China

Russia aims to use CBDC for international settlements with China: Report

Russia is in the pilot phase of its central bank digital currency development (CBDC), and new reports indicate that the country could use its national digital currency to settle international trade. According to a report published in Reuters, Russia is reportedly planning to use the digital rouble for mutual settlements with China by next year. The digital rouble is currently being tested for settling with the banks and is expected to be completed by early next year. The United States Treasury Department added 22 individuals and two Russia-based entities to the sanction list in the third week of September. With the growing sanctions against Russia from the West in the wake of the ongoing conflict with Ukraine, the country has been actively looking for alternate financial routes and trade s...

SEVENTEEN’s Jun Drops His Latest & Sexiest Solo Single ‘Limbo’: Watch

After SEVENTEEN wrapped the U.S. leg of their Be the Sun world tour, member Jun took no time to release a new solo track that keeps fans hot even as temperatures are cooling down. “Limbo” is the new single from Jun, the Chinese-born K-pop star who is one of the standout performers and dancers in SEVENTEEN, released in both Korean and Chinese. While Jun has previously focused on ballads and acoustic tracks when it comes to solo tracks, “Limbo” delivers his seductive side. The star purrs, “Listen, I’ve been looking for the love/ I wanna hear your voice/ You know what I mean?” over grinding, electro-pop production. The accompanying music video is equally bewitching. From rocking latex gloves and a crop top to giving his best sexy vampire character, Jun’s looks throughout the visual are only o...

China accounts for 84% of all blockchain patent applications, but there’s a catch

China accounts for 84% of all blockchain applications filed worldwide, according to the latest data shared by the country’s government official. China has steered clear of the cryptocurrency market. However, the Beijing government has been supportive of the underlying blockchain technology. The country has actively promoted the use of blockchain tech over the years, and thus the high percentage of blockchain patents isn’t surprising. President Xi Jinping has also played a key role in promoting the nascent blockchain technology. In 2019, the President called upon citizens, tech companies and stakeholders of the ecosystem to actively participate and innovate with the nascent tech as it would play a key role in the future of the next industrial revolution. As Cointelegraph reported earlier, C...

Blockchain incubator valued at $100M following NGC Ventures-led Series A

Blockchain-focused incubator and adviser PANONY has closed a Series A funding round backed by NGC Ventures, one of Asia’s largest crypto investment firms, putting the company on track to expand its portfolio and geographic presence. Although the funding terms weren’t disclosed, the Series A gave PANONY a valuation of $100 million, the company reported Monday. The Hong Kong-based PANONY said it would use the funds to expand into other jurisdictions, launch new service offerings and expand its networking capabilities. Founded in 2018 by Alyssa Tsai and Tongtong Bee, PANONY invests in blockchain- and Web3-focused startups and offers ongoing advisory and business support. The company maintains operations across Greater China, South Korea and the United States. While PANONY didn’t disclos...

In videos: 12 surreal man-made dive sites

From lost ancient cities to the world’s largest underwater theme park, these man-made dive sites are sure to intrigue At Atlas & Boots, we’ve dived some astonishing sites, from Steve’s Bommie in the Great Barrier Reef to the Sonesta plane wrecks in Aruba. We’re pretty hopeless at fish identification, so when it comes to diving, unless it’s a truly amazing reef system, we’re generally more interested in diving something new or unique (like an airplane or bommie). Enter the man-made dive site. We’ve scoured the Internet in search of videos of some of the most curious artificial dive sites out there – every one of which has now been added to our diving bucket list. Man-made dive sites From historic cities that have crashed into the ocean to artificial exhibitions installed ...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

Tech giant Meitu loses over $43M of its crypto investment in bear market

Hong Kong tech giant Meitu made headlines in April last year after it reported nearly $100 million in crypto holdings. However, with the advent of the bear market, the tech firm has lost nearly half of the valuation of its crypto holdings. According to a local media report, Meitu reported an impairment loss of over 300 million yuan, approximately $43.4 million, on their crypto holdings. An impairment loss is a loss in value of an asset when it falls below the carrying value of the investment. The financial filing revealed that the impairment loss has more than doubled from the last quarter, something the firm had anticipated earlier. The tech giant has said that its crypto holdings could impact the net loss of the company by the end of the first half of the year. In a July exchan...

Billboard China Announces Partnership With Tencent Music Entertainment Group

Billboard announced on Wednesday (Aug. 31) that the company has partnered with Tencent Music Entertainment Group to develop its new Billboard China brand. As the leading online music and audio entertainment platform in China, Tencent will work with Billboard to launch the “Chinese Music Gravity Project,” a pioneering initiative that will shine a spotlight on Chinese music artists through a series of engaging content collaborations and other features. By enlisting TME, Billboard will also share its global content — authoritative charts, expert recommendations, music news coverage and more — across the platform’s many channels, including QQ Music, Kugou Music, Kuwo Music and WeSing. As of late 2020, Tencent Music, which licenses Billboard China, controlled 77% of China’s streaming ...

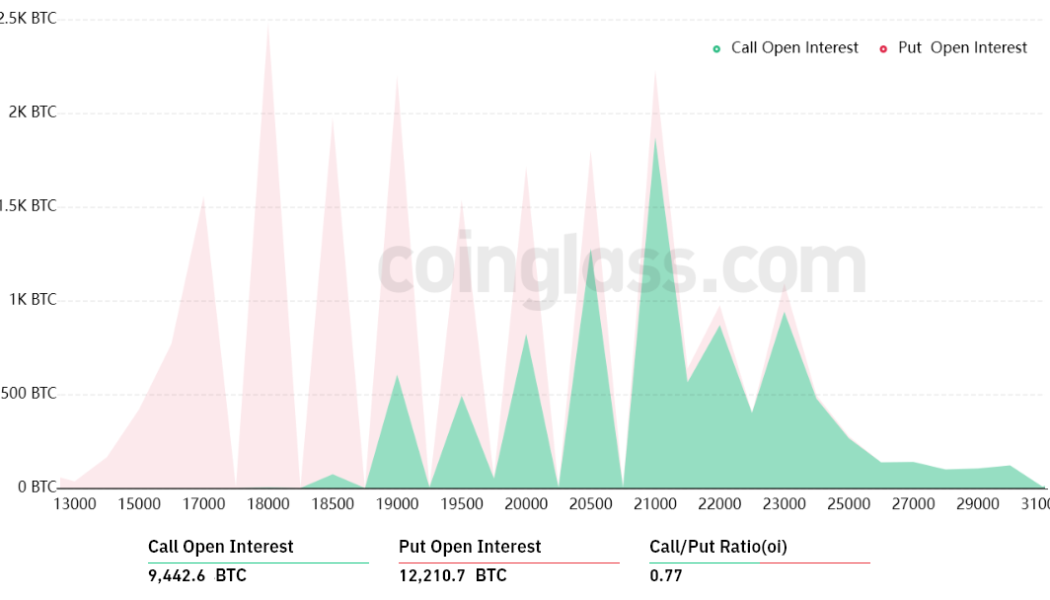

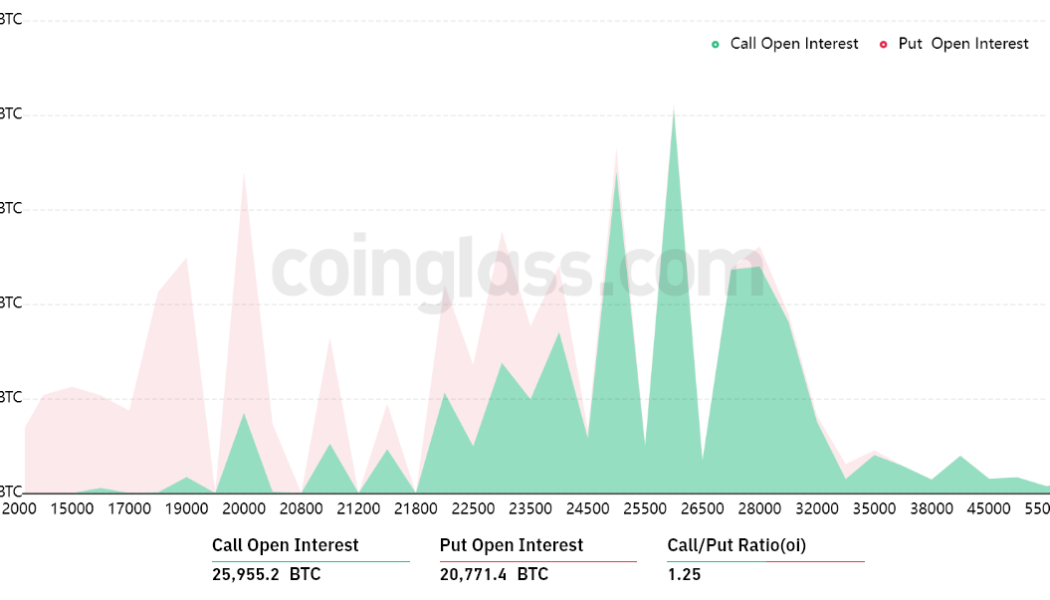

Data shows Bitcoin and altcoins at risk of a 20% drop to new yearly lows

After the rising wedge formation was broken on Aug. 17, the total crypto market capitalization quickly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion support, last seen on June 10, became even more distant. Total crypto market cap, USD billion. Source: TradingView The worsening conditions are not exclusive to crypto markets. The price of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the trend and is now trading at 3.16%. These are all signs that investors are feeling less confident about the central bank’s policies of requesting more money to hold those debt instruments. Recently, Goldman Sachs chief U.S. equity strategist David Ko...