Bitcoin

Luna Foundation Guard raises $1B to form UST reserve denominated in Bitcoin

The nonprofit organization focused on the open-source stablecoin network behind Terra USD, Luna Foundation Guard, has closed on a $1 billion raise through the sale of LUNA tokens. In a Tuesday tweet, Terra said Jump Crypto and Three Arrows Capital led the $1 billion round with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital and others. The platform said proceeds from the sale — $1 billion — would “go towards establishing a Bitcoin-denominated Forex Reserve for UST,” a stablecoin in the Terra ecosystem. 1/ The long awaited [REDACTED] 3 is here! The Luna Foundation Guard (LFG) has closed a $1 billion private token sale to establish a decentralized $UST Forex Reserve denominated in $BTC! — Terra (UST) Powered by LUNA (@terra_money) February 22, 2022 “One common ...

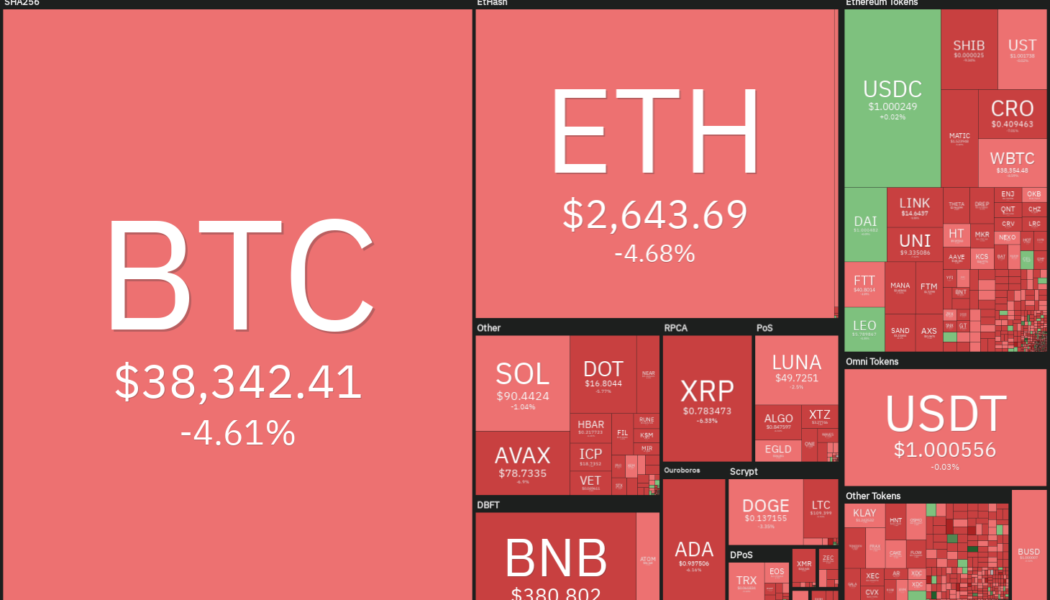

Market crash sees ADA fall to a multi-month low, DOT and AVAX drop out of the top ten

The price of Cardano’s native token ADA sank to $0.82 after enduring more losses today Binance USD has moved to 9th in market capital, displacing Avalanche and Polkadot that have suffered heavy losses today Cryptocurrencies are trading in the red on Tuesday as the bloodbath persists on account of the growing tensions between Russia-Ukraine. Market data shows that only Terra’s LUNA has registered a green candle in the last few hours. Bitcoin dropped below $36,500 earlier today for the first time since 4th February, setting a multi-week low of $36,488 as per CoinMarketCap. Though the OG cryptocurrency has since steadily climbed back to $37,600 as of writing, it is still down 2.85% in the last 24 hours. The current Bitcoin price means it has shed almost 14% in one week. Ether has ...

Bitcoin Mayer Multiple returns to July 2021 levels in fresh sign $37K BTC is a long-term buy

Bitcoin (BTC) has dipped enough for one of its best-known indicators to signal a rare long-term investment opportunity is here. As of Feb. 22, the Mayer Multiple is sitting at its lowest level since Bitcoin bounced at $29,000 in July last year. Mayer Multiple down 50% in 3 months The latest in a series of metrics to echo the pit of the 2021 retracement on BTC/USD, the Mayer Multiple currently measures 0.76, having halved since November’s $69,000 all-time high. The Multiple measures Bitcoin’s current price against its 200-day moving average. Its creator, Trace Mayer, believes that any reading below 2.4 offers an increasingly profitable trade for potential investors, and the lower the score, the more likely a long-term buy-in will turn out to be effective. For context, the Multip...

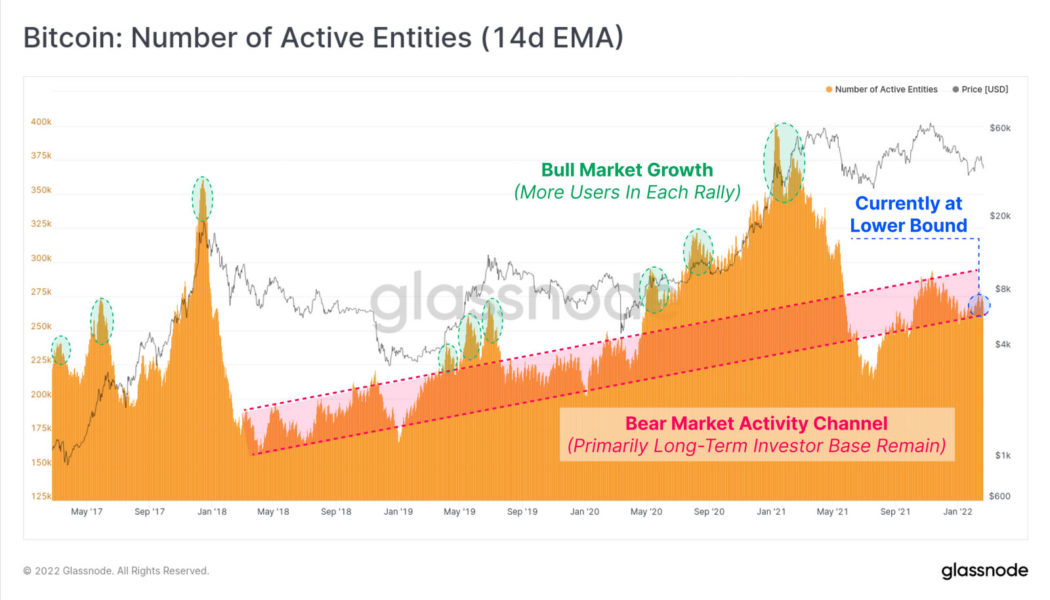

Glassnode theorises an extended BTC bear market, points to on-chain metrics

Analytics firm Glassnode says sizeable investor losses and recency bias are likely to sustain a prolonged bear market Despite the currently unimposing number of daily active users, Glassnode notes that long term hodlers are increasing linearly in the long term In its February 21 newsletter, blockchain data and intelligence provider Glassnode has suggested that Bitcoin investors are seeing a significantly growing number of motivations to sell their holdings. As volatility pushed Bitcoin to either side of the $40k psychological support last week, it peaked close to $45k but eventually closed nearer $38k. The blockchain analytics firm observed that external factors, including anticipation of the Fed’s March meeting and geopolitical issues globally, are cause for the dwindling price leve...

On-chain metrics hint at a bearish outlook for Bitcoin

Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent. In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data. The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the reason for the current risk-off sentiment for crypto assets. “Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.” It added that as the downtrend deepens, “the probability of a ...

Bitcoin investors are not giving up their holdings despite a shaky market

Investors are unwilling to let go of their Bitcoin to avoid making a sale they might regret later, according to Three Arrow Capital CEO Bitcoin’s daily active entities have hit mid-2019 numbers, but the activity remains on a rise Three Arrow Capital CEO Zhu Su has indicated that Bitcoin investors now have more patience and are not panic selling as they did for the Bitcoin copped between 2017-2018. On-chain data has revealed that the top digital asset holders have been hodling for more than an entire year despite the fluctuating prices and endless market corrections. A good number of the large Bitcoin investors have gone as far as adding more coins to their portfolios in that period. Su explained that traders who sold their holdings as the markets slumped between 2018 and 2019 soon en...

Solana’s weekend bounce risks turning into a bull trap — Can SOL price fall to $60 next?

A rebound move witnessed in the Solana (SOL) market this weekend exhausted midway as its price dropped below the $90 level from a high of $96 on Feb. 21. In doing so, SOL price technicals are now risking a classic bearish reversal setup. Solana price risks dropping to $60 Dubbed head-and-shoulders (H&S), the technical pattern emerges when the price forms three peaks in a row atop a common support level (called a neckline). As it typically turns out, the pattern’s middle peak, called a “head,” comes longer than the other two peaks, called theleft and right shoulders, which come to be of similar heights. The H&S pattern tends to send the prices lower—at length equal to the maximum distance between the head and the neckline—once they decisively break below its ...

Huobi executive says a Bitcoin bull run isn’t happening until late 2024

Huobi’s Du Jun expects a bear market to last until the next Bitcoin halving event He explained that previous price patterns show that bull runs usually succeed halving events Du Jun, the co-founder of digital assets exchange Huobi has predicted that Bitcoin could hold out on a bull market, at least until late 2024 when ‘halving’ occurs next. Speaking to CNBC, Jun observed that a bull run for the world’s top digital asset has historically been accompanied by halving. Halving is an event written into Bitcoin’s fundamental code during which the rewards to Bitcoin miners are cut by half. In reference, the Huobi co-founder noted that Bitcoin’s last two occurrences of all-time high Bitcoin prices had followed a halving event. Last year, Bitcoin peaked abo...

Altcoins Back in The Green: SOL and LUNA Leading the Comeback

The cryptocurrency market has painted a picture of green into the new week in what is seemingly a trend for February This is the third week that the market has started strongly – last week, the market embarked on an uptrend on Tuesday Bitcoin and Ethereum recover Bitcoin, whose price plunged to a 24-hour low of $38,112 over the weekend, has bounced back and is currently trading at $39,025 against the dollar. Despite seeing a positive 2.01% 24-hour change, the coin is still down over 7.40% in the last seven days. Ethereum’s native coin has similarly bounced from a dip to a weekend low of $2,585.95 posted during yesterday’s trading session. Though Ether is still trading below $2,800 ($2,715) – it has seen approximately 3.33% of gains in the last 24 hours as per CoinMarketCap data. Here’s a l...

‘Coin days destroyed’ spike hinting at BTC price bottom? 5 things to watch in Bitcoin this week

Bitcoin (BTC) heads into the last week of February lower but showing signs of strength as a key support level holds. After a nervous few days on macro and crypto markets alike, BTC/USD is below $40,000, but signs are already there that a comeback could be what starts the week off in the right direction. The situation is far from easy — concerns over inflation, United States monetary policy and geopolitical tensions are all in play, and with them, the potential for stocks to continue suffering. Further cues from the Federal Reserve will be hot property in the short term, with March expected to be when the first key interest rate hike is announced and delivered. Could it all be a storm in a teacup for Bitcoin, which on a technical basis is stronger than ever? Cointelegraph presents five fact...

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

Top 5 cryptocurrencies to watch this week: BTC, LEO, MANA, KLAY, XTZ

Russia’s massive build-up of soldiers, warplanes, equipment and extended military drills near Ukraine’s borders increased fears of a possible invasion within the next few days. That could have renewed selling in Bitcoin (BTC), which plummeted below the strong support at $39,600. Among the gloom and doom, there is a ray of hope for crypto investors because data from Glassnode shows that more than 60% of Bitcoin supply has not been used in any transaction for more than a year. This suggests that long-term hodlers are not dumping their positions in the downtrend. Crypto market data daily view. Source: Coin360 Mike McGlone, chief commodity strategist at Bloomberg Intelligence, warned that Bitcoin could be in for a “rough week ahead” and cautioned that “inflation is unlikely to drop...