Bitcoin

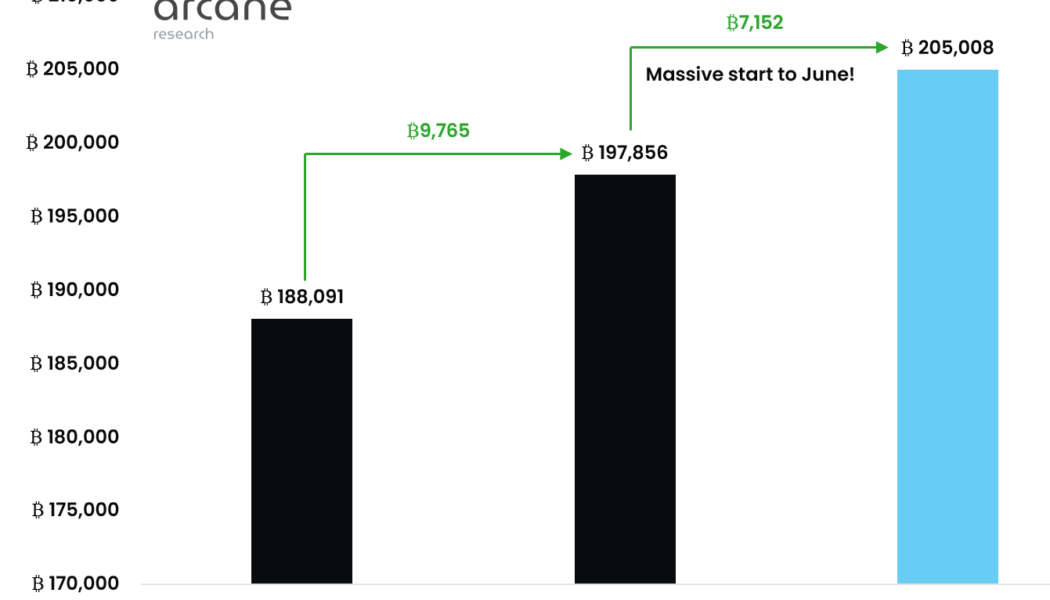

Over 200K BTC now stored in Bitcoin ETFs and other institutional products

Bitcoin (BTC) investment vehicles are seeing “gargantuan” inflows this month, which is a fresh sign that traders’ appetite for BTC exposure is mounting. Data from monitoring firm Arcane Research published this week shows that Bitcoin exchange-traded products (ETPs) now have record high BTC under management. “Happier days” for Bitcoin ETPs as buyers pile in Despite BTC price action failing to draw in buyers at over 50% below all-time highs, not everyone is feeling risk-off. According to Arcane’s data, Bitcoin ETPs have seen a flurry of interest from institutional investors both this month and last. In total, Bitcoin ETPs, which include products such as the ProShares Bitcoin Strategy exchange-traded fund (ETF), now have 205,000 BTC under their control — a new record. “While the M...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

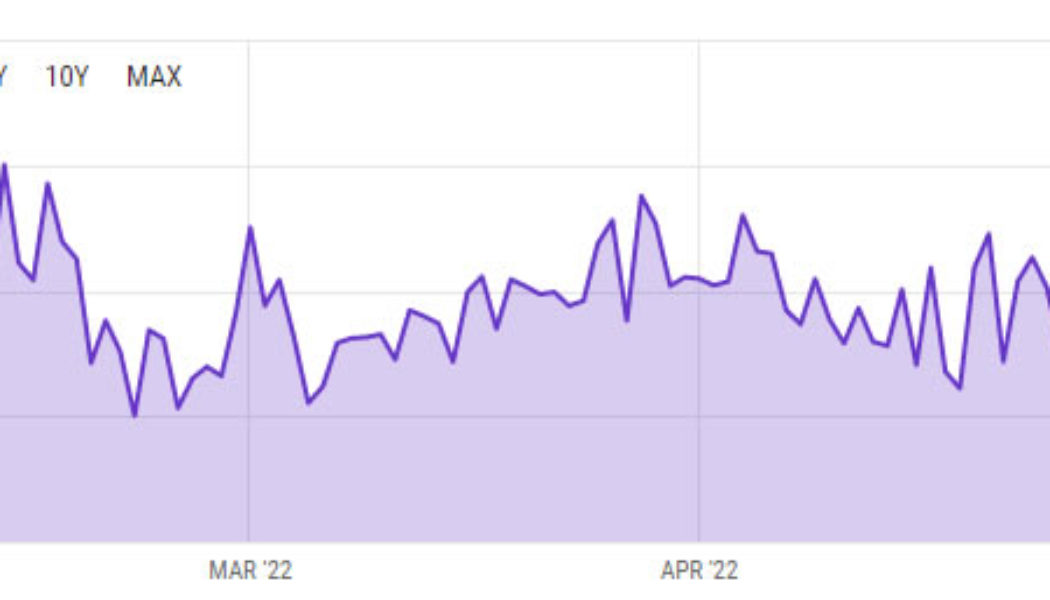

Bitcoin daily mining revenue slumped in May to eleven-month low

Bitcoin (BTC) mining revenue and profitability have continued to slide along with the asset’s price this year as the crypto winter deepens. May has been one of the worst months for Bitcoin miners in the past year as revenue and profitability continue to tank. Bitcoin daily mining revenue tanked as much as 27% in May, according to data from Ycharts sourcing data from Blockchain.com. On May 1, the analytics provider reported daily revenue of $40.57 million for BTC miners, but by the end of the month, it had fallen to $29.37 million. Daily mining revenue hit an eleven-month low of $22.43 million on May 24. BTC daily mining revenue YTD – ycharts.com Daily mining revenue spiked to a peak of around $80 million in April 2021 but has since fallen 62% to current levels. May ended the...

Bitcoin price risks $29K ‘nosedive’ as Wall Street opens with fresh losses

Bitcoin (BTC) lost bullish momentum at the June 1 Wall Street open as United States equities faced another day of retracement. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Zooming out, “nothing” has changed Data from Cointelegraph Markets Pro and TradingView captured a sharp U-turn for BTC/USD at the start of trading, $1,600 in three hours. At the time of writing, the pair traded at around $30,400, giving back the past days’ gains. For Cointelegraph contributor Michaël van de Poppe, $29,000 was now on the radar after support levels refused to cushion Bitcoin’s initial fall. “Very simple, Bitcoin needs to hold here to have a test at $33K area possible,” he tweeted as BTC/USD reached $31,150. “If not, this is going to nosedive qui...

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

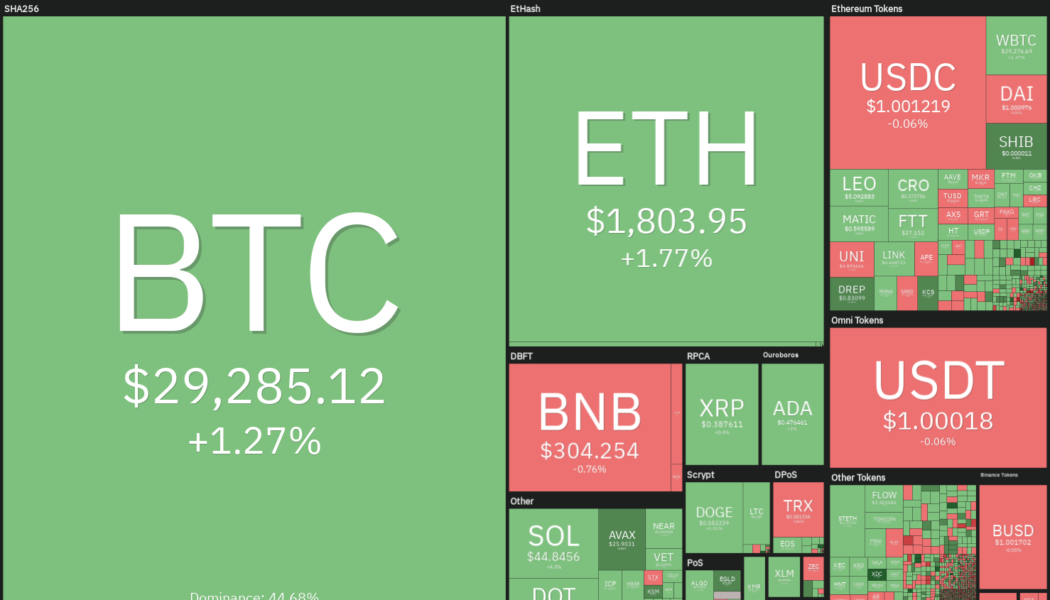

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Bitcoin ‘ready’ for $32.8K after consolidation as BTC price gains 6.3%

Bitcoin (BTC) stayed higher on May 30 as early week gains saw BTC/USD retain $30,500. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView $32,000, $35,000 flagged as lines in the sand Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency consolidating near $30,600 at the time of writing after hitting highs of $30,900 on Bistamp. Its best performance since May 16, the return to relative strength was welcomed by analysts, some of whom began to discuss the possibility of a range breakout. “Finally, Bitcoin is making the run upwards,” Cointelegraph contributor Michaël van de Poppe told Twitter followers. “Some more consolidation here and we’re ready to break further upwards in which $32.8K and $35K are the resistances. The moment that the market gets...

Top 5 cryptocurrencies to watch this week: BTC, ETH, XTZ, KCS, AAVE

After declining for eight successive weeks, the Dow Jones Industrial Average rebounded sharply last week to finish higher by 6.2%. However, Bitcoin (BTC) has not been able to replicate the performance of the United States equities markets and is threatening to paint a red candle for the ninth week in a row. A positive sign is that Bitcoin whales have been buying the market correction. Glassnode data shows that the number of Bitcoin whale wallets with a balance of 10,000 Bitcoin or more has risen to its highest level since February 2021. The accumulation in the whale wallets suggests that their long-term view for Bitcoin remains bullish. Crypto market data daily view. Source: Coin360 Blockware Solutions highlighted that the Mayer Multiple metric which compares the 200-day simple moving aver...

Bitcoin to set a new record 9-week losing streak with BTC price down 22% in May

Bitcoin (BTC) threatened to continue an unprecedented losing streak on May 29 as BTC/USD stayed in a right intraday range. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Stocks correlation offers no comfort to BTC bulls Data from Cointelegraph Markets Pro and TradingView flagged the largest cryptocurrency heading for nine weeks of downtrend in a row — the most in history. Already at a dubious record, Bitcoin’s weekly chart closes provided the backdrop to weakness that continued to disappoint analysts over the weekend. Even stock markets, troubled by central bank tightening, managed to put in gains over the week, while Bitcoin and the majority of altcoins added to losses. “Most concerning has been the divergence between Equities and Crypto. S&P and NASDAQ ha...

STEPN rebounds sharply after falling 80% in a month — is GMT price bottoming out?

A massive downtrend in the STEPN (GMT) prices witnessed in the last 30 days appears to be nearing exhaustion. GMT’s price has rebounded by nearly 35%—from $0.80 on May 27 to $0.99 on May 28. Interestingly, the upside retracement started after the price fell in the same range, which had acted as support before GMT’s 500% and 120% price rallies in March and early May, respectively. GMT/USD daily price chart. Source: TradingView Additionally, the rebound further preceded an 80% drop from its record high of $4.50, established on April 27, which left GMT oversold, per its daily relative strength index reading that slipped below the oversold threshold of 30 on May 26. The technical support, in addition to oversold RSI, suggests GMT is in the process of bottoming out. GMT price levels...

Bitcoin price stuck below $29K as Terra LUNA comes back from the dead

Bitcoin (BTC) analysts faced another day of frustration on May 28 as BTC/USD refused to offer volatility up or down. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView “Not the decoupling we wanted” Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency sticking in a narrow short-term range into the weekend. Previously forecast support levels to avoid a deeper correction managed to hold in the May 27 Wall Street trading session, but a bounce higher was similarly absent as commentators looked for fresh cues. “Short resistance and long support until one of them breaks. Keep it simple in ranges as they are there to engineer liquidity for trend continuation or reversals,” popular trading account Crypto Tony summarized in part ...

JPMorgan picks out crypto as the preferred alternative asset

JPMorgan analysts chose Bitcoin over real estate, adding that the former’s fair value is 30% above current prices They also observed that VC funding should turn the current bear market and prevent a crypto winter akin to 2018/2019 JPMorgan analysts led by Nikolaos Panigirtzoglou have opined on the current crypto market, finding that the fair price of the world’s leading digital asset, Bitcoin, is 30% higher than current prices. The bank’s analysts said that there’s significant potential that Bitcoin could rise to $38,000 and carry other crypto tokens along with it, despite recent market capitulation. “The past month’s crypto market correction looks more like capitulation relative to last January/February, and going forward, we see upside for Bitcoin and crypto markets more generally,...