Bitcoin

Bitcoin set for volatile monthly close after BTC price ‘checks all boxes’ for major move

Bitcoin (BTC) has reentered its most significant lifelong consolidation zone but could still crash to a “macro bottom,” new research warns. In a Twitter thread on April 27, on-chain analytics platform Material Indicators shone a light on the importance of $38,000 for BTC price action. Bitcoin circles all-important point of control After lingering near liquidity at or above $37,700 on intraday timeframes, data from Cointelegraph Markets Pro and TradingView shows, BTC/USD has yet to make a clear move up or down, and traders have been left guessing which way the market will go. Macro factors are demanding further downside, as the impact of inflation and geopolitical strife is clearly felt on equities markets. At the same time, on-chain signals are anything but bearish, led by miners and ...

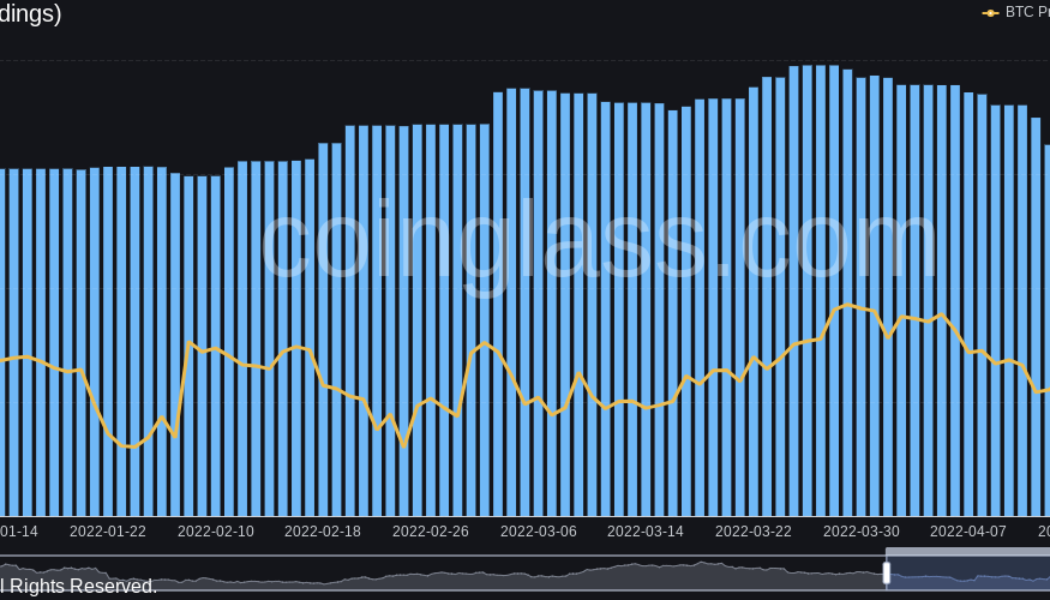

Purpose Bitcoin ETF adds 1.1K BTC as data hints investors want to ‘buy the dip’

The world’s first Bitcoin (BTC) spot price exchange-traded fund (ETF) is buying BTC again after a month of selling. Data from on-chain monitoring resource Coinglass confirms that on April 27, Canada’s Purpose Bitcoin ETF added 1,132 BTC to its holdings. Data: Buy the dip interest “skyrocketing” Despite fears that Bitcoin is not yet done with its sell-off, an about turn at Purpose hints at increasing institutional demand. Beginning March 28, when BTC/USD traded above $48,000, Purpose began reducing its exposure, which at the time totaled 36,321 BTC. Wednesday’s increase is thus the first since March 25. At the time of writing, Purpose held 31,162.7 BTC, while BTC/USD traded at $39,000. Purpose Bitcoin ETF BTC holdings chart. Source: Coinglass The move coincides with figures from...

Portal partners with HighCircleX to launch tokenised shares on the Bitcoin blockchain

Tokenised equities have been launched on various blockchains, but this is the first time they will be coming to Bitcoin. Portal, a cross-chain Layer-2 DEX network, announced earlier today that it had partnered with HighCircleX, a blockchain-based asset marketplace by High Circle Ventures. The partnership will see the two entities tokenise shares in pre-IPO companies on the Bitcoin blockchain. This latest development is a huge plus for Portal in its bid to bring real-world use cases to Bitcoin. According to the press release shared with CoinText, the tokenisation of equity in private, pre-IPO companies will help bring liquidity to illiquid assets, the companies said. Furthermore, it will increase the utility of the Bitcoin blockchain. Portal’s Executive Chairman, Dr. Chandra Duggirala, said...

Could XRP price lose another 70% by Q3?

Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to reach $0.64, its lowest level since Feb. 28. More XRP price downside ahead? The plunge increased the possibility of triggering a bearish reversal setup called descending triangle. While these patterns form usually during a downtrend, their occurrences following strong bullish moves usually mark the end of the uptrend. XRP has been in a similar trading channel since April 2022, bounded by two trendlines: a lower horizontal and an upper downward sloping. The pattern now nears its resolve as XRP pulls back toward the support trendline that’s also coinciding with the 50-week exponential moving average (50-week EMA; the blue wave), five weeks after testing the upper trendline as resistance. XRP/USD weekl...

Bitcoin spoofs $39.5K breakout at Wall St open as Elon Musk Twitter takeover nears

Bitcoin (BTC) saw a classic “fakeout” move on April 25 as volatility kept traders firmly on edge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders stay gloomy on BTC outlook Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly climbing almost $1,000 as Monday’s Wall Street trading session began. The move was short-lived, the pair coming back down to where it started within an hour after hitting local highs of $39,517 on Bitstamp. Monday had begun with a whimper for Bitcoin bulls, who lost ground on the weekly close and failed to avoid $40,000 flipping to resistance on daily timeframes. For popular trader Crypto Ed, $30,000 was still on the table as a potential short-term target. “To me, it seems any bounce we...

Bitcoin sets up lowest weekly close since early March as 4th red candle looms

Bitcoin (BTC) stayed below $40,000 on April 24 as the weekly close looked set to be a painful one for bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Binance bids slowly thin below spot Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to retake the $40,000 mark after losing it before the weekend. As traders braced for classic volatility into the weekly close, Bitcoin looked decidedly unappetizing. At $39,500 on Bitstamp, the spot price at the time of writing would constitute the lowest weekly close since the week of March 7. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView “Pretty obvious uptrend since mid-to-late January imo. If we have our 4th RED weekly close today could be bad though,” Twitter account CryptoBull comment...

‘Something sure feels like it’s about to break’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week in an uncertain place facing uncertain times — is $40,000 now resistance? The largest cryptocurrency has just closed a fourth red weekly candle in a row, something that has not happened since June 2020. As cold feet over the macro market outlook continues to be the norm, there seems little to comfort bulls as the week gets underway — and Bitcoin is not done selling off yet. On the back of $4,000 in losses over the past four days alone, price targets now focus on retests of liquidity levels further towards $30,000. It is not all doom and gloom — long-term hodlers and key participants such as miners are showing a more positive stance when it comes to Bitcoin as an investment. With that in mind, Cointelegraph takes a look at the forces at work when it comes to ...

How to use a Bitcoin ATM

Things required to use a Bitcoin ATM There are a few things you’ll need to prepare before you can get started on using a Bitcoin ATM: A crypto wallet The first thing you’ll need before using a Bitcoin ATM is a crypto wallet. More specifically, you’ll need a Bitcoin wallet. A crypto wallet is an app or a piece of software that allows you to store your crypto. In this case, you’ll need a wallet that specifically supports Bitcoin (BTC) — one that allows you to send and receive Bitcoin. It shouldn’t be a challenge to find a good one as Bitcoin is virtually the most popular cryptocurrency out there. There are many different types of wallets, and they all have their advantages and disadvantages. Related: Bitcoin wallets: A beginner’s guide to storing BTC A Bitc...

Bitcoin funding rates show demand to short BTC as $40K becomes resistance

Bitcoin (BTC) consolidated under $40,000 on April 23 as market expectations favored further losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Extreme fear” accompanies Bitcoin’s descent to $39,200 Data from Cointelegraph Markets Pro and TradingView followed a bearish BTC/USD after the pair touched $39,200 on Friday’s Wall Street open. Falling in line with stocks, Bitcoin now faced the prospect of resistance cementing itself at the $40,000 mark, with traders showing their lack of confidence in a short-term rebound. Data from on-chain analytics site Coinglass confirmed that funding rates across derivatives exchanges were firmly negative into the weekend, suggesting that the majority of market participants expected shorting to be a profitable ne...

Bitcoin’s 30-day correlation with tech stocks hits July 2020 numbers

The Fed’s decision to tighten monetary policy has primarily caused this increased correlation Bitcoin’s correlation with the dollar strength index is as high as March 2020 Analysts at Arcane Research have published a report detailing that Bitcoin’s 30-day correlation with the stocks has reached heights not seen since July 2020. The post revealed that the flagship crypto’s correlation with gold is now at an all-time low, all of which are bearish indicators for the leading digital asset token. Further, it also noted that Bitcoin’s correlation to the U.S. Dollar index had reached 0.53, the highest since March 2020, as the dollar continues regaining strength. Impact of the U.S. Fed policy One huge cause for this shift is the U.S. Federal Reserve policy. While the leading digital asset by...

Price analysis 4/22: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) turned down sharply on April 21, maintaining its tight correlation with the U.S. equity markets, which reversed direction after U.S. Federal Reserve Chair Jerome Powell hinted that a 50 basis point rate hike was “on the table” in May. The selling has continued on April 22 as investors trim risky assets in expectation of an aggressive stance from central banks to curb surging inflation. Veteran trader Peter Brandt said in a tweet recently that the Nasdaq 100 (NDX) was showing a formation similar to the one it had made before plunging in the year 2000. If history repeats itself then the NDX could witness a sharp correction. That may be negative for the crypto markets in the short term because of the close correlation between Bitcoin and the NDX. Daily cryptocurrency market...

ETF Securities ties up with 21 Shares to launch BTC and ETH EFTs in Australia

EBTC and EETH would be the first spot ETFs tracking Ether and Bitcoin via the Australia Dollar Both ETFs are expected to go live on April 27 on the CBOE Australia exchange Exchange-traded products (ETPs) specialist firm 21Shares has joined hands with ETF Securities to launch two exchange-traded funds (EFTs) tracking the two largest digital tokens. The two would be named the ETFS 21Shares Bitcoin ETF – EBTC and the ETFS 21Shares Ethereum ETT – EETH. They would be novel EFTs to track Bitcoin and Ethereum-native Ether using the Australian Dollar directly. The exposure to cryptocurrencies that the two products will offer customers will be entirely backed by Bitcoin and Ether held in cold storage at the Coinbase crypto. The tickers will go live on April 27, listing on the CBO...