BTC price

Bitcoin performs classic bounce at $40.7K as BTC price comes full circle from January 2021

Bitcoin (BTC) bounced off what is for some a key level on Jan. 9, closely mimicking events from September 2021. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Shorters will get rekt” at $40,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing course at around $40,700 to subsequently pass $42,000. The behavior, while uninspiring for some, firmly reminded others of Bitcoin price behavior at the end of September, when $40,700 acted as a springboard which ultimately produced $69,000 all-time highs seven weeks later. History and Context 40.7k $BTC https://t.co/LqlkxxJ0BF pic.twitter.com/neJlH6mnmN — Pentoshi DM’S ARE SCAMS (@Pentosh1) January 8, 2022 “Months have passed since September. And yet, BTC finds itself in the...

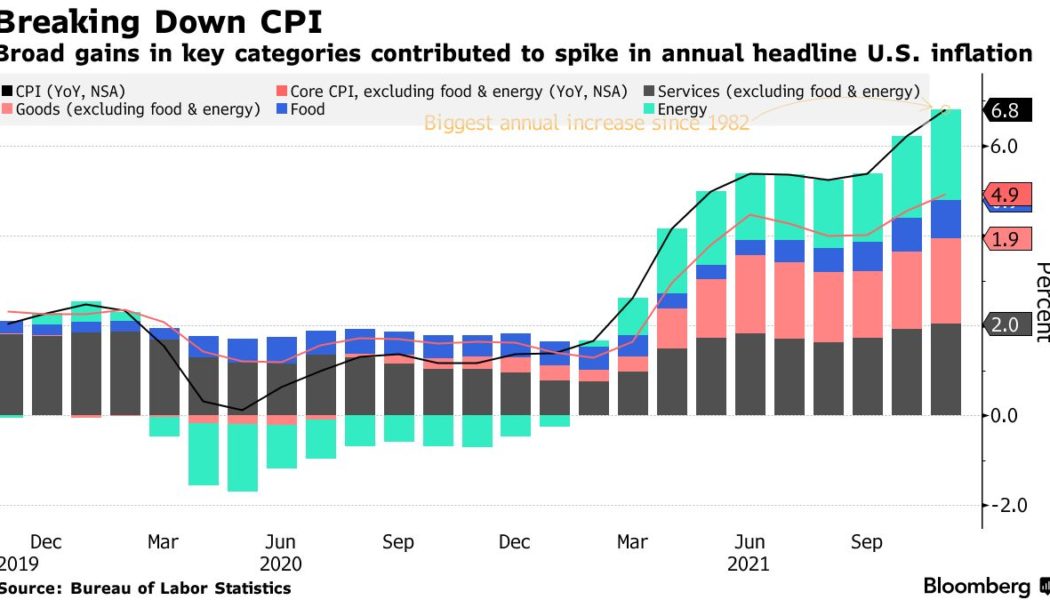

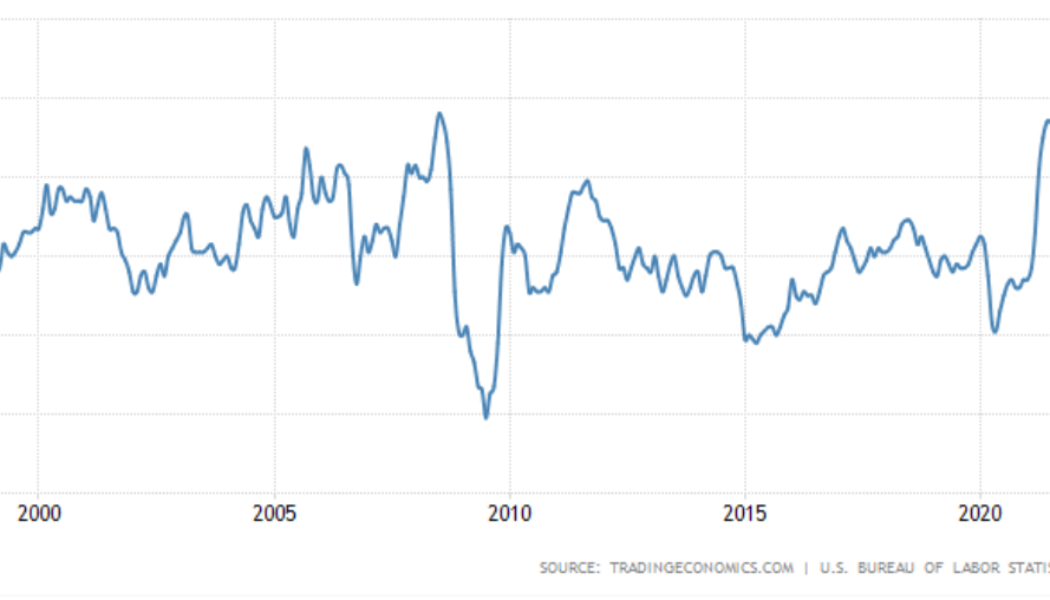

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

Bitcoin clings to $42K as key moving average break from July reappears

Bitcoin (BTC) consolidated above $42,000 prior to Wall Street’s opening bell on Jan. 7 as more similarities to last year’s lows emerged. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC “very closely” mimicking May behavior Data from Cointelegraph Markets Pro and TradingView tracked a nervous Bitcoin market as BTC/USD avoided another retest of $40,000 support. Earlier, after briefly falling below $41,000, analysts had warned that a further capitulation event may occur, this having the potential to bring the pair down to $30,000 or even lower. That figure rings true for market participants, having formed the bottom of a protracted capitulation which lasted from May to July last year. Then, as now, miner upheaval combined with macroeconomic factors...

Bitcoin price bounces off $42K as order book imbalance turns ‘crazy’

Bitcoin (BTC) briefly touched $43,000 prior to Wall Street opening on Jan. 6 as new market analysis offered bad news for bears. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Very similar to $30,000” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged after hitting its lowest levels in nearly six weeks. Amid six-month lows for sentiment and a feeling of foreboding on social media, analysis investigating trader behavior nonetheless concluded that all is not as bad as it seems. In a series of posts on the day, popular Twitter account Byzantine General argued that for all the downside, sellers are practically exhausted. “This is starting to feel very similar to the 30k range now,” he summarized. “The imb...

Bitcoin monthly RSI lowest since September 2020 in fresh ‘oversold’ signal

A key Bitcoin (BTC) metric has just reached its lowest levels since the months after the March 2020 market crash. As noted by popular analysts on Jan. 5, Bitcoin’s relative strength index (RSI) is printing a “hidden bullish divergence” on monthly timeframes — and if it plays out, they say, the result will be very pleasing for hodlers. RSI falls below summer 2021 floor Amid frustration at the lack of direction on BTC/USD, it is no secret that a host of on-chain indicators has long demanded higher price levels. The current $46,000 may slide further, but the classic RSI metric now shows just how comparatively “oversold” Bitcoin is at that price. “Bitcoin monthly RSI is currently lower than the May–July 2021 correction,” popular analyst Matthew Hyland ...

New year, same ‘extreme fear’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) begins its first full week of 2022 in familiar territory below $50,000. After ending December at $47,200 — far below the majority of bullish expectations — the largest cryptocurrency has a lot to live up to as signs of a halving cycle peak remain nowhere to be found. With Wall Street set to return after stocks conversely ended the year on a high, inflation rampant and interest rate hikes looming, 2022 could soon turn out to be an interesting market environment, analysts say. So far, however, all is calm — BTC/USD has produced no major surprises for weeks on end. Cointelegraph takes a look at what could change — or continue — the status quo in the coming days. Stocks could see 6 months of “up only” Look no further than the S&P 500 for an example of the state of...

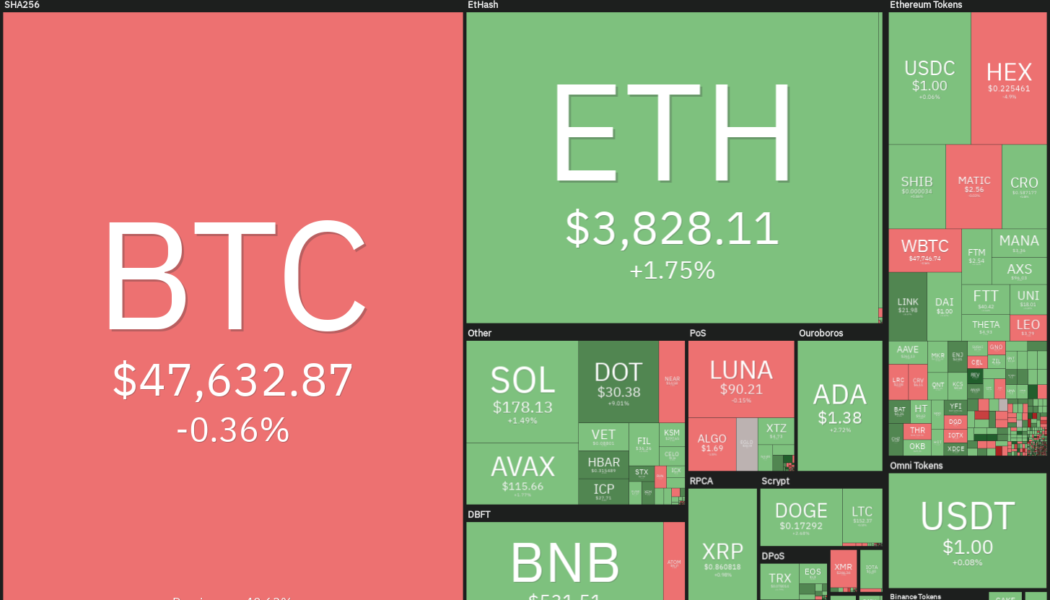

Top 5 cryptocurrencies to watch this week: BTC, LUNA, FTM, ATOM, ONE

Bitcoin (BTC) continues to languish below the psychological level at $50,000 in the first few days of the New Year, indicating a lack of aggressive buying by traders. Former BTCC CEO Bobby Lee said the exodus of the Chinese traders who had until Dec. 31 to exit Chinese exchanges may have kept prices lower into the year-end. However, President Nayib Bukele of El Salvador, the first country to adopt Bitcoin as legal tender, believes that Bitcoin could rally to $100,000 this year. President Bukele also said that two more countries will accept Bitcoin as legal tender in 2022. Crypto market data daily view. Source: Coin360 The increased crypto adoption by institutional investors in 2021 is another long-term positive. According to CoinShares, net inflows into crypto funds in 2021 were more than ...

Bitcoin starts 2022 at $47.2K as fresh research pins performance on China trader exodus

Bitcoin (BTC) bears lost out at the last minute as 2021 came to an end — and consensus is building around China again being the reason for weakness. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView China “last hammer” could now provide optimism on BTC Hours before the yearly close, BTC/USD dived $2,000 to lows of $45,630 on Bitstamp before a modest recovery drew a line under 2021 at $47,200, data from Cointelegraph Markets Pro and TradingView shows. While something of an anticlimax and far below many popular projections, the lack of parabolic upside for Bitcoin has recently seen explanations shift to exchanges. Chinese users, following years of the government tightening the screws around crypto trading, had until Dec. 31 to leave the major Chinese exchanges, whi...

Bitcoin holds $48K as final Wall Street session caps 60% YTD gains for BTC

Bitcoin (BTC) chipped away at its latest gains on Dec. 31 as the final trading session of 2021 opened on Wall St. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin posts 60% year-to-date gains Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it meandered around the $48,000 mark, having reached multi-day highs of $48,550 hours earlier. The uptick had coincided with the December expiry on Bitcoin options, by far the biggest date on the options calendar at nearly $6 billion. Conspicuous buying was recorded on U.S. professional exchange Coinbase Pro in the run-up to the event. With stocks heading higher in Asia, all eyes were on the potential for a final flourish against a background of concern over inflation in 2022. The S&P 500 broke its ...

Bitcoin gains $1.5K in under an hour as BTC price erases days of downtrend

Bitcoin (BTC) put in an early end-of-year flourish on Dec. 31 as an upward boost saw BTC/USD retake $48,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Options expiry fades Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly gaining over $1,500 in a single hour on Friday. A refreshing counterpoint to several days of downtrend, the move gave a taste of what could happen in a crypto market where liquidity is thinner than normal over the holiday period. Futures + option expiry — IamNomad (@IamNomad) December 31, 2021 December’s Bitcoin options expiry event, worth almost $6 billion, could have provided the snap relief, traders argued, this traditionally pressuring BTC price action beforehand. A survey by the Bitcoin Twitter account earlier in Decem...

Bitcoin gains after $46K drop as ‘bottoming out’ continues into 2022

Bitcoin (BTC) recovered from fresh lows on Dec. 30 as markets remained undecided on their end-of-year trajectory. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $46,000 may not mark floor Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing to $47,731 on Bitstamp, reversing almost all of the previous day’s losses. Prior to the Wall St. open, the pair was still above the $47,000 mark, as traders nonetheless warned that choppy BTC price action was not yet over. “Pretty boring markets lately. Just a process of bottoming out for Bitcoin,” Cointelegraph contributor Michaël van de Poppe summarized. “We’re retesting $46K as support, bounced, but we might need to take the liquidity beneath the lows before we’re going to make s...