crypto blog

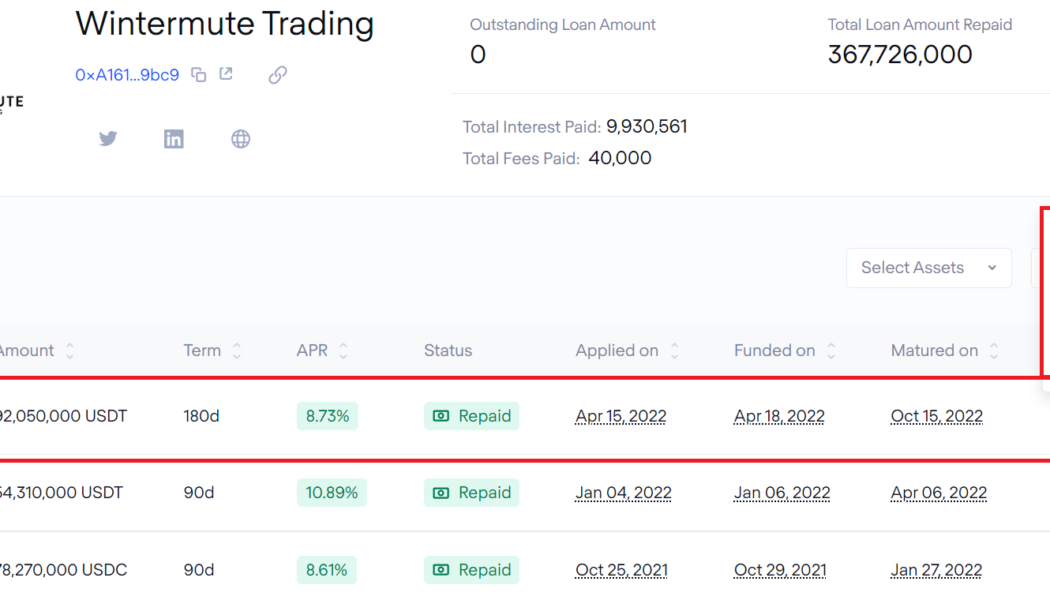

Wintermute repays $92M TrueFi loan on time despite suffering $160M hack

When Wintermute, a cryptocurrency market maker, lost $160 million due to a hack, concerns related to the repayment of debt worth $189.4 million surfaced. However, in an exciting turn of events, Wintermute paid back its largest debt due Oct. 15, involving a $92 million Tether (USDT) loan issued by TrueFi. After repayment of TrueFi’s $92 million loan, Wintermute still owes $75 million to Maple Finance in USD Coin (USDC) and wrapped ether (WETH) and $22.4 million to Clearpool, a total of $97.4 million in debt. Loan details show that Wintermute Trading had borrowed $92.5 million for a term period of 180 days. James Edwards from Libre Blockchain suspects that “some of the funds from their recent “hack” contributed to the payback.” He further claimed that BlockSec’s attempt to debunk...

Nodes are going to dethrone tech giants — from Apple to Google

While highly regarded even at the time of its writing, Marc Andreessen’s 2011 landmark essay, “Why Software Is Eating the World,” has proven even more prophetic than it seemed at the time. At the dawn of a decade when software would prove invaluable to nearly every aspect of modern life, Andreessen argued that every company was now ostensibly a software company, whether the company liked it or not. Tailoring his argument to many of the companies that were market leaders at the time, his ideas eventually also applied to companies that either hadn’t fully defined their markets or didn’t even yet exist but would go on to generate billions in market share: Uber, Lyft, TikTok/ByteDance, Robinhood and Coinbase, among several others. If you were going to be a unicorn in the 21st century, software...

It’s time for the feds to define digital commodities

This month, the European Union (EU) agreed on the text for a unified licensing regime for cryptocurrency exchanges to operate across the EU bloc as part of its Markets in Crypto Assets Regulation (MiCA). The United States — despite being a traditional global leader in legal frameworks for technological innovation — has not provided that same regulatory clarity. National cryptocurrency exchanges in the U.S. are regulated at the state level through a patchwork of money transmission laws that overburden companies while under-protecting consumers. In our view, many digital tokens are properly characterized as digital commodities rather than securities. Yet, a unified federal regime for cryptocurrency exchanges listing digital commodities does not exist. To create one, Congress must pass ...

What is a Web3 browser and how does it work?

A software program called a web service enables computer-to-computer communication over the internet. However, web services are nothing new and typically take the form of an application programming interface (API). The Web is a collection of related hypertext materials that may be accessed online. For example, a user examines web pages that may contain multimedia using a web browser and uses hyperlinks to move between them. Tim Berners-Lee, who was employed by CERN, The European Organization for Nuclear Research, in Geneva, Switzerland, invented the Web in 1989. Since then, Berners-Lee has actively directed the development of web standards and has pushed for the creation of the Semantic Web, also called Web3. The phrase “Web3” is used to characterize multiple evolutions of web intera...

Google and Coinbase strike a deal, BNY Mellon begins crypto custody and WisdomTree’s Bitcoin ETF gets denied: Hodler’s Digest, Oct. 9-15

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Starting in early 2023, Coinbase’s payment service, Coinbase Commerce, will facilitate crypto payments for customers purchasing Google’s cloud services thanks to a deal between the two companies. Google will only allow certain crypto assets for payment, including Bitcoin. Initially limited to certain participants, the option to pay with crypto will eventually be expanded to other customers, an executive at Google Cloud told CNBC. Google Cloud has taken several other steps toward crypto and blockchain industry ...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

What are CC0 NFTs, and why are they important?

As the Web3 world has largely promoted transparency and openness with code, NFT creators and teams are also opting for the same with art. However, that is just the beginning of the journey, and these nonfungible token creators and communities must realize that. CC0 can sometimes be portrayed as a logical conclusion where the NFT creators hand over the process of building on their creation to their community and beyond. Some NFT collections have had several derivative projects promoting the culture of the NFT almost as brand extensions. However, declaring a project as CC0 is just the beginning. NFT project teams and creators who take the CC0 route must actively promote the use of the brand and onboard other creators and projects to build brand extensions to their NFT collections. ...

‘No emotion’ — Bitcoin metric gives $35K as next BTC price macro low

Bitcoin (BTC) is showing textbook macro bottom signs in a “business as usual” bear market, data suggests. In fresh findings published on Oct. 13, popular Twitter trader Alan revealed that BTC price action is closely mimicking prior cycles. Trader on Stoch data: “Don’t be shaken out” While some are concerned about the current state of Bitcoin and crypto markets, on-chain indicators have long suggested that the 2022 bear market is comfortingly similar to previous ones. Eyeing the one-month stochastic chart for BTC/USD, Alan highlighted Bitcoin repeating a structure common to both the 2014 and 2018 bear markets. Stochastic oscillators are classic tools for identifying price cycles and bullish and bearish interplay. Bitcoin has proved to be no exception, with monthly low Stoc...

The SEC should be aiming at Do Kwon — But it’s getting distracted by Kim Kardashian

In less than a week, Terraform Labs founder Do Kwon’s passport will expire. Interpol issued a red notice for Kwon last month, and this month, his assets were reportedly frozen by the South Korean government. Kwon has been tweeting freely in response — and almost always denies the reports. “I don’t know whose funds they’ve frozen, but good for them, hope they use it for good,” he wrote in one message. Playing a game of cat and mouse with both the authorities and the public, Kwon seems to be living a life of freedom while enjoying his internet access. Meanwhile, regulators with the United States Securities and Exchange Commission have been highly vocal in reprimanding Kim Kardashian and other celebrities for shilling assorted cryptocurrency projects. Although they deserve to be rebuked...

Barely halfway and October already the biggest month in crypto hacks: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. October is historically associated with the bulls, but in 2022, the month has also become the leader in crypto hacks as barely halfway through, and the DeFi ecosystem has already seen nearly a dozen hacks resulting in losses of hundreds of millions of dollars. The largest hack occurred on Solana’s DeFi platform Mango Markets on Oct. 11, resulting in a loss of over $100 million worth of crypto. The hacker has now come out to demand $70 million in USD Coin (USDC) stablecoin as a bounty to return the stolen crypto. In another hack, TempleDAO was exploited for $2 million on the same day as Mango Market’s exploit. Movi...