Bitcoin

Two years since the Covid crash: 5 things to know in Bitcoin this week

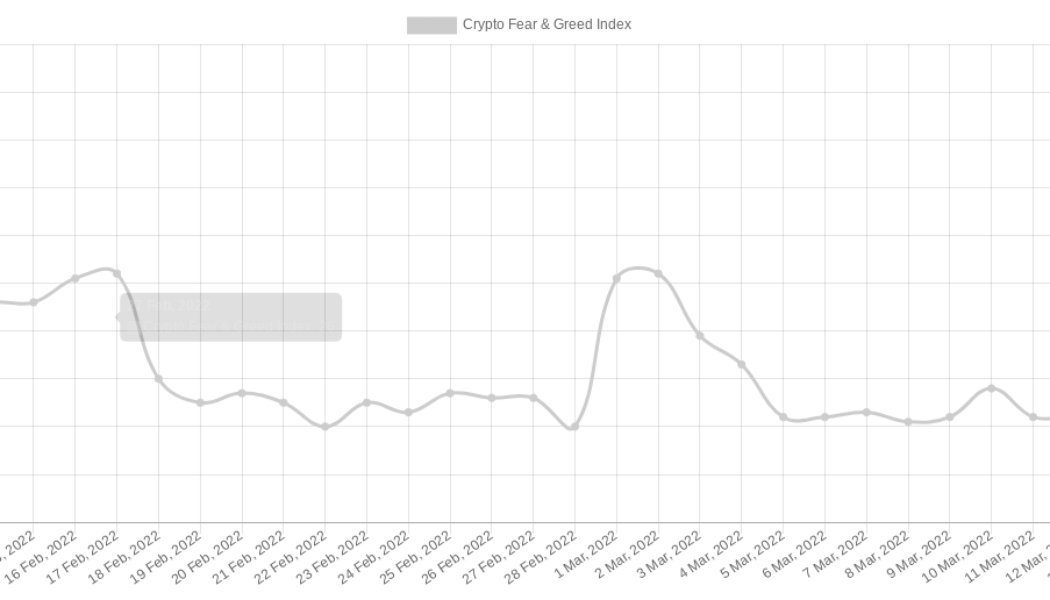

Bitcoin (BTC) starts a new week struggling to preserve support as key macro changes appear on the horizon. In what could turn out to be a crucial week for Bitcoin and altcoins’ relationship with traditional assets, the United States Federal Reserve is set to be the main talking point for hodlers. Amid an atmosphere of still rampant inflation, quantitative easing still ongoing and geopolitical turmoil focused on Europe, there is plenty of uncertainty in the air, no matter what the trade. Add to that a failure by Bitcoin to benefit from the chaos and the result is some serious cold feet — what would it take to instil confidence? Just as it seems nothing could break the now months-old status quo on Bitcoin markets, which have been stuck in a trading range for all of 2022 so far, upcoming even...

Bitcoin drifts into weekly close while Fed rate hike looms as next major BTC price trigger

Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-awaited Fed action set to come this week Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday. The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and outside crypto continued without surprises. Now, attention was already focusing beyond Sunday’s close, specifically on the upcoming decision on interest rates from the United States Federal Reserve. Due March 16, the extent of the presumed rate hike could provide temporary volatility and even...

Bitcoin threatens $38K as 3-day chart hints at March 2020 Covid crash repeat

Bitcoin (BTC) further tested $38,000 overnight as the weekend began with uncertainty among traders. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 3-day chart could be “precursor” for weekly Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $39,000 after several attempts to break $38,000 support. The pair had also seen a brief spurt above $40,000 Friday thanks to geopolitical developments, this nonetheless lasting a matter of minutes before the previous status quo returned. Such “fakeouts” to higher levels — which ended with Bitcoin coming full circle and liquidating both short and long positions — was already familiar behavior for market participants this month. Now, however, lower timeframes were beginning to show signs that a more...

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

Bitcoin spikes above $40K as Russia sees ‘positive shifts’ in Ukraine war dialogue

Bitcoin (BTC) saw instant volatility on March 11 amid hope that the Russia-Ukraine conflict could find a diplomatic solution. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hope rises — but so do Bitfinex shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly surging $1,400 before reversing to consolidate below $40,000 Friday. The move followed fresh comments from Russian President Vladimir Putin, who in a meeting with Belarusian counterpart Aleksandr Lukashenko said that there had been “positive shifts” in the Ukraine dynamic. “There are certain positive shifts, negotiators on our side tell me,” he said, quoted by Reuters and others. Bitcoin, already known for not “liking” escalations in armed conflicts, imme...

Stacks price plunges hard after rallying 70% in a day — more STX losses ahead?

Stacks (STX) pared a considerable portion of the gains it made on March 10 as the euphoria surrounding its $165 million pledge to support Bitcoin (BTC) projects showed signs of fading. STX’s price dropped by over 30% to reach a level as low as $1.33 on Friday when measured from its week-to-date high of $1.94. The selloff, in part, appeared technical as the $1.94-top fell in the same range that served as solid support between October 2021 and January 2022, only to flip later to become a resistance area. STX/USD daily price chart. Source: TradingView It also appears that traders spotted selling opportunities due to STX’s long wick candlestick on March 10. Stacks rallied by as much as 73% into the day while forming a disproportionally long bullish wick on the daily chart that hint...

Real Vision’s Raoul Pal insists Bitcoin is correlated with risk in the short term

The macro guru told the community to focus on Bitcoin’s long-term He labelled the current liquidity and behaviour’ noise. Co-founder and CEO of Real Vision Raoul Pal has defined an interesting position on Bitcoin’s market behavior. The crypto investor earlier today posted on his Twitter account telling the community that Bitcoin, just as other assets, remains a risk-on product in the short term. However, unlike a good number of these ‘other’ risk assets, Bitcoin promises an exponential pattern of growth over the long term. Bitcoin’s long-term trend is different from the majority of risk assets The former Goldman Sachs executive asked holders to ignore the current volatility “noise” and instead focus on the overall potential of the digital ass...

Crypto market recedes after Wednesday’s rally, FTM and XMR down over 10%

The upwards momentum inspired by yesterday’s release of the Biden crypto executive order has waned The majority of the top cryptocurrencies are seeing losses in the range of 4% to 8% The price of most crypto coins soared late Tuesday and remained high for the larger part of Wednesday. The midweek upswing was as a result of the White House crypto directive that was released yesterday, albeit the Treasury department, through Janet Yellen, had inadvertently shown a glimpse of what the order would entail. Bitcoin and company surged as the markets welcomed the vague order, interpreting it as progressive for the sector. Crypto assets have nosedived The market outlook has, however, changed 24 hours later, with many crypto assets resuming a downtrend after failing to sustain the momentum. Co...

How to navigate cryptocurrency tax implications amidst the CPA shortage

Cryptocurrency is a hot topic worldwide, especially with prices of Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies hitting higher thresholds and resulting in another banner year for investors. While the earnings look good on paper, one factor is often left to consider –– that is, crypto taxes. It is not uncommon for traders to take advantage of the constant fluctuations, buy the dip, sell the uptrend, and repeat it frequently. Unfortunately, each transaction is considered a taxable event, making the conversation about cryptocurrency taxes a daunting one. The impending crackdown on cryptocurrency taxation only spurs on the need to start the conversation. This crackdown is far from recent, with 2021 headlines of an IRS chief stating the country was losing trillions of dollars in unp...

Bitcoin stems losses after US bans Russian oil, gold heads to record highs

Bitcoin (BTC) erased then recovered its daily gains later on March 8 as United States President Joe Biden announced a complete ban on Russian oil imports. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC comes full circle, while gold steals the show Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it targeted $38,000 an hour after Tuesday’s Wall Street open. Having hit $39,240, the pair swiftly changed trajectory as Biden confirmed the plans, which added to oil’s already strong gains and further pressured stocks and risk assets. “Today, I’m announcing that the United States is targeting the main artery of Russia’s economy,” he said at a press conference. “We’re banning all imports of Russian oil and gas and energy. That means that Russia...

Bitcoin stuck under $40K, but BTC price hits another all-time high vs. Russian ruble

Bitcoin (BTC) recovered from one-week lows on March 8 after a lack of progress in Russia-Ukraine talks that sent markets tumbling. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Commodities “trading like meme stocks” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at $37,170 on Bitstamp after Monday‘s Wall Street open. Overnight progress maintained support with the pair trading at around $38,500 at the time of writing. Crypto and stocks reacted badly to the lack of consensus that ended the third round of negotiations to end hostilities between Russia and Ukraine. “There are small positive subductions in improving the logistics of humanitarian corridors… Intensive consultations have continued on the basic political block of the regulations, alo...