Court

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Zipmex gets 3 month protection in Singapore amid halted withdrawals

Cryptocurrency exchange Zipmex has gotten a chance to sort out liquidity issues as a court in Singapore has granted the firm with more than three months of creditor protection. Singapore’s High Court has ruled to give each of the five Zipmex entities a moratorium until Dec. 2, 2022 to come up with a restructuring plan, Bloomberg reported on Monday. The action aims to protect Zipmex from potential creditor lawsuits during the moratorium period after the exchange abruptly halted crypto withdrawals on its platform in mid-July. The cryptocurrency has since resumed partial withdrawals from Zipmex’s trade wallet but is yet to resume all withdrawals. Zipmex sought creditor protection for a period of six months subsequently after halting withdrawals, filing five moratorium applications on July 27....

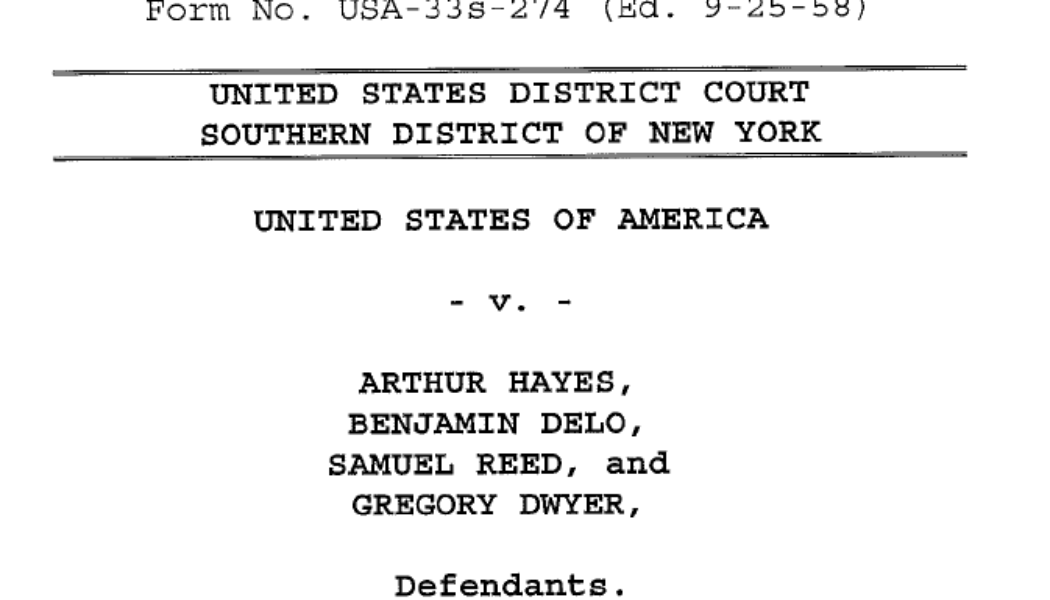

BitMEX former executive pleads guilty to violating the Bank Secrecy Act

Another top executive joins three co-founders of the crypto exchange BitMEX, pleading guilty in the United States District Court for the Southern District of New York. The court case under the headline “U.S. v. Hayes et al.” goes on for two years, with BitMEX management being indicted for violating the U.S. Bank Secrecy Act. According to the Wall Street Journal, on Aug. 8, a one-time head of business development at BitMEX, Gregory Dwyer, admitted his guilt of violating the Bank Secrecy Act in court. As part of a plea deal, Dwyer would pay a $150,000 fine. As Manhattan Attorney Damian Williams commented on this development: “Today’s plea reflects that employees with management authority at cryptocurrency exchanges, no less than the founders of such exchanges, cannot willfu...

Crypto Biz: The 3AC saga takes another bizarre twist

About eight months ago, I vouched pretty strongly for Su Zhu to be included in the prestigious Cointelegraph Top 100. My reasoning was pretty straightforward: Zhu was not only an influential figure on social media, but he ran arguably the most revered hedge fund in crypto — Three Arrows Capital, also known as 3AC. Then, the bear market of 2022 exposed 3AC as a house of cards run by founders who believed their own hype — and made reckless business decisions along the way. With the 3AC saga still unfolding, we received privileged information this week about the company’s remaining assets. The revelations aren’t good if you’re a 3AC creditor looking to be made whole again. Source claims 3AC’s Deribit exposure is worth much less than reported An anonymous source close to the 3AC debacle ...

SEC dismisses claims against John McAfee, fines accomplice for ICO promo

The United States Securities and Exchange Commission (SEC) obtained the final judgment for an initial coin offering (ICO) promotion scheme against late entrepreneur John McAfee and accomplice Jimmy Gale Watson, Jr., filed on October 5, 2020. In the original complaint, the SEC alleged that McAfee and Watson promoted ICO investments on Twitter without disclosing that they were paid for them. Watson allegedly assisted McAfee in negotiating promotional deals with ICO issuers and cashing out the crypto payments, among other pump-and-dump charges. The U.S. District Court for the Southern District of New York found Watson guilty of violating the law and imposed a cumulative fine of $375,934.86. In addition, Watson has been barred from participating in ICO-related issuance, purchase, offer o...

Celsius denies allegations on Alex Mashinsky trying to flee US

Troubled crypto lending firm Celsius is putting their best foot forward to recover operations alongside CEO Alex Mashinsky, who currently stays in the United States, the company has claimed. A spokesperson for Celsius has denied rumors that the company’s CEO tried to flee the U.S. last week amid the ongoing liquidity crisis of the Celsius Network. The representative told Cointelegraph on Monday that the firm continues working on restoring liquidity, stating: “All Celsius employees — including our CEO — are focused and hard at work in an effort to stabilize liquidity and operations. To that end, any reports that the Celsius CEO has attempted to leave the U.S. are false.” Celsius’ statement came shortly after Mike Alfred, co-founder of the crypto analytics firm Digital Assets Data, took to T...

Arthur Hayes to serve 2-year probation owning up to BitMEX’s AML mishap

Bringing closure to the long-awaited judgment related to the money laundering activities over the BitMEX crypto exchange, one of the four federal district courthouses in New York reportedly sentenced two-year probation and six months of home detention to founder and ex-CEO Arthur Hayes. Arthur Hayes, along with the other BitMEX co-founders — Benjamin Delo and Samuel Reed — and the company’s first non-employee Gregory Dwyer, pleaded guilty to the Bank Secrecy Act (BSA) violations on Feb 24, admitting to “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program at BitMEX.” Indictment against BitMEX co-founders and employees for violating BSA. Source: Justice.gov Pleading guilty to supporting money laundering is a punishable offense, often carrying a ...

UK Court recognizes NFTs as ‘private property’ — What now?

At the beginning of May, the British Web3 community celebrated an important legal precedent — the High Court of Justice in London, the closest analog to the United States Supreme Court, has ruled that nonfungible tokens (NFT) represent “private property.” There is a caveat, though: In the court’s ruling, this private property status does not extend to the actual underlying content that NFT represents. Cointelegraph reached out to legal experts to understand what this decision could possibly change in the British legal landscape. The theft of Boss Beauties In February 2022, Lavinia D. Osbourne, founder of Women in Blockchain Talks, wrote on Twitter that two digital works had been stolen from the Boss Beauties — a 10,000-NFT collection of empowered women that was created by “Gen Z chan...

Shanghai court affirms that Bitcoin is virtual property, subject to property rights

The Shanghai High People’s Court has issued a document in which it states that Bitcoin is subject to property rights laws and regulations. That finding was made in relation to a lawsuit filed in a district court in October 2020 involving the recovery of a loan of 1 Bitcoin (BTC). The lower court recognized Bitcoin as having value, scarcity and disposability, and therefore being subject to property rights and meeting the definition of virtual property. According to the Sina website, the Shanghai Baoshan District People’s Court ruled in favor of plaintiff Cheng Mou, ordering defendant Shi Moumou to return the Bitcoin. When the defendant failed to do so, the case was returned to the court, which held a mediation in May 2021. Since the defendant no longer had possession of the Bitcoin, t...

Chinese court rules marketplace guilty of minting NFTs from stolen artwork

A court in the Chinese city of Hangzhou ruled a one-of-a-kind judgment against a nonfungible token (NFT) marketplace for allowing a user to create (or mint) NFTs of stolen artwork. As reported by South China Morning Post, the court verdict toward the NFT marketplace was made after Shenzhen-based company Qice filed a lawsuit against NFTCN’s parent company, BigVerse. The lawsuit claimed that an NFTCN user stole a copyrighted artwork of Ma Qianli, a Chinese artist specializing in drawing and printing. The user of the NFT platform allegedly poached one of Ma’s creations of a cartoon picture. Based on the evidence collected, the court found the NFTCN platform guilty of not checking for forgery or intellectual property (IP) theft prior to allowing users to mint NFTs. As a result, NFTCN was charg...

EOS Network Foundation reveals plans to pursue a $4.1B lawsuit against Block.one

In a new chapter of the EOS community versus creators saga, the EOS Network Foundation’s (ENF) founder and “community-elected CEO” Yves La Rose revealed that they are preparing for a legal “war” against EOS creators Block.one. According to La Rose, they are reviewing any potential legal action “to seek $4.1B in damages.” Currently, the EOS leader mentioned that a Canadian law firm is working with them to explore what legal action they can take against the original developers of EOS. As Founder of @EosNFoundation I share your frustrations! We are taking further steps to hold @B1 accountable for its past actions and broken promises against #EOS. Review of ALL possible legal recourse to seek $4.1B in damages underway. Let’s do this together! #4BillionDAO coming — Yves La Rose (@BigBeard...

Law Decoded: Tangible wins, new menaces and the global crypto taxation drive, Feb. 1–7

Every global event or major political crisis these days can trigger a digital asset-related conversation. As China welcomes the world’s top athletes to the Beijing 2022 Winter Olympics, showing off ultra-high-tech facilities and sports infrastructure, some United States politicians have raised concerns over the Games’ potential to act as a booster to the digital yuan’s adoption. In neighboring Myanmar, the military government that had overthrown the nation’s elected leadership a year ago is now looking into launching its own digital currency, not to project economic influence but to improve the domestic payments system and the struggling economy more broadly. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the las...