Bitcoin

Bitcoin returns to test $40K as macro factors pile up to squash BTC bulls

Bitcoin (BTC) bended to new macro pressures on March 4 after bulls failed to hold $42,000 for long. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Europe stocks sink on Friday open Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching lows of $40,800 on Bitstamp Friday after a major options expiry event. Overnight performance, initially showing a recovery, had been stymied by worries over a nuclear power plant fire in Ukraine. Stocks futures fell on the news, the severity of which was subsequently questioned. In Germany, the DAX index hit a one-year low on the daily open, with the S&P 500 yet to commence trading. “From recent high, index has lost 17%, way more than S&P 500,” markets commentator Holger Zschaepitz noted. “Investors are turning ...

Bitcoin and Ether prices dip as crypto market turns red ahead of the weekend

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for d...

Here is why deVere Group CEO expects Bitcoin to clock $50k this month

Nigel Green believes the Ukraine crisis and institutional investor interest could spur a price surge He explained that the recent developments have paraded Bitcoin’s key traits Since hitting an all-time peak, Bitcoin has been the epitome of fluctuating currencies, but CEO of Financial services firm deVere Group Nigel Green believes that the asset is likely to rise (in the coming months) from its 14th place among the most valuable currencies in the world today. Pointing to its current momentum, the CEO has predicted that Bitcoin could hit $50k before the end of March. Green backed his projection citing the ongoing crisis in Ukraine and a growing appetite for institutional investment as the impetus that will sustain the push to the predicted price. The financial services mogul held tha...

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

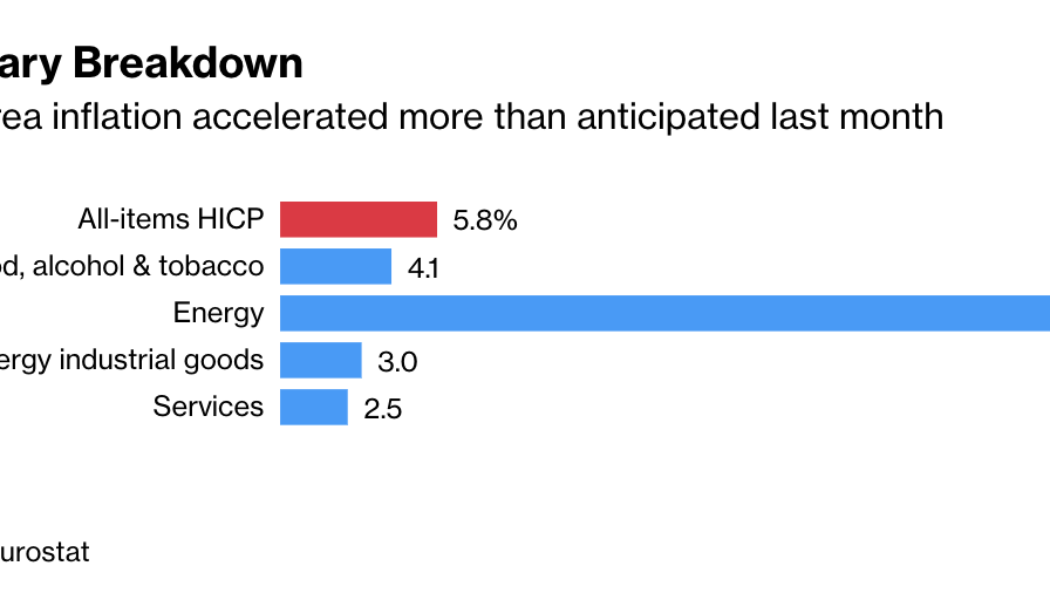

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...

Bitcoin casts off dip, climbs past $45K as Fed signals rate hike coming in March

Bitcoin (BTC) hit daily lows then bounced strongly on March 2 as fresh comments by the United States Federal Reserve added to macro volatility. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Powell: March rate hike expected “appropriate” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $43,350 on Bitstamp before the Wall Street open Wednesday. A recovery ensued as trading began, however, with the pair already back above $45,000 at the time of writing. The volatility followed the release of a new statement from Fed Chair Jerome Powell, who for the first time gave concrete notice of a key rate hike coming this month. “Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so,̶...

Bitcoin analysts eye crucial levels to hold after BTC price almost hits $45K, Ethereum $3K

Bitcoin (BTC) checked its latest gains at the Wall Street open on Mar. 1 as bulls sought to defend $44,000 highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC weekly gains hit 17% Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it declined from its local peak of $44,980 on Bitstamp at the opening bell. The second day of trading with armed conflict in Europe as its background, March 1 continued a surprisingly cool phase for U.S. equities, with only oil showing the knock-on effects of the Ukrainian war. Bitcoin, by contrast, held onto the majority of its advances, which had been rekindled in earnest on March 1. Versus the same time a week ago, BTC/USD was up 17% at the time of writing. Bitcoin since weaponized finance began with Russia. C...

Bitcoin accumulation among whales surges as crypto market rallies

Bitcoin saw a ballistic upswing late yesterday, peaking at $44,000 The number of wallets holding more than 1,000 BTC has risen in the last 24 hours Bitcoin had a fairly decent run in February compared to January, when it fell from $46.73k at the start of the year to $37.45k on the last day of the month. Last month, the flagship cryptocurrency mostly traded above $42k in the first two weeks before paring down in the third week. The correction was followed by a steep crash to a monthly low of $34,459 last Thursday. A renewed rally kicking off late yesterday has put the coin in an uptrend, reclaiming $44k. Along with the price gains, the number of holders in different groups (based on the amount of bitcoin they hold) has increased. Whales are taking up crypto at a faster rate Data from CoinMe...

$300M in crypto liquidations accompanies Bitcoin’s surge to $44K

Bitcoin (BTC) hit $44,000 overnight on Mar. 1 as a rally that began Monday sparked unexpected results. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders warns of “massive variables” for BTC price Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $44,250 on Bitstamp before consolidating, still above $43,000 at the time of writing. The move had come in two main bursts, beginning just prior to the Wall Street open. Against a highly uncertain macro backdrop, analysts had been hard-pressed to forecast what Bitcoin price action would do next, a mood that continued as local highs appeared. Yesterdays #BTC trade we took with the group. Didn’t expect it to run that hard tbh. Would have raised TP probably because I think it can...

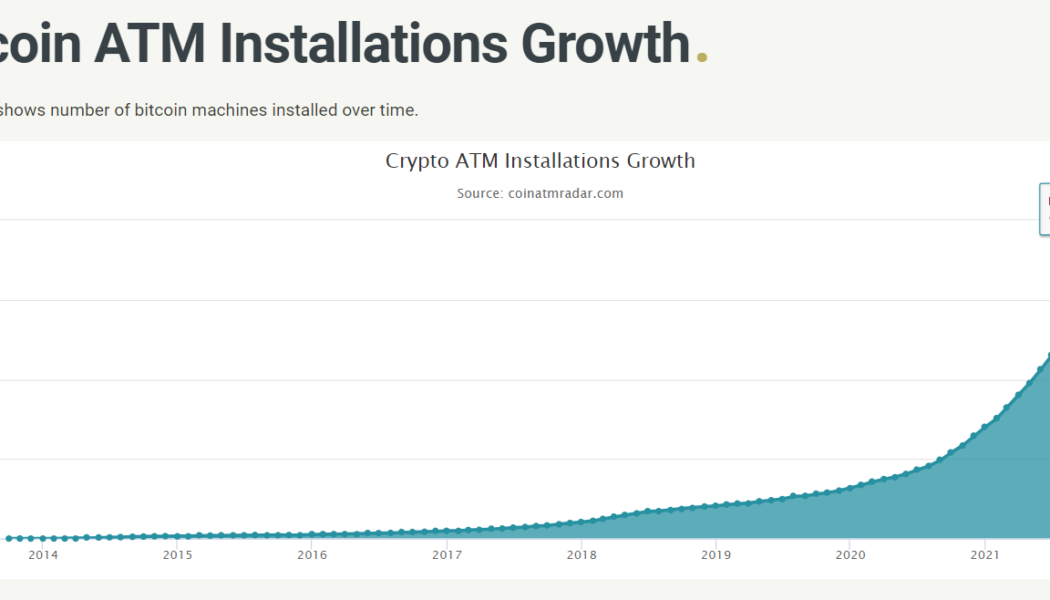

Bitcoin ATM installations slow down in early 2022, making a first in history

Over the last six months, Bitcoin (BTC) recorded numerous milestones — El Salvador’s mainstream adoption, a new all-time high of $69,000 and a stronger-than-ever network hash rate. However, for the first time in history, global Bitcoin ATM installations in the first two months have slowed down when compared to the preceding year. Bitcoin ATM installations in the first two months of the year have historically increased year-over-year, as evidenced by data from Coin ATM Radar. The trend, however, breaks this year. Overall Bitcoin ATM installations. Source: Coin ATM Radar Considering only January and February 2022, a total of 1,817 crypto ATMs have been installed worldwide. In the same timeframe last year, 2,435 crypto ATMs were installed, which is 618 ATMs more when compared to this year. In...

Bitcoin rebounds over $41K after painting a ‘bullish hammer’ — Can BTC hit $64K next?

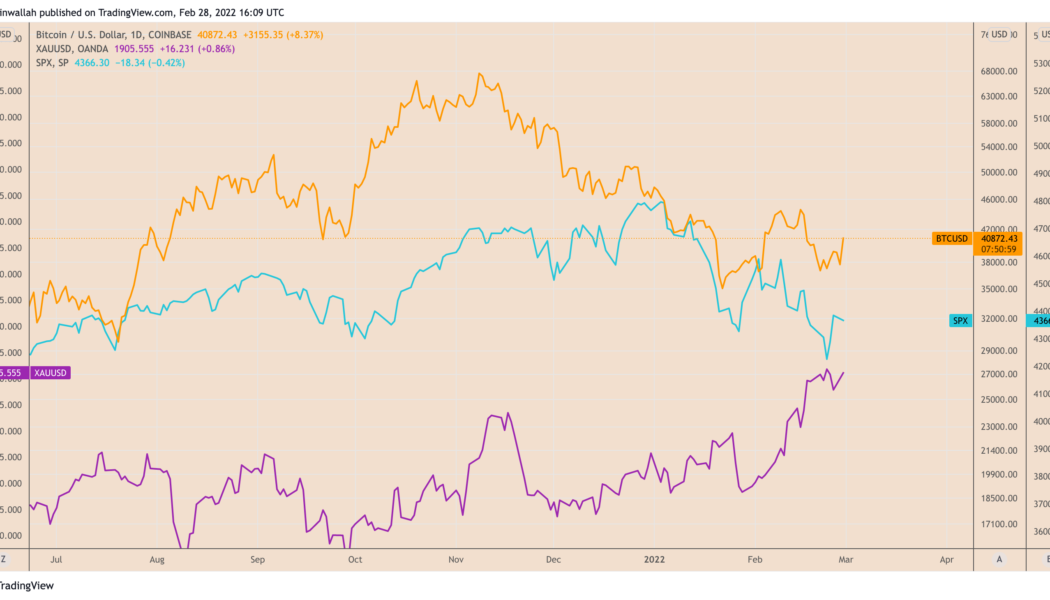

Bitcoin (BTC) rallied above $41,000 on Feb. 28 in a new sign of buying sentiment returning after last week’s brutal selloff across the risk-on markets, including the S&P 500. BTC’s price jumped by over 9% to reach $41,300, in part, as traders reacted to the ongoing development in the Russia-Ukraine crisis. In doing so, the cryptocurrency briefly broke its correlation with the U.S. stock market indexes to perform more like safe-haven gold, whose price also went higher in early trading on Feb. 28. BTC/USD versus XAUUSD and S&P 500 daily price chart. Source: TradingView Bitcoin downtrend exhausting — analyst Johal Miles, an independent market analyst, spotted “significant buying pressure” in the market, adding that its downtrend might be heading towards exhaust...

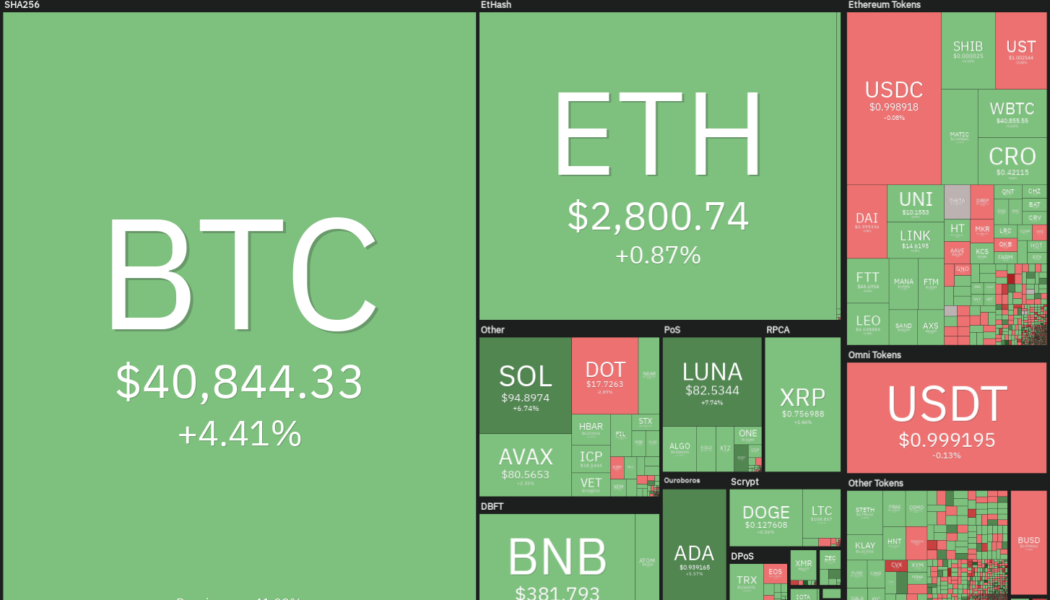

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

How to trade crypto using BTC dominance?

Bitcoin (BTC) is both the first and the most prominent cryptocurrency in the world when it comes to market capitalization as well as trading volume. These factors are quite significant, considering that all cryptocurrencies trade against Bitcoin and Bitcoin’s dominance can actually serve as a valuable indicator when trading all different types of cryptocurrencies. This post will offer insight on how to trade cryptocurrency while utilizing the Bitcoin dominance indicator and how to read the Bitcoin dominance index chart overall. What is the BTC dominance chart? Bitcoin dominance is uncovered by comparing Bitcoin’s market capitalization to the capitalization of the entire crypto market. The higher Bitcoin’s market capitalization the more Bitcoin dominance is at play, and we have the answer t...