Bitcoin

Visa should be ‘scared’: Lightning Labs raises $70M to add stablecoins

Bitcoin software firm Lightning Labs has secured a large funding round enabling it to further develop the Lightning Network for faster, cheaper Bitcoin and stablecoin transactions. The $70 million Series B funding round was led by Valor Equity Partners, with participation from Baillie Gifford, Goldcrest Capital, and several other angel investors. Lightning Labs builds additional features and software for the Lightning Network (LN), Bitcoin’s layer-two transaction solution. The funding will be channeled into a new protocol it has developed called Taro, which will enable stablecoins to be transferred using the LN, according to reports. Lightning Labs will not issue stablecoins, but the infrastructure will allow them to be sent over the network. Stablecoin transactions were made possible with...

Visa should be ‘scared’: Lightning Labs raises $70M to add stablecoins

Bitcoin software firm Lightning Labs has secured a large funding round enabling it to further develop the Lightning Network for faster, cheaper Bitcoin and stablecoin transactions. The $70 million Series B funding round was led by Valor Equity Partners, with participation from Baillie Gifford, Goldcrest Capital, and several other angel investors. Lightning Labs builds additional features and software for the Lightning Network (LN), Bitcoin’s layer-two transaction solution. The funding will be channeled into a new protocol it has developed called Taro, which will enable stablecoins to be transferred using the LN, according to reports. Lightning Labs will not issue stablecoins, but the infrastructure will allow them to be sent over the network. Stablecoin transactions were made possible with...

MicroStrategy subsidiary adds another 4,197 BTC to balance sheet

On Tuesday, enterprise software development firm MicroStrategy announced via a filing with the U.S. Securities and Exchange Commission (SEC) that its subsidiary MacroStrategy acquired 4,197 Bitcoin (BTC) ($190.5 million) between February 15 and Tuesday. MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per #bitcoin. As of 4/4/22 MicroStrategy #hodls ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin. $MSTRhttps://t.co/Z45OuJU5KI — Michael Saylor⚡️ (@saylor) April 5, 2022 The coins were bought at a weighted average price of $45,714, which is roughly equivalent to the price of the digital asset at the time of publication. As a result, MicroStrategy and its subsidiaries now hol...

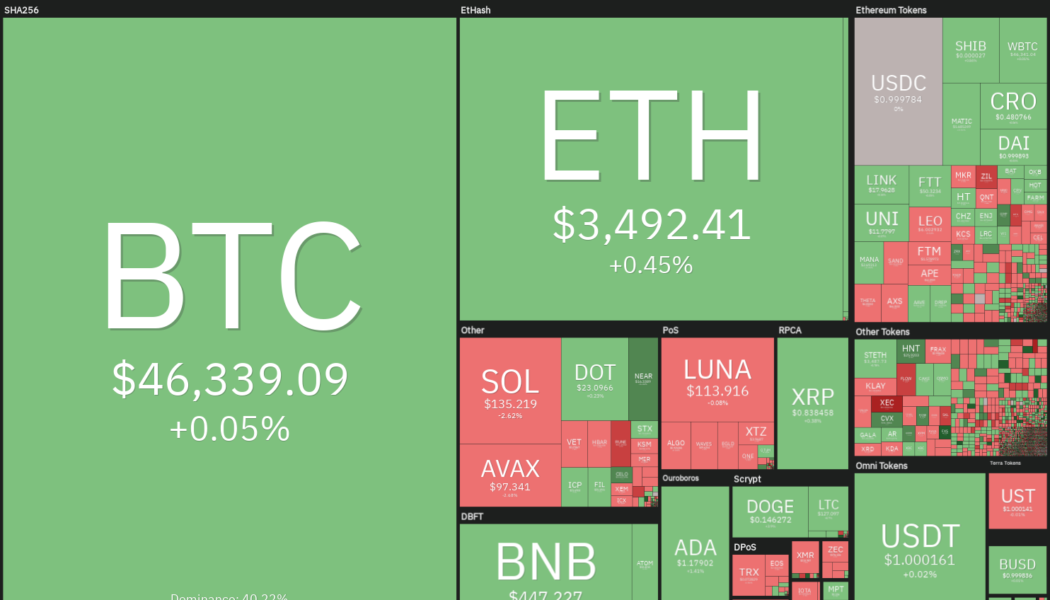

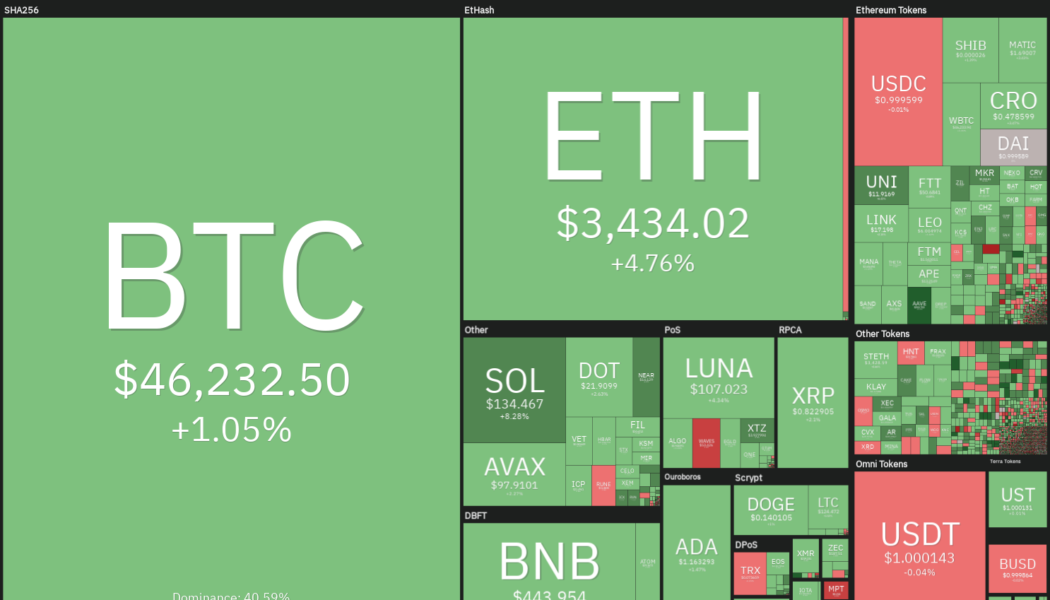

Bitcoin leads altcoins in setting up for a positive Q2

Ethereum has been consolidating around $3,500 for the last 24 hours ETH and ADA are gaining from imminent updates coming to the respective networks Recent days have seen Bitcoin enjoy a reasonable upswing in prices, carrying with it several other altcoins. The Satoshi coin has gained approximately 11% over the last two weeks and largely maintained above $45k. According to data by Coingecko, the world’s leading digital asset touched $44,347 on April 1, the lowest price level it has seen in the last week. Bitcoin was last seen changing hands at $46,160. The recent uptrend is a culmination of growth that has been building since mid-March. In the early days of last month, Bitcoin slumped, falling from $41,770 on March 1 to $39k support on March 6. Afterward, it started making signif...

Bitcoin dices with $46K as Elon Musk Twitter buy sends Dogecoin near 2-month highs

Bitcoin (BTC) traded in an uncertain territory on April 4 as the Wall Street open failed to unleash bullish continuation. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader gives $43,000 BTC near-term dip target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping above and below the $46,000 mark on April 4, continuing a low-volatility few days. The pair had managed to seal a second week near the 2022 yearly open, with analysts already hoping for a breakout to $50,000 or even beyond. At the time of writing, however, there was still no sign of such an outcome, while Bitcoin stuck to an increasingly narrow low-timeframe trading range. “Bitcoin is not really clear to me; it could be because of a very slow weekend, which is disturbing a bit, [in...

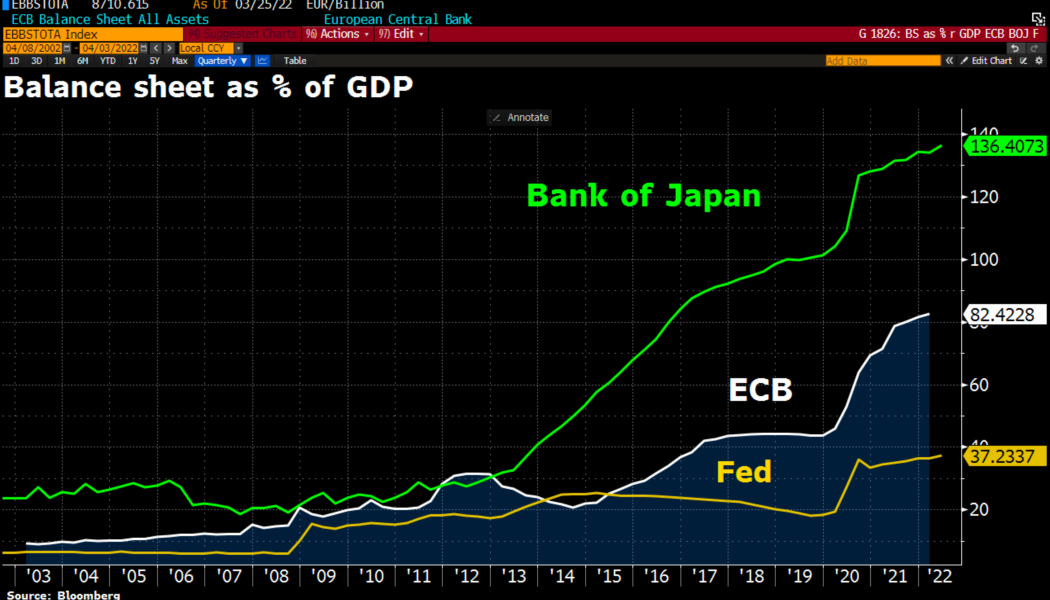

BTC starts 2022 all over again — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week and a new quarter as if it were starting the new year — at just over $46,000. In what will seem like some serious deja-vu for hodlers, BTC/USD is at practically the same level it was on Jan. 1, 2022. Price action has been quiet — too quiet, perhaps — in recent days, but behind the declining volatility, there are signs that the market is busy deciding future direction. From macro to on-chain, there are in fact plenty of cues to keep an eye on in April, amid a backdrop of Bitcoin — at least so far — retaining its yearly open price as support. Cointelegraph takes a look at five of these factors as they pertain to BTC price performance over the coming week. Inflation meets fresh money printing There has been much talk of the end of the post-COVID “easy money” pe...

Top 5 cryptocurrencies to watch this week: BTC, VET, THETA, RUNE, AAVE

Bitcoin (BTC) is attempting to hold above its closest support level, and traders are watching to see if the price can remain strong and close above the 2022 yearly open price at $46,200 for the second week in a row. April has historically been the best performing month of the year for the S&P 500, according to Sam Stovall, chief investment strategist at CFRA. If history repeats itself and the close correlation between the United States equity markets and Bitcoin continues, it could bode well for the crypto markets in the near term. Crypto market data daily view. Source: Coin360 Another sentiment booster could be that the 19th million Bitcoin entered circulation on April 1. For the remaining 2 million BTC, the crypto markets will have to wait for a long time because the last Bitcoin is ...

Can Bitcoin seal its best weekly close of 2022? BTC price sits at $46.5K

Bitcoin (BTC) bulls had everything to play for on April 3 as the first weekly close of the month looked set to be above the all-important $46,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Anything could happen in final hours of Sunday Data from Cointelegraph Markets Pro and TradingView painted an interesting picture Sunday, as commentators waited for some classic end-of-week volatility. BTC/USD had delivered few surprises over the weekend, with an overnight dip to near $45,500 the worst that hodlers had to confront. Now, the odds were on for a potential second weekly close above the 2022 yearly open of $46,200. Will #Bitcoin close its second consecutive weekly candle above $46,000? Find out soon! pic.twitter.com/0zIAMtOGzS — Matthew Hyland (@MatthewHyland_) Ap...

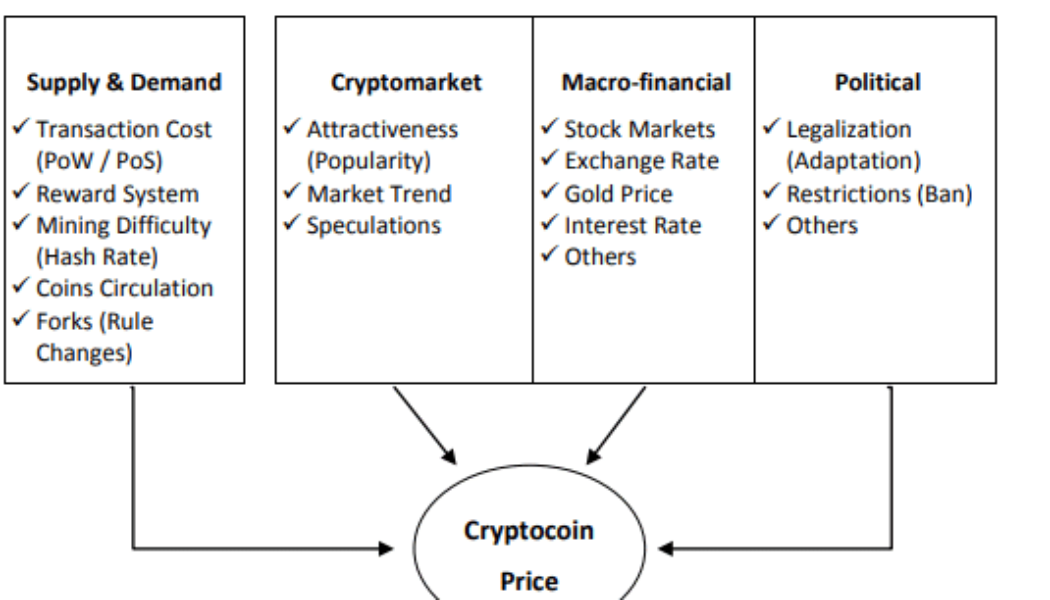

Is Bitcoin a hedge against inflation?

Putting money in store of value investments like gold, real estate, stocks and crypto helps curb inflation. As cash loses purchasing power over time, keeping cash leads to people losing their savings. This has prompted people to put their money in store of value investments such as gold, real estate, stocks and, now, crypto. Will Bitcoin protect against inflation has been a question in the town ever since. To be held as a store for value, an asset should be able to hold its purchasing power over time. In other words, it should increase in value or at least remain stable. Key properties associated with such assets are scarcity, accessibility and durability. Gold as a hedge against inflation During past inflationary periods, gold has had a mixed track record. In the 1980s, there were times w...

Bitcoin regains yearly open as trader says $50K next week ‘might be likely’

Bitcoin (BTC) consolidated above the 2022 yearly open on April 2 after a return to form briefly saw bulls reclaim $47,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price holds “crucial” long-term support Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $46,600 Saturday on the back of a clear bounce at long-term support. The pair had dipped to lows of around $44,300 Friday, these nonetheless shortlived as positive sentiment took control into the Wall Street open. For Cointelegraph contributor Michaël van de Poppe, with intent to retain newly flipped support confirmed, the odds were on for an attack on $50,000. “Crucial area held up for Bitcoin, in which continuation upwards seems likely,” he summarized to Twitter...

Price analysis 4/1: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) has clawed back much of the losses that took place in January and now the focus of traders shifts to April, which has historically been a strong month for the cryptocurrency. According to Coinglass data, Bitcoin has closed April in the red on onlthree occasions and the worst monthly loss was a 3.46% drop in 2015. Although history favors the bulls, the Whale Shadows indicator has noticed that more than 11,000 Bitcoin has left a wallet in which it had been lying dormant for seven to ten years. The movement of similar-sized quantities from dormant accounts has generally resulted in a major top, according to independent market analyst Phillip Swift. Daily cryptocurrency market performance. Source: Coin360 Along with keeping an eye on the crypto markets, traders should ...