Bitcoin

Bitcoin targets record 8th weekly red candle while BTC price limits weekend losses

Bitcoin (BTC) gave bears little joy over the weekend as the May 22 weekly close looked set to revolve around $30,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Waiting for Bitcoin to “make a decision” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it held a narrow range after the Wall Street trading week. With volatility absent, traders hoped for a move to larger areas of support or resistance next. “Still wedged between the supply and demand zone .. Hoping for a break today so we have some juicy action to play with,” popular trader Crypto Tony summarized, noting upside and downside targets were around $27,900 and $31,000, respectively. Time for #Bitcoin to make a decision? pic.twitter.com/DEfNhuvnYa — Matthew Hyland (@MatthewHyland_) ...

Bitcoin ends week ‘on the edge’ as S&P 500 officially enters bear market

Bitcoin (BTC) struggled to recover its latest losses on May 21 after Wall Street trading provided zero respite. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price reflects drab stocks performance Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading at dipping below $28,700 into the weekend, subsequently adding around $500. Down 4.7% from the previous day’s $30,700 highs, the pair looked firmly rangebound at the time of writing after United States stocks indices saw a volatile final trading day of the week. The S&P 500, managed to reverse after initially falling at the open, nonetheless confirmed bear market tendencies, trading at 20% below its highs from last year. The S&P 500 has officially entered a bear market pic.twitter.com/N...

Bitcoin ‘death cross’ data hints 43% drop due in BTC price bear market

Bitcoin (BTC) may fall more than 40% from last week’s bottom, new data warns as one analyst confronts what he says is now a bear market. In a series of tweets on May 20, popular trader and analyst Rekt Capital argued that BTC/USD should dive to near $20,000 to conform to historical norms. Death cross BTC price target now $22,700 Much debate has surrounded the so-called “death cross” constructions on the Bitcoin chart. These involve the declining 50-period moving average (50MA) crossing under the 200MA. Often in the past, such an event has triggered considerable price downside, this then going on to mark what Rekt Capital calls “generational bottoms.” “More often than not, the depth of a $BTC correction pre-Death Cross is similar to retrace depth post-Dea...

Weaker dollar lifts Bitcoin to $30.7K as analyst eyes 60% BTC dominance

Bitcoin (BTC) hit 48-hour highs overnight into May 20 as U.S. dollar weakness gave bulls some much-needed respite. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar strength declines after 20-year record Data from Cointelegraph Markets Pro and TradingView recorded a high of $30,725 for BTC/USD on Bitstamp. Still struggling to flip $30,000 to reliable support, the pair nonetheless avoided a deeper retracement, helping calm fears that last week’s $23,800 capitulation event did not mark the bottom. The U.S. dollar index (DXY) provided the background to Bitcoin’s relatively solid performance, this coming off two-decade highs to dip 2% in a week. This appeared to relieve some pressure on stock markets, the S&P 500 finishing May 19 down a more modest 0.58% compared to previo...

Bitcoin trades in $29K ‘no man’s land’ as Tesla ESG fallout routs stocks

Bitcoin (BTC) stayed $1,000 lower on May 19 after a grim trading session on Wall Street the day before put pay to further upside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Musk blasts ESG “scam” after S&P 500 exit Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $29,000 at the time of writing, having bounced at $28,600 on Bitstamp. The pair had declined in step with United States equities, with the S&P 500 particularly in focus as it set its largest intraday decline since June 2020. Drama over Tesla, which was removed from the index amid ongoing controversy, fuelled the poor performance. The firm’s CEO, Elon Musk, publicly rebuked those behind the decision, which appeared tied to adherence to so-called environmental, social and gove...

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

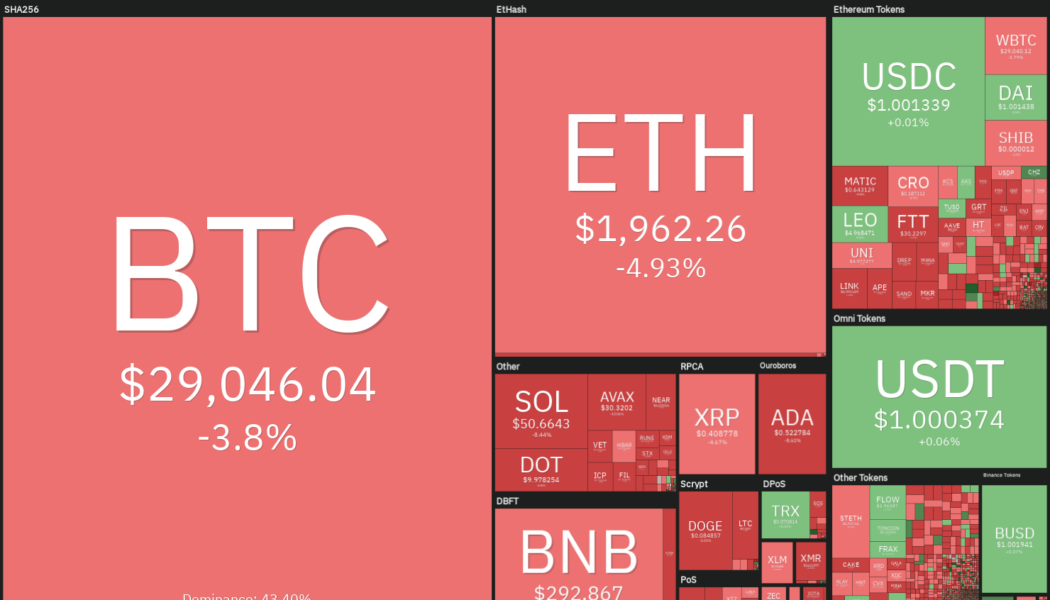

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Bloomberg strategist compares Bitcoin’s declining volatility to Amazon stocks in 2009

The Fed’s position against risk-on assets is purging the most speculative assets, such as meme coins. The senior commodity strategist at Bloomberg Intelligence, Mike McGlone, has forecasted the declining volatility against stock markets will allow Bitcoin and Ethereum to come out ahead While crypto markets have suffered greatly since the start of May, bearish conditions can only last finitely and there are signs the downturn is coming to an end or at least abating. In a recent interview with Yahoo Finance, Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, has expressed his belief that even as the nascent crypto markets suffer alongside the S&P 500, the former will come out on top. Fed measures against inflation fuelled the recent crash McGlone explained that the ...

Bitcoin clasping to remain above $30k as Solana leads altcoins in recovery

Bitcoin has mounted a slight recovery following last week’s crash to a multi-month low of $26,350 Many altcoins have charted green candles today, with Solana leading the way among the top ten coins by market cap Leading a recovery upwards of $30k this week, Bitcoin lost ground after briefly hovering above $31k yesterday. The leading digital asset had built momentum from $28,700 last Saturday, climbing as high as $31,305 early Monday before retracing as far as $29,260, CoinMarketCap data shows. The pioneer crypto has since recorded a series of minor gains and is now pushing towards $31,000 again. However, the ascent above $30,000 has not been without opposition from bears. At the time of writing, Bitcoin is exchanging hands at $30,215 – having gained approximately 1.77% in the last 24...

FTX CEO favours PoS chains over Bitcoin for payment

Sam Bankman-Fried caused a stir on social media following remarks on Bitcoin’s inability to efficiently support millions of transactions per second He, however, believes the flagship cryptocurrency can serve as a store of value FTX CEO Sam Bankman-Fried, earlier this week, weighed in on the Bitcoin utility discussion. The crypto entrepreneur remarked that the notion that Bitcoin could facilitate payments into the future is a flawed one. In a recent interview with Financial Times, Bankman-Fried explained that Bitcoin lacks the measure of scalability desired to achieve adoption as a payments network on a mass scale. “Things that you’re doing millions of transactions a second with have to be extremely efficient and lightweight and lower energy cost. Proof of stake networks...

El Salvador hosts 32 central banks and 12 other institutions to discuss Bitcoin

The majority of central banks and financial authorities that featured are from Africa The continent lags in terms of crypto adoption and use compared to Europe, America, and Asia It has been more than seven months since El Salvador made Bitcoin its legal tender – a decision the country’s president Nayib Bukele has insisted is for the good of the citizens. This is despite caution from monetary institutions like the IMF and strong opposition by a faction of El Salvadorians. During this period, the Central African Republic followed suit in adopting the Satoshi coin as an officially accepted currency form – the first in Africa. On Monday, El Salvador president Bukele met with representatives from central banks and financial institutions of 44 different countries, as he had previous...

Utility tokens vs. equity tokens: Key differences explained

Investors familiar with the concept of equity investing will find equity tokens to be an extension of the same thought process as initial public offerings while those with a riskier appetite can venture into plonking their capital on the utility tokens in which they believe. One glaring difference between utility and equity tokens is the fact that the former is not regulated as they provide access to a service rather than a specific investment in an asset or company as do equity tokens. However, for those asking the question of whether utility tokens can be traded, the answer is that they are similar to equity tokens in this aspect and are available for trading on various exchanges. To answer whether utility tokens are good investments though, any money put into a utili...

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...