Bitcoin

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

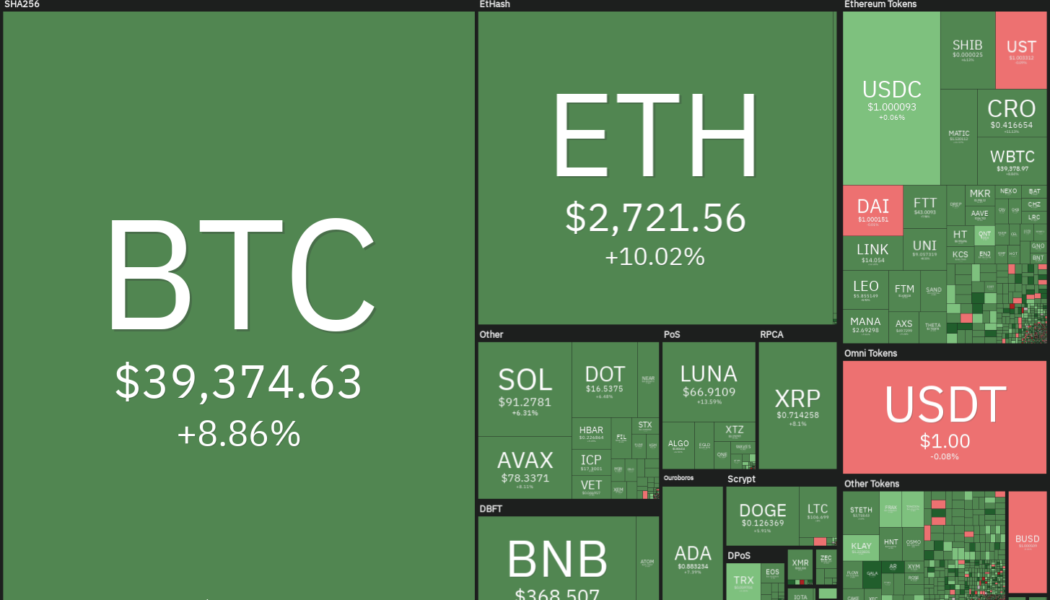

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Bitcoin fails to beat resistance as $40K stays out of reach into weekly close

Bitcoin (BTC) faced down $40,000 on Feb. 27 as hopes for the weekly close hinged on avoiding a fourth red monthly candle in a row. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tensions mount for TradFi markets open Data from Cointelegraph Markets Pro and TradingView showed BTC/USD making several attempts to break out of the $30,000-$40,000 corridor Sunday, all of which ended in rejection. The pair had stayed broadly higher throughout the weekend, cutting traders some slack after a week of volatility at the hands of geopolitics and media headlines. Now, $38,500 was the level to watch for Bitcoin to close out the week and the month — failure to do so would mean a fourth straight monthly red candle. #Bitcoin has less than 36 hours to close above $38.5k in order to break th...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ATOM, FTM

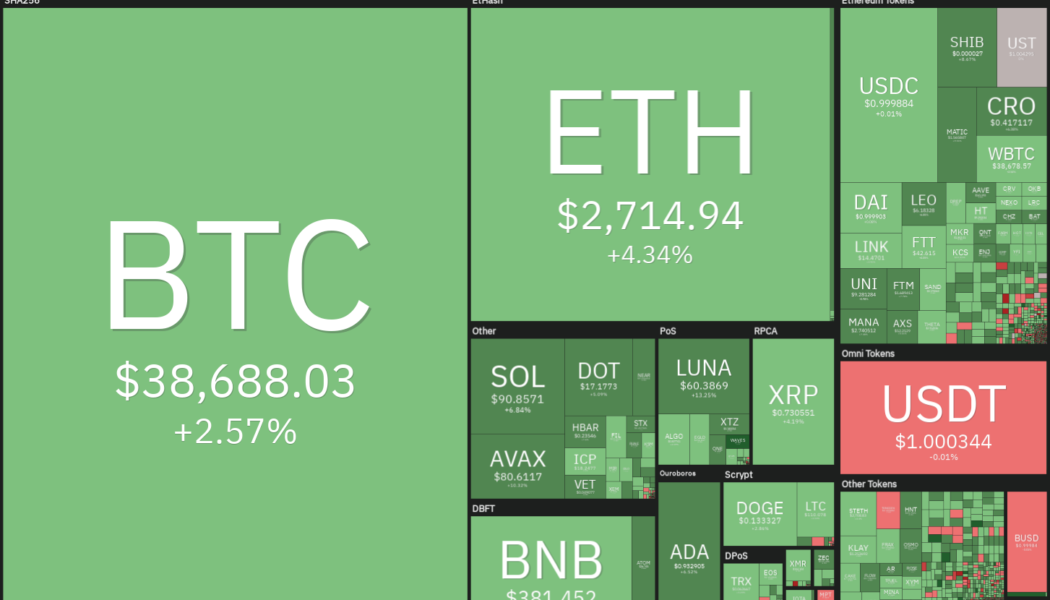

The geopolitical news flow is likely to result in volatile moves in Bitcoin (BTC) and altcoins in the next few days. News of Russian President Vladimir Putin ordering the nuclear deterrence forces on high alert may be viewed as a negative, but reports of talks between the warring nations could be positive as it raises hopes of an end to the conflict. The crypto community came into focus as the Ukrainian government called for help and sought crypto donations. Some individuals on social media said their Ukrainian credit cards had stopped working and they were not able to withdraw money from their banks. They highlighted how crypto was the only money left with them. Crypto market data daily view. Source: Coin360 While some analysts are projecting that Bitcoin may have bottomed out, Cointelegr...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

Bitcoin consolidates after $40K surge as analyst eyes weekly higher low for BTC price

Bitcoin (BTC) began a nervous weekend at around $39,000 on Feb. 26 after an overnight spike briefly saw $40,000 return. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks gains but crypto “fear” pervades Data from Cointelegraph Markets Pro and TradingView revealed calmer conditions for BTC/USD Saturday after overnight volatility saw highs of $40,330 on Bitstamp. With traditional markets closed, the probability of “fakeout” moves up or down was elevated thanks to thinner weekend volumes on crypto markets. The geopolitical turmoil focused on Ukraine and occupier Russia formed the backdrop for continued cautious sentiment, amid concerns that Monday, in particular, could bring fresh instability. The Crypto Fear & Greed Index, while inching up to...

Bitcoin whales fuel BTC price comeback as stocks brush off Russia-Ukraine shocks

Bitcoin (BTC) kept $40,000 in play at the Wall Street open on Feb. 25 after 16% daily gains increased bulls’ confidence. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Whales “leading the charge” towards $40,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling the $39,000 mark at the start of trading Feb. 25, geopolitical turmoil failing to induce a fresh major sell-off. Stocks also benefited as the week came to a close, with Germany’s DAX up 3% on the day and the FTSE 100 up 4% in London. Signals from the Russia-Ukraine conflict provided an additional boost, with the prospect of talks being raised by Ukrainian president Volodymyr Zelensky to end hostilities. With $34,300 this week’s floor, optimism was slowly incre...

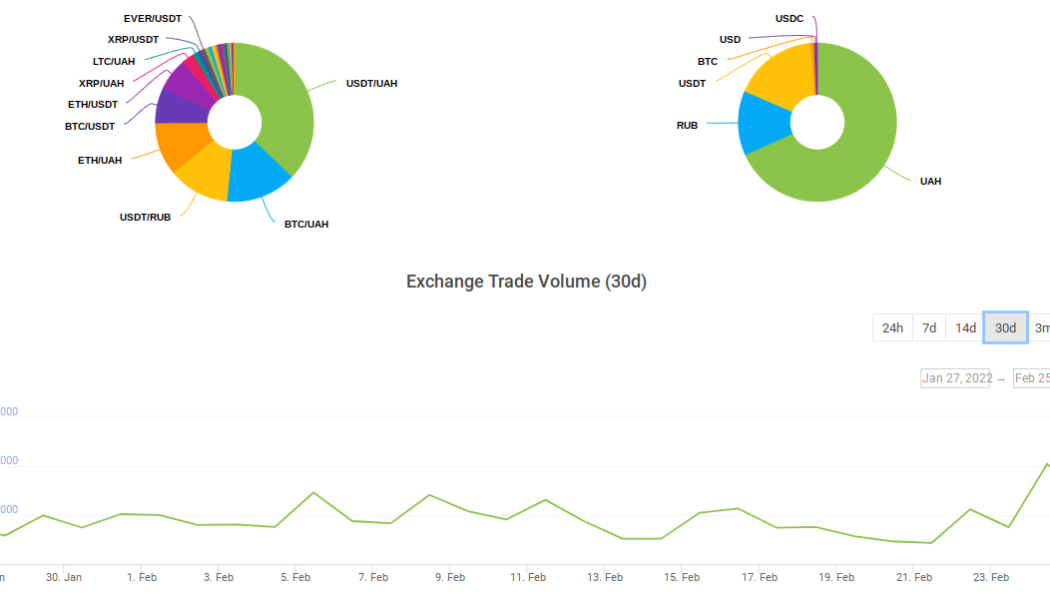

Ukraine Bitcoin exchange volume spikes 200% as Russia war sparks currency concerns

Bitcoin (BTC) and altcoin trading volumes have surged at a major Ukraine cryptocurrency exchange in the aftermath of Russia’s invasion, data shows. According to monitoring resource CoinGecko, on Feb. 24, volume at Kuna almost trippled to over $4 million. Crypto on the radar of Ukrainians As the armed conflict with Russia began, the impact on the fiat currencies of both countries was immediately apparent. While the Russian ruble suffered noticeably more, the Ukrainian hryvnia also fell, targeting 30 per dollar in what would be a new all-time low. Ukraine, which just this month finally ratified a law legalizing cryptocurrency after much to-and-fro between lawmakers, unsurprisingly saw interest in alternatives snap higher. The effect was obvious at seven-year-old Kuna, volumes at which ...

Bitcoin rises above $36K as 24-hour crypto liquidations pass $500M

Bitcoin (BTC) edged higher after Wall Street opened on Feb. 24 with Russia’s Ukraine invasion and its aftermath still top on markets’ agenda. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Risk sentiment set to be “dominant driver” in crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD nearing $36,400 on Bitstamp two hours after the opening bell, up to $2,000 from its recent lows. Skittish markets faced the music from Russia’s overnight incursion into Ukraine, a move that continued and ricocheted across global trading. Russia’s stock market unsurprisingly faced a different level of trauma, with MOEX losing 50% and at one point halting trading altogether. Bitcoin, suffering earlier in the day, nonetheless staged a ...

Bitcoin slumps following Putin’s announcement of a military operation in Ukraine

Russian President Vladimir Putin has announced military action in Ukraine Bitcoin, alongside the majority of the crypto assets, have plunged as the market reacts to the news Tensions have been high across the month, with reports warning that Russia has been consolidating troops in areas bordering Ukraine. Russia has insistently maintained that it had no plans to invade Ukraine. However, the situation has changed dramatically in recent hours. Russia’s President Vladimir Putin announced early Thursday that the country’s military is advancing into Ukraine for what he referred to as a “special military operation” to conclude the “demilitarisation” of Ukraine. With reports of explosions in Ukraine’s Kyiv capital, worry is growing that this could turn in...

Last Bitcoin support levels above $20K come into play as BTC price faces ‘time of uncertainty’

Bitcoin (BTC) may yet reenter the $20,000 zone, but the coming weeks could provide a solid buying opportunity, a new report forecasts. In its latest market update on Feb. 24, trading platform Decentrader laid out the final areas of support between the current Bitcoin spot price and $20,000. Analyst eyes BTC’s 20-week and 200-week MA for cues Military action by Russia in Ukraine has markets in a spin Thursday, with stocks and crypto following a firm downtrend as uncertainty grips Asia, Europe and the United States alike. Bitcoin has already lost 12% in under 24 hours, and expectations are that the worst is not yet over —reactions to the Russian offensive continue to flow in, along with potential financial sanctions. As such, Decentrader, like many other analysts, is notably cautious o...

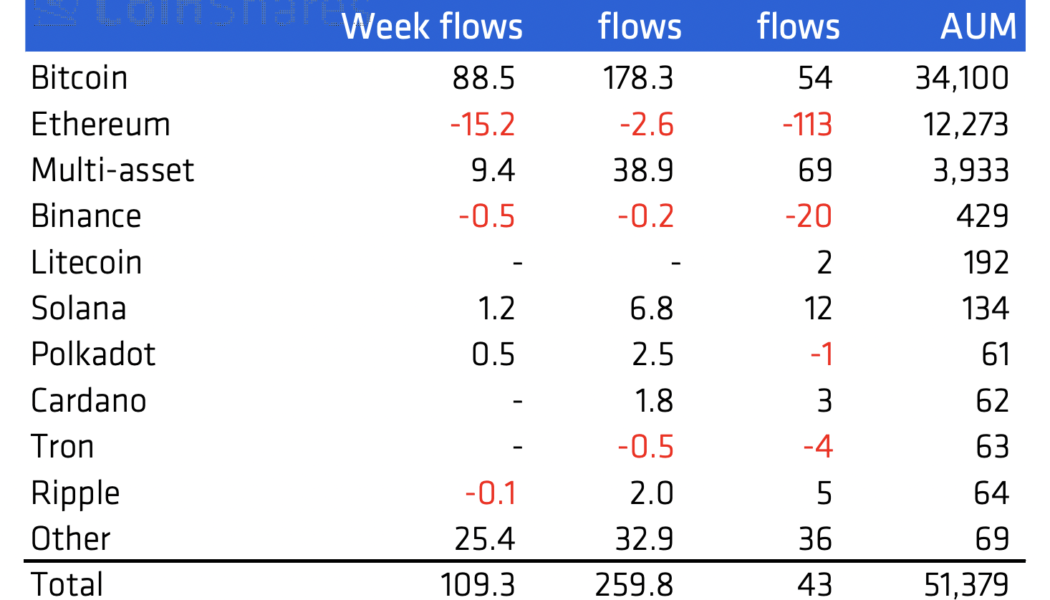

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...