Court

3AC subpoenas issued as dispute grows over claims of Terraform dump

A federal judge overseeing Three Arrows Capital’s (3AC’s) bankruptcy proceedings has signed an order approving subpoenas to be delivered to 3AC’s former leadership, including co-founders Su Zhu and Kyle Davies. The subpoenas require the founders to give up any “recorded information, including books, documents, records, and papers” in their custody that relates to the firm’s property or financial affairs. The infamous hedge fund, worth $10 billion at its peak, filed for Chapter 15 bankruptcy on Jul. 1 with its troubles tied up in too much leverage and the collapse of Terra Luna (LUNA), known now as Terra Classic (LUNC), and its algorithmic stablecoin formerly known as TerraUSD (UST). Since then, the liquidators — advisory firm Teneo — have been trying to hunt down the firm’s assets and pin ...

SBF’s lawyers terminate FTX representation due to conflicts of interest

Paul, Weiss, the law firm backing FTX CEO Sam Bankman-Fried (SBF) amid bankruptcy, renounced representing the entrepreneur, citing a conflict of interest. The decision to withdraw from representation after SBF’s tweets were found to disrupt the law firm’s reorganization efforts. Starting Nov. 14, SBF published a series of tweets that amassed extensive attention across Crypto Twitter. The move, however, sparked speculations that the cryptic tweets were used to distract bots from noticing concurrently deleted tweets. While no ill-intent could be concluded, Paul, Weiss attorney Martin Flumenbaum believed that SBF’s “incessant and disruptive tweeting” was negatively impacting the reorganization efforts: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, th...

South Korea seizes $104M from Terra co-founder suspecting unfair profits

While crypto exchange FTX stole the limelight from other fallen ecosystems, South Korean authorities continue their efforts to bring closure to the victims of the year’s first crypto crash — Terraform Labs. Nearly six months after the Terra (LUNA) blockchain was officially halted, South Korean authorities froze approximately $104.4 million (140 billion won) from co-founder Shin Hyun-seong based on suspicion of unfair profits. The decision to freeze Shin’s asset worth over $104 million was approved by the Seoul Southern District Court, which was based on a request from the prosecutors. The claim related to Shin’s involvement in selling pre-issued Terra (LUNA) tokens to unwary investors. Based on suspicion of profiting from unwarranted LUNA sales, the district court froze the allegedly stole...

You have our swords: 12 independent entities pledge legal support for Ripple

Fintech firm Ripple is garnering more support from the crypto and finance industry in its ongoing battle with the United States Securities and Exchange Commission (SEC). On Nov. 4, Ripple CEO Brad Garlinghouse proudly tweeted that the number of companies, developers, exchanges, associations and investors officially supporting the firm has reached 12. The pile of amicus briefs being filed is mounting up according to Ripple Labs general counsel Stuart Alderoty. An amicus brief is a legal document filed in appeals cases to aid the court by providing extra relevant information or arguments. These briefs are filed by amicus curiae, a Latin phrase that translates to “friend of the court.” “It’s unprecedented (I’m told) to have this happen at this stage,” Garlinghouse exclaimed. For those of you ...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...

Rex Orange County Charged With 6 Counts of Sexual Assault in the U.K.

British singer-songwriter Rex Orange County has been charged with six counts of sexual assault in his native U.K., Billboard has confirmed. The charges stem from an accusation that the artist (born Alexander O’Connor) twice assaulted a woman in the West End on June 1. That was allegedly followed by four additional assaults against the same woman the following day: once in a taxi and three more times at his home in London’s Notting Hill district. On Monday (Oct. 10), O’Connor denied all counts during an appearance at Southwark Crown Court in London. He has been set free on unconditional bail ahead of a provisional trial date on Jan. 3. The news was first reported by The Sun. “Alex is shocked by the allegations which he denies and looks forward to clearing his name in court,” said a represen...

Accused ‘shadow banker’ Reggie Fowler seeks a 6-month sentencing delay

Reggie Fowler, a former NFL team owner and alleged “shadow banker” who might face up to 30 years of imprisonment, asked the court of the Southern District of New York for a six-month adjournment. Technically, it was Fowler’s lawyer Ed Sapone who requested an “unusually long adjournment,” justifying it with his “serious medical condition” as well as with the necessity to obtain information relevant to the case from financial institutions, entities and individuals located in Europe. According to independent journalist Amy Castor, who reported this development, Sapone made his request on Saturday — three days before the scheduled sentencing. As the prosecutors didn’t protest the adjournment, it will grant Fowler at least six months of freedom. He now resides in Arizona on ba...

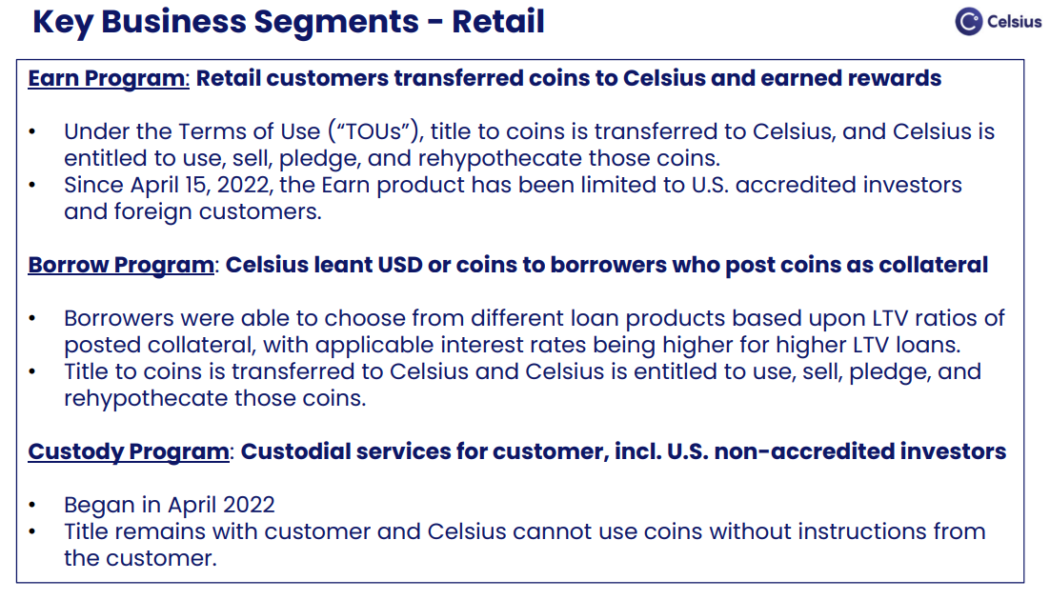

Tens of Celsius clients ask US court to recover $22.5M in crypto

The bankrupt cryptocurrency lender Celsius is facing more legal issues as disgruntled clients are taking action to recover their funds after the platform froze withdrawals in June. An ad hoc group of 64 custodial account holders at Celsius on Wednesday filed a complaint with the U.S. Bankruptcy Court for the Southern District of New York in order to recover their assets. According to court documents, the creditors are seeking to recover a total of more than $22.5 million worth of cryptocurrency assets collectively held in Celsius’ custody service. The ad hoc group is represented by bankruptcy-focused law firm Togut, Segal & Segal. The plaintiffs noted that Celsius has “not honored any withdrawals from any programs,” including custody services. According to the complaint, that contradic...

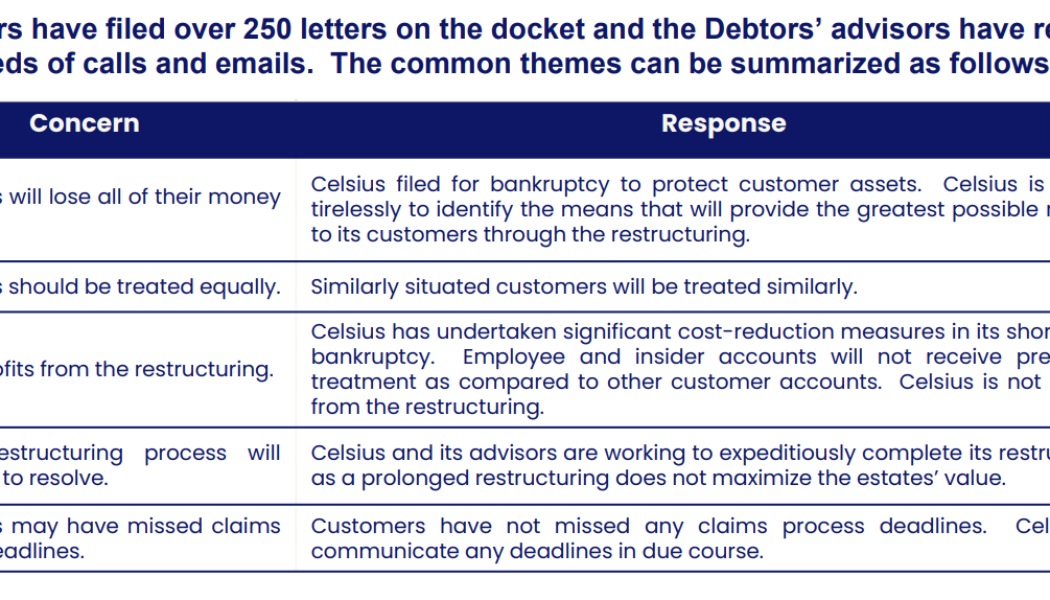

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

For greater good: NY judge allows Celsius to mine, sell Bitcoin

Not even 24 hours after revealing a three-month cash flow forecast that threatens total exhaustion of funds, a New York judge allowed crypto lender Celsius Network to mine and sell Bitcoin (BTC) during its bankruptcy. Since July 2022, Celsius Networks stands at the crosshair of United States officials after reports of bankruptcy surfaced, which risks losing the live savings of numerous crypto investors. Last week many got very upset with me as I said @CelsiusNetwork would run out of money & solutions needed to be acted upon faster. I was told I don’t understand Chapter 11. They have now confirmed they run out of money by October. https://t.co/CyzjgKpId7 pic.twitter.com/vBIRIGEmG2 — Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) August 15, 2022 During the second day of the case h...