not issued in mid-March as initially planned. No official date when the ...

Kenyan-based energy company offers bitcoin miners reserve geothermal power

The country’s biggest energy producer is luring bitcoin miners as it seeks to be a trailblazer in the continent’s growing crypto space The company also hopes to capture the attention of top mining firms in Europe and America that could tap the massive reserves within the country Crypto mining has come under harsh criticism for the massive electricity used to generate new coins and verify blockchain transactions. The annual energy consumption in the crypto mining industry is estimated to be nearly 119 Terawatt hours. This, if quantified, exceeds the energy consumption of the Netherlands, with only about 30 other countries having a higher consumption, according to data from the Cambridge Bitcoin Energy Consumption Index (CBECI). KenGen, an energy producer in Kenya, has seen an opportun...

Bitcoin long-term hodlers begin ‘distribution’ which preceded BTC price bottoms

Bitcoin (BTC) stayed wedged in a tight range on June 4 as traders’ demands for a new macro low persisted. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-term holders begin ‘distribution’ Data from Cointelegraph Markets Pro and TradingView showed BTC/USD stuck between $29,000 and $30,000 into the weekend. The pair had managed a revival to near $31,000 the previous day, but the last Wall Street trading session of the week put pay to bulls’ efforts. As “out-of-hours” markets offered thin volumes but little volatility, eyes were on the potential direction of what would be an inevitable breakout. “The weekly chart on Bitcoin looks nothing short of horrific and so the trend continuation remains. I do think we consolidate a little l...

Is Solana a ‘buy’ with SOL price at 10-month lows and down 85% from its peak?

Solana’s (SOL) price dropped on June 3, bringing its net paper losses down to 85% seven months after topping out above $260. SOL price fell by more than 6.5% intraday to $35.68, after failing to rebound with conviction from 10-month lows. Now sitting on a historically significant support level, the SOL/USD pair could see an upside retracement in June, eyeing the $40-$45 area next, up around 25% from today’s price. SOL/USD daily price chart. Source: TradingView 60% SOL price decline ahead? However, a rebound scenario is far from guaranteed and Solana faces headwinds from trading in lockstep with Bitcoin (BTC), the top cryptocurrency (by market cap) that typically influences trends across the top altcoins. Notably, the weekly correlation coefficient between BTC and SO...