BTC price

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

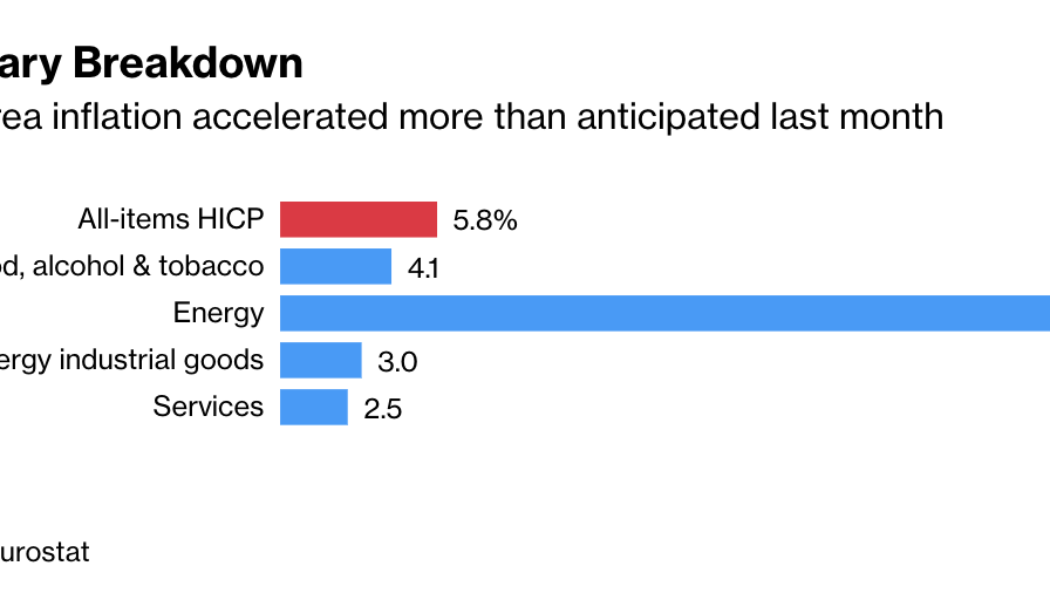

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...

Bitcoin casts off dip, climbs past $45K as Fed signals rate hike coming in March

Bitcoin (BTC) hit daily lows then bounced strongly on March 2 as fresh comments by the United States Federal Reserve added to macro volatility. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Powell: March rate hike expected “appropriate” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $43,350 on Bitstamp before the Wall Street open Wednesday. A recovery ensued as trading began, however, with the pair already back above $45,000 at the time of writing. The volatility followed the release of a new statement from Fed Chair Jerome Powell, who for the first time gave concrete notice of a key rate hike coming this month. “Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so,̶...

Bitcoin analysts eye crucial levels to hold after BTC price almost hits $45K, Ethereum $3K

Bitcoin (BTC) checked its latest gains at the Wall Street open on Mar. 1 as bulls sought to defend $44,000 highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC weekly gains hit 17% Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it declined from its local peak of $44,980 on Bitstamp at the opening bell. The second day of trading with armed conflict in Europe as its background, March 1 continued a surprisingly cool phase for U.S. equities, with only oil showing the knock-on effects of the Ukrainian war. Bitcoin, by contrast, held onto the majority of its advances, which had been rekindled in earnest on March 1. Versus the same time a week ago, BTC/USD was up 17% at the time of writing. Bitcoin since weaponized finance began with Russia. C...

$300M in crypto liquidations accompanies Bitcoin’s surge to $44K

Bitcoin (BTC) hit $44,000 overnight on Mar. 1 as a rally that began Monday sparked unexpected results. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders warns of “massive variables” for BTC price Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $44,250 on Bitstamp before consolidating, still above $43,000 at the time of writing. The move had come in two main bursts, beginning just prior to the Wall Street open. Against a highly uncertain macro backdrop, analysts had been hard-pressed to forecast what Bitcoin price action would do next, a mood that continued as local highs appeared. Yesterdays #BTC trade we took with the group. Didn’t expect it to run that hard tbh. Would have raised TP probably because I think it can...

Bitcoin fails to beat resistance as $40K stays out of reach into weekly close

Bitcoin (BTC) faced down $40,000 on Feb. 27 as hopes for the weekly close hinged on avoiding a fourth red monthly candle in a row. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tensions mount for TradFi markets open Data from Cointelegraph Markets Pro and TradingView showed BTC/USD making several attempts to break out of the $30,000-$40,000 corridor Sunday, all of which ended in rejection. The pair had stayed broadly higher throughout the weekend, cutting traders some slack after a week of volatility at the hands of geopolitics and media headlines. Now, $38,500 was the level to watch for Bitcoin to close out the week and the month — failure to do so would mean a fourth straight monthly red candle. #Bitcoin has less than 36 hours to close above $38.5k in order to break th...

Bitcoin consolidates after $40K surge as analyst eyes weekly higher low for BTC price

Bitcoin (BTC) began a nervous weekend at around $39,000 on Feb. 26 after an overnight spike briefly saw $40,000 return. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks gains but crypto “fear” pervades Data from Cointelegraph Markets Pro and TradingView revealed calmer conditions for BTC/USD Saturday after overnight volatility saw highs of $40,330 on Bitstamp. With traditional markets closed, the probability of “fakeout” moves up or down was elevated thanks to thinner weekend volumes on crypto markets. The geopolitical turmoil focused on Ukraine and occupier Russia formed the backdrop for continued cautious sentiment, amid concerns that Monday, in particular, could bring fresh instability. The Crypto Fear & Greed Index, while inching up to...

Bitcoin whales fuel BTC price comeback as stocks brush off Russia-Ukraine shocks

Bitcoin (BTC) kept $40,000 in play at the Wall Street open on Feb. 25 after 16% daily gains increased bulls’ confidence. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Whales “leading the charge” towards $40,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling the $39,000 mark at the start of trading Feb. 25, geopolitical turmoil failing to induce a fresh major sell-off. Stocks also benefited as the week came to a close, with Germany’s DAX up 3% on the day and the FTSE 100 up 4% in London. Signals from the Russia-Ukraine conflict provided an additional boost, with the prospect of talks being raised by Ukrainian president Volodymyr Zelensky to end hostilities. With $34,300 this week’s floor, optimism was slowly incre...

Bitcoin rises above $36K as 24-hour crypto liquidations pass $500M

Bitcoin (BTC) edged higher after Wall Street opened on Feb. 24 with Russia’s Ukraine invasion and its aftermath still top on markets’ agenda. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Risk sentiment set to be “dominant driver” in crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD nearing $36,400 on Bitstamp two hours after the opening bell, up to $2,000 from its recent lows. Skittish markets faced the music from Russia’s overnight incursion into Ukraine, a move that continued and ricocheted across global trading. Russia’s stock market unsurprisingly faced a different level of trauma, with MOEX losing 50% and at one point halting trading altogether. Bitcoin, suffering earlier in the day, nonetheless staged a ...

Last Bitcoin support levels above $20K come into play as BTC price faces ‘time of uncertainty’

Bitcoin (BTC) may yet reenter the $20,000 zone, but the coming weeks could provide a solid buying opportunity, a new report forecasts. In its latest market update on Feb. 24, trading platform Decentrader laid out the final areas of support between the current Bitcoin spot price and $20,000. Analyst eyes BTC’s 20-week and 200-week MA for cues Military action by Russia in Ukraine has markets in a spin Thursday, with stocks and crypto following a firm downtrend as uncertainty grips Asia, Europe and the United States alike. Bitcoin has already lost 12% in under 24 hours, and expectations are that the worst is not yet over —reactions to the Russian offensive continue to flow in, along with potential financial sanctions. As such, Decentrader, like many other analysts, is notably cautious o...

Bitcoin Mayer Multiple returns to July 2021 levels in fresh sign $37K BTC is a long-term buy

Bitcoin (BTC) has dipped enough for one of its best-known indicators to signal a rare long-term investment opportunity is here. As of Feb. 22, the Mayer Multiple is sitting at its lowest level since Bitcoin bounced at $29,000 in July last year. Mayer Multiple down 50% in 3 months The latest in a series of metrics to echo the pit of the 2021 retracement on BTC/USD, the Mayer Multiple currently measures 0.76, having halved since November’s $69,000 all-time high. The Multiple measures Bitcoin’s current price against its 200-day moving average. Its creator, Trace Mayer, believes that any reading below 2.4 offers an increasingly profitable trade for potential investors, and the lower the score, the more likely a long-term buy-in will turn out to be effective. For context, the Multip...

‘Coin days destroyed’ spike hinting at BTC price bottom? 5 things to watch in Bitcoin this week

Bitcoin (BTC) heads into the last week of February lower but showing signs of strength as a key support level holds. After a nervous few days on macro and crypto markets alike, BTC/USD is below $40,000, but signs are already there that a comeback could be what starts the week off in the right direction. The situation is far from easy — concerns over inflation, United States monetary policy and geopolitical tensions are all in play, and with them, the potential for stocks to continue suffering. Further cues from the Federal Reserve will be hot property in the short term, with March expected to be when the first key interest rate hike is announced and delivered. Could it all be a storm in a teacup for Bitcoin, which on a technical basis is stronger than ever? Cointelegraph presents five fact...

Bitcoin extends decline below $42K ahead of fresh Fed comments on inflation

Bitcoin (BTC) fell further with stocks on the Wall Street open Thursday as nervous markets awaited further U.S. economic policy cues and battled geopolitical tensions. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Macro conditions stay grim for stocks, crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD losing the $42,000 mark for the first time in several days at the start of trading. The Fed and tensions over Ukraine had already formed a backdrop to lackluster market performance both in crypto and beyond, with that trend staying firmly in force on the day. With the likelihood increasing that a rate hike could come from the U.S. next month, attention was on James Bullard, president of the St. Louis Fed, ahead of a statement due less than an hour fr...