Bitcoin

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

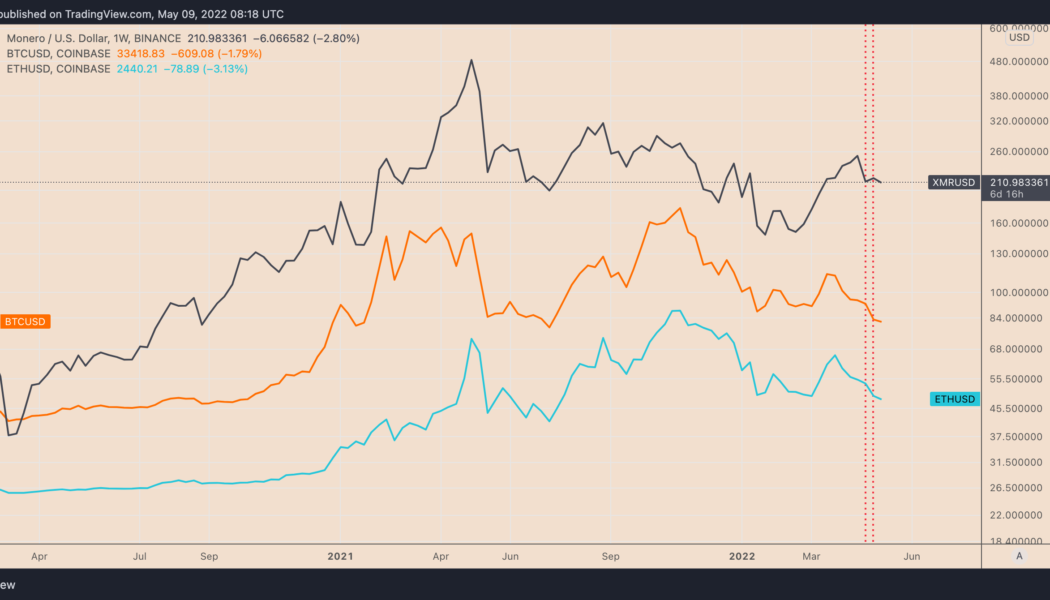

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Bitcoin sets news 2022 lows as analyst says trip to $24K realized price ‘entirely possible’

Bitcoin (BTC) set a new record low price for 2022 on May 9 as crypto markets continued selling off prior to the Wall Street opening. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price sinks under $36,700 Data from Cointelegraph Markets Pro and TradingView confirmed the firmly bearish achievement for BTC/USD, which hit $32,637 on Bitstamp. With the latest installment of a string of losses in May, the pair continued to trade under $33,000 at the time of writing, with weekly losses now at 15%. “Bitcoin sweeping the lows here, that’s probably next liquidity,” Cointelegraph contributor Michaël van de Poppe told Twitter followers in one of several posts on the day: “We could go towards $30-31Kish as that’s a daily block, but I’d be looking at longs around these regio...

Top 5 cryptocurrencies to watch this week: BTC, ALGO, XMR, XTZ, THETA

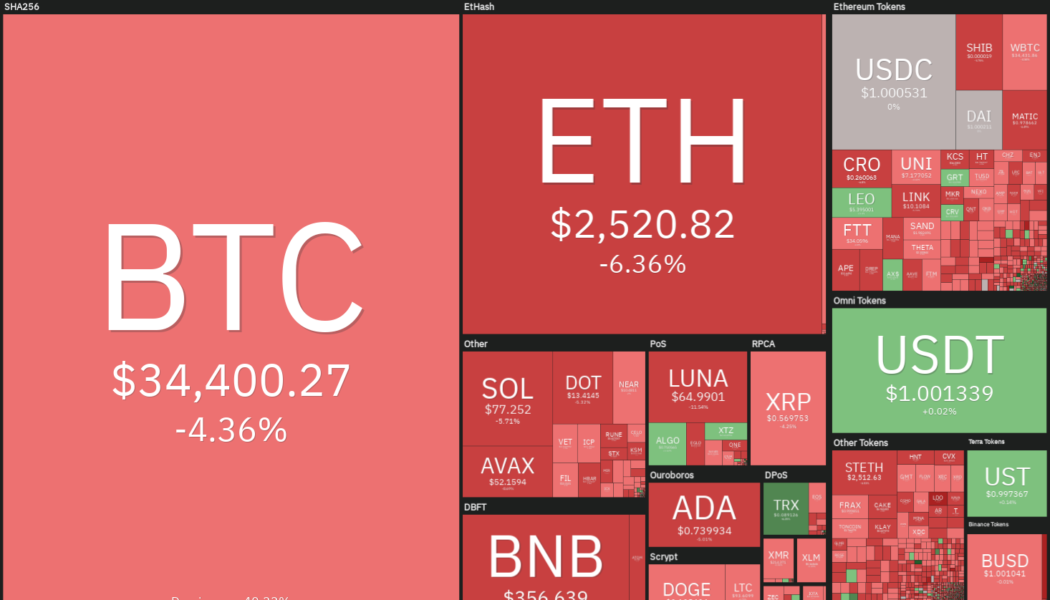

The S&P 500 and the Nasdaq have declined for five consecutive weeks, indicating that traders continue to reduce exposure to risky assets. Bitcoin’s (BTC) close correlation with United States equity markets has resulted in its price remaining under pressure. Bitcoin has extended its decline during the weekend and is now on track for its sixth successive weekly loss, the first such occurrence since 2014. The weakness in Bitcoin has pulled down the entire crypto markets, whose market capitalization has dipped below $1.6 trillion. Crypto market data daily view. Source: Coin360 When the sentiment is bearish, traders sell on every negative news. The de-peg of Terra’s U. S. dollar stablecoin TerraUSD (UST) also appears to be increasing sell pressure across the crypto market. After Bitcoin’s s...

Bitcoin price target now $29K, trader warns after Terra weathers $285M ‘FUD’ attack

Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC circles $34,400 lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing. The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility. Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets. Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at aroun...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

Bitcoin clings to $36K as data suggests BTC price sell-off came from short-term holders

Bitcoin (BTC) found a new home at $36,000 into May 7 as volatility finally cooled into the weekend. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra down at least $250 million in crunch Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling the $36,000 mark overnight after losing 12% in just 72 hours. Still near its lowest levels since late February, the pair had nonetheless avoided a rematch of 2022 lows at the time of writing despite low-volume weekend market conditions. In his latest Twitter update on May 6, popular trader Anbessa highlighted the planned support level to buy Bitcoin in what he described as a “fakeout” — a zone beginning at just under $33,000. #Bitcoin Update Twitter friendly, easy words BTC support, BTC fakeou...

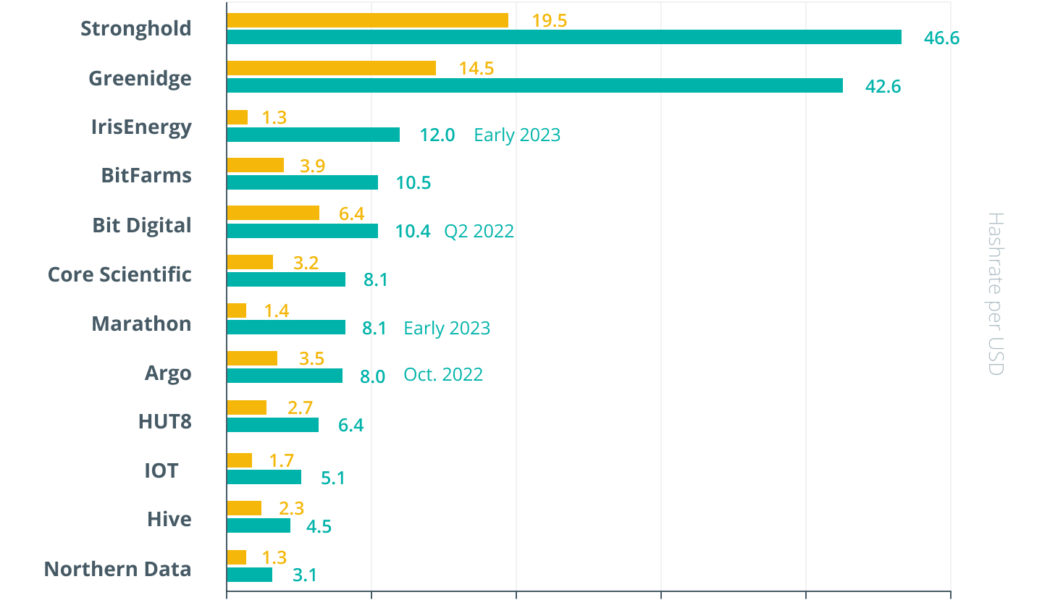

Controlling 17% of BTC hash rate: Report on publicly listed mining firms

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library. The latest paper looks at a particular group of players in the Bitcoin (BTC) mining industry. Published by crypto consulting firm Crypto Oxygen, the report highlights the current landscape of publicly listed crypto mining companies that control approximately 17% of the total hash rate of the entire Bitcoin network. The crypto mining industry is a quickly growing and evolving sector. In January this year, a United States-based company Core Scientific went public via a special purpose acquisition company (SPAC) merger, making it the largest publicly traded crypto mining company in revenue and h...

Senator Tommy Tuberville proposes a bill in support of crypto retirement plans

The Alabama senator says the government shouldn’t interfere with how users invest their retirement savings He plans to introduce the Financial Freedom Act to this effect The DoL and Senator Elizabeth Warren already took moves opposing Fidelity Investments’ plan to offer crypto investments for retirement plans At the end of April, Fidelity Investments announced the launch of a new service that would allow employees in the 23,000 companies it serves to complete Bitcoin investment of up to 20% of the 401(k) pension plan. With the provision, users would be able to invest in crypto without the involvement of crypto exchanges The DOL had warned against such an offering The recent move by Fidelity meant that the retirement plan provider had directly contravened guidance issued by the Department o...

‘Someone is blowing up’ — Bitcoin sees 2022 volume record amid hopes capitulation is over

Bitcoin (BTC) dipping below $36,000 “smells like capitulation,” one trader says as suspicion mounts over United States stock markets. In a tweet on May 6, Cointelegraph contributor Michaël van de Poppe suggested that the BTC price was at least giving “serious signals.” Analyst: Stocks saw “forced liquidation” After plunging to 10-week lows in line with equities on the May 5 Wall Street trading session, Bitcoin bounced at levels last seen in February. The downturn in both crypto and stocks, which followed an initial bounce the day prior on the back of expected rate hikes by the Federal Reserve, appeared to be more than traders bargained for. The S&P 500 finished the day down 3.5%, while the Nasdaq 100 ended down 5%. Outside stocks, U.S. 10-year Treasury futures shed 1%, a rare comb...

Bitcoin price hits 10-week lows as $40K spike becomes ‘nasty bull trap’

Bitcoin (BTC) hit its lowest level in over two months later on May 5 as Wall Street trading saw volatility return with a bang. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView DXY celebrates as stocks, crypto tumble Data from Cointelegraph Markets Pro and TradingView painted an unsettling picture for hodlers as BTC/USD fell to $36,520 on Bitstamp. Capping losses, which totaled 8.3% at one point, Bitcoin only bounced at a price last seen on Feb. 24 this year. As Cointelegraph reported, the performance had come in tandem with mayhem in U.S. markets as equities gave up previous gains to flip bearish on the economic outlook. The Federal Reserve’s “priced in” rate hikes thus appeared to have been something of a red herring. “BTC breaks below 37K after a na...

Bitcoin trader keeps $40.8K BTC price target amid warning over risk asset ‘pain trade’

Bitcoin (BTC) consolidated below $40,000 on May 5 after United States economic policy excitement saw a spike to one-week highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed sparks little crypto reaction Data from Cointelegraph Markets Pro and TradingView confirmed an overnight peak of $40,050 on Bitstamp following comments from the Federal Reserve and Chair Jerome Powell. The U.S. central bank had conformed to market expectations with a 0.5% key rate hike, also suggesting that similar repeat hikes would follow. With that, a modest market rally left Bitcoin eerily lacking volatility in what was a strong contrast to previous Fed pronouncements on topics such as inflation. While many expected risk assets en masse — including crypto — to deflate under the new poli...

The Flippening: Ethereum Has Overtaken Bitcoin in 26% of Countries Worldwide

26% of nations have more Ethereum investors than Bitcoin, including USA Argentinians are the biggest Bitcoin maxis, with 73% of cryptocurrency investors holding the coin, as inflation skyrockets in the country Meme mania is highest in the USA, with more American Dogecoin investors than any other country Japan is the most bullish on Solana dethroning Ethereum as the King of DeFi Intro Once upon a time, Bitcoin was the world’s only cryptocurrency. The industry has come a long way since, however, and today we have over 18,000 cryptocurrencies serving a variety of use cases. Some have aimed to compete with Bitcoin, while others have almost nothing in common with it. We have meme-coins, such as Dogecoin and Shiba, which have taken the world by storm. We have the burgeoning industry of DeF...