Bitcoin

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

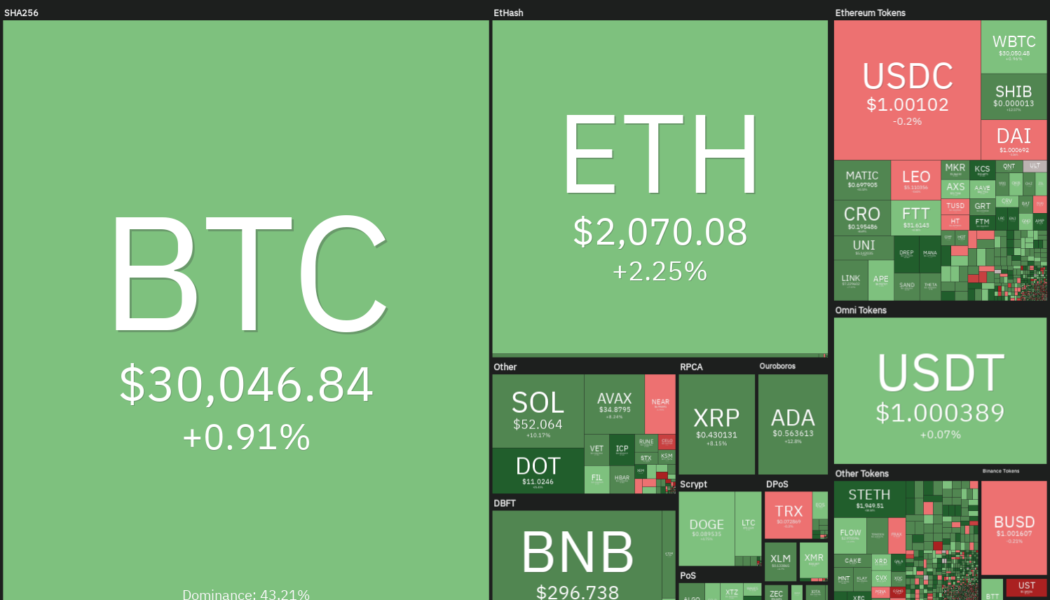

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

Bitcoin stays under $30K as LUNA gains 600% during ‘insane volatility’

Bitcoin (BTC) failed to reclaim $30,000 into May 14 as traders looked forward to a relatively stable weekend. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitfinex longs gather strength Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it lingered below the $30,000 mark, now rapidly becoming resistance. The pair had reached just shy of $31,000 before retracing, while the end of the traditional market trading week had been accompanied by fresh warnings of a new macro low still to come. #Bitcoin – Looks like we might get the inverse H & S before going into the weekend. Hoping to see this 4h candle hold and see it push up. Then I’ll move stops in profit and let it ride during the weekend. 2% risk, 2% stop loss. pic.twitter.com/lxRuk3M43G — ...

Crypto mining stocks crash as the market continues bleeding heavily

Bitcoin is down 13% in the last 24 hours, extending a bearish run that has wiped almost 30% of its value over the last seven days The massive-sell off has been felt by Bitcoin mining companies whose stock has registered declines Terra’s collapsing ecosystem has been the biggest headline in the crypto sector, but it isn’t the only crypto entity that has been affected by the market downturn. Its native token LUNA crumbled after continued losses totalling 98% in the last 24 hours. Its related stable coin, TerraUSD, has suffered a similar fate – down to $0.4711 against the dollar. Bitcoin is faring badly itself but is much better than Ethereum and many other altcoins. The flagship asset today fell below $28,000 – a low it hasn’t visited since December 2020. Notably, the latest b...

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

Bitcoin falls below $27K to December 2020 lows as Tether stablecoin peg slips under 99 cents

Bitcoin (BTC) fell out of its long-term trading range on May 12 as ongoing sell pressure reduced markets to 2020 levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tether wobbles as UST stays under $0.60 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it exited the range in which it had traded since the start of 2021. At the time of writing, the pair circled $26,700 on Bitstamp, marking its lowest since Dec 28, 2020. The weakness came as fallout from the Terra stablecoin meltdown continued to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues due to losses on LUNA and UST. “People are still processing this but this is the Lehman moment for crypto” Hearing about a lo...

Crypto Crisis: Over $1 billion liquid in 24 hours

The crypto market has witnessed a massive sell-off in the past 24 hours, triggered by the recent crash of Bitcoin (BTC) below $30,000. As a result, the positions of hundreds of thousands of crypto traders were liquidated. For example, data from Coinglass shows that more than $1 billion in trading positions has been wiped out in the past 24 hours. Multi-million dollar wipe out Traders expecting a bounce were hit the hardest by the correction, as nearly $750 million in long positions were liquidated over the past day. The volatility also took a toll on those betting crypto will fall in a straight line, as nearly $200 million in short positions were wiped out over the same period. With bearish momentum taking over the crypto markets, traders trying to time Ethereum (ETH) suffered its biggest ...

Terra ‘rescue plan’ still at large as LUNA falls below $5, Bitcoin spikes to ‘$138K’ in UST

Panic appeared to set in on crypto markets overnight on May 11 as Blockchain protocol Terra failed to steady its bleeding cryptoassets. Data from Cointelegraph Markets Pro and TradingView showed both the firm’s in-house token, LUNA and stablecoin, TerraUSD (UST) seeing fresh heavy losses on the day. A dubious new “all-time high” for Bitcoin After a mass sell-off which some argued was “coordinated” to destroy the Terra ecosystem, UST lost its peg to the U.S. dollar. Attempts to shore up the peg with both LUNA and Bitcoin (BTC) reserves failed, and as uncertainty gripped the market, both UST and LUNA dived to levels unimaginable just days previously. Getting close … stay strong, lunatics — Do Kwon (@stablekwon) May 10, 2022 Co-founder Do Kwon said that a “recove...

Bitcoin falls below $30k to retouch a ten-month low: Here is what is happening?

Crypto and traditional markets continue seeing wide-scale sell-offs in response to the Fed’s tighter monetary policy Glassnode says the rush to de-risk from assets such as Bitcoin pushed the token’s network transaction costs 15% higher than average Cryptocurrency markets have been in the red since the value of the largest crypto-token, Bitcoin, plunged below the $40k on April 28. Since last Thursday, the fall has been even more intense. Yesterday, the price of Bitcoin fell below $30k for the first time since July 2021, as markets – traditional and cryptocurrency – saw increased sell-offs in reaction to the US Federal Reserve’s renewed aggressive monetary policy. The price of the flagship crypto was spotted as low as $29,944 on CoinMarketCap during yesterday’s session. Though it...

Cathie Wood says the bear crypto market could be nearing a close

ARK Invest’s Cathie Wood believes a bearish run for crypto markets could soon be over, as markets all over are now capitulating She predicted that the market cap of truly ‘disruptive innovation’ will exponentially grow to $210 trillion by 2030 CEO of asset management firm ARK Invest Cathie Wood remains unfazed over the long-term behaviour of cryptocurrencies despite the most recent downturn in the price levels of this asset class. Speaking during an appearance in a recent update of the Into the Know series, the ARK Invest chief explained that the increased co-movement between crypto-assets and the stock market, which has caused the current unimpressive run, is a sign that the bear market could be coming to an end. She said that a bear environment for crypto assets could soon tou...

El Salvador buys the dip to boost government’s coffer with 500 BTC

The Central American nation now holds 2,301 BTC Despite recent Bitcoin additions, its use as legal tender remains unpopular with Salvadorans The president of El Salvador Nayib Bukele, has remained resolute, sticking to his grand Bitcoin adoption masterplan. The Central American nation, earlier this week, boosted its Bitcoin position following another bulk purchase during the recent market dip. The second BTC purchase this year Tweeting out the news on Monday, President Bukele confirmed that El Salvador added 500 BTC for $15.37 million, translating to an average price of $30,744. Notably, this was a more enticing price level than the $36,585 average price for the 410 Bitcoins the country added in January. “El Salvador just bought the dip! 500 coins at an average USD price of ~$30,744,” ...

‘Kwontitative easing’ — BTC price hits $43K in UST as Terra empties $2.2B BTC bag

Bitcoin (BTC) fell below $30,000 for the first time in ten months on May 10 as turmoil at Blockchain protocol Terra continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price bounces at $29,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD plumbing lows of $29,731 on Bitstamp. The first trip under the $30,000 mark since July 2021, overnight BTC price performance came amid both declining stock markets and fresh trouble for Terra’s United States dollar stablecoin, TerraUSD (UST). As Cointelegraph continues to report, UST saw an attack involving mass-selling this week, which culminated in Terra using its giant 750 million BTC reserves to prop up its USD peg. Initial liquidity steps to mitigate the impact of the threat proved insufficient, ho...