Bitcoin

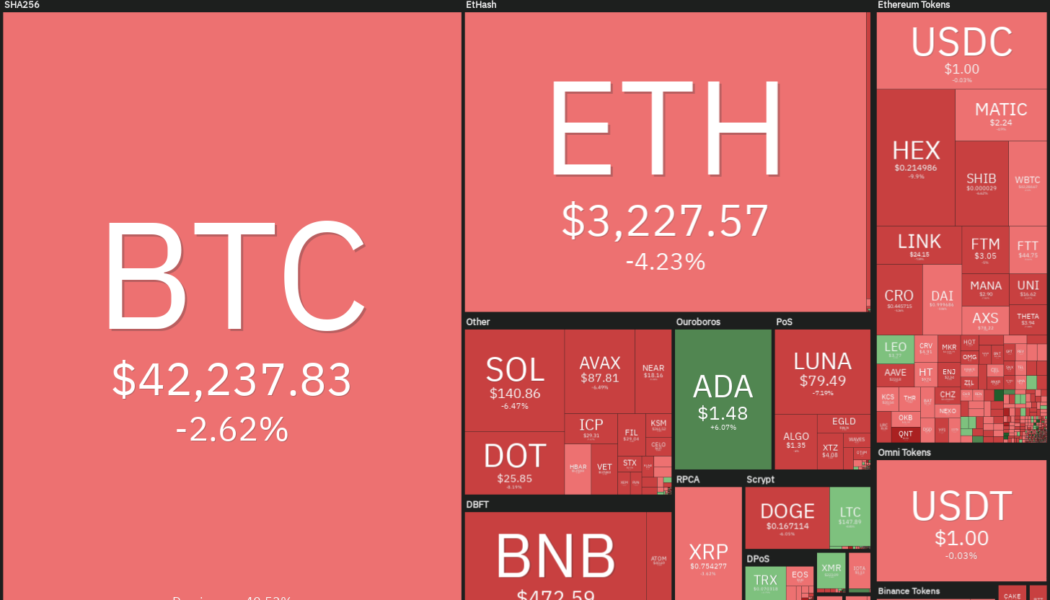

Crypto market sees red ahead of weekend – Bitcoin and Ether down more than 7.50% on the day

For the second time in two weeks, Bitcoin has fallen below $40k, this time coming closest to the $38k support The crypto market crashed during today’s morning session in its entirety, with dollar-pegged stablecoins being the only survivors. Data provided by CoinMarketCap indicates that Bitcoin, which had gained towards $43,000 on Thursday, fell to a six-month low of $38,560. At the time of publication, the pioneer crypto coin is trading below $39k, having shed 7.68% in the last 24 hours. Along with Bitcoin, Ethereum is also feeling the blow to the market. In the past 24 hours, the second most valuable digital asset dipped to a $2,827.7o low. At the time of press, the coin is changing hands slightly above that figure, at $2,880.22, but still down 8.34% on the day. Altcoins in the red ...

Crypto liquidations pass $700M as altcoins take a hit from Bitcoin sinking below $40K

Bitcoin (BTC) stayed lower on Friday after an overnight bout of volatility sent the largest cryptocurrency to six-month lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $40,000 optimism unwinds Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing at $38,250 after shedding over $4,000 in hours. Circling $39,000 at the time of writing, traders were reeling from the sudden downside, which came just as BTC had hit multi-day highs, passing $43,000. Liquidations across trading platforms were thus predictably significant. For Bitcoin and altcoins combined, 24-hour position unraveling totaled $725 million, with BTC positions accounting for $292 million. The vast majority of the casualties were long positions, a sign that the area around $40,000 had att...

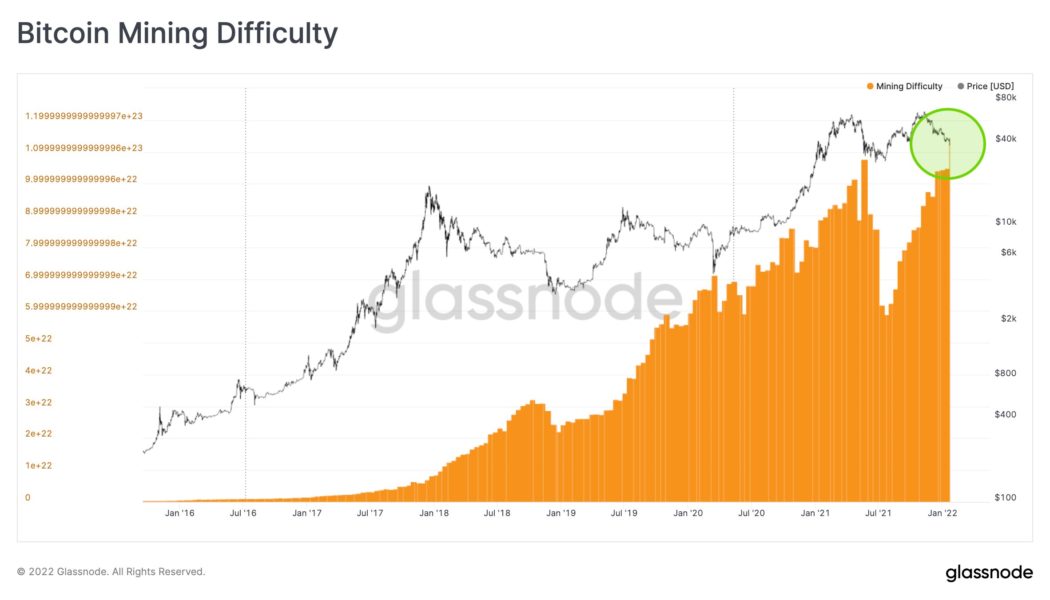

Bitcoin fundamentals diverge from BTC price dip as difficulty hits new all-time high

Bitcoin (BTC) may have tanked to six-month lows this week, but under the hood, the network is now verifiably stronger than ever. Data from on-chain monitoring resources including Glassnode and BTC.com confirms that as of Friday, the Bitcoin network difficulty is at a new all-time high. Difficulty passes 26 trillion for the first time The difficulty, which expresses how much miners need to work to solve the equations to process transactions on the blockchain, is arguably the most important of fundamental Bitcoin network components. The metric automatically adjusts to increase or decrease mining effort according to miner participation — the more competition among miners, the higher the difficulty. This has the effect of keeping mining stable regardless of factors such as sentiment, pric...

Wait, what? Former Bitcoin bull Raoul Pal only owns one Bitcoin?

Former Goldman Sachs hedge fund manager and cryptocurrency bull Raoul Pal claimed in a tweet that he now only owns a single Bitcoin. As the claim was made in the heat of a Twitter fight with self-proclaimed “Bitcoin Strategist” Greg Foss it’s not entirely clear whether it’s an exaggeration or an accurate statement about his holdings. Pal is the founder and CEO of Real Vision and Global Macro while Foss is an executive director at Validus Power Corp. The revelation of his apparently small holding certainly caused uproar and angst among Bitcoin true believers, who’ve looked at Pal askance ever since he started calling Ethereum “the greatest trade” and predicted that ETH and altcoins will eventually outperform BTC. Fascinating to see that since inception ETH has outperformed BTC by 250%. It o...

MicroStrategy CEO won’t sell $5B BTC stash despite crypto winter

Despite a 40% drop in the value of Bitcoin (BTC), MicroStrategy’s Michael Saylor has no intention of selling his firm’s $5-billion stash. Even if BTC suffers a lengthy bear market, Saylor told Bloomberg that he is a “Bitcoin bull” and does not intend to alter MicroStrategy’s multi-billion-dollar BTC acquisition plan. He took a firm stance against cashing out BTC: “Never. No. We’re not sellers. We’re only acquiring and holding Bitcoin, right? That’s our strategy.” This current crypto winter doesn’t have Michael Saylor feeling all that cold. He tells @emilychangtv why in Studio 1.0 https://t.co/EsUlY5sscN pic.twitter.com/zWStdl5qsF — Bloomberg TV (@BloombergTV) January 20, 2022 MicroStrategy became the first publicly listed corporation in the United States to acquire and hold Bitcoin a...

Canadian restaurant chain reports earning 300% gains on BTC investment to weather pandemic

More than a year after a Canada-based Middle Eastern restaurant chain converted its fiat cash reserves into Bitcoin, the owner reported the move helped save the business during the pandemic. According to a Tuesday report from Canadian news outlet Toronto Star, when Tahini’s restaurant owners Aly and Omar Hamam and their cousin Ahmed decided to convert the company’s savings into Bitcoin (BTC) in August 2020 because it offered “a much better alternative to saving cash,” the price of the crypto asset was roughly $12,000. Aly Hamam reported the business had benefited from the initial crypto investment. “We made the move to the corporate balance sheet on a Bitcoin-standard back in August of 2020, and since then, we’re up more than 300 percent on our initial investment,” said Hamam. “It’s really...

Strike wallet is 5th most popular finance app in Argentina, but where’s the BTC?

Strike’s digital wallet has become the fifth most popular finance app in Argentina within a week of its launch. The firm, led by hoodie-wearing CEO Jack Mallers, rolled out its crypto payment services for the Argentinian market on Jan 12. Strike is famed for enabling Bitcoin (BTC) payments via the Lightning network, particularly in El Salvador. However, according to local media and user reports, the firm’s app in Argentina reportedly currently only supports the use of Tether’s stable coin USDT for transfers via Lightning. Users are able to purchase Bitcoin via the app though, and send it to a third party wallet. Mallers tweeted on Jan. 18 that Strike’s app is currently ranked as the fifth-highest finance app and the top new app overall on the Argentinian Apple app store, as he emphasized t...

Bitcoin mining becomes more sustainable: Mining Council’s Q4 survey

The percentage of the global Bitcoin mining industry running on renewable power increased by 1% to 58.5% in the fourth quarter of 2021 according to new data. The Bitcoin Mining Council (BMC) announced the findings of its fourth quarter survey on Jan. 18. The survey focused on three metrics: sustainable power mix, technological efficiency and electricity consumption. Q4 #Bitcoin Mining Council Survey Confirms Improvements in Sustainable Power Mix and Technological Efficiency. Estimated sustainable energy mix was 58.5%. Join us at 5pm ET today for a full briefing.https://t.co/t1gTZV9GtT — Michael Saylor⚡️ (@saylor) January 18, 2022 Founded in May 2021, the BMC is a voluntary global forum of Bitcoin mining companies such as Bit Digital, BitFury, Bitfarms and Atlas Mining, and ot...

Intel to reveal new energy-efficient Bitcoin mining ASIC at next ISSCC

Reports indicate that Intel, one of the largest computer processor manufacturers, intends to reveal a new “Ultra-Low-Voltage Energy-Efficient Bitcoin Mining ASIC” known as Bonanza Mine at the upcoming IEEE International Solid-State Circuits Conference in February 2022. Intel submitted a patent in November 2018 outlining similar ideas for “high-performance Bitcoin Mining.” It is suspected that the processes described in the patent could make their way into the product being shown off at the ISSCC. According to the patent, the ASIC behind the Bonanza Mine will be able to finish calculations just as effectively as other ASICs while eliminating the need for repeated or redundant computations. This system is proposed to reduce overall power consumption by approximate...

Miami Bitcoin Conference to Conclude With Music Festival Featuring deadmau5, Steve Aoki, More

Several of dance music’s biggest names are ready to celebrate “hyperbitcoinization” with performances to close out the upcoming Bitcoin 2022 Conference. Since the advent of Miami Music Week and Ultra Music Festival, Miami has always been a cultural hub for dance music. In even more recent times, however, the city has positioned itself as the future crypto capital of the U.S. The effort has been fostered through the leadership of Miami’s Mayor Francis Suarez, who has opted to take his own salary in Bitcoin and has facilitated the creation of Miami’s own dedicated blockchain asset, MiamiCoin. Becoming the home to the annual Bitcoin Conference, the largest celebration of the world’s most popular digital asset has proved a boon to Miami’s rep...

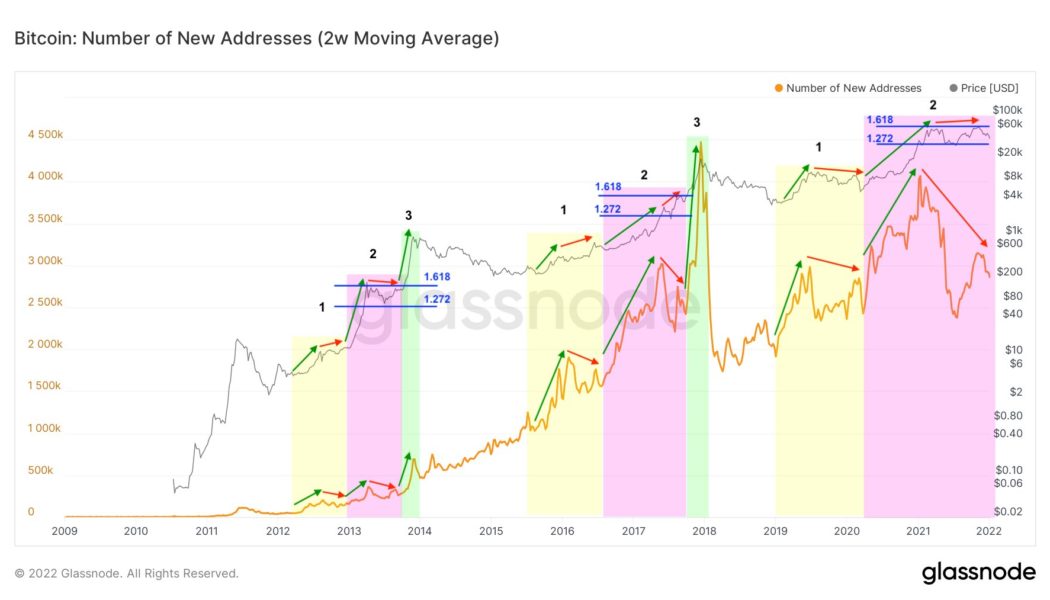

What bear market? Current BTC price dip still matches previous Bitcoin cycles, says analyst

Bitcoin (BTC) has “at least one more upward impulse to come” before reaching this halving cycle’s all-time high, new research maintains. In a series of tweets about the current state of BTC price action, popular analyst TechDev argued that contrary to many opinions, there is nothing unusual about BTC/USD in 2022. Bitcoin in 2021: Nothing to see here With a drawdown of 40% from November’s all-time highs of $69,000 still ongoing, sentiment has likewise taken a hit — “extreme fear” still characterizes both Bitcoin and altcoin markets. For TechDev, known for his optimistic takes on the Bitcoin outlook, there is nonetheless nothing to worry about. Analyzing new wallet addresses relative to price behavior, he showed that last year’s scenario — new address numbers making lower highs while price m...

Price analysis 1/17: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin’s (BTC) volatility has been shrinking in the past few days. The standard deviation of daily Bitcoin returns for the last 30 and 60 days as calculated by the Bitcoin Volatility Index is at 2.63%, the least volatile it has been since November 2020. Generally, tight ranges are followed by strong price expansions. In 2020, the low volatility period in November was followed by a sharp rally in mid-December, which resulted in a supercycle that carried the price all the way to $64,854 on April 14, 2021. Daily cryptocurrency market performance. Source: Coin360 However, there is no certainty that the volatility expansion will happen only to the upside. The price could break out in either direction. Commentator Vince Prince warned that the high leverage ratio of Bitcoin could trigger a big c...