Bitcoin

MicroStrategy booked losses in Q1, with plunging Bitcoin price

The largest corporate Bitcoin holder recorded a Bitcoin impairment loss of $170.1 million in the first three months of 2022 Its latest Bitcoin addition was funded by a $205 million Bitcoin-backed loan. The world’s largest enterprise Bitcoin hodler MicroStrategy on Tuesday released its first-quarter 2022 financials, revealing a total revenue of 119.3 million, down 2.9% on the year. A tough Q1 MicroStrategy also said it saw a cumulative impairment loss of $1.071 billion on its Bitcoin Strategy. In the three-month period ending March 31, during which Bitcoin dropped by 1.2%, the software intelligence firm held 129,218 BTC, which at the time had a total market value of $5.893 billion and a carrying value of $2.896 billion. The company’s most recent purchases saw as many as 4,167 BTC...

Ethereum “Flippening” debate to resurface post-Merge?

Once upon a time in crypto-land, the word “Flippening” was brandished about daily. The term is slang for the much-discussed possibility of Ethereum “flipping” Bitcoin’s market cap, and hence becoming the world’s biggest cryptocurrency. But recently, there has not been as much talk about a new King, as the below Google Trend data for the search term “Flippening” shows. Regarding the price action, 1 ETH is now worth 0.06 BTC, having been close to 0.09 BTC before Christmas. As has become customary in the crypto markets, Bitcoin has held up better than its smaller counterparts, as the entire market has wobbled in 2022. However, the scale of ETH’s decline, denominated in Bitcoin, is indeed surprising, and steeper than we had seen for most of the pandemic bull run. Bitcoin Strength However...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

Bitcoin nervously awaits Fed as Paul Tudor Jones says ‘clearly don’t own’ stocks, bonds

Bitcoin (BTC) kept investors guessing on May 3 as markets awaited May 4’s Federal Reserve comments. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tudor Jones says “no thanks” to stocks, bonds Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $38,000 at May 3’s Wall Street open. The pair had stayed practically static over 24 hours to the time of writing as volatility in stocks dictated the mood. Amid multiple calls for a “capitulation” style event to hit both crypto and TradFi markets, there was an eerie sense of calm leading up to the Federal Open Markets Committee (FOMC) meeting, with news on U.S. rate hikes to follow. Everyone is waiting for Jerome Powell to come up tomorrow to have a speech...

Fed ‘will determine the fate of the market’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with much to make up for after its worst April performance ever. The monthly close placed BTC/USD firmly within its established 2022 trading range, and fears are already that $30,000 or even lower is next. That said, sentiment has improved as May begins, and while crypto broadly remains tied to macro factors, on-chain data is pleasing rather than panicking analysts. With a decision on United States economic policy due on May 4, however, the coming days may be a matter of knee-jerk reactions as markets attempt to align themselves with central bank policy. Cointelegraph takes a look at the these and other factors set to shape Bitcoin price activity this week. Fed back in the spotlight Macro markets are — as is now the standard — on edge this week as another U....

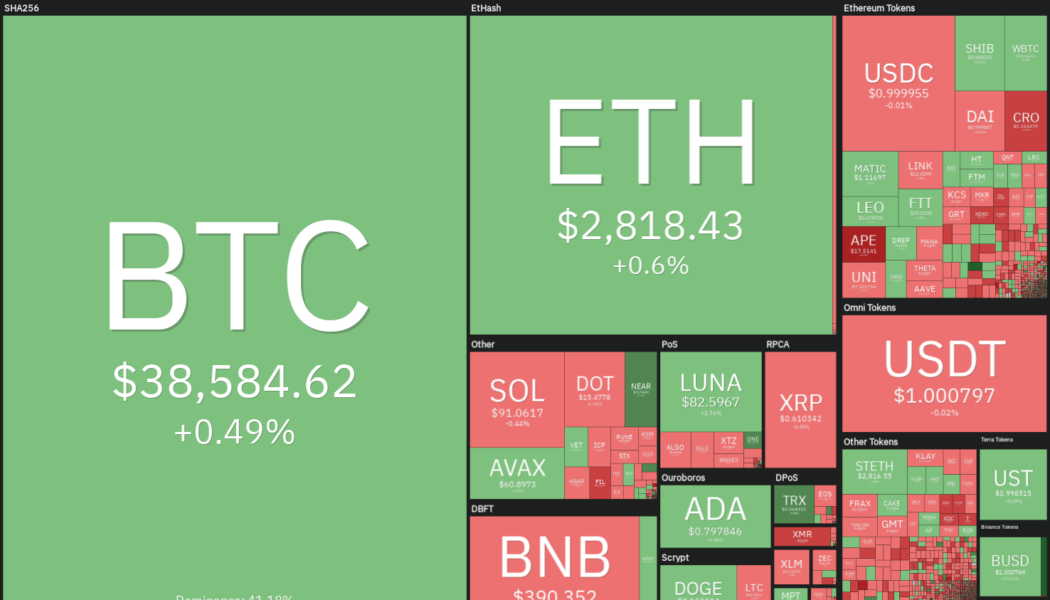

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

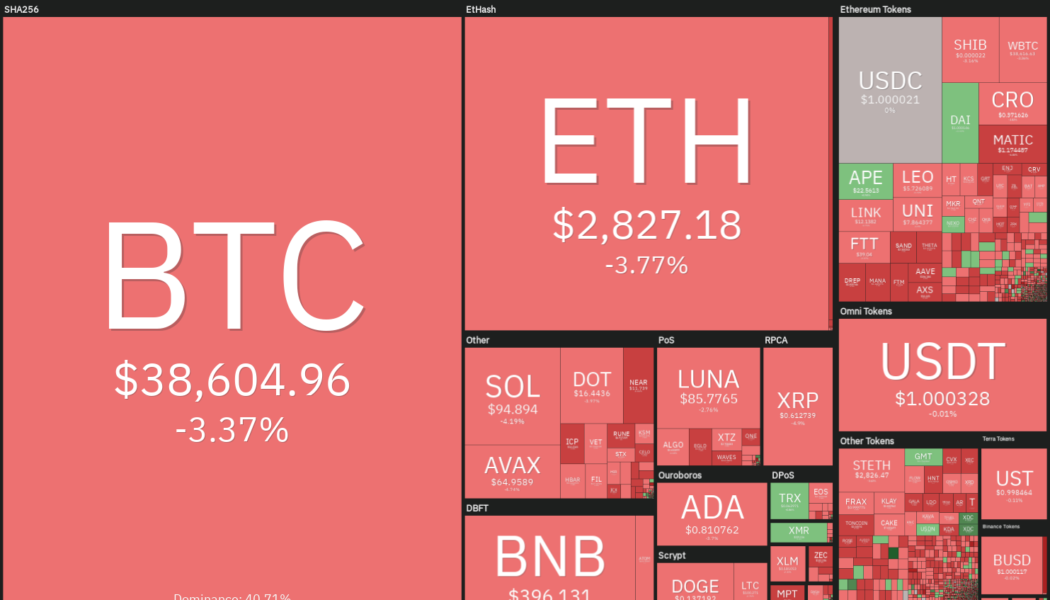

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Bitcoin retreats toward $38K after Friday sparks losses for ‘nearly everything’ outside China

Bitcoin (BTC) fell into the May holiday weekend after late trading saw crypto losses echo “basically everything.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Macro keeps BTC firmly in its place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing at $38,180 on Bitstamp to circle $38,600 on April 30. The pair had performed weakly on April 29, and this nonetheless echoed the vast majority of traditional assets — with the notable exception of Chinese equities. “Almost everything went down today besides gold, platinum, and Chinese stocks,” economist Lyn Alden summarized. With that, the S&P 500 finished on April 29 down 3.6% and the Nasdaq 100 down 4.5%. Hong Kong’s Hang Seng, on the other hand, gained 4% overall. The United States Dollar I...

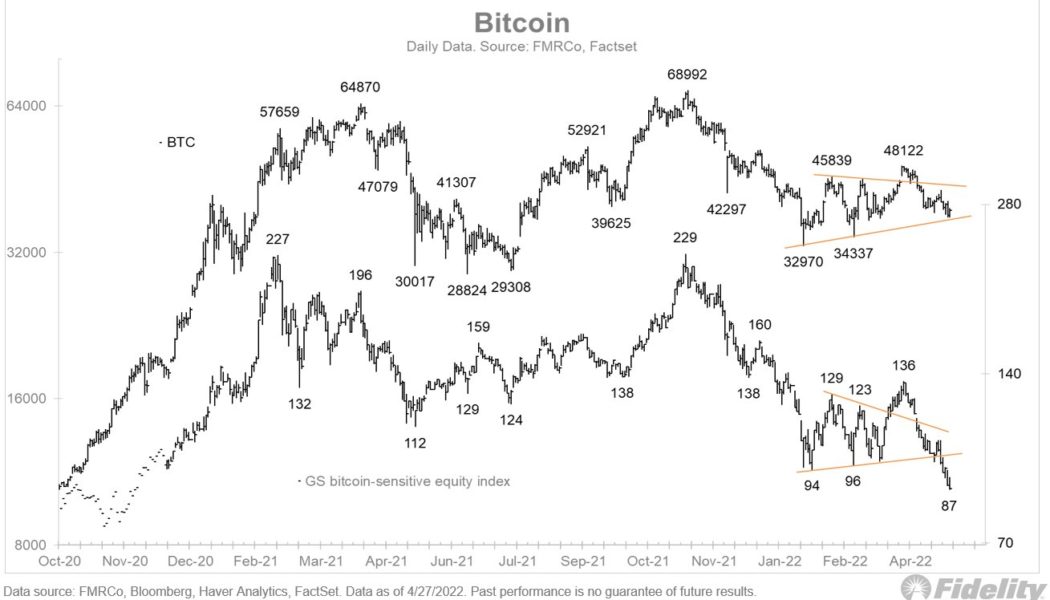

These are the BTC price levels to watch as Bitcoin risks worst April on record

Bitcoin (BTC) sits at a historically important price point for hodlers, but where could it be headed in the coming days? As the monthly close looms and various countries prepare for the May holidays, traders are mapping out the options — with some surprises. $35,000 becomes key focus While Bitcoin market commentators rarely agree on much, one thing is more or less accepted this week — that April’s monthly close will be volatile. Due over the weekend, that volatility has the potential to be exacerbated by a lack of trading volume thanks to markets being off either for the weekend or long weekend. Even with macro participation, however, the situation would seem not to favor Bitcoin bulls. As Cointelegraph reported, Friday saw major indices, with the notable exception of China, finish i...

Bitcoin disappoints on bull run as AMZN stock sees biggest 1-day drop since 2014

Bitcoin (BTC) fell into the Wall Street open on April 29 as United States markets opened to volatility, including an 11% drop in Amazon stock. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView All change at the Fed Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD dipping to $38,622 on Bitstamp Friday. Despite a let-up in the U.S. dollar’s relentless bull run, Bitcoin showed little signs of strength as it remained firmly under $40,000. Macro factors remained against the largest cryptocurrency along with risk assets more broadly, commentators noted, as the Federal Reserve reduced its balance sheet. The start of #Fed deleveraging? Fed balance sheet has shrunk for the 2nd consecutive week. Total assets now at $8,939bn, equal to 36.6% of US’ GDP vs ECB&...

Dogecoin Jesus? Roger Ver resurfaces on Twitter, backs DOGE over BTC

Roger Ver, an early investor and ardent promoter of Bitcoin (BTC) which earned him the moniker “Bitcoin Jesus” has resurfaced on Twitter after a year and backed Dogecoin (DOGE) in an interview, preferring it for payments over the world’s first crypto. In an interview with Bloomberg, the Bitcoin.com founder said how he was a fan of the memecoin due to its fast transaction times and low fees: “Dogecoin is significantly better, it’s cheaper and more reliable [than Bitcoin]. If I had to pick three contenders for the world’s dominant cryptocurrency, they would be Doge, Litecoin and Bitcoin Cash.” Ver also took time in the interview to voice his support for honorary Dogecoin CEO Elon Musk’s Twitter takeover. “It’ll certainly make Twitter more attractive,” said Ver. “I am really, really grateful ...