Bitcoin

Bitcoin price bounces after Amazon stock gains 15% in US tech comeback

Bitcoin (BTC) recovered much of its recent losses on Feb. 4, but concerns remained that a retest of $30,000 was incoming. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $38,600 remains focal pivot Data from Cointelegraph Markets Pro and TradingView showed BTC/USD returning to $38,000 Friday, up over 2% in 24 hours. The pair saw a strong comeback overnight after suffering at the hands of United States stock sellers for two days straight. A similar turnaround for tech stocks later on Thursday, with Amazon gaining 15%, set the stage for Bitcoin to rise in step, with BTC proponents nonetheless criticizing the over volatility of some equities. The rebound, meanwhile, could go some way to averting a deeper retracement for Bitcoin, this nonetheless favored by Cointelegraph contributo...

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

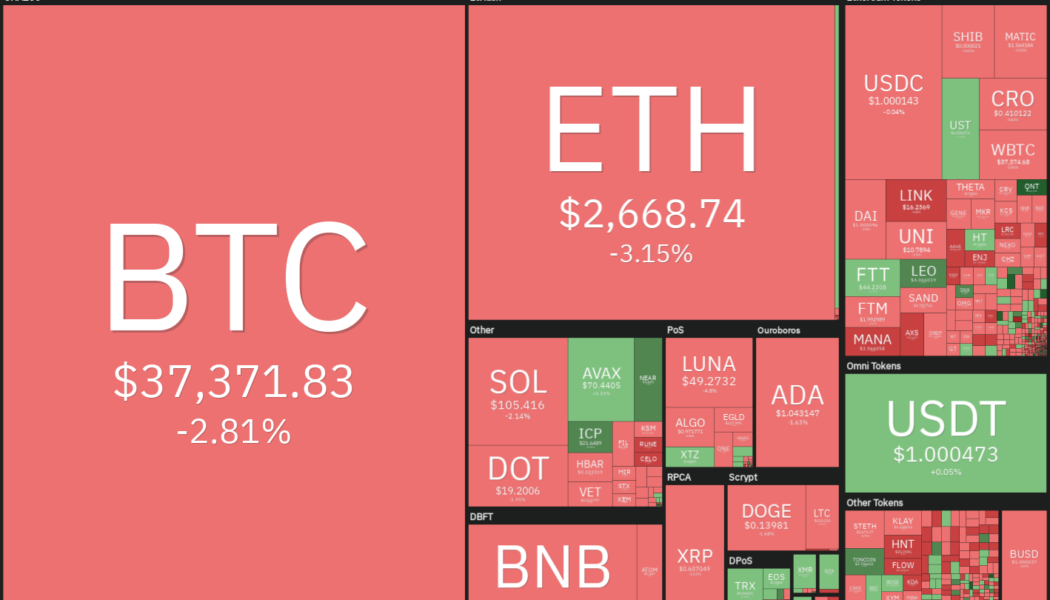

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...

BTC price faces crucial trend battle as Bitcoin RSI confirms breakout

Bitcoin (BTC) may have stopped short of $40,000, but this week’s gains have helped spark a more significant breakout for underlying price strength. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI breaks a two-month tradition Data from Cointelegraph Markets Pro and TradingView shows that sustained BTC price action above $37,000 this week has allowed the relative strength index (RSI) to diverge from a multi-month downtrend. After going from $36,700 to $39,280 in February, Bitcoin still lacks the momentum needed to challenge $40,000 resistance. That could soon change, however, as one trader shows that RSI has now exited its dive deep into “oversold” territory. RSI looks at how “oversold” or “overbought” an asset is at a given price point. As Cointelegraph reported, since ...

MicroStrategy reveals it completed another BTC purchase worth about $25 million

MicroStrategy’s appetite for Bitcoin remains high as ever as it has continued accumulating more of the cryptocurrency The company’s executives have previously remarked that the company doesn’t intend to stop buying or to sell The Virginia-based business intelligence firm on Tuesday revealed that it completed another bitcoin purchase worth 25 million across January. A filing with the US Securities and Exchange Commission showed that the NASDAQ-listed company acquired 660 bitcoins last month at an average price of $37,865 inclusive of additional expenses. The January purchase is however significantly smaller than previous purchases the company has made. For context, the company bought 7,002 bitcoins between October and the end of November. Prior to that, it had made it’s a smaller ...

El Salvador relaunches Chivo wallet, plans to deploy 1,500 Bitcoin ATMs

El Salvador, the first country to adopt Bitcoin (BTC) as a legal tender, has relaunched its in-house Chivo wallet to address the existing challenges of BTC transfers locally. With AlphaPoint integration, the updated Chivo wallet is expected to carry out instantaneous low-fee Bitcoin transactions while fixing concerns related to stability and scalability. Within the first month of establishing BTC as a legal tender, President Nayib Bukele announced that Chivo wallet onboarded 2.1 million Salvadorans, which by the end of the year amasses 75% of the population. However, the mass adoption met with numerous roadblocks, including system issues and missing funds. Seeking a permanent solution for over 4 million BTC users, the government of El Salvador partnered with a white label infrastructure pr...

NYDIG offering allows participating companies to pay employees in Bitcoin

The New York Digital Investment Group, or NYDIG, has launched a benefit program allowing employees of participating companies to convert a portion of their paychecks into Bitcoin. In a Tuesday announcement, the NYDIG said several firms involved with sports, entertainment and digital currencies would be among the first to offer the crypto payments, including Everbowl, MVB Bank, StretchZone, crypto analytics firm The TIE, crypto mining firm Iris Energy and Fertitta Entertainment — the conglomerate behind restaurant giant Landry’s and the National Basketball Association’s Houston Rockets. Company employees who participate in NYDIG’s Bitcoin Savings Plan can choose how much of their pay will be converted into Bitcoin (BTC), with no transaction or cold storage fees. NYDIG chief innovation...

El Salvador President affirms Bitcoin price surge is inevitable

Nayib Bukele believes that the price of Bitcoin will soon rocket El Salvador’s Minister of Finance has responded to the IMF’s demands to drop Bitcoin as a legal currency El Salvador President Nayib Bukele has once again publicly expressed his bullish view on Bitcoin, predicting that in “just a matter of time,” the crypto asset would see enormous gains in price. Scarcity to fuel Bitcoin price uptrend Yesterday, Bukele posited that Bitcoin’s maximum supply of 21 million coins might not be adequate to serve the demand as adoption rises. He anticipates that Bitcoin’s increased adoption and scarcity would be a catalyst for the predicted upthrust. “There are more than 50 million millionaires in the world. Imagine when each one of them decides they s...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

DFINITY-based Internet Computer unveils Bitcoin and Ethereum integration plans

Internet Computer will integrate Bitcoin via the ‘Chromium Satoshi Release’ before the end of Q1 this year The Ethereum integration would not come until Q3 when the ‘Vanadium Vitalik Release’ is run DFINITY Foundation, a non-profit organisation that supports the public blockchain Internet Computer, has released its roadmap for 2022. The release detailed that Internet Computer plans to develop Bitcoin and Ethereum blockchains integrations. This would effectively cut out the current need for a bridge, eliminating a potential loophole for ill-intentioned actors. “The ICP [and] BTC integration will prompt a new wave of DeFi applications built to leverage the world’s largest cryptocurrency,” a tweet from the DFINITY Foundation read. Unlocking the power ...