BTC price

BTC price falls to $34K as Bitcoin RSI reaches most ‘oversold’ since March 2020 crash

Bitcoin (BTC) refused to stem recent losses during Jan. 22 as predictions of a flight to $33,000 and lower looked increasingly likely to become a reality. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView. Open interest “still not flushed” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell through $35,000 during the first half of Saturday. With few silver linings available for the bulls, lower weekend volume was poised to deliver some classic erratic moves after Bitcoin lost $40,000 support on Friday. While some, including El Salvador, made the most of the new lower levels, others voiced concern that despite the drop, pressure still remained on bulls. “Crazy part is open interest still hasn’t flushed,” trad...

Crypto liquidations pass $700M as altcoins take a hit from Bitcoin sinking below $40K

Bitcoin (BTC) stayed lower on Friday after an overnight bout of volatility sent the largest cryptocurrency to six-month lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $40,000 optimism unwinds Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing at $38,250 after shedding over $4,000 in hours. Circling $39,000 at the time of writing, traders were reeling from the sudden downside, which came just as BTC had hit multi-day highs, passing $43,000. Liquidations across trading platforms were thus predictably significant. For Bitcoin and altcoins combined, 24-hour position unraveling totaled $725 million, with BTC positions accounting for $292 million. The vast majority of the casualties were long positions, a sign that the area around $40,000 had att...

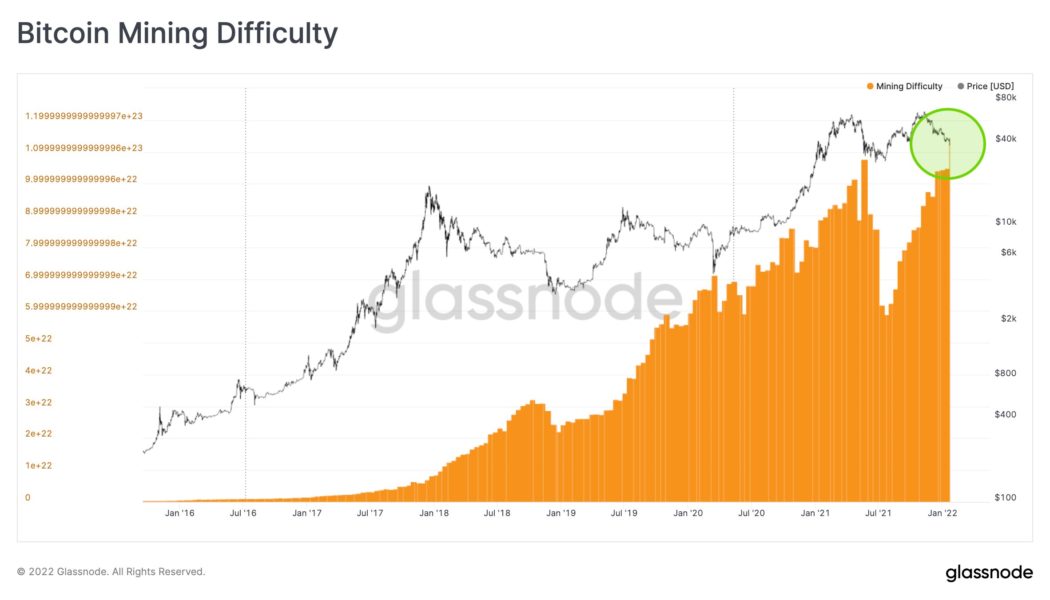

Bitcoin fundamentals diverge from BTC price dip as difficulty hits new all-time high

Bitcoin (BTC) may have tanked to six-month lows this week, but under the hood, the network is now verifiably stronger than ever. Data from on-chain monitoring resources including Glassnode and BTC.com confirms that as of Friday, the Bitcoin network difficulty is at a new all-time high. Difficulty passes 26 trillion for the first time The difficulty, which expresses how much miners need to work to solve the equations to process transactions on the blockchain, is arguably the most important of fundamental Bitcoin network components. The metric automatically adjusts to increase or decrease mining effort according to miner participation — the more competition among miners, the higher the difficulty. This has the effect of keeping mining stable regardless of factors such as sentiment, pric...

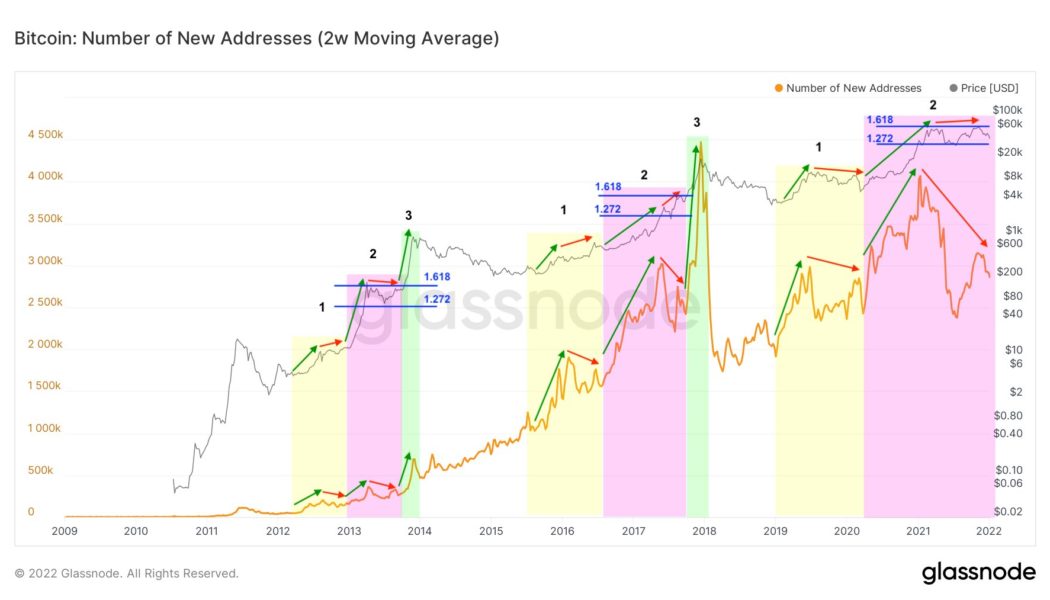

What bear market? Current BTC price dip still matches previous Bitcoin cycles, says analyst

Bitcoin (BTC) has “at least one more upward impulse to come” before reaching this halving cycle’s all-time high, new research maintains. In a series of tweets about the current state of BTC price action, popular analyst TechDev argued that contrary to many opinions, there is nothing unusual about BTC/USD in 2022. Bitcoin in 2021: Nothing to see here With a drawdown of 40% from November’s all-time highs of $69,000 still ongoing, sentiment has likewise taken a hit — “extreme fear” still characterizes both Bitcoin and altcoin markets. For TechDev, known for his optimistic takes on the Bitcoin outlook, there is nonetheless nothing to worry about. Analyzing new wallet addresses relative to price behavior, he showed that last year’s scenario — new address numbers making lower highs while price m...

BTC ‘likely’ to repeat Q4 2020 move — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week facing multiple hurdles but with strong internal support — can old resistance below $50,000 finally fall? A correction event now almost in its third month is frustrating many, but conditions may soon be right for a fresh charge against opportunistic bears, an increasing number of analysts are saying. With inflation running hot and United States lawmakers set to make the Bitcoin mining debate public this week, there are plenty of potential pitfalls in store. Nonetheless, it’s beginning to feel like Bitcoin is at the point where it is capable of producing a classic surprise when the majority of the mainstream economy least expects it. Cointelegraph takes a look at five factors worth paying attention to when charting BTC price action over the coming week. Bitco...

Bitcoin dips below $42K as new forecast says breakout ‘most probable outcome’ for BTC price

Bitcoin (BTC) returned closer to $40,000 on Thursday as $44,000 resistance proved too much for bulls to overcome. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Buying another dip Data from Cointelegraph Markets Pro and TradingView showed BTC/USD shedding around 4% in 24 hours on Jan. 14. The pair had topped $44,450 on Bitstamp before the retracement kicked in, this seeing local lows of $41,780. While disappointing for those hoping that the worst of the pullback was over, analysts appeared unsurprised by the move, which they said could resolve via a fresh test of $40,000 support. Pretty much the path for #Bitcoin. pic.twitter.com/VY0BkTXYOM — Michaël van de Poppe (@CryptoMichNL) January 14, 2022 Popular trader Pentoshi also appeared to get his wish—BTC “sweepingR...

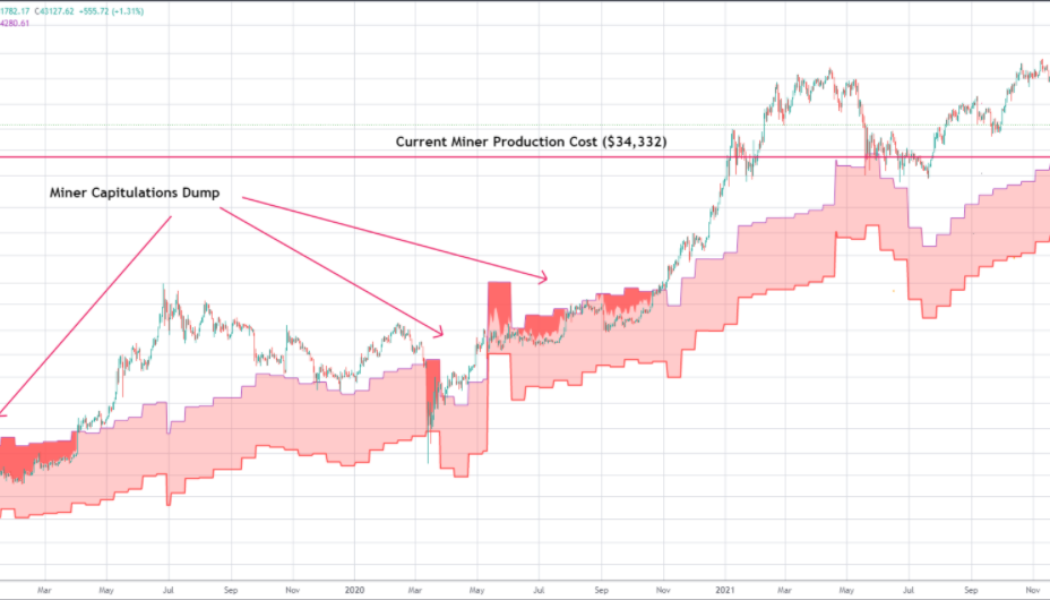

Bitcoin miners can take fresh 20% BTC price hit before capitulating, data shows

The Bitcoin (BTC) mining business is bigger than ever at current price levels, and new data shows just how unlikely a mass miner sell-off really is. As noted by popular Twitter account @venturefounder on Jan. 14, even at $42,000, the BTC/USD trading pair is around 20% above miners’ cost price. Miner capitulation behind “worst” BTC price dips Despite falling a full $27,000 below all-time highs, BTC is more enticing than ever for miners. Hash rate, an estimate of the total processing power dedicated to mining, reached new all-time highs this week. Those concerned that a fresh BTC price dip could pressure miners into selling, meanwhile, received fresh assurances via data covering how much BTC/USD should trade at for them to break even. Referencing the BTC productio...

Bitcoin sells off after $44K resistance tap, eliciting scrutiny from options traders

Bitcoin (BTC) fell more than 2% from local highs during Jan. 13 in the latest move to keep market participants guessing about what’s to come for the largest digital asset. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “One step at a time” Data from Cointelegraph Markets Pro and TradingView tracked the pullback for BTC/USD after the pair hit its highest levels in more than a week. A trip to $44,450 on Bitstamp after the Wall Street open was followed by an hourly candle that at one point sparked losses of $1,500. A fresh sign that rangebound activity remains the order of the day for Bitcoin, bulls were disappointed after multiple calls for a fairly easy squeeze toward $46,000. For popular trader and analyst Scott Melker, “There was still no clear sign of direction.” ...

Top or bottom? Traders at odds over whether Bitcoin will keep rising

Bitcoin (BTC) touched $44,000 a second time on Jan. 12 amid increasing divergence of opinion about whether the price bottom is “in.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed the $44,000 mark acting as local resistance Thursday, following forecasts that $46,000 could soon return. Bitcoin stayed broadly higher overnight following the previous day’s United States inflation data, but for some, now was not the time to become overly confident. “BTC starting to feel a little toppy (local), although asks are diffused through some key resistance levels,” Twitter account Material Indicators commented as part of a recent update. “Some bitcoin bulls may show up to clear a few levels, but the whole herd i...

Bitcoin funding rates stay negative as BTC price spikes to $43.5K

Bitcoin (BTC) surged almost $1,000 in minutes on Jan. 12 as encouraging signs emerged from exchanges. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $43,468 Wednesday, its highest since Jan. 6. The pair had been due to continue volatile moves, traders said, with more and more favoring a push higher rather than a renewed downside. This would likely come in the form of a “short squeeze” against latecomer shorters, they argued, and Wednesday’s sudden wick higher appeared to support the theory. Funding rates across derivatives platforms stayed either neutral or negative during the volatility, further hinting that the market had been overly betting on fresh losses. Bitcoin funding rates chart. Source: C...

Bitcoin drops below $40K for first time in 3 months as fear set to ‘accelerate’

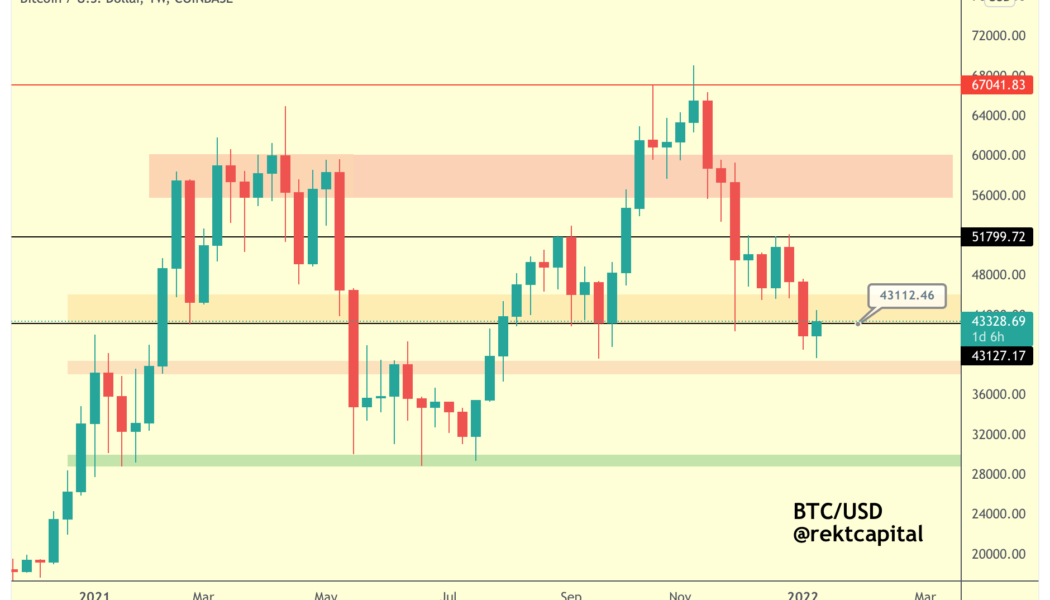

Bitcoin (BTC) fell below the landmark $40,000 mark for the first time since September 2021 on Jan. 10, heightening a rout that began six weeks ago. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bollinger bands step in Data from Cointelegraph Markets Pro and TradingView showed BTC/USD encountering predictable volatility as bears finally steered the market back into the $30,000 zone. The move had been long preempted, with forecasts even calling for an identical floor to that of July — just below $30,000. “And we’re dipping into the $40K region for Bitcoin, through which the fear will only accelerate even more,” Cointelegraph contributor Michaël van de Poppe reacted. For trader and analyst Rekt Capital, the first point of support lay in the lower of the tw...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...