BTC price

Bitcoin threatens $38K as 3-day chart hints at March 2020 Covid crash repeat

Bitcoin (BTC) further tested $38,000 overnight as the weekend began with uncertainty among traders. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 3-day chart could be “precursor” for weekly Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $39,000 after several attempts to break $38,000 support. The pair had also seen a brief spurt above $40,000 Friday thanks to geopolitical developments, this nonetheless lasting a matter of minutes before the previous status quo returned. Such “fakeouts” to higher levels — which ended with Bitcoin coming full circle and liquidating both short and long positions — was already familiar behavior for market participants this month. Now, however, lower timeframes were beginning to show signs that a more...

Bitcoin spikes above $40K as Russia sees ‘positive shifts’ in Ukraine war dialogue

Bitcoin (BTC) saw instant volatility on March 11 amid hope that the Russia-Ukraine conflict could find a diplomatic solution. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hope rises — but so do Bitfinex shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly surging $1,400 before reversing to consolidate below $40,000 Friday. The move followed fresh comments from Russian President Vladimir Putin, who in a meeting with Belarusian counterpart Aleksandr Lukashenko said that there had been “positive shifts” in the Ukraine dynamic. “There are certain positive shifts, negotiators on our side tell me,” he said, quoted by Reuters and others. Bitcoin, already known for not “liking” escalations in armed conflicts, imme...

Bitcoin stems losses after US bans Russian oil, gold heads to record highs

Bitcoin (BTC) erased then recovered its daily gains later on March 8 as United States President Joe Biden announced a complete ban on Russian oil imports. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC comes full circle, while gold steals the show Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it targeted $38,000 an hour after Tuesday’s Wall Street open. Having hit $39,240, the pair swiftly changed trajectory as Biden confirmed the plans, which added to oil’s already strong gains and further pressured stocks and risk assets. “Today, I’m announcing that the United States is targeting the main artery of Russia’s economy,” he said at a press conference. “We’re banning all imports of Russian oil and gas and energy. That means that Russia...

Bitcoin stuck under $40K, but BTC price hits another all-time high vs. Russian ruble

Bitcoin (BTC) recovered from one-week lows on March 8 after a lack of progress in Russia-Ukraine talks that sent markets tumbling. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Commodities “trading like meme stocks” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at $37,170 on Bitstamp after Monday‘s Wall Street open. Overnight progress maintained support with the pair trading at around $38,500 at the time of writing. Crypto and stocks reacted badly to the lack of consensus that ended the third round of negotiations to end hostilities between Russia and Ukraine. “There are small positive subductions in improving the logistics of humanitarian corridors… Intensive consultations have continued on the basic political block of the regulations, alo...

Bitcoin steadies as gold hits $2K, US dollar strongest since May 2020

Bitcoin (BTC) stayed near one-week lows on March 7 as a flight to safety among investors did crypto markets no favors. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Gold, dollar spell sour times for stocks Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at around $37,600 overnight before tracking around $1,000 higher. The pair had faced pressure into the weekly close, resulting in its lowest levels this month amid reports that Western sanctions against Russia could expand to include an oil embargo. An already panicky atmosphere thus fueled performance by safe haven gold, which returned to $2,000 per ounce for the first time since August 2020 Monday. XAU/USD 1-week candle chart. Source: TradingView Coming in step was the U.S. dollar, which surg...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

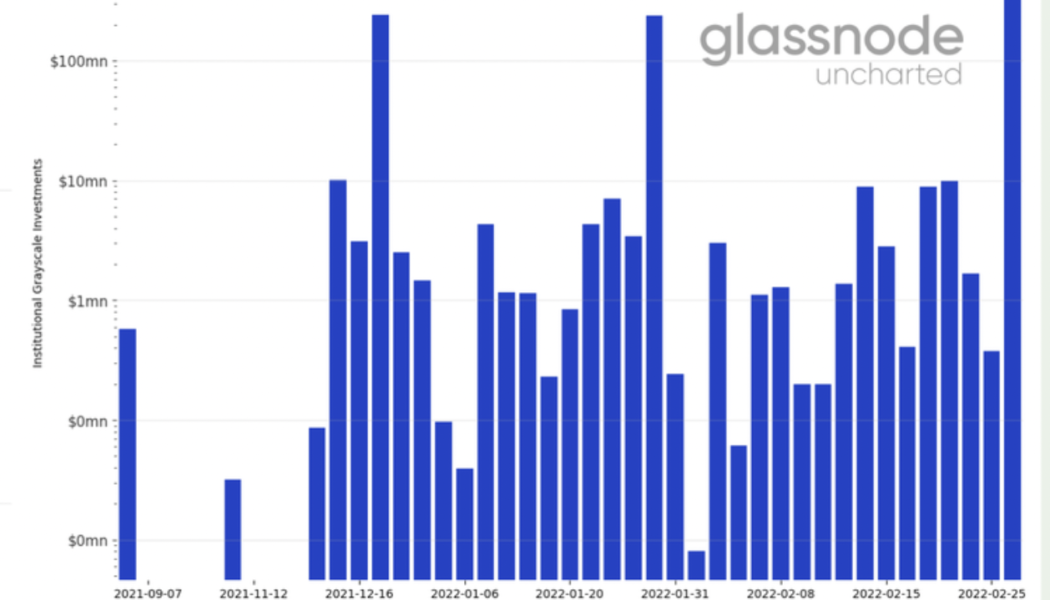

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Bitcoin loses $40K as BTC price support levels give way to 1-week lows

Bitcoin (BTC) stayed below some critical support zones into the weekend after a late sell-off cost bulls the $40,000 mark. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Upper range support levels crumble for BTC Data from Cointelegraph Markets Pro and TradingView painted a lackluster picture for BTC/USD Saturday, the pair lingering near $39,000 after seeing lows of $38,600. Traders had hoped that various price points above $40,000 would be sufficient to steady the market after its latest run to $45,200. In the event, however, bids failed to preserve the trend, sending Bitcoin back to the middle of a range in which it had acted throughout 2022. #Bitcoin is hanging onto the edge of a cliff the past few hours pic.twitter.com/dAD2AveTOi — Matthew Hyland (@MatthewHyland_) Mar...

Bitcoin declines with US stocks as nuclear threat ripples through markets

Bitcoin (BTC) bulls saw no relief at the Wall Street open on March 4 as the $40,000 support appeared on the horizon. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: Markets “shaky,” but BTC could bounce Data from Cointelegraph Markets Pro and TradingView revealed new March lows of $40,551 for BTC/USD on Bitstamp, taking two-day losses to 10.2%. Fears over the security of Ukraine’s nuclear infrastructure drove not just crypto but traditional markets lower on the day, with the S&P 500 following European indexes to decline by 1.4%. “Bitcoin correcting as tensions around Ukraine are increasing, and fear is increasing too as Gold is rushing upwards,” Cointelegraph contributor Michaël van de Poppe explained in his latest Twitter update. “Might be seeing a b...

Bitcoin returns to test $40K as macro factors pile up to squash BTC bulls

Bitcoin (BTC) bended to new macro pressures on March 4 after bulls failed to hold $42,000 for long. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Europe stocks sink on Friday open Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching lows of $40,800 on Bitstamp Friday after a major options expiry event. Overnight performance, initially showing a recovery, had been stymied by worries over a nuclear power plant fire in Ukraine. Stocks futures fell on the news, the severity of which was subsequently questioned. In Germany, the DAX index hit a one-year low on the daily open, with the S&P 500 yet to commence trading. “From recent high, index has lost 17%, way more than S&P 500,” markets commentator Holger Zschaepitz noted. “Investors are turning ...