Bitcoin

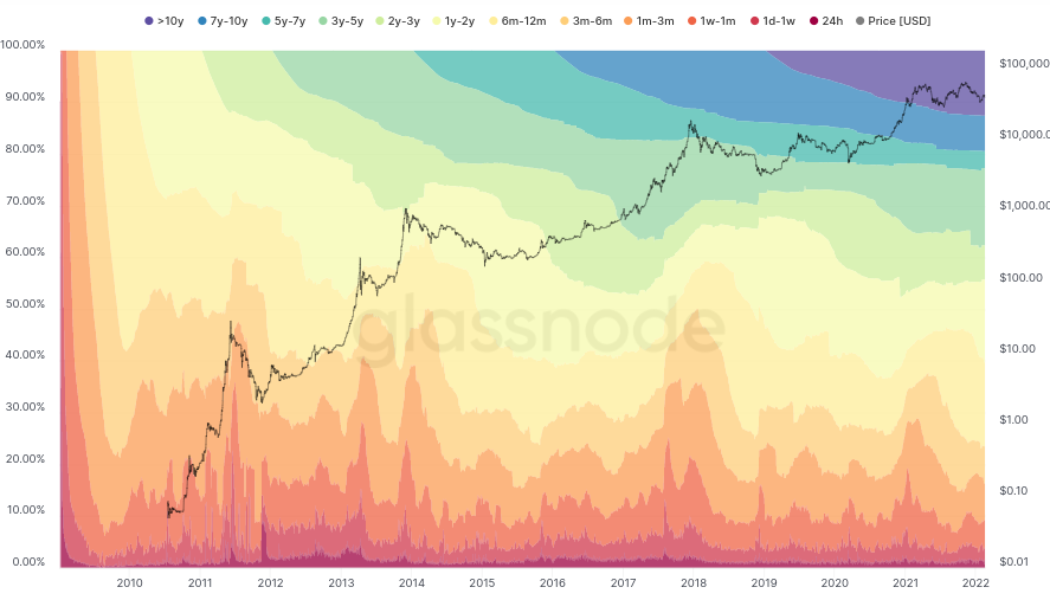

Bitcoin inactive supply nears record as over 60% of BTC stays unspent for at least 1 year

Bitcoin (BTC) may be struggling at $40,000 but fresh data is reinforcing the fact that hardly anyone is interested in selling. Data from on-chain analytics firm Glassnode shows that despite price volatility, over 60% of the BTC supply has not left its wallet in a year or more. Strong hands have rarely been stronger Stubborn hodling by long-term investors is a characteristic that differentiates the current Bitcoin market climate from most other downtrends. With spot price action passing 50% losses versus November’s all-time highs last month, expectations were for cold feet to kick in — but among seasoned hodlers, the sell-off never came. In fact, the opposite has been true for an extended period — long-term investors are adding to their positions or staying put on their BTC exposure. ...

Georgia lawmakers consider giving crypto miners tax exemptions in new bill

Five members of the Georgia House of Representatives have introduced a bill that would exempt local crypto miners from paying sales and use tax. On Monday, Georgia Representatives Don Parsons, Todd Jones, Katie Dempsey, Heath Clark, and Kasey Carpenter introduced HB 1342, a bill which has yet to be titled. The legislation proposes to amend the state tax code “to exempt the sale or use of electricity used in the commercial mining of digital assets” and would likely only apply to commercial miners operating in a facility of at least 75,000 square feet — roughly 6,968 square meters. The proposed bill is the latest in the series of state-level measures aiming to encourage crypto miners to set up shop. In January, Illinois lawmakers introduced a bill which would extend tax incentives for data c...

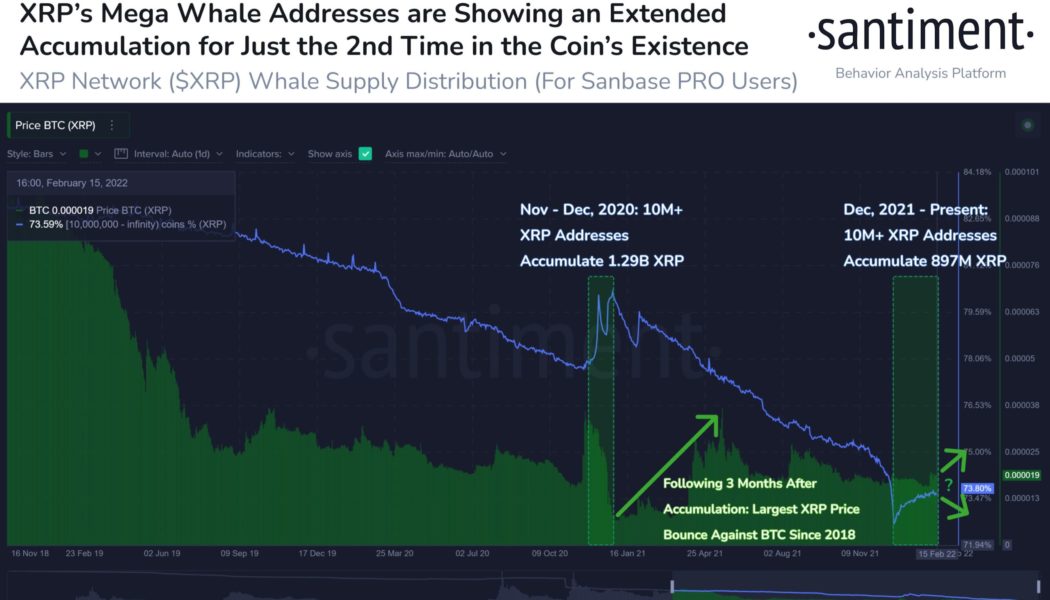

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

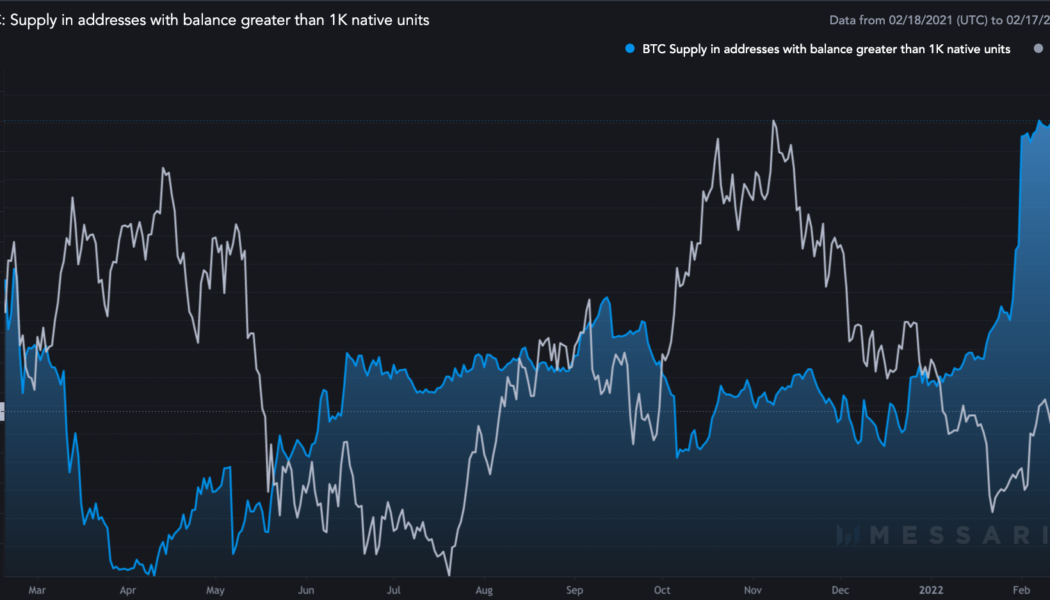

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

Bitcoin extends decline below $42K ahead of fresh Fed comments on inflation

Bitcoin (BTC) fell further with stocks on the Wall Street open Thursday as nervous markets awaited further U.S. economic policy cues and battled geopolitical tensions. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Macro conditions stay grim for stocks, crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD losing the $42,000 mark for the first time in several days at the start of trading. The Fed and tensions over Ukraine had already formed a backdrop to lackluster market performance both in crypto and beyond, with that trend staying firmly in force on the day. With the likelihood increasing that a rate hike could come from the U.S. next month, attention was on James Bullard, president of the St. Louis Fed, ahead of a statement due less than an hour fr...

Crypto analyst predicts that March is likely to be bearish for Bitcoin

InvestAnswers host has observed that Bitcoin usually plunges 8.5 times out of 10 in March He contends that the coming Fed meeting and current global unrest could affect Bitcoin’s price A popular crypto analyst who hosts InvestAnswers, a YouTube channel on financial education, has told his subscribers how he expects the BTC market to play out in March. His projection was in response to a question from a follower who inferred to the analyst’s previous assertions that March is usually a bearish month for Bitcoin. The InvestAnswers host explained that Bitcoin typically posts a red candle in March a strong 8.5 times out of ten. The host noted that several factors could add to this historical pattern and destabilise Bitcoin in the coming month. Several factors hang in the balance A F...

Here’s why crypto analyst Nicholas Merten believes Bitcoin is prime to surge

Crypto analyst Nicholas Merten has said Bitcoin not falling below $30k was a better price-performance than anticipated Merten also predicted Bitcoin price could reach $200k by November Crypto analyst Nicholas Merten has reviewed his Bitcoin price targets, evaluating the path the world’s largest digital asset is likely to follow in the coming months. Speaking during a recent episode on his YouTube channel, Merten observed that Bitcoin’s progressive fall from an all-time high of 69k last November to less than half that price point (as low as $33,500) towards the end of January was not as bad as it could have gotten. The DataDash host observed that the token could have plunged below $30k, but traders have increasingly begun buying the dip much faster. He explained that traders are...

Fidelity International launches Bitcoin ETP on Deutsche Boerse

Major financial services firm Fidelity International will be listing a Bitcoin exchange-traded product on the SIX Swiss Exchange and Germany’s Xetra digital stock exchange. According to a Tuesday announcement from Deutsche Boerse, a physical Bitcoin exchange-traded product, or ETP, from Fidelity International is now available for trading on the Deutsche Boerse Xetra and Frankfurt Stock Exchange under the ticker FBTC. In addition, the company reportedly said it planned to have the crypto investment vehicle listed on the SIX Swiss Exchange in the coming weeks. Fidelity Digital Assets will act as the custodian for the physically-backed Bitcoin (BTC) ETP, which will be centrally cleared with global exchange Eurex Clearing. The ETP has a total expense ratio of 0.75%. At the time of publication,...

Bitcoin price circles $44K as analyst asks, ‘Who remains to sell here?’

Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView OBV sparks 2021 recovery comparisons Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp. In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot. While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside. “When I consider everything BTC HODLers withstood in 2021- When I observe ...

Here is why crypto strategist de Poppe believes Bitcoin’s $41k support is crucial

Crypto markets analyst Michael van de Poppe has identified crucial $41k support for Bitcoin He theorised that Bitcoin going above $46k is a trigger for altcoins to start performing better Van de Poppe expects extended sideways action for Ethereum unless it breaks above $3,100 Crypto strategist Michael van de Poppe has reviewed how the crypto community should expect the market to shape up over the next few days. Bitcoin Speaking on the king cryptocurrency, Van de Poppe observed in a recent YouTube session that the coin is dancing around a crucial support level, which he says is likely to determine the direction Bitcoin could take in the short term. He pointed out that $41k was an important price level for Bitcoin, explaining that should support persist at this level, then Bitcoin could test...

Crypto analyst predicts gains for XRP, SHIB and BTC – Here’s his argument

Crypto analyst and Coin Bureau host is seeing a bull flag that could inspire a Bitcoin rally to $46k He also expects XRP to grow further with the news of Ripple joining the Digital Euro Association Metaverse news should eventually awaken SHIB to pump by up to 50% soon Pseudonymous Coin Bureau host, Guy, has observed that Bitcoin, XRP and Shiba Inu could be ready for a pump in the coming days. During a Monday YouTube session, Guy stated that the three had mounted a solid case to show that they are ripe for an uptrend. Bitcoin price can touch $56k soon The popular crypto markets analyst told his following that he is seeing the formation of a small bull flag for the world’s king of digital assets, which may or may not materialise. As the bull flag indicates an expectation for the upward...

Bitcoin hits $44K after Canada emergency powers accompany 6% BTC price increase

Bitcoin (BTC) opted for fresh upside on Feb. 15 as a trip to near $40,000 saw an abrupt change of direction. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI prints classic bull signal Data from Cointelegraph Markets Pro and TradingView showed BTC/USD gaining swiftly overnight into Tuesday, going on to pass $44,000. A classic relative strength index (RSI) breakout, this time on the lower four-hour timeframe, preceded the move, which put the pair a full 6% higher versus Monday’s lows. #Bitcoin 4 Hour RSI broke out and MACD just had a Bullish Cross: pic.twitter.com/2bRVFeQsfX — Matthew Hyland (@MatthewHyland_) February 14, 2022 “I do think these are the first signs of a trend break,” popular Twitter account Phoenix commented in a fresh post on the day. It ...