Bitcoin

Bitcoin holds onto 10% gains ahead of crucial Fed rate hike comments

Bitcoin (BTC) held onto fresh upside on Tuesday after a resurgent stock market took the largest cryptocurrency above $37,500. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView. Fed may spark fresh volatility Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading above $36,000 on Tuesday, with maximum 24-hour gains totaling 14% versus Monday’s floor. Bitcoin’s correlation to equities remained in focus ahead of a fresh Wall Street open and key information regarding interest rates from the United States Federal Reserve. The Fed’s Federal Open Market Committee (FOMC) is set to meet Wednesday, and any news regarding interest rates could have instant repercussions for both traditional and crypto markets. “Tomorrow’s FED ...

Green shoots? Institutional crypto funds see first inflows in 5 weeks

After five weeks of constant outflows, institutional investment is finally trickling back into crypto funds with BTC the asset of choice and ETH falling out of favor. In its weekly Digital Asset Fund Flows report published on Jan. 24, crypto investment firm CoinShares observed inflows for some institutional products. It is the first time in five weeks that there has been a net positive inflow as $14.4 million re-entered the space with investors buying the dip. The researchers reported that these inflows came during a period of significant price weakness, adding that this suggests investors “are seeing this as a buying opportunity” at current price levels. Capital continued to flow out from CoinShares own BTC fund, however, 21Shares and ProShares registered minor gains. Most of the inflows ...

Illiquid supply ‘going up relentlessly’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) is starting the final week of January in a place no one wanted but many warned about — a 50% drawdown from all-time highs. A flight to $34,000 means that BTC/USD is now down by half in just two months, and perhaps naturally, concerns are that the losses could continue. With $30,000 so far unchallenged, Bitcoin remains slightly above the trough of its dip from $58,000 to $29,000 last summer. With macro markets facing a tough time of their own thanks to rapidly changing United States Federal Reserve policy, crypto holders will be eyeing their coins’ correlation to traditional assets going forward. Can Bitcoin break the trend? So far, there are few signs that a significant rebound is on the cards, but below the headlines, not all is as it seems when it comes to Bitcoin’s strengt...

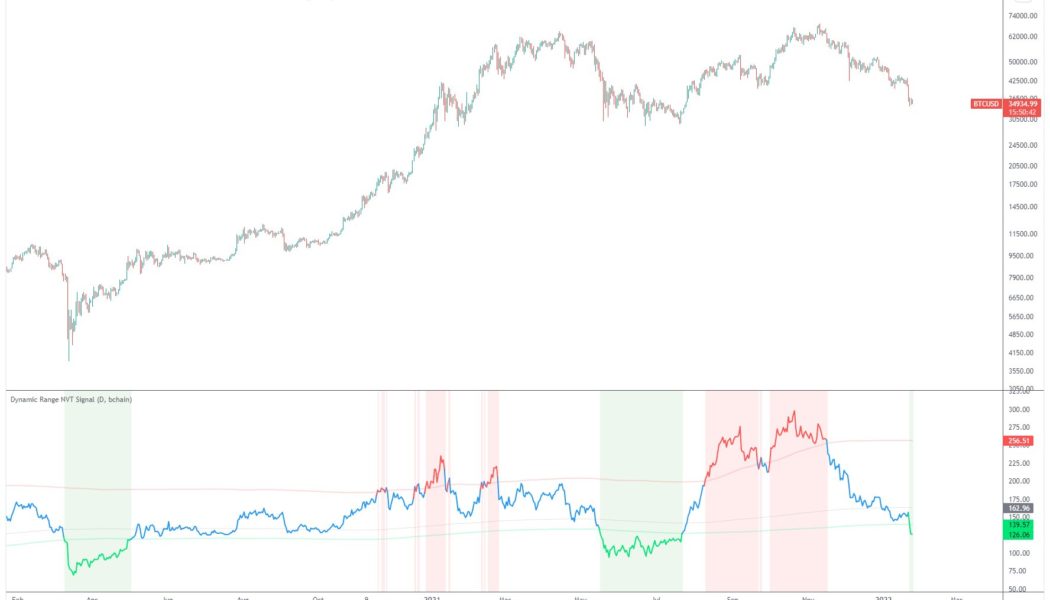

Bitcoin ‘enters value zone’ as BTC price floor metric goes green again

Bitcoin (BTC) has just reentered a key price zone, which has signaled the beginning of the end for bear phases, data confirms. In a tweet on Jan. 24, Charles Edwards, founder of crypto investment firm Capriole, flagged Bitcoin’s network value to transaction (NVT) ratio metric as it delivered a new and rare “oversold” signal. NVT says it’s reversal time Bitcoin price losses accelerated over the weekend, with the market not far off a retest of the seminal $30,000 mark prior to Monday’s Wall Street open. Nonetheless, for on-chain analysts, there are plenty of reasons to believe that the extent of losses seen recently is more of a market overreaction than a taste of things to come. Supporting that thesis is NVT, which calculates how overbought or oversold Bitcoin really is. NVT, first&nb...

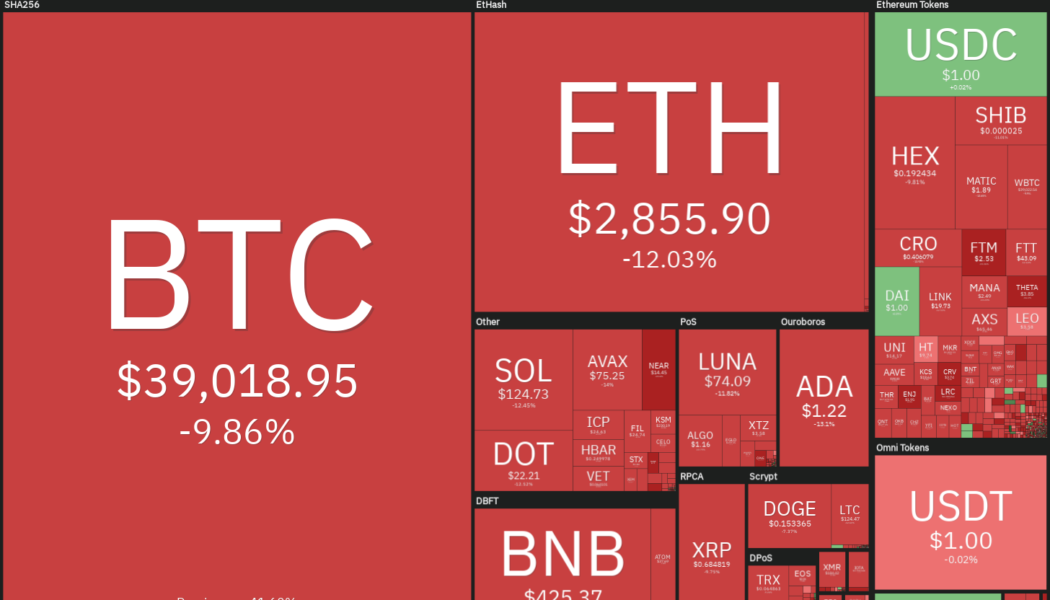

ADA sinks below $1.00 after market sell-off knocks off accrued gains

Cardano’s native token ADA is currently trading over 66% below its all-time high set five months ago The recent market slump that started during Friday’s morning session has taken a huge chunk out of the cryptocurrency sector’s circulating value. Bitcoin, Ethereum and Binance Coin down more than 5% on the day Bitcoin (BTC) plunged below $38k on Friday before seeing more dips and dropping below $35k. Down approximately 6.4% in the last 24 hours, it is now trading at $33,653.05 as per data from coinmarkecap. Ethereum (ETH) price, which broke above $3,200 on Thursday’s trading session, is down 27.54% over the last seven days. The second-largest crypto-asset sunk below the $2,400 critical level on Saturday, bottoming around $2,330. On the day, the token has lost 11.21% ...

How to pick or analyze altcoins?

What are altcoins? The word “altcoin” is derived from “alternative” and “coin.” Altcoins refer to all alternatives to Bitcoin. Altcoins are cryptocurrencies that share characteristics with Bitcoin (BTC). For example, Bitcoin and altcoins have a similar basic framework. Altcoins also function like peer-to-peer (P2P) systems and share code, much like Bitcoin. Of course, there are also marked differences between Bitcoin and altcoins. One such difference is the consensus mechanism used by these altcoins to validate transactions or produce blocks. While Bitcoin uses the proof-of-work (PoW) consensus mechanism, altcoins typically use proof-of-stake (PoS). There are different altcoin categories, and they can best be defined by their consensus mechanisms and unique functionalities. Here are the mo...

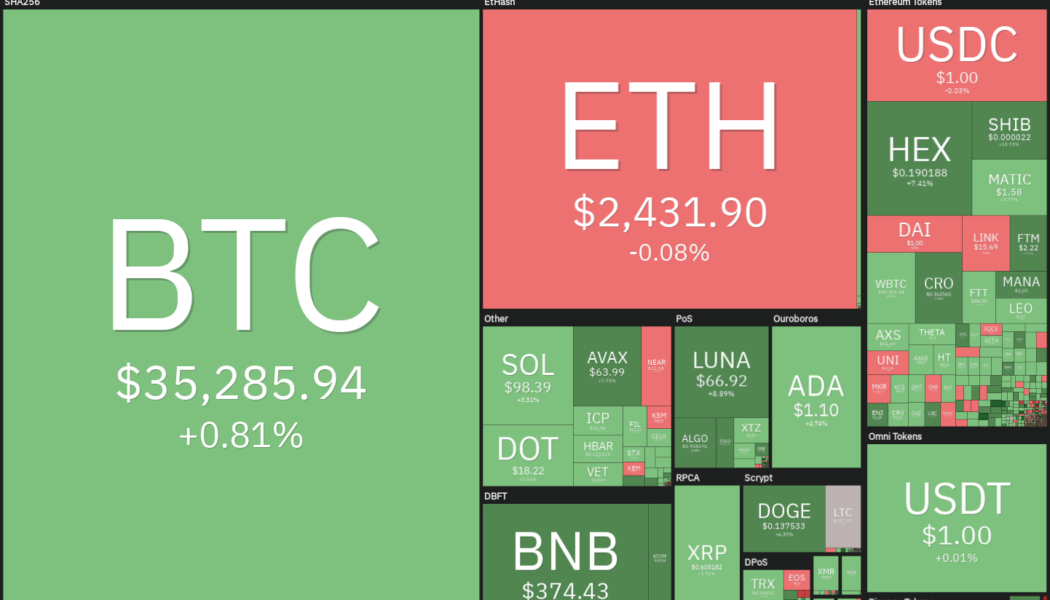

Top 5 cryptocurrencies to watch this week: BTC, LUNA, ATOM, ACH*, FTM

Bitcoin (BTC) fell close to $34,000 on Jan. 21, which reflects a 50% decline from the $69,000 all-time high made on Nov. 10, 2021. Altcoins also could not buck the trend and faced intense selling pressure, which pulled the total crypto market capitalization to $1.6 trillion, a 46% decline from its November 2021 all-time high near $3 trillion. It is not only the crypto markets that are facing selling by investors. The S&P 500 has also plummeted 8% year-to-date. However, gold has outperformed and risen about 1.76% during the period, cementing its billing as a safe haven asset. Crypto market data daily view. Source: Coin360 Several retail traders who purchased Bitcoin near its all-time high are voicing their concerns on social media. However, El Salvador’s President Nayib Bukele does not ...

SEC rejects MicroStrategy‘s Bitcoin accounting practices: Report

Business intelligence firm MicroStrategy reportedly acted contrary to the Securities and Exchange Commission’s (SEC‘s) accounting practices for its crypto purchases. According to a Bloomberg report, a comment letter from the SEC released Thursday showed that the regulatory body objected to MicroStrategy reporting information related to its Bitcoin (BTC) purchases based on non-Generally Accepted Accounting Principles (GAAP). The business intelligence firm has been reporting that it used these methods of calculating figures for its BTC buys, excluding the “impact of share-based compensation expense and impairment losses and gains on sale from intangible assets.” Essentially, this negates some of the effects of the volatility of the crypto market. GAAP rules are seemingly not design...

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounce

Solana (SOL) price may fall to $70 a token in the coming weeks as a head and shoulders setup emerged on the daily timeframe and possibly points toward a 45%+ decline. The chart below shows that SOL price rallied to nearly $217 in September 2021, dropped to a support level near $134 and then moved to establish a new record high of $260 in November 2021. Earlier this week, the price fell back to test the same $134-support level before breaking to a 2022 low at $87.73. SOL/USD weekly price chart featuring head and shoulders setup. Source: TradingView This phase of price action appears to have formed a head and shoulders setup, a bearish reversal pattern containing three consecutive peaks, with the middle one around $257 (called the “head”) coming out to be higher than the oth...

BTC price falls to $34K as Bitcoin RSI reaches most ‘oversold’ since March 2020 crash

Bitcoin (BTC) refused to stem recent losses during Jan. 22 as predictions of a flight to $33,000 and lower looked increasingly likely to become a reality. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView. Open interest “still not flushed” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell through $35,000 during the first half of Saturday. With few silver linings available for the bulls, lower weekend volume was poised to deliver some classic erratic moves after Bitcoin lost $40,000 support on Friday. While some, including El Salvador, made the most of the new lower levels, others voiced concern that despite the drop, pressure still remained on bulls. “Crazy part is open interest still hasn’t flushed,” trad...

Redditors share their thoughts on buying Bitcoin at all-time highs

Many crypto enthusiasts turned to social media on Friday to voice their frustrations with the state of the crypto market. One Reddit user named imyourkingg allegedly invested 30% of his net worth into Bitcoin (BTC) a few months ago, saying: “I don’t need this money for the next 5 to 10 years, but I have to admit sometimes I get so afraid of Bitcoin’s future; I mean it crashes or never reach $100k, $200k as the predictions for 2025+ says or at least $55k again lol, and I lose that money, especially when all of my friends, my mom and family call me crazy for investing on it.” Crypto’s decentralized nature means there are no circuit breakers equivalent to the ones that exist on traditional stock exchanges. The resulting bull/bear cycles can be extreme, and d...

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...