CBDC

Buying Bitcoin ‘will quickly vanish’ when CBDCs launch — Arthur Hayes

Bitcoin (BTC) holders looking to avoid Central Bank Digital Currencies (CBDCs) may have gained a surprise ally — banks. In his latest blog post, “Pure Evil,” Arthur Hayes, ex-CEO of crypto derivatives platform BitMEX, argued that banks may limit the impact of the CBDC “horror story.” Hayes: Bitcoiners and banks stand against CBDC “dystopia” CBDCs are currently in various stages of development worldwide. Fans of financial sovereignty naturally fear and even despise them, as they imply total government control over everyone’s money and purchasing power — “a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves,” says Hayes. Among opponents of CBDCs are not only Bitcoiners, however. Sharing the cause will likely be the commercial banks ...

FX spot settlement in 10 seconds: NY Fed releases results of wholesale CBDC research

The Federal Reserve Bank of New York Innovation Center has released a report on the first phase of its Project Cedar wholesale central bank digital currency (wCBDC) Nov. 4. The Fed still has no plans to issue a CBDC, NY Fed executive vice president and head of markets Michelle Neal said at a presentation in Singapore, but it has investigated foreign exchange spot settlement “from the perspective of the Federal Reserve.” Its prototype wCBDC, intended for use by financial institutions rather than the public, was able to implement transactions dramatically faster and more securely than the current standard. A foreign exchange spot transaction was chosen as the use case for the 12-week first phase of Project Cedar because of its relative simplicity and that type of transaction is often used as...

CBDCs are a declaration of war against the banking system claims economist

CBDCs are a declaration of war against the banking system, Richard Werner — development economist and professor at De Montfort University — told Cointelegraph at Web Summit on Nov. 4. Known for his quantitative easing theory, published almost 30 years ago, Werner is an advocate for a decentralized economy. In an exclusive interview with Cointelegraph’s editor-in-chief Kristina Lucrezia Cornèr, he discussed the challenges that surround decentralization, the role of central banks, and how blockchain can help promote transparency in economies. This interview was part of Cointelegraph’s extensive coverage at Web Summit in Lisbon — one of the world’s leading tech conferences. Cointelegraph: Do you think that a decentralized financial system is actually possible? Richard Werner:...

Canada to examine crypto, stablecoins, and CBDCs in new budget

The Canadian federal government is set to launch a consultation on cryptocurrencies, stablecoins, and Central Bank Digital Currencies (CBDCs) as revealed in its new mini-budget. The government’s “2022 Fall Economic Statement” released on Nov. 3 by Deputy Prime Minister Chrystia Freeland works as a fiscal update in conjunction with its main yearly budget. The statement included a small section on “Addressing the Digitalization of Money” that outlined the government’s crypto plans. It said the rise in cryptocurrencies and money digitalization is “transforming financial systems in Canada and around the world” and the country’s financial system regulation “needs to keep pace.” The statement opined that money digitalization “poses a challenge to democratic institutions around the world” h...

Singapore’s MAS says no urgent case for retail CBDC, but launches 4 fast trials of it

The Monetary Authority of Singapore (MAS) has wrapped up the first stage of its Project Orchid examination of a retail central bank digital currency (CBDC). According to the white paper released on Oct. 31, there is no “urgent case” for a retail CBDC in Singapore, but the study envisioned the infrastructure required in case a need arose. It also conceptualized a new model for digital currency — purpose-bound money — and pulled large Singaporean banks and government agencies into the research with a series of trials. Singaporean consumers do not need a retail digital dollar at present because of the high quality of services already available, the authors wrote. They indicated, however, that the most foreseeable use case may be for the benefit of the MAS rather than users: “Electro...

Hong Kong unveils completed retail CBDC project that has a CBDC-backed stablecoin

The Hong Kong Monetary Authority presented its completed Aurum retail central bank digital currency (CBDC) prototype on Oct. 21. The system, developed in conjunction with the Bank for International Settlements (BIS) Innovation Hub, has a unique structure that reflects the intricacies of the existing system for issuing money in Hong Kong. Aurum consists of a wholesale interbank system and retail e-wallet. The e-wallet is created at a local bank and has a smartphone interface. A validator system prevents bank over-issuance and user double redemption. The intermediated retail CBDC is used in the e-wallets, and CBDC-backed stablecoins are used in the interbank system. The unusual CBDC-backed stablecoins digitally mirror Hong Kong’s existing currency system, in which bank notes are issued by th...

Fed governor Waller says US CBDC would not enhance things the world loves about US fiat

A United States central bank digital currency (CBDC) would not enhance the qualities of the U.S. fiat dollar that foreign companies value most, U.S. Federal Reserve Board governor Christopher Waller in a speech released Oct. 14. CBDC skeptic Waller took a look at the question through the lens of national security at a symposium held at Harvard University. Waller had a more favorable view of dollar-backed stablecoin. The role of the U.S. dollar worldwide is an area where economics, CBDCs, and national security dovetail, Waller said. The indisputable primacy of the U.S. dollar in the world brings benefits to the United States and the other countries where the dollar plays a role in their economies or as a reserve currency. Just in: New speech Fed Gov. Christopher Waller – The U.S. Doll...

US lawmakers request Justice Dept share CBDC assessment

Republican members of the U.S. House Financial Services Committee have requested the Department of Justice provide its assessment and legislative proposals regarding a digital dollar within ten days. In an Oct. 5 letter addressed to U.S. Attorney General Merrick Garland, 11 Republican lawmakers asked the Justice Department for a copy of its “assessment of whether legislative changes would be necessary to issue a CBDC,” as required by President Joe Biden’s executive order on digital assets issued in March. The House members claimed the “appropriate place for the discussion” on legislation concerning a central bank digital currency would be in the U.S. legislative branch rather than the federal executive department. “The House Committee on Financial Services […] has spent considerable ...

The Caribbean is pioneering CBDCs with mixed results amid banking difficulties

The Caribbean region is in a tough situation for banking. The 35 nations comprising the region face challenges common to many tiny economies, such as dollarization and dependence on foreign trade and remittances. In addition, the increasingly common banking practice called de-risking is taking a heavy toll. So, it is probably no coincidence that the region is also at the forefront of digital currency adoption. Carmelle Cadet, the founder and CEO of banking solutions company Emtech, is a native of Haiti who has experience working with central banks in Haiti and Ghana. Her company is also a member of the new Digital Dollar Project Technical Sandbox Program that is exploring aspects of a United States central bank digital currency (CBDC). Cadet spoke to Cointelegraph about her experienc...

BIS marks CBDC pilot as ‘successful’ with $22M transacted

A multi-jurisdictional central bank digital currency (CBDC) pilot has been marked “successful” by the Bank for International Settlements (BIS) after a month-long test phase that facilitated $22 million worth of real-value cross-border transactions. The central banks of Hong Kong, Thailand, China and the United Arab Emirates took part in the pilot program along with 20 commercial banks from those regions. More than $12 million worth of value was issued onto the test platform, which facilitated 164 foreign exchange transactions and cross-border payments between the participating firms totaling over $22 million worth of value, according to a Tuesday LinkedIn post from the BIS. Graphic from the BIS on the CBDC pilot. Source: LinkedIn Daniel Eidan, an adviser and solution architect at the BIS,&...

Russia aims to use CBDC for international settlements with China: Report

Russia is in the pilot phase of its central bank digital currency development (CBDC), and new reports indicate that the country could use its national digital currency to settle international trade. According to a report published in Reuters, Russia is reportedly planning to use the digital rouble for mutual settlements with China by next year. The digital rouble is currently being tested for settling with the banks and is expected to be completed by early next year. The United States Treasury Department added 22 individuals and two Russia-based entities to the sanction list in the third week of September. With the growing sanctions against Russia from the West in the wake of the ongoing conflict with Ukraine, the country has been actively looking for alternate financial routes and trade s...

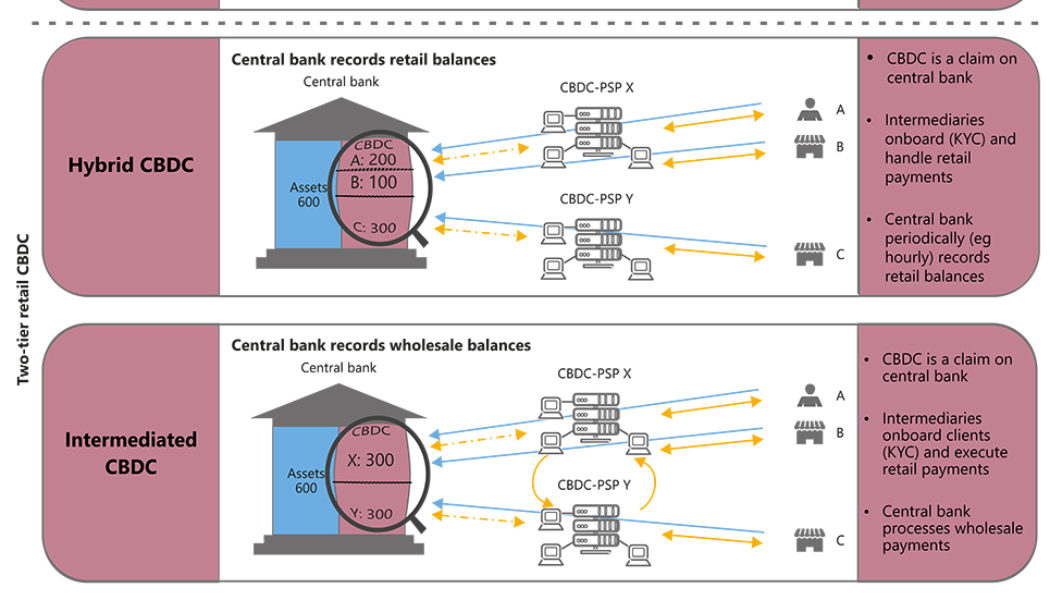

Hong Kong Monetary Authority provides update on retail CBDC that may become DeFi onramp

The Hong Kong Monetary Authority (HKMA) published a paper outlining the state of research on its proposed retail central bank digital currency (rCBDC) and plans for its further development. This is the third paper the HKMA has published on the e-HKD, as the proposed CBDC is called. The proposed rCBDC would have a two-tier structure consisting of a wholesale interbank system and the retail user wallet system. No wholesale Hong Kong CBDC has been introduced yet, but research on it began in 2017, four years before rCBDC planning started. The rCBDC would be disintermediated. The paper notes: “While it appears that e-HKD might not have an imminent role to play in the current retail payment market, we believe prospective use cases for e-HKD can emerge quickly out of the rapid evolution, or...