BTC price

Bitcoin price circles $44K as analyst asks, ‘Who remains to sell here?’

Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView OBV sparks 2021 recovery comparisons Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp. In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot. While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside. “When I consider everything BTC HODLers withstood in 2021- When I observe ...

Bitcoin hits $44K after Canada emergency powers accompany 6% BTC price increase

Bitcoin (BTC) opted for fresh upside on Feb. 15 as a trip to near $40,000 saw an abrupt change of direction. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI prints classic bull signal Data from Cointelegraph Markets Pro and TradingView showed BTC/USD gaining swiftly overnight into Tuesday, going on to pass $44,000. A classic relative strength index (RSI) breakout, this time on the lower four-hour timeframe, preceded the move, which put the pair a full 6% higher versus Monday’s lows. #Bitcoin 4 Hour RSI broke out and MACD just had a Bullish Cross: pic.twitter.com/2bRVFeQsfX — Matthew Hyland (@MatthewHyland_) February 14, 2022 “I do think these are the first signs of a trend break,” popular Twitter account Phoenix commented in a fresh post on the day. It ...

Bitcoin inches towards higher weekly close with CME futures gap in focus

Bitcoin (BTC) was on the cusp of making a new higher weekly close on Feb. 13 as bulls kept the market above $42,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin: Potential CME gap to come Data from Cointelegraph Markets Pro and TradingView tracked fairly stress-free conditions for BTC/USD over the weekend, with the weekly candle set to conclude in under 12 hours. The pair had briefly dipped below the $42,000 mark before recovering, this setting it up to challenge last week’s close of $42,400 on Bitstamp. Should it succeed, the close would be a three-week high, Bitcoin nonetheless keeping traders guessing as a matter of a few hundred dollars separated the upcoming close from the last. If #BTC loses this 4HR Range Low as support in the short-term, tha...

Bitcoin dips below $42K as crypto sentiment returns to ‘fear’

Bitcoin (BTC) trended toward a $40,000 retest on Feb. 12 as BTC price action bore out analysts’ predictions. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader hopes to avoid ‘ugly’ weekly close Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching local lows of $41,741 on Bitstamp Saturday before a rebound over $42,000. An about-turn had ended the pair’s advance after U.S. CPI data hit, and calls soon emerged for a return to $40,000 or even lower to see how steely bulls’ resolve really was. For Cointelegraph contributor Michaël van de Poppe, the results were still inconclusive, but caution was definitely needed going forward on short-timeframe trades. “Bitcoin looking at the same resistance still,” he sum...

Bitcoin metrics demand BTC price gains as analysis calls for ‘near-term caution’

Bitcoin (BTC) has a “possibility” of winning back more lost ground this month, but a retest of $40,000 may test bulls beforehand. In its latest market update on Feb. 11, trading suite Decentrader voiced cautious optimism over BTC price action. Derivatives turn complementary After rallying above $45,500 on the back of United States economic data, BTC/USD has since dropped back into the range that has defined it this week. For Decentrader, the chances of a low-timeframe decline are there, even if on-chain metrics are putting in rare bull signals. “Bitcoin is at a relatively neutral level with clear zones of resistance and support above and below,” the update summarized. Acting in bulls’ favor is sentiment, now in “neutral” rather than “fear” territory, and encouraging signs from de...

Bitcoin centers on $44K as BTC price MACD delivers long-awaited bull signal

Bitcoin (BTC) hovered around $44,000 on Feb. 9 as a modest uptick towards the Wall Street open provided relief for support levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Melt-up or breakdown? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting in the range defined in recent days without significant downside pressure. Circling $44,000, traders were mostly preoccupied with a potential retracement, this having the potential to wipe out practically all recent progress. “Now that we are at monthly resistance we may see a pullback. Even if we do, a higher low to 38K–40K would be “healthy” followed by continuation to 50K+ and a reclamation of our monthly resistance after which point, I’ll have my sights set on a new ATH...

Bitcoin begins correction after $45K rejection — Where can BTC price bounce next?

Bitcoin (BTC) gave back $2,500 of its newly-won gains during Feb. 8 as a long-awaited correction took center stage. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopes $42,000 will be preserved Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it neared $43,000 after previously hitting new multi-week highs of $45,500. At the Wall Street open, ranging continued as bulls eyed levels for potential support in the event of further losses. Previously, these had included both $40,000 and $41,000, along with several zones in the upper $30,000–$40,000 corridor. For popular Twitter trader Muro, however, $42,000 needed to gain significance as an intermediate floor to flip sentiment bullish. “Either we get not significant pullback and go to 51 next,...

Bitcoin rebound hits $45.5K as focus switches to future support retests

Bitcoin (BTC) hit new multi-week highs above $45,000 on Feb. 8 as the largest cryptocurrency’s comeback continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $40,000 becomes popular retest target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $45,500 on Bitstamp in its latest surge before consolidating. Volatility was once again in evidence as the pair fluctuated by $1,000 on intra-hour timeframes, circling $44,800 at the time of writing. Fears of a major correction were nonetheless left unfounded on the day, despite theories that $40,000 could see a retest next. lol okay a couple hundred dollars lower than previous tweet but I’m back to thinking we run it back to retest 40K idk honestly listening to this space has my brain all...

BTC price returns to $43K — 5 things to watch in Bitcoin this week

Bitcoin (BTC) is in a fighting mood this week as the weekly close buoys bulls’ cause and wipes out several weeks of downside — can it continue higher? After challenging $42,000 over the weekend, there was a cautious sense of optimism as higher levels remained in play. Sunday saw a fresh push, with overnight progress attacking $43,000 before fresh consolidation. With Monday’s Wall Street open primed to deliver more of the turbulence in big tech stocks seen late last week, the environment for crypto traders is an interesting one in February. With its notable positive correlation, Bitcoin is thus sensitive to moves up and down — but equities refuse to move unanimously in the same direction. Looking for guidance, hodlers will still remember January’s lows, and these are also fresh in the mind ...

Bitcoin stays higher after stocks propel BTC price toward $42K

Bitcoin (BTC) held above $41,000 into the weekend after a late surge Friday took the largest cryptocurrency to two-week highs. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView “The only good bear is a dead bear” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maintaining newly re-won ground Saturday, with the pair’s correlation to stock makets firmly in focus. Analysts had highlighted the $39,600 area as a key line to cross and flip to new support in order to secure further upside. In the event, this was no issue for bulls, as Bitcoin “gapped up” in seconds as it neared $40,000 to continue higher. Amid the newfound strength, the mood was conspicuously more buoyant than in recent days or even weeks. Popular analyst Credible Cry...

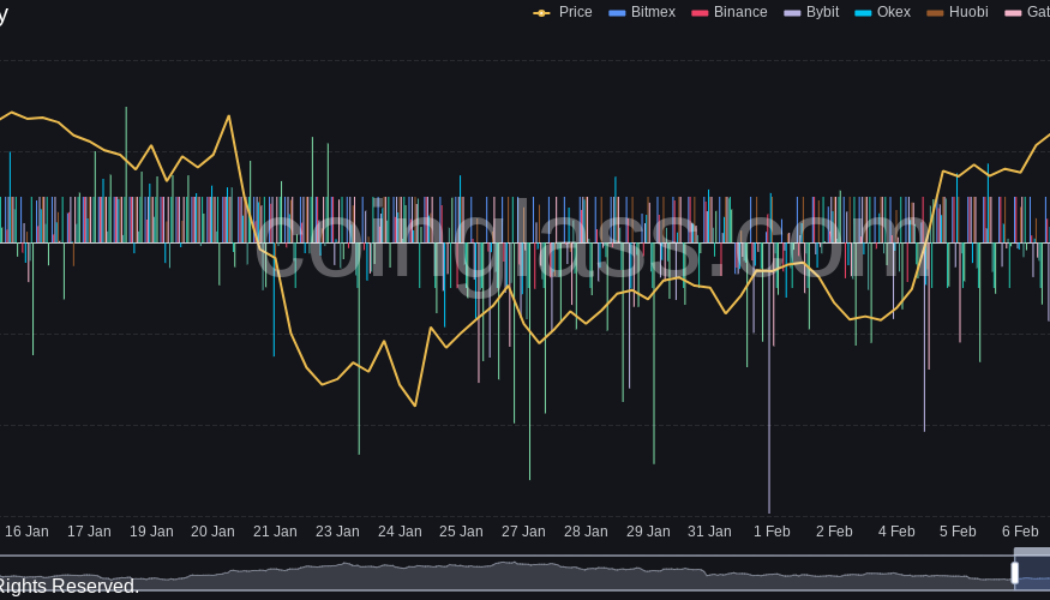

Bitcoin returns to $40K, liquidating over $50M of shorts in hours

Bitcoin (BTC) returned to $40,000 for the first time in two weeks during Feb. 4 as Wall Street volatility proved a boon for BTC bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Liquidations mount for BTC shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly jumping past the $40,000 on Feb. 4, just two hours after the Wall Street open produced rapid gains. At the time of writing, the pair was up $3,000 in two hours — an unexpectedly strong performance, which naturally caused short sellers significant pain. According to on-chain monitoring resource Coinglass, BTC liquidations were $50 million over the most recent four-hour period, with cross-crypto liquidations passing $100 million. BTC liquidations chart. Source: Coinglass Analysts, who we...