Capitulation

Capitulation ongoing but markets not at the bottom yet: Glassnode

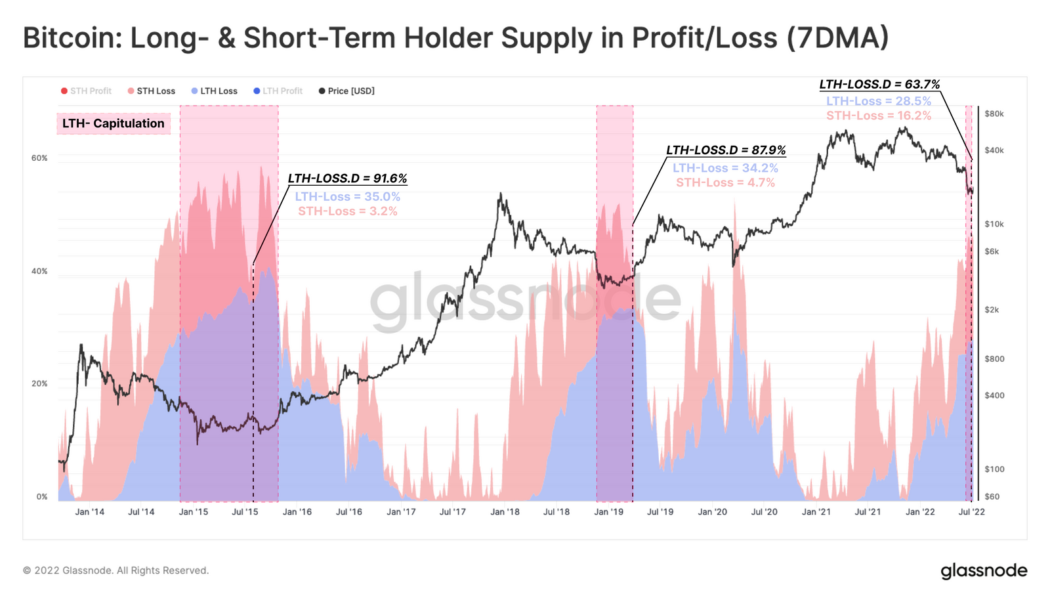

Bitcoin wealth is being distributed from weak hands to strong hands due to ongoing capitulation from retail investors and miners, signaling that the bottom may be close. The latest ‘The Week On-Chain’ report from blockchain analysis firm Glassnode on July 11 explains that market capitulations have been ongoing for about a month and that several other signals suggest bottom formations in Bitcoin prices. However, Glassnode analysts wrote that the bear market “still requires an element of duration” as Long-Term Holders (LTH), who tend to have greater confidence in Bitcoin as a technology, increasingly bear the greatest unrealized losses. “For a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and...