Bitcoin

Monero defies crypto market slump with 10% XMR price rally — what’s next?

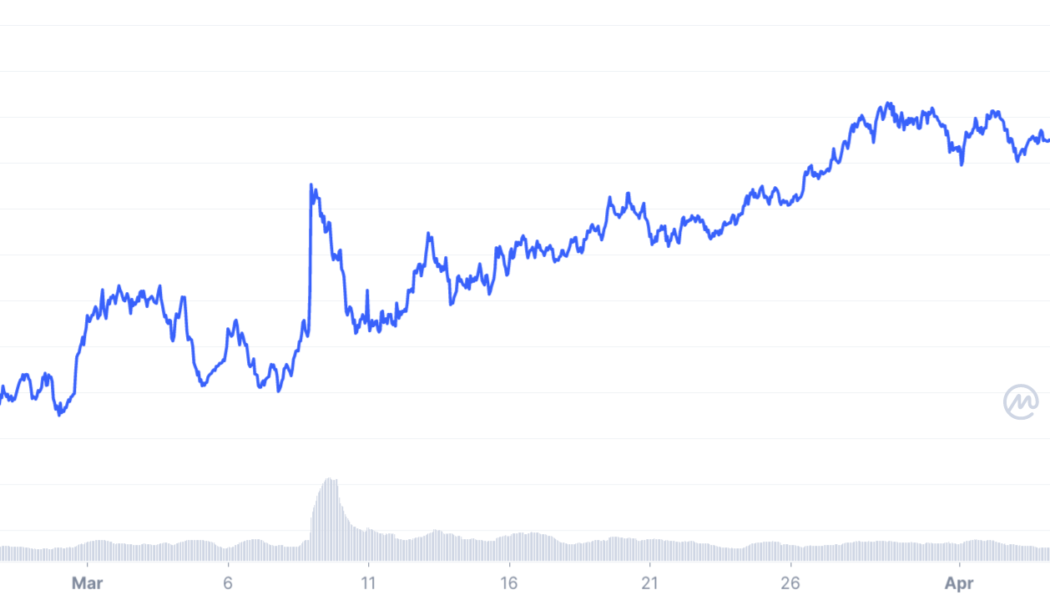

Privacy-focused cryptocurrency Monero (XMR) rallied by nearly 9.5% in the past week compared with the crypto market’s decline of 8.5% in the same period. What’s more, the XMR/USD pair has broken above a strong, multi-month resistance trendline, hinting at more upside ahead. XMR price action XMR’s price was down by a modest 0.87% on April 10 from its two-month-high of $245 established a day before. However, the cryptocurrency still outperformed its top rivals, including Bitcoin (BTC) and Ether (ETH), on a weekly timeframe. Speculations about entities using Monero to bypass sanctions could have boosted its appeal among investors. Meanwhile, The American research group Brookings warned last month that Monero, the first in the line of privacy coins, could...

Price analysis 4/8: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to defend the immediate support levels, indicating that bears sense an opportunity and are looking to take control of the price action. The short-term price action does not seem to worry the long-term Bitcoin bulls who expect a massive return in the next few years. While speaking at the Bitcoin 2022 conference in Miami, ARK Invest CEO Cathie Wood reiterated her Bitcoin price target of $1 million by 2030. Meanwhile, telecom billionaire Ricardo Salinas said during the conference that BTC and Bitcoin equities form 60% of his liquid investment portfolio. That is a massive increase from his Bitcoin exposure in 2020, which formed just 10% of his liquid assets. Daily cryptocurrency market performance. Source: Coin360 While the long-term may be ...

Bitcoin whales fill their bags despite warnings BTC price could fall below $40K

Bitcoin (BTC) headed toward $42,000 on April 9 after bulls failed to spark a late-week turnaround. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin lines up 10% weekly red candle Data from Cointelegraph Markets Pro and TradingView showed BTC/USD slowly dissolving support levels in place for several weeks as the weekend began. After multiple tests of $43,000, that area finally gave way to see the pair hit lows of $42,131 on Bitstamp, its lowest since March 23. Bulls hoping for a rescue move felt the pain, with cross-crypto liquidations totaling $200 million in the 24 hours to the time of writing Saturday, data from on-chain monitoring resource Coinglass confirmed. Crypto liquidations chart. Source: Coinglass For traders, the short-term outlook was thus firmly bearish...

60 Minutes feature on El Salvador’s Bitcoin Beach will air Sunday

60 Minutes, the CBS news show that has been running since 1968, will feature El Salvador’s Bitcoin Beach in a new episode airing April 10. According to a Friday post from 60 Minutes’ Twitter account, the investigative news show will air a segment on the crypto-friendly area of El Zonte, a village located in El Salvador, where residents and visitors have been able to use Bitcoin (BTC) to pay for anything from utility bills to tacos. Sharyn Alfonsi, a journalist and correspondent for the show, interviewed Mike Peterson, one of the people who funded the project and encouraged crypto adoption among residents. How did a town in El Salvador become known as Bitcoin Beach? Sunday, Sharyn Alfonsi meets with Mike Peterson who helped make it happen. pic.twitter.com/tHaHsTKFx1 — 60 Minutes (@60Minutes...

Bitcoin plumbs April lows as US dollar strength hits highest since May 2020

Bitcoin (BTC) neared new price lows for April on April 8’s Wall Street open amid a fresh surge in the U.S. dollar. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $43,000 hangs in the balance Data from Cointelegraph Markets Pro and TradingView captured another day of gloom for BTC bulls as the largest cryptocurrency slipped back under $43,000. In a classic move, BTC/USD reacted unfavorably to a resurgent dollar, with the U.S. dollar currency index (DXY) returning above 100 for the first time since May 2020. Coming on the back of tightening measures from the Federal Reserve, the greenback also spelled a headache for stocks, which opened down on the day. U.S. dollar currency index (DXY) 1-week candle chart. Source: TradingView While some considered the DXY event a temp...

DeFiChain adds Intel, Disney, iShares MSCI China ETF, and MicroStrategy dTokens

DeFiChain, the world’s leading blockchain built on the Bitcoin blockchain has announced that it has added four new decentralized tokens (dTokens) after a Ticker voting by the community. The four newly added dTokens are based on four assets namely Walt Disney Co, iShares MSCI China ETF, Intel Corporation, and MicroStrategy Incorporated. The tokens shall be denoted as follows: $dINTC – Intel Corporation $dMCHI – iShares MSCI China ETF $dDIS – Walt Disney Co $dMSTR – MicroStrategy Incorporated Following the addition of the four new dTokens, the Lead Engineer at DeFiChain, Prasanna Loganathar said: “DeFiChain is continuously expanding the dToken universe to give users a serious alternative to the traditional financial broker – all whilst offering the flexibility and benefits of decentralizatio...

Bitcoin sentiment falls into ‘fear’ as BTC price action hits $42.9K breakdown target

Bitcoin (BTC) kept disappointing hodlers on April 7 as the Bitcoin 2022 conference got underway to a limp BTC price performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed prepares $95 billion monthly balance sheet shrink Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped below multiple support levels to reach its lowest since March 23. Reversing at $42,741 on Bitstamp on April 7, the largest cryptocurrency was decidedly less bullish than the week prior, with analysts quick to point out contributing factors. Central bank monetary tightening, namely from the U.S. Federal Reserve, remained the favorite, this having a potential long-lasting impact across risk assets going forward. “The biggest headwind to Bitcoin and macroeconomi...

Bitcoin bulls may have to wait until 2024 for next BTC price ‘rocket stage’

Bitcoin (BTC) may track sideways for another two years before reigniting its bull run, new data argues. In a tweet on April 6, veteran trader Peter Brandt highlighted historical patterns suggesting that hodlers will have to wait until 2024 for their next moonshot. 8 months down, 25 to go? Bitcoin has surprised analysts with its performance over the past year, as the highly anticipated “blow-off” top in Q4 2021 was much lower than expected. After BTC/USD lost over 50% of those modest new all-time highs, the debate around the relationship of price to Bitcoin’s four-year halving cycles changed. The market, as Cointelegraph reported, was used to a macro price top coming once per four-year cycle, specifically the year after each of Bitcoin’s block subsidy halving events....

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

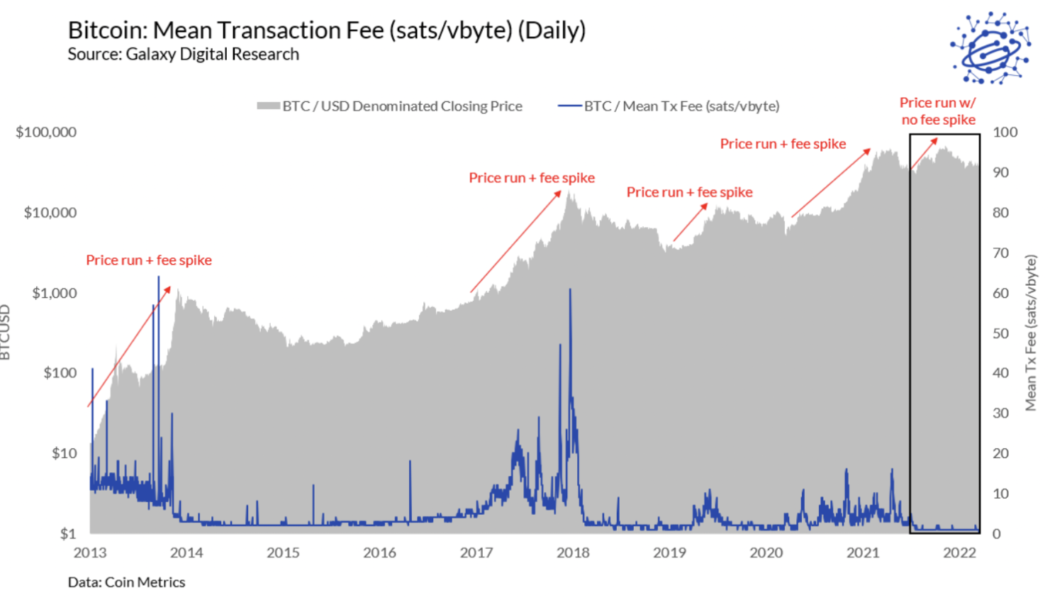

Bitcoin transaction fees hit decade lows, here’s why

It’s a great time to move Bitcoin (BTC) between wallets and exchanges. Bitcoin transaction fees have hit all-time lows in BTC, according to research by Galaxy Digital. #bitcoin fees are at all-time lows. the craziest thing? fall 2021 was the first bull run not accompanied by a major spike in fees. how is that possible? what does it mean? here’s a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021) pic.twitter.com/gnWssTckX2 — Alex Thorn (@intangiblecoins) April 5, 2022 As shown on the graph below, the Bitcoin mean transaction fee has plummeted to 0.00004541 Bitcoin ($2.06) in 2022, while the median is 0.00001292 Bitcoin ($0.59) which is the lowest of any year except 2011, according to the report. Graph to show the fees trending down ...

Lightning Labs secures $70M from Valor Equity-led Series B raise

The Bitcoin-focused firm intends to use the funds to continue advancing its Lightning solutions Lightning Labs also proposed a new protocol, Taro, that will facilitate low-cost stablecoin transactions Lightning Labs yesterday shared news of a $70 million Series B raise, adding that the funds will go into projects set to introduce stablecoin and other asset transfers on Bitcoin. The funding round saw participation from several names, including asset management firm Baillie Gifford and Valor Equity Partners – the latter leading it. Other entities and individuals that took part are NYDIG, Goldcrest Capital, Kingsway, Stillmark, Brevan Howard, Moore Strategic Ventures, Silvergate CEO Alan Lane, and Robinhood CEO Vlad Tenev. The California-based, which focuses on the development of software tha...

Lightning Labs secures $70M from Valor Equity-led Series B raise

The Bitcoin-focused firm intends to use the funds to continue advancing its Lightning solutions Lightning Labs also proposed a new protocol, Taro, that will facilitate low-cost stablecoin transactions Lightning Labs yesterday shared news of a $70 million Series B raise, adding that the funds will go into projects set to introduce stablecoin and other asset transfers on Bitcoin. The funding round saw participation from several names, including asset management firm Baillie Gifford and Valor Equity Partners – the latter leading it. Other entities and individuals that took part are NYDIG, Goldcrest Capital, Kingsway, Stillmark, Brevan Howard, Moore Strategic Ventures, Silvergate CEO Alan Lane, and Robinhood CEO Vlad Tenev. The California-based, which focuses on the development of software tha...