Bonds

Concord Taps Bond Market With $1.65 Billion Asset-Backed Security

Independent music company Concord is the latest to tap into a growing market for music royalty-backed securities with Concord Music Royalties, LLC, Series 2022-1, a $1.65 billion asset-backed security. The bond will be supported by mechanical, performance and synchronization royalties from more than 1 million assets. The proceeds will be used to fund reserve accounts, pay transaction expenses, repay debt and for other general corporate purposes, according to a report by ratings agency KBRA. KBRA gave Series 2022-1 a preliminary rating of A+ (on a scale ranging from AAA to D), citing the “large, diversified catalog with globally recognized songs and artists” such as R.E.M., Plain White T’s, Creed, Evanescence, Genesis, Phill Collins and Mike + The Mechanics — the latter t...

Bukele’s government introduced a bill to launch the ‘Bitcoin bonds’

Amid the crypto market downturn, El Salvador finally made a decisive step to the realization of its ambitious “Bitcoin bonds” project. The Minister of the Economy, Maria Luisa Hayem Brevé, introduced a bill confirming the government’s plan to raise $1 billion and invest them into the construction of a “Bitcoin city.” A 33-page digital securities bill, dated Nov. 17, urges lawmakers to create a legal framework using the digital assets in public issuances by El Salvador. They should also consider all the requirements for this procedure and the obligations of issuers and asset providers. The “volcano bonds” or “Bitcoin bonds” were introduced by the government of Nayib Bukele back in 2021. The initial plan proposed issuing roughly $1 billion of those bonds and allocating the raised funds to th...

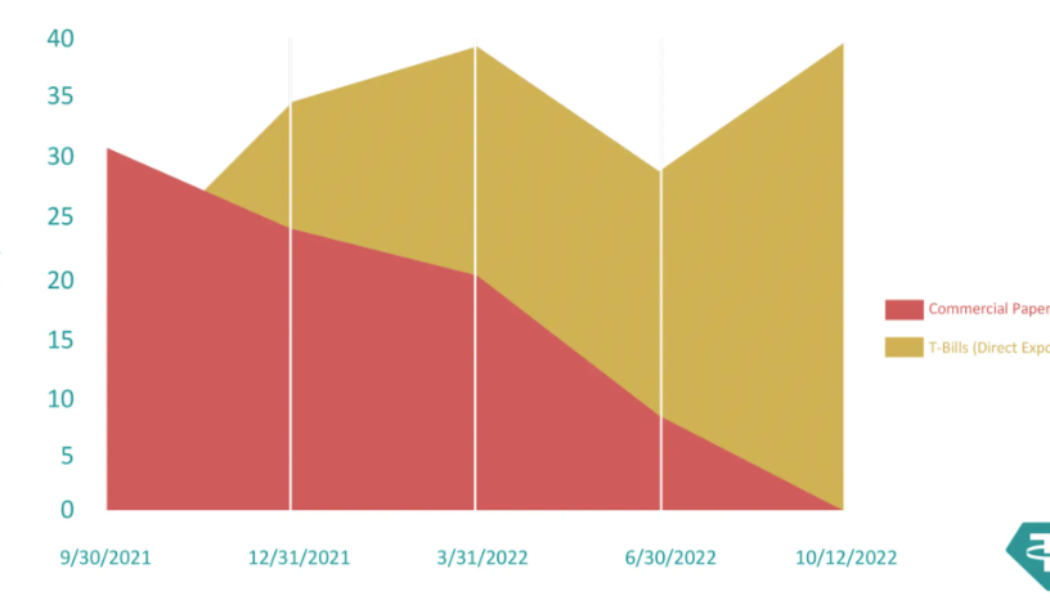

Tether reduces commercial paper exposure to zero, replaces investments with T-Bills

Stablecoin issuer Tether Holdings Limited has unwound its exposure to commercial paper, addressing a long-standing item of contention among detractors who’ve criticized the quality of its reserves. In addition to removing commercial paper from its reserves, Tether announced on Oct. 13 that it had replaced those investments with United States Treasury Bills. “Reducing commercial papers to zero demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market,” the company said. From roughly $30 billion down to zero, Tether has replaced its commercial paper holdings with more secure U.S. T-Bills. Source: Tether. While Tether has long been subjected to public scrutiny about its reserves detractors have focused on the composition of its assets for t...

El Salvador Bitcoin bond delayed due to security concerns: Tether CTO

El Salvador, the Central American nation that adopted Bitcoin (BTC) as a legal tender in September last year, has delayed the launch of its billion-dollar Bitcoin bond again. The Bitcoin bond, also known as the “Volcanic bond” or Volcanic token, was first announced in November 2021 as a way to issue tokenized bonds and raise $1 billion in return from investors. The fundraiser will then be used to build a “Bitcoin City” and buy more BTC. The bond was set to be issued in the first quarter of 2022 but was postponed to September in the wake of unfavorable market conditions and geopolitical crises. However, earlier this week, Bitfinex and Tether chief technology officer Paolo Ardoino revealed that the Bitcoin bond will be delayed again to the end of the year. Ardoino, in...

Why September is shaping up to be a potentially ugly month for Bitcoin price

Bitcoin (BTC) bulls should not get excited about the recovery from the June lows of $17,500 just yet as BTC heads into its riskiest month in the coming days. The psychology behind the “September effect” Historic data shows September being Bitcoin’s worst month between 2013 and 2021, except in 2015 and 2016. At the same time, the average Bitcoin price decline in the month is a modest -6%. Bitcoin monthly returns. Source: CoinGlass Interestingly, Bitcoin’s poor track record across the previous September months coincides with similar downturns in the stock market. For instance, the average decline of the U.S. benchmark S&P 500 in September is 0.7% in the last 25 years. S&P 500 performance in August and September since 1998. Source: Bloomberg Traditional chart a...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

Altcoin Roundup: Analysts give their take on the impact of the Ethereum Merge delay

The rollout of Ethereum 2.0, or Eth2, includes a transition from proof-of-work to proof-of-stake that will supposedly transform Ether (ETH) into a deflationary asset and revolutionize the entire network. The event has been a trending topic for years and while anticipation for “The Merge” has been building over the past couple of months, this week Ethereum core developer Tim Beiko informed the world that “It won’t be June, but likely in the few months after. No firm date yet.” Delays in Ethereum network upgrades are nothing new and so far, the immediate effect on Ether’s price following the revelation has been minimal. Here’s what several analysts have said about what the merger means for Ethereum and how this most recent delay could affect ETH price moving forward. Staking Rewards ex...

Michael Saylor: Financial markets are ‘not quite ready’ for Bitcoin bonds

MicroStrategy CEO and Bitcoin permabull, Michael Saylor believes that traditional financial markets aren’t quite ready for Bitcoin-backed bonds. Saylor told Bloomberg on Tuesday, that he’d love to see the day come where Bitcoin-backed bonds are sold like mortgage-backed securities, but warned that, “the market is not quite ready for that right now. The next best idea was a term loan from a major bank.” MacroStrategy, a subsidiary of @MicroStrategy, has closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase #bitcoin. $MSTR $SIhttps://t.co/QYw2ZgeE3U — Michael Saylor⚡️ (@saylor) March 29, 2022 The remarks come two days after MicroStrategy’s (MSTR) Bitcoin-specific subsidiary MacroStrategy, announced that it had taken out a $205 million Bitcoin-...

President Bukele hits out at Bitcoin Bond ‘FUD’ as CZ jets in to El Salvador

El Salvador President Nayib Bukele took to Twitter on Wednesday evening, hitting out at a Reuters report claiming Binance CEO Changpeng Zhao (CZ) was flying in to save El Salvador’s Bitcoin Bond. “Please don’t spread Reuter’s FUD,” Bukele tweeted to his 3.6 million followers, rebuking the claim that CZ was flying in to assist after the $1 billion bond offering, originally scheduled for mid-March, was postponed until September. He was responding to a tweet on the subject by Bitcoin Magazine, which has now deleted the post. I’m a fan of @BitcoinMagazine, please don’t spread @Reuters FUD. The #Bitcoin Volcano Bonds will be issued with @bitfinex. The short delay in the issuance is only because we are prioritizing internal pension reform and we have to send that to congress before. https://t.co...

14% of Salvadoran businesses have transacted in BTC: Chamber of Commerce

Businesses in El Salvador have been slow to adopt Bitcoin (BTC) ever since the country famously recognized the digital asset as legal tender in September 2021, according to a recent survey by the Salvadoran Chamber of Commerce. Of the 337 companies polled between Jan. 15 and Feb. 9, only 14% said they had transacted in BTC since the Bitcoin Law came into effect. Over 90% of the companies indicated that Bitcoin adoption in the country had little impact on their sales. Seventy-one percent of the companies polled were micro or small businesses, 13% classified as medium-sized enterprises and 16% were large companies. While the low adoption rate may appear underwhelming at the surface, El Salvador has been on the U.S. dollar standard since 2001. Unlike the currencies of other emerging eco...

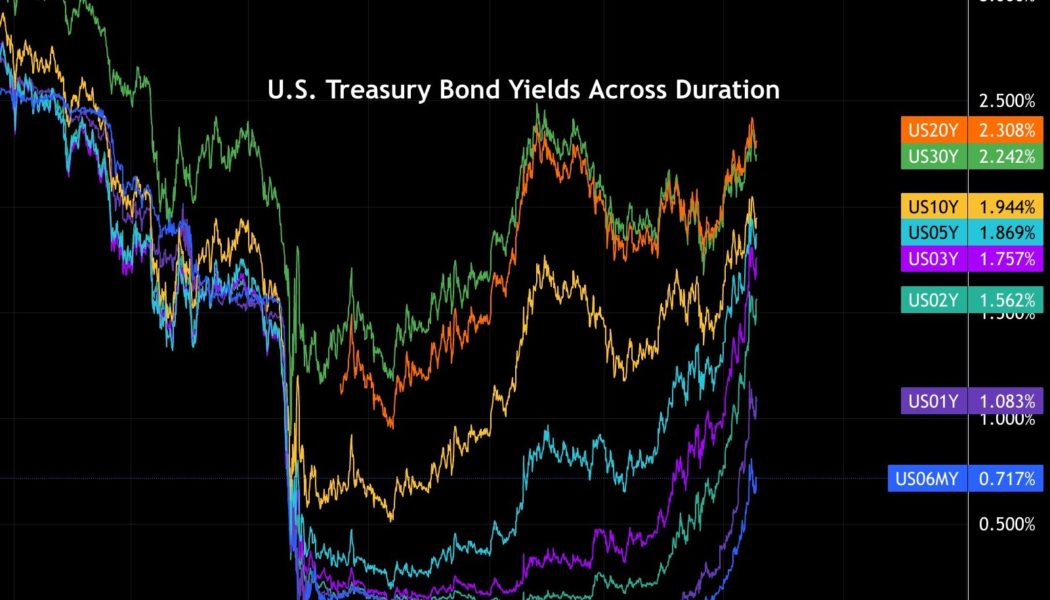

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

- 1

- 2