CBDC

US Treasury report encourages instant payment, recommends more CBDC research

United States President Joe Biden ordered more than a dozen reports to be written when he released his Executive Order (EO) 14067 “Ensuring Responsible Development of Digital Assets.” Five had due dates within 90 days, and the last three were published simultaneously by the Treasury Department on Sept. 16. The reports were prepared in response to instructions in Sections 4, 5 and 7 of the EO. The report ordered in EO Section 4 is titled “The Future of Money and Payments.” The report looks at the several payment systems currently in use that are operated by the Federal Reserve or the Clearing House, which is owned by a group of major banks. These will be supplemented by the non-blockchain FedNow Service instant payment system that is expected to begin operating in 2023. Stablecoins are intr...

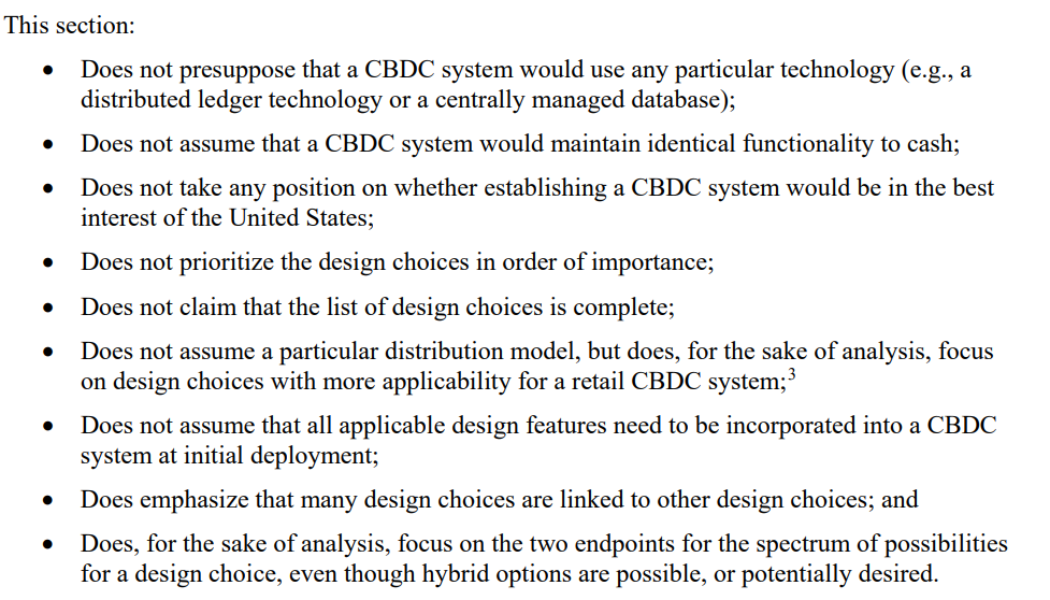

White House OSTP department analyzes 18 CBDC design choices for the US

As directed by the President of the United States, Joe Biden, the Office of Science and Technology Policy (OSTP) submitted a report analyzing the design choices for 18 central bank digital currency (CBDC) systems for possible implementation in the US. The technical analysis of the 18 CBDC design choices was made across six broad categories — participants, governance, security, transactions, data and adjustments. The OSTP foresees technical complexities and practical limitations when trying to build a permissionless system governed by a central bank, adding: “It is possible that the technology underpinning a permissionless approach will improve significantly over time, which might make it more suitable to be used in a CBDC system.” However, the analysis assumed there is a central authority ...

Exiled Myanmar democratic leaders want to issue CBDC to fund the revolution

Half a year after the military junta in Myanmar revealed its plans to launch a digital currency, the country’s government, ousted in a coup in 2021, voices its own intention to launch one using frozen national funds. In a Sept. 6 interview with Bloomberg, the minister of planning of exiled Myanmar’s National Unity Government, Tin Tun Naing, asked for the “U.S. blessing” to use “virtually” the country’s reserves, frozen by the Federal Reserve Bank of New York since Feb. 2021. The funds Naing mentions have been frozen on Singaporean, Thai and Japanese accounts and could amount to billions of dollars according to Bloomberg. While Naing doubts the United States could decide to allocate these assets directly to National Unity Government, he points to the possibility of using them as ...

Reserve Bank of India preparing to trial a CBDC with public sector banks and fintechs

The Reserve Bank of India (RBI) is in talks with fintech companies and state-controlled banks about a trial run of a central bank digital currency (CBDC), local publication Moneycontrol reported on Sept. 5. An unnamed public sector bank official told the publication that the trial may precede an RBI launch of a CBDC this fiscal year. U.S.-based financial services company FIS was mentioned as one of the fintech companies with which the RBI is consulting. FIS senior director Julia Demidova confirmed to Moneycontrol that, “FIS has had various engagements with the RBI […] and, of course, our connected ecosystem could be extended to the RBI to experiment various CBDC options.” FIS announced the launch of its CBDC Virtual Lab on Aug. 25. The company was already active in the CBDC sphere as ...

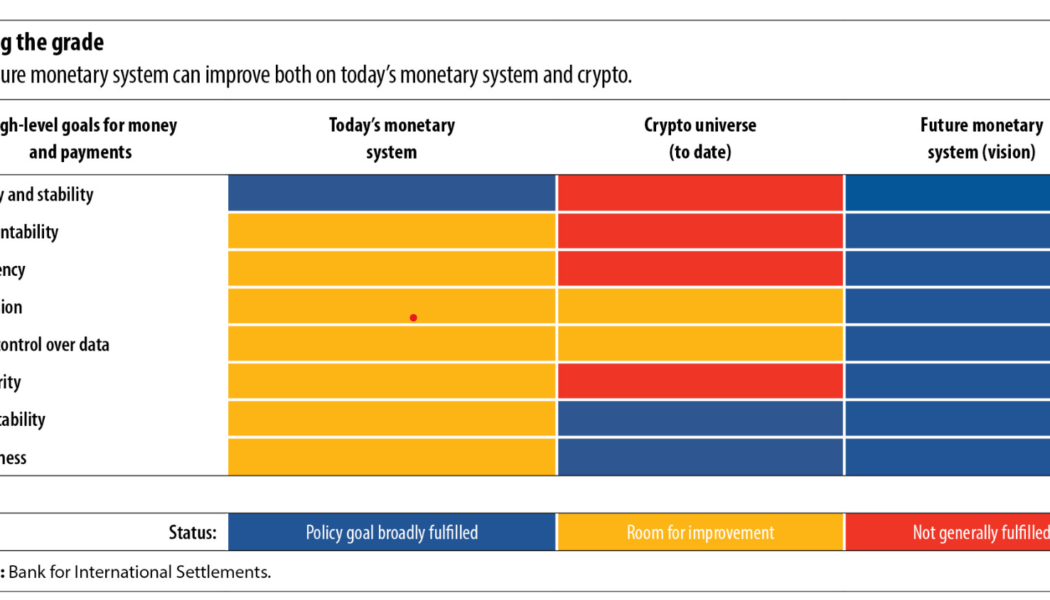

Crypto’s adaptability, openness key to ideal monetary system, say BIS execs

Governments across the globe see central bank digital currencies (CBDC) as a means to improve the existing fiat ecosystem. Cryptocurrency’s technical prowess supported by the central bank’s underlying trust is key to enabling a rich monetary ecosystem, suggests an International Monetary Fund (IMF) publication. “Digital technologies promise a bright future for the monetary system,” reads the publication attributed to IMF deputy managing director Agustín Carstens and BIS executives Jon Frost and Hyun Song Shin. A BIS study from June revealed that cryptocurrencies outdo fiat ecosystems when it comes to achieving the high-level goals of a future monetary system. Some of the most significant flaws preventing present-day cryptocurrencies from mainstream adoption, pointed out by the BIS exe...

Nigeria aims for millions of new eNaira users as it increases features, targets unbanked

The eNaira, Nigeria’s central bank digital currency (CBDC), will enter the second phase of its expansion with new technology to beef up its user base, Nigerian Central Bank governor Godwin Emefiele said Thursday, speaking at the 2022 eNaira Hackathon in Abuja. The eNaira, Africa’s first CBDC, was launched in October 2021. “The eNaira is a journey, not a one-time event,” Emefiele said, adding: “We don’t have a choice but to live with the fact that we are now in a digital economy, in a digital space, where the user[s] of cash will dissipate almost to zero.” “The second phase of the project has begun and is intended to drive financial inclusion by onboarding the unbanked and underserved users […] with a target of about 8 million active users,” Emefiele continued. The CBDC has had about 840,00...

Built to fall? As the CBDC sun rises, stablecoins may catch a shadow

There’s a ferment brewing with regard to central bank digital currencies (CBDCs), and most people really don’t know what to expect. Varied effects seem to be bubbling up in different parts of the world. Consider this: China’s e-CNY, or digital yuan, has already been used by 200 million-plus of its citizens, and a full rollout could happen as early as February — but will a digital yuan gain traction internationally? Europe’s central bank has been exploring a digital euro for several years, and the European Union could introduce a digital euro bill in 2023. But will it come with limitations, such as a ceiling on digital euros that can be held by a single party? A United States digital dollar could be the most awaited government digital currency given that the dollar is the world’s rese...

Russia plans to roll out digital ruble across all banks in 2024

The Bank of Russia continues working towards the upcoming adoption of the central bank digital currency (CBDC), planning an official digital ruble rollout in a few years. According to the Bank of Russia’s latest monetary policy update, the authority will begin to connect all banks and credit institutions to the digital ruble platform in 2024. That would be an important year for Russia as the country is expected to hold presidential elections in March 2024 and incumbent President Vladimir Putin has the constitutional right to get re-elected. By that time, the central bank expects to complete “real money” customer-to-customer transaction trials as well as the testing of customer-to-business and business-to-customer settlements. In 2023, the Bank of Russia also intend to conduct beta testing ...

Iran makes $10M import with crypto, plans ‘widespread’ use by end of Sept

Struggling through decades of economic sanctions, Iran has placed its first international import order using $10 million worth of cryptocurrency, according to a senior government trade official. News that the Islamic republic placed its first import order using crypto was shared by Iran’s Deputy Minister of Industry, Mine & Trade Alireza Peyman-Pak in a Twitter post on Aug. 9. While the official did not disclose any details about the cryptocurrency used or the imported goods involved, Peyman-Pak said that the $10 million order represents the first of many international trades to be settled with crypto, with plans to ramp this up over the next month, noting: “By the end of September, the use of cryptocurrencies and smart contracts will be widely used in foreign trade with ta...

The Bank of Thailand to pilot Retail CBDC by the end of 2022

On top of its wholesale central bank digital currency (CBDC) projects and proof-of-concept Retail CBDC testing with corporates, the Bank of Thailand (BOT) will extend the scope of CBDC development aimed at retail to a pilot phase. A possible real-life application of the “Retail CBDC” will be conducted inside the private sector on a limited scale. he Friday announcement on the official page of the BOT goes: “The BOT will assess the benefits and associated risks from the Pilot to formulate related policies and improve the CBDC design in the future.” The pilot is separated into two tracks. During the first one — a “Foundation track” — CBDC will be tested in cash-like activities, i.e., paying for goods and services, within limited areas and a scale of 10,000 retail users...

Board urges Bank of Central African States to introduce common digital currency: Report

The Bank of Central African States, or Banque des États de l’Afrique, which serves Cameroon, the Central African Republic, Chad, Equatorial Guinea, Gabon, and the Republic of the Congo, could be closer to releasing a central bank digital currency reportedly at the urging of its board. According to a Friday report from Bloomberg, the board sent an email calling for the regional bank to introduce a digital currency in an effort to modernize payment structures and promote regional financial inclusion. The Central African Republic, or CAR, passed legislation adopting Bitcoin (BTC) as legal tender in the country in April, but has not recognized a central bank digital currency, or CBDC. Nigeria’s central bank was one of the first in the region to launch a CBDC called the eNaira in October ...

China’s central bank to expand deployment of e-CNY

According to China’s state institution Xinhua News Agency, Lan Zou, head of monetary policy at the People’s Bank of China (PBoC), announced that the country would be expanding the number of digital yuan (e-CNY) test sites in the country from 11 to 23. They are spread out across 15 out of 31 of China’s provinces and autonomous regions. The PBoC is China’s central bank and is responsible for the development of the e-CNY central bank digital currency, or CBDC. During Wednesday’s press conference, Zou praised the success of the recent e-CNY rollout, stating: “e-CNY trials during the first half of 2022, such as acting as a means of payment during the Beijing Olympics, were spectacularly successful. The e-CNY has demonstrated to be an invaluable tool in ...