Bitcoin

‘One currency change every generation,’ how monetary skepticism spearheaded cryptocurrency adoption in Czechia

Czechia, a country of 10.7 million people in Central Europe, is known for its beautiful capital (Prague), rich history and good beer. Within the last decade, however, one can now add cryptocurrency adoption to that list. In fact, the Trezor wallet, the first cryptocurrency hardware wallet in the world, was invented here in 2014 and is still going strong. Its parent company, SatoshiLabs, has expanded into creating secure chips for electronic hardware via Tropic Square and advancing cryptocurrency education via Invity. What’s more, the country also gave birth to the world’s first Bitcoin (BTC) mining pool — Braiins (Slush Pool), with close to 1.3 million BTC mined since 2010. Then there’s General Bytes, one of the world’s largest crypto ATM chains, with close to 8,000...

Bitcoin set to help communities — Latinx nonprofit now accepts crypto donations

An organization that supports communities in times of need employs the helping hands of crypto to open the doors for a “broader swath of philanthropists.” Powered by charity provider The Giving Block, Corazón Latino is set to accept Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and many other cryptocurrencies to help its goals of reconnecting communities with the environment and providing quick responses to places affected by disasters like the COVID-19 pandemic. The nonprofit consistently runs initiatives focused on eco-tourism, conservation and climate resilience. Apart from these, Felipe Benitez, the founder and executive director of Corazón Latino, says that the organization has “provided rapid response mobilizations to support communities” during emergencies. Arizo...

TESLA Currently Hold $1.990 Billion Bitcoin

Facebook WhatsApp Reddit Twitter Shares TESLA, automobile manufacturing company base in United is currently hold Bitcoin worth $1.990 billion Bitcoin. TESLA was founded by Elon Musk, 1st of July 2003. The company headquarters is base in Tesla USA. MmCrypto share the story on twitter. Elon Musk always called Doge father because he has been the brain behind the promise of Doge Coins. .u0a34cc9bd6dd659414d0de40f4810b74 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:inherit; border:0!important; border-left:4px solid #16A085!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2...

CoinDesk CEO reflects on the necessity of decentralised currencies

CoinDesk chief Emily Parker told CNBC yesterday that CBDCs present undue privacy concerns She also noted there is tremendous innovation around privacy in the crypto sector Speaking in an interview with CNBC yesterday, Emily Parker, the chief executive of cryptocurrency news outlet CoinDesk, faulted the possible negatives of a CBDC and rooted for a world where users have an option to hold decentralised currency. Parker inferred to Bitcoin’s fundamental philosophy – decentralisation away from control by centralised entities such as the government, such that no one can manipulate or shut down the network. User privacy concerns The CEO also told Power Lunch that the very definition of centralised currencies illustrates why a decentralised coin is so much needed. Centralised currencies ar...

Russia Recognized Bitcoins, Others crypto as a currency

Facebook WhatsApp Reddit Twitter Shares Russian government has move to recornize Bitcoin and other Cryptocurrency as a currency in the country. The Russian government and the Central Bank has come to Conclusions, to formally recornize cryptocurrency as means of currency in the country. The development is come after the initials plan to ban mining Bitcoin in Russia. .u080e74559fcb162bfd7331ffad6dae84 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:inherit; border:0!important; border-left:4px solid #16A085!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, ...

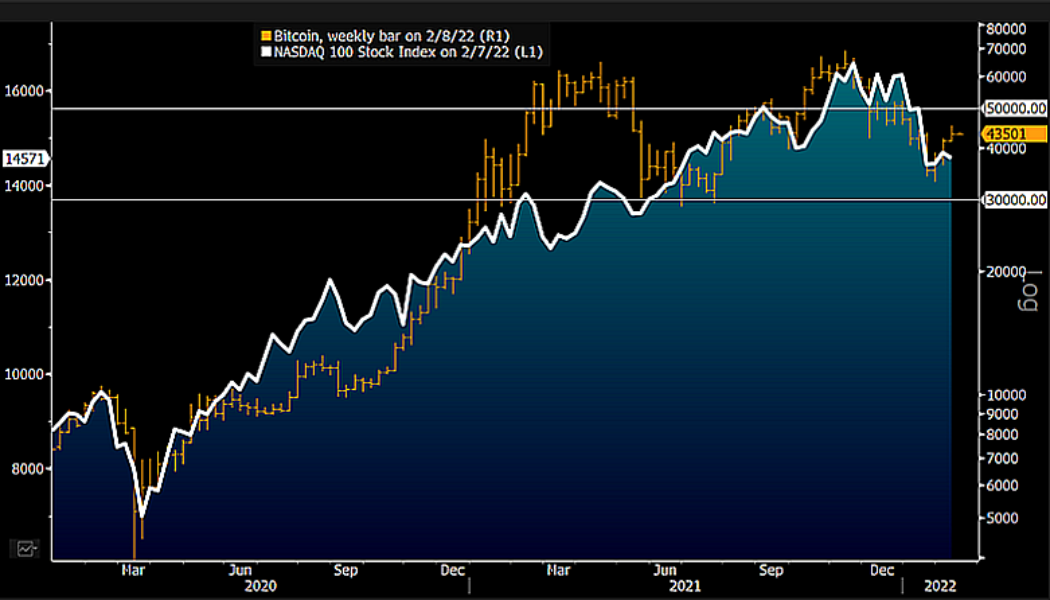

Bitcoin hasn’t bottomed yet, Bloomberg’s McGlone says

Commodity strategist Mike McGlone has said that Bitcoin will survive the current market forces He, however, noted that it is very likely the flagship cryptocurrency hasn’t hit its lowest thus far Bloomberg Intelligence’s senior commodity strategy has delivered another bullish projection on the leading cryptocurrency. In a tweet sent out today, the commodity expert noted that Bitcoin is showing divergent strength against stocks but warned that the asset hasn’t reached the bottom. He reckons that the crypto asset will sink to its bottom when the stock market pulls a similar move. McGlone, who has previously predicted Bitcoin to touch $100,000 by the end of the year, also observed that many traditional assets are currently enduring deflationary forces resulting from the stat...

Bitcoin centers on $44K as BTC price MACD delivers long-awaited bull signal

Bitcoin (BTC) hovered around $44,000 on Feb. 9 as a modest uptick towards the Wall Street open provided relief for support levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Melt-up or breakdown? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting in the range defined in recent days without significant downside pressure. Circling $44,000, traders were mostly preoccupied with a potential retracement, this having the potential to wipe out practically all recent progress. “Now that we are at monthly resistance we may see a pullback. Even if we do, a higher low to 38K–40K would be “healthy” followed by continuation to 50K+ and a reclamation of our monthly resistance after which point, I’ll have my sights set on a new ATH...

Here’s why FSInsight foresees BTC and ETH racing past 200k and 12k, respectively

A report by FSInsight predicts Bitcoin should end the year in the $138k to 222k range The report also indicated that Ethereum could reach $12k as it’s remarkably undervalued Market data outlook firm FSInsight has predicted that Bitcoin could reach $222,000 and Ethereum grow as much as $12,000 in the second half of the year. In a recent report, Digital Assets in A Post-Cycle World, the firm said that a number of factors could work in favour of the coins pushing them to reach the projected price. Several Bitcoin metrics are bullish FSInsight explained that Bitcoin is showing better market efficiency and has not exhibited rapid and unsustainable price appreciation as in previous cycles, which could be attributed to its shift from a payment method to a store of value. Further, the report...

Tether daily active addresses down to a two-year low: Santiment

Tether whales account for almost 80% of the current USDT supply, as per data from Santiment Bitcoin mega whales have accumulated a significant chunk of the cryptocurrency since the last week of December Data from market behaviour analysis platform Santiment paints a picture of whale domination in the Tether and USD Coin stablecoin markets. It also shows that the number of Tether daily active addresses has crashed to lows last recorded over two years ago. Tether and USD Coin whale dominance Tether, the world’s largest stablecoin, currently has a market capital closing in on $78 billion (roughly 3.8% of the entire cryptocurrency market capital). Only Bitcoin and Ethereum have a higher market circulating value among crypto tokens and other digital assets. Tether addresses with a valuati...

Valkyrie debuts a green Bitcoin miners ETF on NASDAQ

Valkyrie Investments is today listing its third Bitcoin-related ETF on the New York -based stock exchange The Valkyrie Bitcoin Miners ETF shall invest in firms whose power consumption is primarily denominated in renewable energy Valkyrie, an asset management firm focused on crypto and traditional finance initiatives is today launching a Bitcoin-related ETF. Known as the Valkyrie Bitcoin Miners ETF, the fund be largely fixated on publicly traded mining firms that get at least 50% of their energy from renewable sources. The ETF goes live on the Nasdaq under the WGMI ticker – a contraction of WAGMI (we’re all gonna make it) and is expected to run an expense ratio of 0.75%. The goal is green The ETF shall invest 80% or more of its assets in company securities for projects that derive at ...

KPMG Canada updates its corporate treasury with more Bitcoin and Ether

KPMG Canada has allocated an undisclosed amount of Bitcoin and Ether to its corporate balance sheet. The company plans to make more inroads into crypto assets in the future. KPMG in Canada disclosed yesterday that it has added crypto assets Bitcoin and Ether onto its balance sheet. The firm revealed that it employed the services of Gemini Trust Company’s crypto custody and execution in updating its corporate treasury. It, however, did not divulge how much of either asset it had purchased. In addition to the ETH and BTC acquired, the audit, tax, and advisory service provider also said it bought carbon offsets to retain a net-zero carbon transaction. Such is important as this conforms to the company’s environmental, social, and governance (ESG) mandate. Managing partner for advis...