BTC price

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

Bitcoin hits 3-week high as fresh impulse move sends BTC price to $43.3K

Bitcoin (BTC) saw a fresh impulse move overnight into March 22 as bulls briefly reclaimed $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI hints at underlying strength Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $43,337 on Bitstamp Tuesday, the pair’s highest since March 3. The action contrasted with the lack of volatility since the weekend, and neatly fitted with the more bullish predictions surrounding near-term trajectory. For popular trader Crypto Ed, who had previously given $43,000 as a low-timeframe target, all was going to plan. #BTC Been showing red box at $43k for a couple of days now…. Imagine not watching my YT videos….. No need at all to listen to dudes, who like to hear talking themselves for >2...

Bitcoin eyes highest weekly close since early February as BTC price hovers under $42K

Bitcoin (BTC) stayed the near top of its recent trading range on March 20 as the weekly close looked set to crack a multi-week high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Weekly close could set 4-week high Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maneuvering around the upper $41,000 zone Sunday. Friday’s late surge had broadly held, and Saturday saw a return of $42,400 on Bitstamp, matching the high from the start of March. Now, the weekly chart looked set to deliver Bitcoin’s best weekly close since early February. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView “This could change anytime, but frankly the Bitcoin price chart currently looks better than it has for quite a while now,” analyst Lyn Alden ...

Bitcoin could see $37.5K weekend dip before ‘bigger move’ next week — new report

Bitcoin (BTC) is set for a “bigger move” as soon as next week, fresh analysis says as volatility faces a breakout situation. In its latest market update, trading suite Decentrader told readers that the time would soon come to “pull the trigger” with liquidity as BTC price action goes up or down. Analyst on BTC: “The bigger move is coming” Bitcoin has been making lower highs and higher lows throughout this week as a descending wedge on lower timeframes sees volatility ebb. Such a situation cannot last forever, and for Decentrader’s Filbfilb, it has a matter of days left to run. “We continue to trade intra day, low timeframes, with an eye on legacy markets and general developments in Ukraine to ensure we have a foot in the market and are ready to pull the trigger in either direct...

Bitcoin spikes to $41.7K highs as Ethereum nears $3K reclaim

Bitcoin (BTC) saw brisk upwards action during the Wall Street trading session on March 18, conforming to predictions that higher levels would see a retest. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets placed on $46,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it advanced $1,650 from daily lows to nearly matching the $41,700 high from March 16. The move buoyed traders, who began to reinforce their short-term view of levels near the top of Bitcoin’s 2022 trading range being challenged. For popular trader Pentoshi, however, such a result would not mean that BTC/USD had broken its downtrend definitively. “Macro headwinds still too strong but midterm, I think we rally bc seller exhaustion before any shot at new lows or prev low...

Bitcoin beats owning COIN stock by 20% since Coinbase IPO

Buying a Coinbase stock (COIN) to gain indirect exposure in the Bitcoin (BTC) market has been a bad strategy so far compared to simply holding BTC. Notably, COIN is down by nearly 50% to almost $186, if measured from the opening rate on its IPO on April 14, 2021. In comparison, Bitcoin outperformed the Coinbase stock by logging fewer losses in the same period — a little over 30% as it dropped from nearly $65,000 to around $41,700 BTC/USD (orange) vs. COIN price (blue). Source: TradingView What’s bothering Coinbase? The correlation between Coinbase and Bitcoin has been largely positive to date, however, suggesting that many investors consider them as assets with similar value propositions. That is primarily due to the buzz around how COIN could become a simpler onboarding experi...

Bitcoin maintains $40K support as Fed confirms rate hike in 4 years

Bitcoin (BTC) held $40,000 on March 17 after an anticipated key interest rate hike from the Federal Reserve delivered a strong response. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed singles out Ukraine war in inflation comments Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to local highs of $41,500 after the Fed announced it would raise rates by 25 basis points to 0.5% — the first such move since 2018. The Federal Open Market Committe (FOMC) voted almost unanimously for the raise, with an accompanying statement warning of persisting “upward pressure on inflation” thanks specifically to the war in Ukraine. “The invasion of Ukraine by Russia is causing tremendous human and economic hardship,” it read. “The im...

Bitcoin calls traders‘ bluff with fresh $40K fakeout as Fed decision day arrives

Bitcoin (BTC) tested traders‘ neves yet again on March 16 as a fresh spike over $40,000 ended in minutes. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Shorts feel the burn after abrupt trip to $41,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly surging to highs of $41,700 on Bitstamp before instantly reversing. Two hourly candles were all it took for the entire market to rise by $2,000, break significant resistance levels and come all the way back down again. The move, while recently commonplace, was not without its casualties, as evidenced by liquidations across exchanges. According to data from on-chain monitoring resource Coinglass, Bitcoin accounted for $98 million of these over the 24 hours at the time of writing. Total crypto liquid...

Bitcoin tracks $39K ahead of Europe vote on proof-of-work legality

Bitcoin (BTC) stayed steady at $39,000 into March 14’s Wall Street close as stocks took the opportunity to reclaim some losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bulls need “miracle” $40,600 reclaim Data from Cointelegraph Markets Pro and TradingView showed BTC/USD unmoved at the opening bell on March 14. The pair had rebounded from a last-minute comedown into March 13’s weekly close to avoid a deeper retracement. The week was set to bring many potential challenges for bulls, however, beginning with a European vote on outlawing proof-of-work algorithm cryptocurrencies March 14. March 13, however, was the main focus, this being the day that the United States Federal Reserve was due to announce a key interest rate hike of a rumored...

Bitcoin could crush Russian ruble by rising another 140%, classic technical setup suggests

Bitcoin (BTC) has declined by around 30% after topping out at 5.8 million rubles a token on March 9. Nonetheless, the said drop could be an excuse for traders to dump another big stash of the Russian national currency if a classic bullish continuation pattern plays out. Bitcoin heads towards 11 million rubles Dubbed the “ascending triangle,” the pattern appears when the price consolidates between a rising lower trendline (support) and a flat upper trendline (resistance). It completes after the price breaks out of the consolidation range in the direction of its previous trend, eyeing levels at length equal to the maximum distance between the triangle’s upper and lower trendline. BTC’s price against the ruble has been trending inside a similar structure since January ...

Two years since the Covid crash: 5 things to know in Bitcoin this week

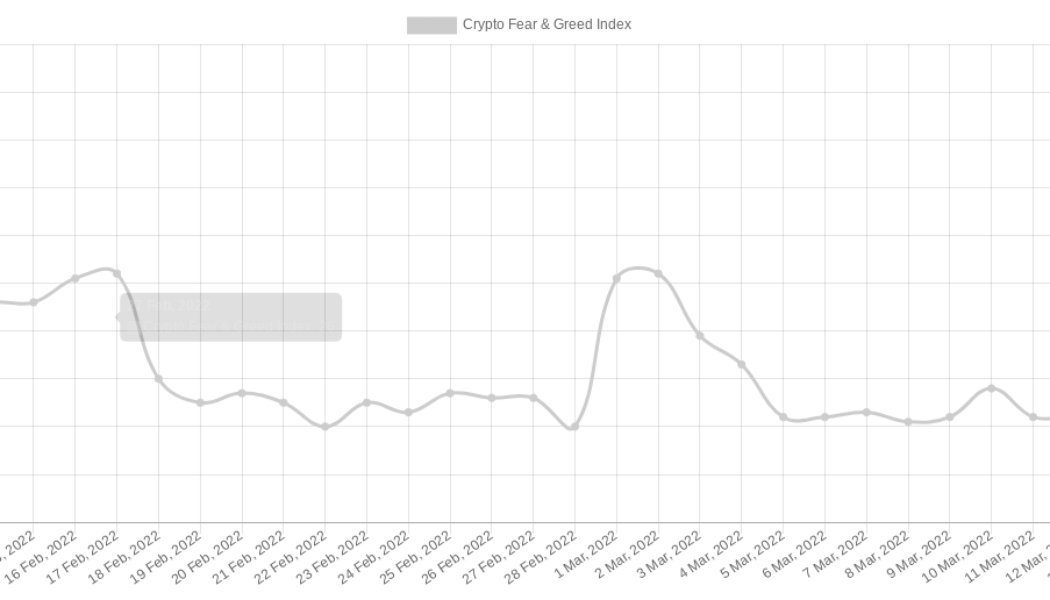

Bitcoin (BTC) starts a new week struggling to preserve support as key macro changes appear on the horizon. In what could turn out to be a crucial week for Bitcoin and altcoins’ relationship with traditional assets, the United States Federal Reserve is set to be the main talking point for hodlers. Amid an atmosphere of still rampant inflation, quantitative easing still ongoing and geopolitical turmoil focused on Europe, there is plenty of uncertainty in the air, no matter what the trade. Add to that a failure by Bitcoin to benefit from the chaos and the result is some serious cold feet — what would it take to instil confidence? Just as it seems nothing could break the now months-old status quo on Bitcoin markets, which have been stuck in a trading range for all of 2022 so far, upcoming even...

Bitcoin drifts into weekly close while Fed rate hike looms as next major BTC price trigger

Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-awaited Fed action set to come this week Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday. The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and outside crypto continued without surprises. Now, attention was already focusing beyond Sunday’s close, specifically on the upcoming decision on interest rates from the United States Federal Reserve. Due March 16, the extent of the presumed rate hike could provide temporary volatility and even...