Coinbase

Crypto layoffs mount as exchanges continue to be ravaged by the prevailing bear market

There’s no denying that the crypto market has been gripped by immense bearish pressure over the past year, as made evident by the fact that the total capitalization of this sector has continued to hover below the $900 billion mark for most of the year after having scaled up to an all-time high of $3 trillion in 2021. These conditions have been characterized by many companies facing insolvency, as well as many of the world’s top exchanges laying off their staff in recent months. Moreover, the recent FTX debacle has set in motion a contagion effect that has continued to have a major effect on several crypto platforms, dissuading newer investors from entering the space in the process. Since Q2 2022, a host of prominent crypto entities (including many digital asset trading and lending platform...

Coinbase agrees to $100M settlement with NY regulator

The New York State Department of Financial Services, or NYDFS, has reached an agreement with Coinbase following an investigation into the cryptocurrency exchange’s compliance program. In a Jan. 4 announcement, the NYDFS said Coinbase will pay a $50-million fine in response to violations of New York’s financial services and banking laws, as well as invest $50 million to correct its compliance program. According to the financial regulator, the crypto exchange had many compliance “deficiencies” related to anti-money laundering (AML) requirements. The NYDFS reported issues with Coinbase’s process for onboarding users and monitoring transactions. “Coinbase has acknowledged its failures in this respect to the Department,” said the NYDFS. “Furthermore, certain of these issues have been known to C...

Crypto exchange adoption boosts ENS registrations to over 2.2M

2022 proved to be a fruitful year for Ethereum Name Service, with the platform recording 2.2 million registered domains despite unfavorable market conditions for the cryptocurrency space. According to the service, over 80% of the total ENS domains created since the project’s inception were registered in 2022. Data from Dune Analytics shows that ENS has around 2.82 million names registered as of Jan. 2, with 630,340 owners of ENS domains. Happy New Year everyone! 2022 was an incredible year for ENS! Over 2.2m ENS names were registered in 2022 (that’s 80% of ALL names created) If you’re ready for 2023, drop your ENS below ✨ — ens.eth (@ensdomains) January 1, 2023 As Cointelegraph previously explored in an exclusive interview with founder Nick Johnson, ENS allows users to m...

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

Crypto billionaires lost $116B since March: Report

The bear market and the wave of bankruptcies in the crypto industry drained $116 billion from the pockets of founders and investors in the past nine months, according to recent estimates by Forbes. The loss represents the combined personal equity of 17 people in the space, with over 15 losing more than half of their fortunes since March. As a result, 10 names were removed from the crypto billionaires list. One of the major losses was attributed to Binance CEO Changpeng “CZ” Zhao. In March, his 70% stake in the crypto exchange was valued at $65 billion, but it is now worth $4.5 billion. Coinbase CEO Brian Armstrong has a net worth estimated at $1.5 billion, down from $6 billion in March. The fortune of Ripple’s co-founder Chris Larsen was reduced from $4.3 billion to...

Coinbase launches tool to recover ‘mistakenly sent’ ERC-20 tokens

Major cryptocurrency platform Coinbase has offered an asset recovery tool for users who “mistakenly send unsupported tokens” to exchange addresses. In a Dec. 15 announcement, Coinbase said users who sent any of roughly 4,000 ERC-20 tokens to a Coinbase address could recover their previously unrecoverable funds by providing “the Ethereum TXID for the transaction where the asset was lost and the contract address of the lost asset.” The exchange said certain ETC-20 tokens including Wrapped Ether (wETH), TrueUSD (TUSD), and staked Ether (STETH) would be eligible for recovery, with a 5% charge on transactions of more than $100. “Our recovery tool is able to move unsupported assets directly from your inbound address to your self-custodial wallet without exposing private keys at any point,” said ...

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

Coinbase CEO says trading revenue has fallen to ‘roughly half’ what it was last year

Coinbase CEO Brian Armstrong has revealed that the exchange’s trading revenue has declined by approximately 50% or more when compared with last year, according to a Dec. 7 report from Bloomberg. Armstrong made the statement as part of an interview with the David Rubenstein Show. When asked about the exchange’s revenue, he stated that the company did $7 billion in revenue and $4 billion in earnings in 2021, but “it’s looking, you know, about roughly half that or less” in 2022. Bloomberg said that a spokesperson for Coinbase later clarified that 2022 revenue, not earnings, was projected to be less than half what it was in 2021. Coinbase had previously stated in a letter to investors that it expected to post a roughly $500 million loss in adjusted EBITDA for 2022. Adjusted EBITDA is an earnin...

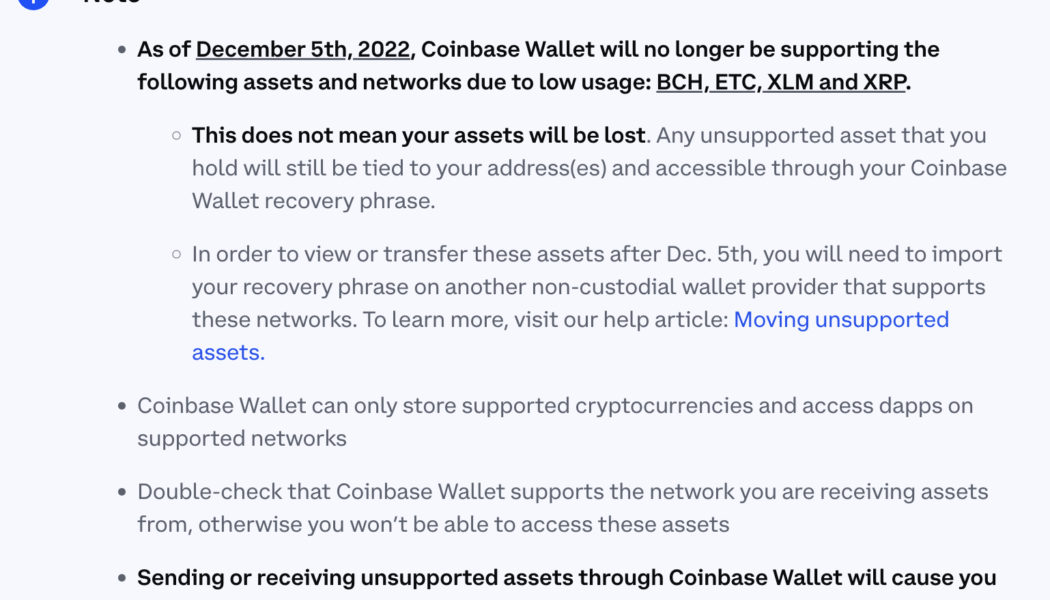

Coinbase Wallet will stop supporting BCH, ETC, XLM and XRP, citing ‘low usage’

Starting on Dec. 5, the Coinbase Wallet will no longer support four major tokens. In a Nov. 29 notice on its help pages, Coinbase said the wallet will no longer support Bitcoin Cash (BCH), XRP (XRP), Ethereum Classic (ETC), and Stellar (XLM) as well as their networks. The crypto firm cited “low usage” of the four tokens in its decision to stop support starting on Dec. 5. “This does not mean your assets will be lost,” said the announcement. “Any unsupported asset that you hold will still be tied to your address(es) and accessible through your Coinbase Wallet recovery phrase.” Source: Coinbase This story is developing and will be updated. [flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=&...

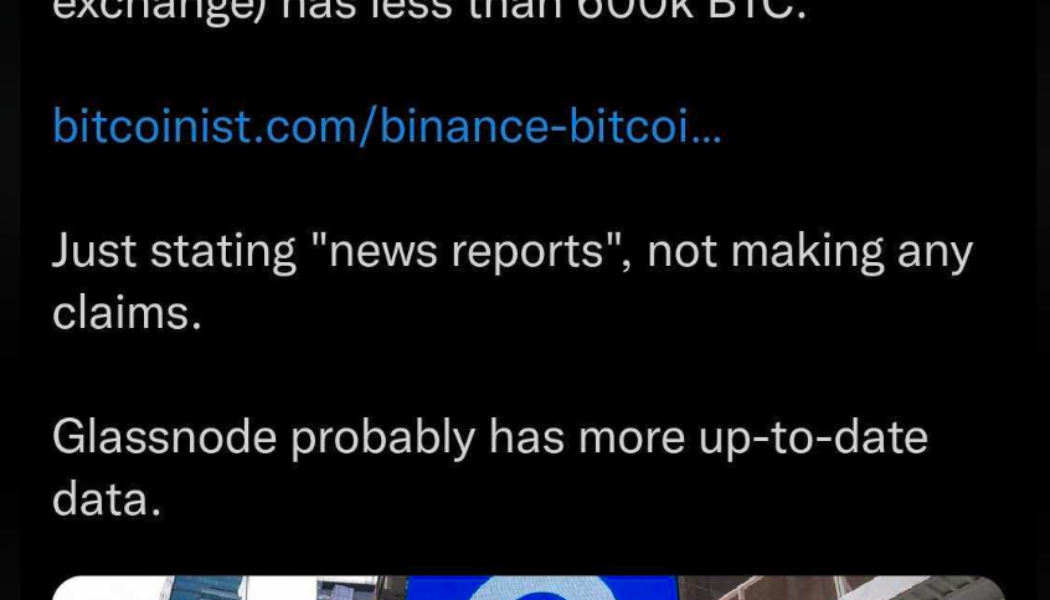

Crypto Twitter reacts to Binance CEO’s deleted tweet about Coinbase’s Bitcoin Holdings

Coinbase was trending on Twitter on Nov. 22 after Binance CEO Changpeng Zhao, known also as CZ, sent out a tweet that appeared to question Coinbase’s Bitcoin holdings. In the since deleted tweet, CZ referenced a yahoo finance article that alleged that “Coinbase Custody holds 635,000 BTC on behalf of Grayscale.” CZ added, “4 months ago, Coinbase (I assume exchange) has less than 600K,” with a link to a 4 month old article from Bitcoinist. The Binance CEO made it clear that he was simply quoting “news reports”, and not making any claims of his own. However, his tweet was not received well by the crypto community. A screenshot of CZ’s since-deleted tweet. Shortly after, Coinbase CEO Brian Armstrong indirectly responded to CZ in a series of tweets, stating; “If you see FUD ou...

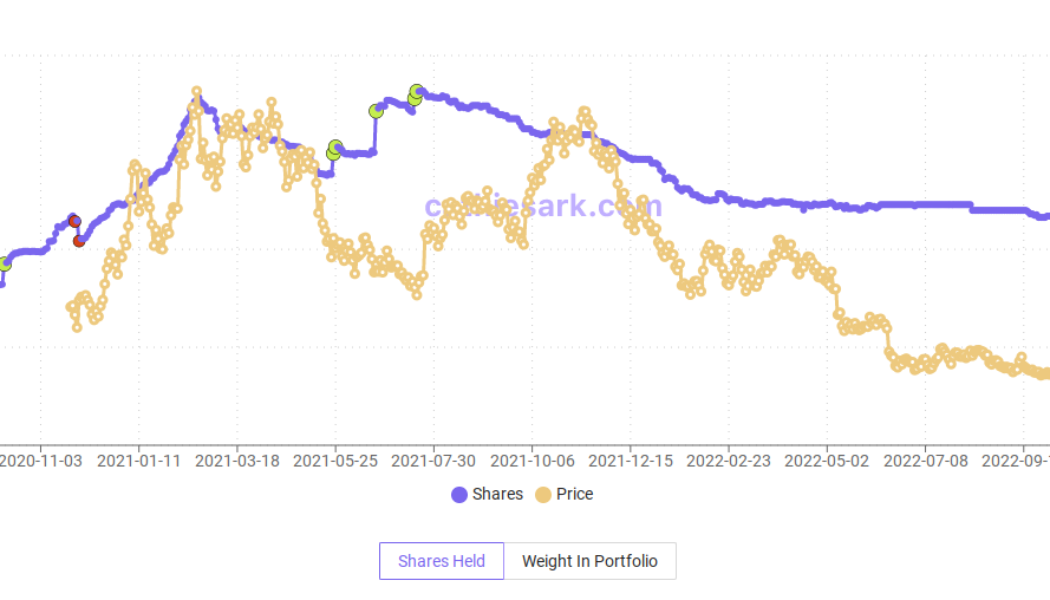

Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

Bitcoin (BTC) firms’ shares are a major “buy” for asset manager ARK Invest in the midst of the FTX meltdown. The latest data confirms that ARK continues to up its holdings of both exchange Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). Cathie Wood buys the dip With FTX contagion still rippling through the crypto industry, ARK’s decision to add exposure to two firms caught in the firing line stands out. According to numbers supplied by CEO Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on Nov. 21. These join a larger tranche of 273,327 shares from Nov. 15, that purchase completed just a week after FTX fell apart. ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s Ark Since then, GBTC has come under the spotlight as ...

GBTC Bitcoin discount nears 50% on FTX woes as investors stock up

The largest Bitcoin (BTC) institutional investment vehicle is coming under suspicion as it trades at a record discount. The Grayscale Bitcoin Trust (GBTC) is the latest Bitcoin industry entity to feel the heat from the debacle over defunct exchange FTX. FTX woes see Coinbase pledge trust in GBTC owner With contagion and fears over a deeper market rout everywhere in Bitcoin and altcoins at present, misgivings are impacting even the best-known — and trusted — crypto industry names. In recent days, it was the turn of GBTC, the long-embattled Bitcoin investment fund, amid problems at a related crypto firm, Genesis Trading. As Cointelegraph reported, parent company Digital Currency Group (DCG), as well as operator Grayscale itself, swiftly sought to reassure investors and the market that its fl...