CBDC

Law Decoded: Tangible wins, new menaces and the global crypto taxation drive, Feb. 1–7

Every global event or major political crisis these days can trigger a digital asset-related conversation. As China welcomes the world’s top athletes to the Beijing 2022 Winter Olympics, showing off ultra-high-tech facilities and sports infrastructure, some United States politicians have raised concerns over the Games’ potential to act as a booster to the digital yuan’s adoption. In neighboring Myanmar, the military government that had overthrown the nation’s elected leadership a year ago is now looking into launching its own digital currency, not to project economic influence but to improve the domestic payments system and the struggling economy more broadly. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the las...

Central Bank of Jordan reveals CBDC plans

Central Bank of Jordan (CBJ) has revealed that it is researching issuing a digital currency. The central bank digital currency (CBDC) would be linked to the Jordanian dinar and have legal standing. Adel Al Sharkas, the governor of CBJ, has reportedly stated that his institution is researching the option of creating a legal digital currency. He also predicted that cryptocurrency trading might eventually be permitted in Jordan once the appropriate legislation is in place. He said: “With regards to the plans to issue a Jordanian digital currency, a study is underway to develop a legal digital currency linked to Jordanian dinar. It is possible in the future to allow cryptocurrency trading, after enacting [the] legislation and regulations.” Per the report, Sharkas’ comments were made duri...

COVID restrictions stymie digital yuan rollout at Beijing Winter Olympics: Report

Though athletes and support staff arriving for the Beijing 2022 Olympics still have the option of using digital currency for payments at many venues, the international test run of China’s CBDC is reportedly facing hurdles due to the pandemic. According to a Monday report from CNN, athletes, officials and journalists for the country’s Olympics games are largely separated from the population of China in a quarantine “bubble” to prevent the spread of COVID-19. These precautions combined with the Chinese government deciding to limit the number of in-person spectators may result in far fewer people testing the digital yuan as a method of payment at the major event. “The Olympic Games would have been the first real chance for tourists and Chinese nationals alike to familiarize themselves w...

U.S. Congressman calls for ‘Broad, bipartisan consensus’ on important issues of digital asset policy

In a letter to the leadership of the United States House Financial Services Committee, ranking member Patrick McHenry took a jab at “inconsistent treatment and jurisdictional uncertainty” inherent in U.S. crypto regulation and called for the Committee to take on its critical issues. McHenry, a Republican representing North Carolina, opened by mentioning that the Committee’s Democrat Chairwoman Maxine Waters is looking to schedule additional hearings addressing matters pertinent to the digital asset industry. He further stressed the need for identifying and prioritizing the key issues and achieving a “broad, bipartisan consensus” on the matters affecting the industry that holds immense promise for the financial system and broader economy. Citing the confusion that the industry faces due to ...

Bank of America says stablecoin adoption and CBDC is ‘inevitable’

It appears that the U.S. will finally be moving forward to create its own central bank digital currency (CBDC) according to the Bank of America. Bank of America crypto strategists Andrew Moss and Alkesh Shah wrote in a Jan. 24 note that CBDCs “are an inevitable evolution of today’s electronic currencies,” according to a Bloomberg report. The analysts wrote: “We expect stablecoin adoption and use for payments to increase significantly over the next several years as financial institutions explore digital asset custody and trading solutions and as payments companies incorporate blockchain technology into their platforms.” Meanwhile, a Jan. 20 report titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation” from the Federal Reserve Bank (FRB) weighed up the benefits and...

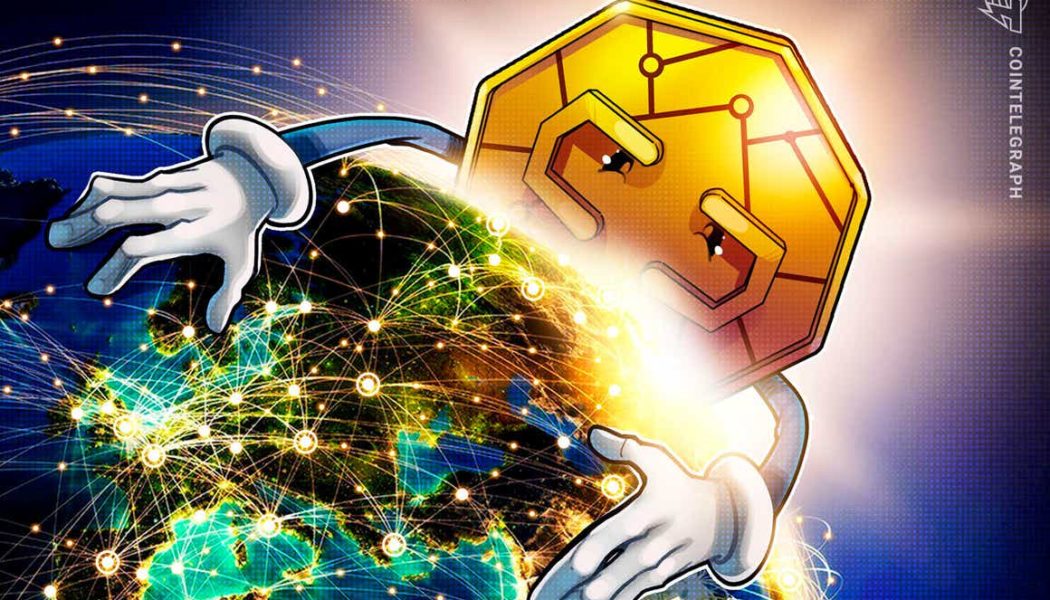

Vibe killers: Here are the countries that moved to outlaw crypto in the past year

Last week, Pakistan’s Sindh High Court held a hearing on the legal status of digital currencies that might lead an outright ban of cryptocurrency trading combined with penalties against crypto exchanges. Several days later, the Central Bank of Russia called for a ban on both crypto trading and mining operations. Both countries could join the growing ranks of nations that moved to outlaw digital assets, which already include China, Turkey, Iran and several other jurisdictions. According to a report by the Library of Congress (LOC), there are currently nine jurisdictions that have applied an absolute ban on crypto and 42 with an implicit ban. The authors of the report highlight a worrisome trend: the number of countries banning crypto has more than doubled since 2018. Here are the ...

Decentralized and traditional finance tried to destroy each other but failed

The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn’t destroy or damage the central banks just like traditional banking didn’t kill crypto. Why? To be fair, the fight between the two was equivalently brutal on both sides. Many crypto enthusiasts were screaming about the coming apocalypse of the world’s financial systems and described a bright crypto future ahead where every item could be bought with Bitcoin (BTC). On the other hand, bankers rushed t...

Law Decoded: First-mover advantage in a CBDC conversation, Jan. 10–17

Last week saw an unlikely first move in the opening narrative battle around a prospective U.S. central bank digital currency: Congressperson Tom Emmer came forward with an initiative to legally restrict the Federal Reserve’s capacity to issue a retail CBDC and take on the role of a retail bank. This could be massively consequential as we are yet to see a similarly sharp-cut expression of an opposing stance. As a matter of fact, it is not even clear whether other U.S. lawmakers have strong opinions on the matter other than, perhaps, condemning privately issued stablecoins as a digital alternative to the dollar. By framing a potential Fed CBDC as a privacy threat first, Emmer could tilt the conversation in the direction that is friendly to less centralized designs of digital money. Below is ...

Here’s why Minnesota rep Tom Emmer thinks the Federal Reserve is unfit to issue a CBDC

Tom Emmer has previously shown a preference for a decentralised digital currency as it would uphold user privacy and retain the elements of cash The US representative for Minnesota’s 6th congressional state, Tom Emmer, revealed yesterday that he intends to introduce new regulations around crypto. The proposed law from Emmer, who had hinted of it a day earlier, would bar the Federal Reserve from conducting any activity as a retail ban. In effect, it would prevent the Fed from issuing a central bank digital currency directly to consumers in the US. He insisted that unlike other countries, such as China, that have developed tokens lacking the “benefits and protections of cash,” a US digital currency should guarantee privacy to users and retain the US dollar’s hege...

China’s central bank releases pilot version of digital yuan wallet

As China’s central bank steps up its effort to create a digital currency, the country has released a pilot edition of its digital yuan wallet application on mobile phone app stores. The People’s Bank of China (PBoC) digital currency research institute developed the “e-CNY (Pilot Version)” app, which was available for download on Chinese Android and Apple app stores on Tuesday in Shanghai. According to a tweet from BlockBeats, a local news source, individual users in China now can download an earlier version of the app to test opening and managing a personal wallet, as well as digital yuan transactions. The e-CNY app is now available on iOS and Android app stores. This App is the official service platform of China’s CBDC for individual users to carry out pilot trials, providing e-CNY ...