CBDC

French central bank head announces Phase 2 of wholesale digital euro project

The first phase of experiments with a wholesale digital euro has been completed, and Phase 2 experiments will begin this year, Banque de France governor François Villeroy de Galhau said Tuesday. Four or five new experiments are expected to be launched. Speaking at the Paris Europlace International Finance Forum, the French central banker summed up the European Union’s achievements in crypto-asset regulation under the French presidency, mentioning the Transfer Fund Regulation (Travel Rule) and Markets in Crypto-Assets (MiCA), specifically. The Eurosystem is looking at the scope and design of a digital euro central bank digital currency (CBDC). The main rationale for a retail digital euro is to maintain the role of central bank money in the economy even as it is “threatened by the digi...

CBDC may threaten stablecoins, not Bitcoin: ARK36 exec

Central bank digital currencies (CBDCs) do not pose any direct threat to cryptocurrencies like Bitcoin (BTC) but are still associated with risks in relation to stablecoins, one industry executive believes. According to Mikkel Morch, executive director at the digital asset hedge fund ARK36, a state-backed digital currency like the U.S. dollar doesn’t necessarily have to be a competitor to a private or a decentralized cryptocurrency. That’s because the use cases and value proposition of the decentralized digital assets “often go beyond the realm of simple transactions,” Morch said in a statement to Cointelegraph on Thursday. The exec referred to Federal Reserve Chair Jerome Powell who earlier this year hinted that the United States government would not stop a “well regulated, privately issue...

US lawmaker lays out case for a digital dollar

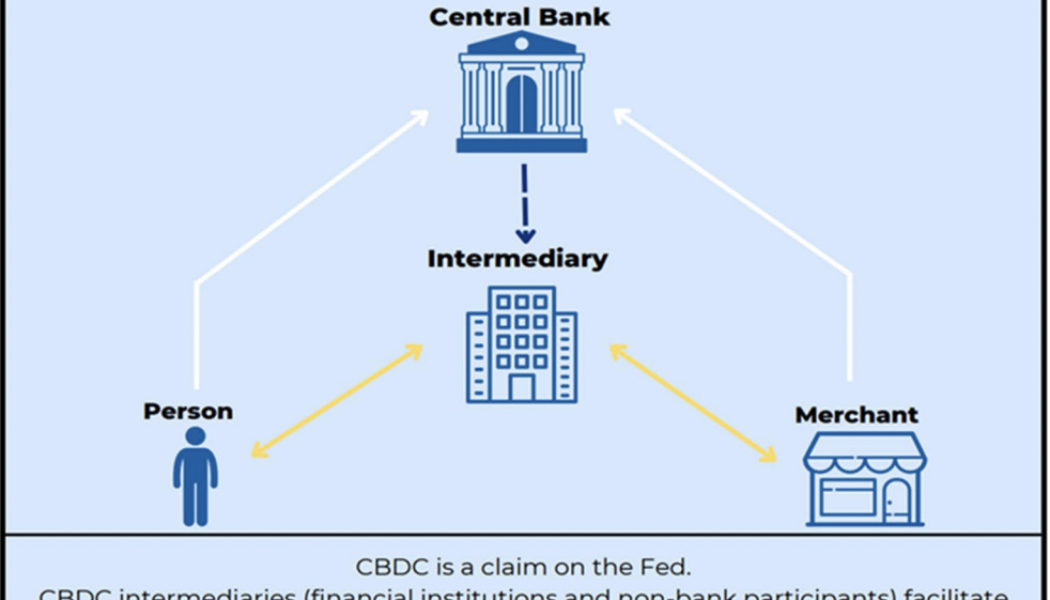

Connecticut House of Representatives member Jim Himes has released a proposal aiming to start a dialogue on the United States potentially launching a central bank digital currency, or CBDC. In a white paper released on Wednesday, Himes urged Congress to begin exploring the rollout of a digital dollar issued by the Federal Reserve to prevent the government from falling behind in innovations in financial technology. According to the U.S. lawmaker, a CBDC “should not be thought of as replacing legacy payment systems and currencies but as an additional alternative for consumers and businesses.” The white paper laid out a proposal in which a CBDC could present concerns over transparency, security and privacy when compared with fiat currency. Himes added that any regulatory framework on CBDCs en...

US central bank digital currency commenters divided on benefits, unified in confusion

In January, the United States Federal Reserve Board of Governors released a discussion paper on a potential U.S. central bank digital currency (CBDC) titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” The comment period for the paper ended May 20, with the Fed receiving over 2,000 pages of comments from individuals alongside responses from leading stakeholders. Cointelegraph read a selection of shareholder responses to the Fed paper, and it quickly became apparent that there are plenty of confidently stated opinions but little agreement among them. The main points of commonality are in the places they are all perplexed. The Fed wants to know Appropriately for its purpose, the Fed paper provides a broad overview of central bank digital currencies and CBDC-adj...

CBDCs can “kill” private crypto: India’s RBI deputy governor to IMF

In discussion with the International Monetary Fund (IMF), T Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), reflected an anti-crypto stance as he spoke about India’s potential to disrupt the crypto and blockchain ecosystem. Rabi Sankar started the conversation by highlighting the success of the Unified Payments Interface (UPI), India’s in-house fiat-based peer-to-peer payments system — which has seen an average adoption and transaction growth of 160% per anum over the last five years. “One of the reasons it is so successful is because it’s simple,” he added while comparing UPI’s growth with blockchain technology. According to Rabi Sankar: “Blockchain, which was introduced six-eight years before UPI started, even today is being referred to as a potentially revolut...

Brazilian central banker describes how CBDC system can halt bank runs

In a paper recently published by the Bank for International Settlements (BIS), Fabio Araujo, an economist at the Central Bank of Brazil (CBB) who is also responsible for the country’s central bank digital currency work, revealed that the monetary authority will have greater control over the population’s money once its CBDC is rolled out. Through the so-called Real Digital, the central bank will be able to halt bank runs and impose other restrictions on citizens’ access to money. Real Digital, the digital version of Brazil’s national currency, has been debated at the central bank since 2015 and will have its first tests in 2023 through nine solutions presented by private companies during the recent Lift Challenge event that was carried out by the CBB. Cointelegraph reported that the v...

NY Fed president urges colleagues to prepare for coming digital payment transformation

Get ready for a fundamental change in money and payments, John Williams, president and CEO of the Federal Reserve Bank of New York, told central bank officials, academics and financial industry leaders from around the world on Wednesday. Williams delivered the opening remarks at an invitation-only workshop on monetary policy implementation co-hosted by the New York Fed and Columbia University. The central banker dismissed much of the digital asset space with a single-sentence observation that not all cryptocurrencies are backed by non-crypto assets. Central bank digital currencies (CBDCs) and stablecoins backed by safe, liquid assets have the potential for innovation, he continued. Related: The United States turns its attention to stablecoin regulation Williams did not elaborate on the pos...

UN agency head sees ‘massive opportunities’ in crypto: WEF 2022

The United Nations is smitten with distributed ledger technology (DLT). In a conversation with Cointelegraph at WEF 2022, United Nations International Computing Centre (UNICC) director Sameer Chauhan explained the “massive opportunities” he sees in cryptocurrencies. [embedded content] A former traditional finance executive and head of the UNICC since 2018, Chauhan has seen the rise and fall of cryptocurrency markets. He shared that groups such as the Bank for International Settlements (BIS) do not want to “miss the boat” when it comes to DLTs. Chauhan explained that cryptocurrencies are neutral technologies: “It’s a tool. You could use it for good or you could use it for profiting—which is not bad. […] In the future, crypto will be a very strong component of how the world interacts a...

India to roll out CBDC using a graded approach: RBI Annual Report

Further cementing India’s decision to introduce an in-house central bank digital currency (CBDC) in 2022-23, the Reserve Bank of India (RBI) proposed a three-step graded approach for rolling out CBDC “with little or no disruption” to the traditional financial system. In February, while discussing the budget for 2022, Indian finance minister Nirmala Sitharaman spoke about the launch of a digital rupee to provide a “big boost” to the digital economy. In the annual report released Friday by India’s central bank, RBI revealed exploring the pros and cons of introducing a CBDC. In the report, RBI stressed the need for India’s CBDC to conform to India’s objectives related to “monetary policy, financial stability and efficient operations of currency and payment systems.” Based on this need, RBI is...

Falling Bitcoin price doesn’t affect El Salvador’s strategy: ‘Now it’s time to buy more,’ reveals Deputy Dania Gonzalez

Dania Gonzalez, Deputy of the Republic of El Salvador, was recently in Brazil to reveal her country’s experiences with the decision to adopt Bitcoin (BTC) as legal tender. Gonzalez’s invitation to Brazil came from digital influencer Rodrix Digital, who was recently in El Salvador to produce a documentary about cryptocurrencies. Among the lawmaker’s activities in Brazil was attending Bitconf 2022, as well as meeting with Dape Capital CEO Daniele Abdo Philippi and Ana Élle, CEO of Agency ROE. Between her agendas, Gonzalez spoke with Cointelegraph and revealed how Bitcoin has helped to change people’s lives in El Salvador and how the federal government, led by President Nayib Bukele, has been taking advantage of the resources invested in BTC to improve the economy. El Salvador jus...

Brainard tells House committee about potential role of CBDC, future of stablecoins

United States Federal Reserve vice chair Lael Brainard submitted a written statement in advance to the Financial Services Committee’s virtual hearing, “On the Benefits and Risks of a U.S. Central Bank Digital Currency (CBDC),” that took place Thursday. That was a sound strategic move, considering that more than 25 legislators lined up to ask questions. Brainard’s appearance before the committee came just after the close of the comment period for the Fed’s discussion paper, “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” However, recent events on the stablecoin market played a preemptive role in the framing of her statement. Brainard acknowledged the position of stablecoins in the economy, saying in her written statement. She said: “In som...