Bitcoin

Crypto markets recover from Monday’s brief dip with BTC eyeing $39k

Market activity has been largely positive in the last few hours THETA price has shot up following the pullback while Ether has cut above $2,550 The cryptocurrency sector is still reeling from late Monday’s short-lived slump that saw tokens fall to their weekly lows. Bitcoin, which appeared to have cleared $39k earlier during the day, slid from $39,060 to a 7-day low of $37,387.92 in four hours, CoinGecko data shows. The king cryptocurrency has since bounced back and is changing hands at $38,860 – up 1.40% in the last 24 hours. Ether, whose ETH/USD hourly trading chart shows positive movement, has clawed its way back above $2,575. Yesterday, the token fell to an intraday low slightly below $2,460 – a price level last touched on February 24. The pair has moved up by 1.4% today and is t...

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

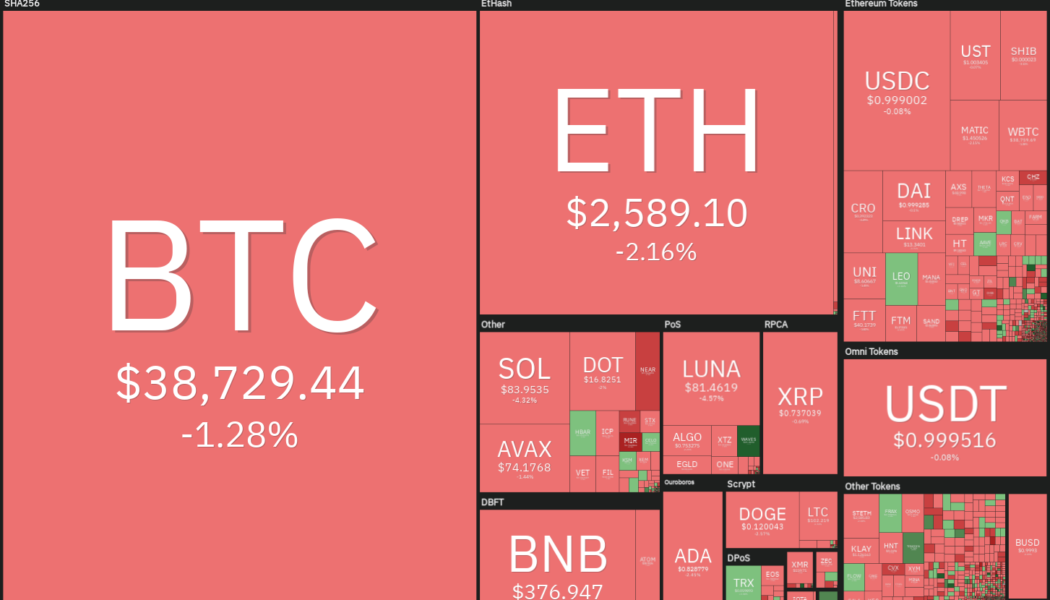

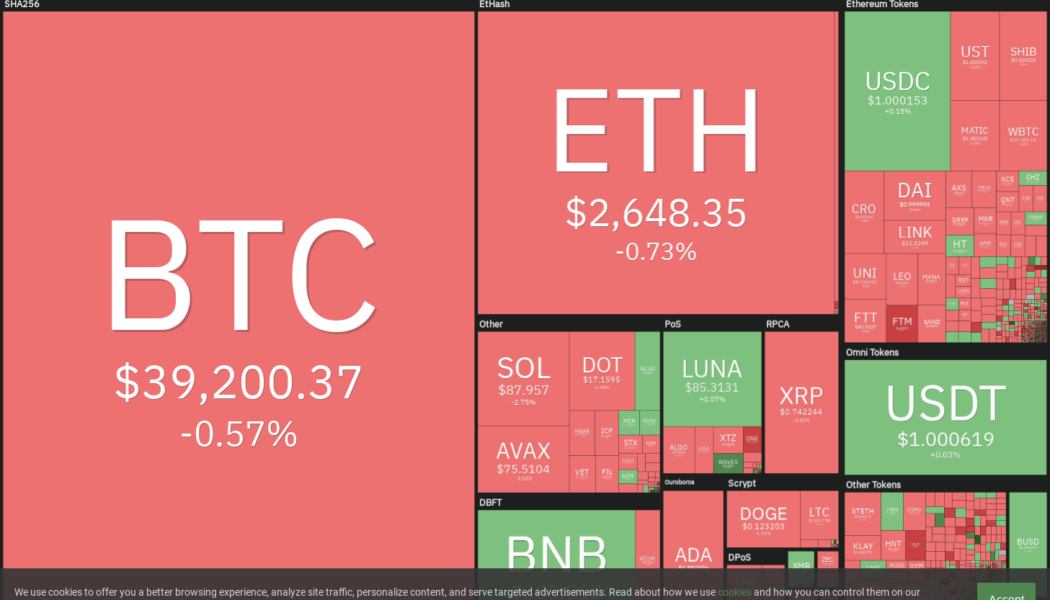

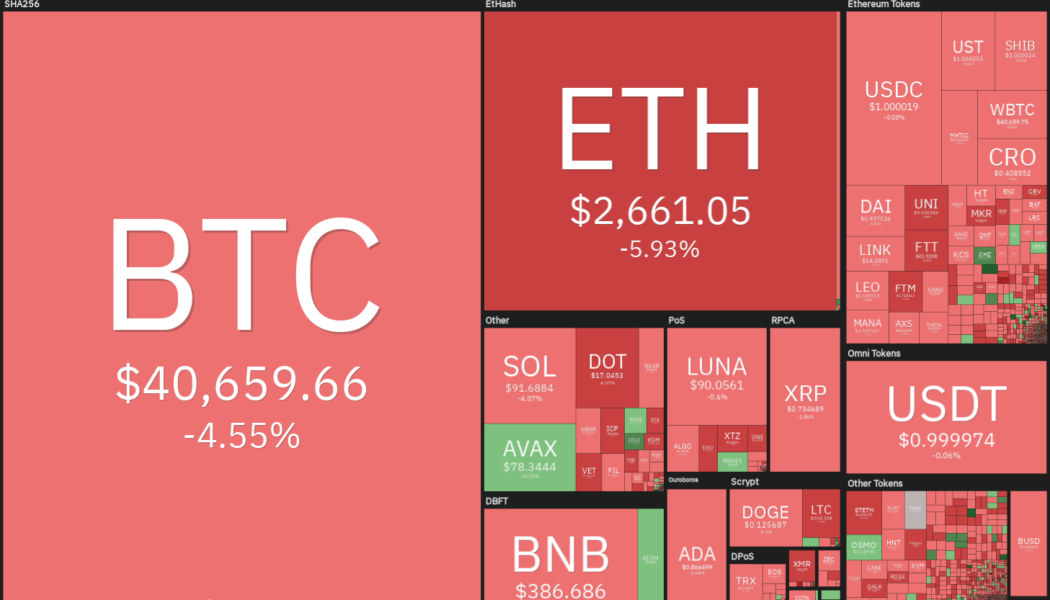

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

Bitcoin steadies as gold hits $2K, US dollar strongest since May 2020

Bitcoin (BTC) stayed near one-week lows on March 7 as a flight to safety among investors did crypto markets no favors. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Gold, dollar spell sour times for stocks Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at around $37,600 overnight before tracking around $1,000 higher. The pair had faced pressure into the weekly close, resulting in its lowest levels this month amid reports that Western sanctions against Russia could expand to include an oil embargo. An already panicky atmosphere thus fueled performance by safe haven gold, which returned to $2,000 per ounce for the first time since August 2020 Monday. XAU/USD 1-week candle chart. Source: TradingView Coming in step was the U.S. dollar, which surg...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

Bitcoin’s recent correction below $40k conforms to a previously bullish triangle pattern, crypto analyst notes

A top crypto analyst has set forth that Bitcoin’s rejection at $45k indicates the asset is now in a triangle trading pattern Credible Crypto also explained that it is unlikely Bitcoin will plunge below $30k as it recently grew above $44,700 Popular crypto markets analyst Credible Crypto has predicted that Bitcoin’s recent rejection at $45k and correction downwards below $40k indicates that the asset is preparing for a surge towards $50k in the coming weeks. In a post shared to his 313k-large Twitter following, the pseudonymous crypto strategist said that following its recent rejection at $45,069, the asset is now fitting into a triangle structure, similar to the one it showed when the price was at $10k. He explained that should the daily demand hold at $38k, then Bitcoin could comple...

Top 5 cryptocurrencies to watch this week: BTC, XRP, NEAR, XMR, WAVES

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend. Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021. Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

Bitcoin loses $40K as BTC price support levels give way to 1-week lows

Bitcoin (BTC) stayed below some critical support zones into the weekend after a late sell-off cost bulls the $40,000 mark. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Upper range support levels crumble for BTC Data from Cointelegraph Markets Pro and TradingView painted a lackluster picture for BTC/USD Saturday, the pair lingering near $39,000 after seeing lows of $38,600. Traders had hoped that various price points above $40,000 would be sufficient to steady the market after its latest run to $45,200. In the event, however, bids failed to preserve the trend, sending Bitcoin back to the middle of a range in which it had acted throughout 2022. #Bitcoin is hanging onto the edge of a cliff the past few hours pic.twitter.com/dAD2AveTOi — Matthew Hyland (@MatthewHyland_) Mar...

What is the Crypto Fear and Greed Index?

Various Crypto Fear and Greed Index signals that influence the behavior of traders and investors include Google trends, surveys, market momentum, market dominance, social media and market volatility. To determine how much greed is trending in the market, examine trending search phrases. For instance, a high volume of Bitcoin-related searches means a high degree of greed among investors. This factor accounts for 10% of the index value. Historically, increases in Bitcoin-specific Google searches have been correlated with an extreme volatility in crypto prices. To calculate the number each day, the Bitcoin Fear and Greed Index considers a few other factors, such as surveys, which account for 15% of the index value. Surveys with participants of over 2000 drive the index value higher, indicatin...

Bitcoin declines with US stocks as nuclear threat ripples through markets

Bitcoin (BTC) bulls saw no relief at the Wall Street open on March 4 as the $40,000 support appeared on the horizon. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: Markets “shaky,” but BTC could bounce Data from Cointelegraph Markets Pro and TradingView revealed new March lows of $40,551 for BTC/USD on Bitstamp, taking two-day losses to 10.2%. Fears over the security of Ukraine’s nuclear infrastructure drove not just crypto but traditional markets lower on the day, with the S&P 500 following European indexes to decline by 1.4%. “Bitcoin correcting as tensions around Ukraine are increasing, and fear is increasing too as Gold is rushing upwards,” Cointelegraph contributor Michaël van de Poppe explained in his latest Twitter update. “Might be seeing a b...