crypto blog

Near Protocol partners with Google Cloud to support Web3 devs

Near Foundation has announced a new partnership between Google Cloud and Near Protocol, providing infrastructure for Near’s Web3 startup platform, Pagoda. According to an Oct. 4 announcement, this partnership will allow Google Cloud to provide “technical support” to Near grant recipients by providing infrastructure for Near’s Remote Procedure Call node provider to Pagoda. Near Protocol is a decentralized application (DApp) platform that focuses on usability among developers and users. It utilizes sharding technology to achieve scalability and, as a competitor to Ethereum, is also smart-contract capable and a proof-of-stake blockchain. Launched in February 2022, Pagoda is a startup platform that provides Web3 developers building on Near with a full-stack toolset to construct, launch a...

Taliban had a ‘massive chilling effect’ on Afghan crypto market: Report

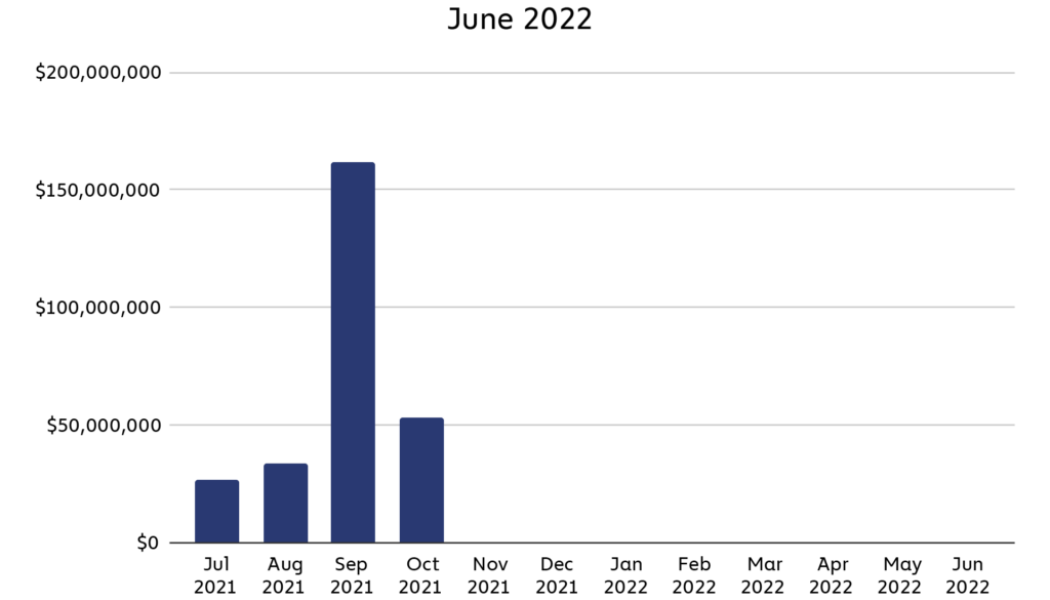

The Taliban’s takeover of Afghanistan has had a “massive chilling effect” on the local cryptocurrency market, bringing it to an effective “standstill,” according to a recent report. Blockchain analytics firm Chainalysis in an Oct. 5 report stated the Middle East and North Africa (MENA) region saw the largest crypto market growth in 2022 but noted that Afghani crypto dealers had three options: “flee the country, cease operations, or risk arrest.” The report states after the Taliban seized power in August 2021, crypto value received in August and September that year spiked to a peak of over $150 million, then fell sharply the following month. Before the takeover, Afghani citizens would on average receive $68 million per month in crypto value mainly used for remittances. That ...

EU Council approves MiCA text, proposal moves to Parliament for a vote

Representatives from a committee with the European Council have moved forward with regulating digital assets in the European Union through the Markets in Crypto-Assets, or MiCA, framework, sending the finalized text to parliament for a vote. According to an information note on Oct. 5, the European Council’s Permanent Representatives Committee approved the MiCA text and sent it to the chair of the European Parliament Committee on Economic and Monetary Affairs. Edita Hrdá, chair of the Permanent Representatives Committee, confirmed that the crypto framework proposal would be enacted “should the European Parliament adopt its position at first reading” in the same wording. The MiCA proposal, first introduced to the European Commission in September 2020, aims to create a consistent regulatory f...

Reversible blockchain transactions would improve cryptocurrency

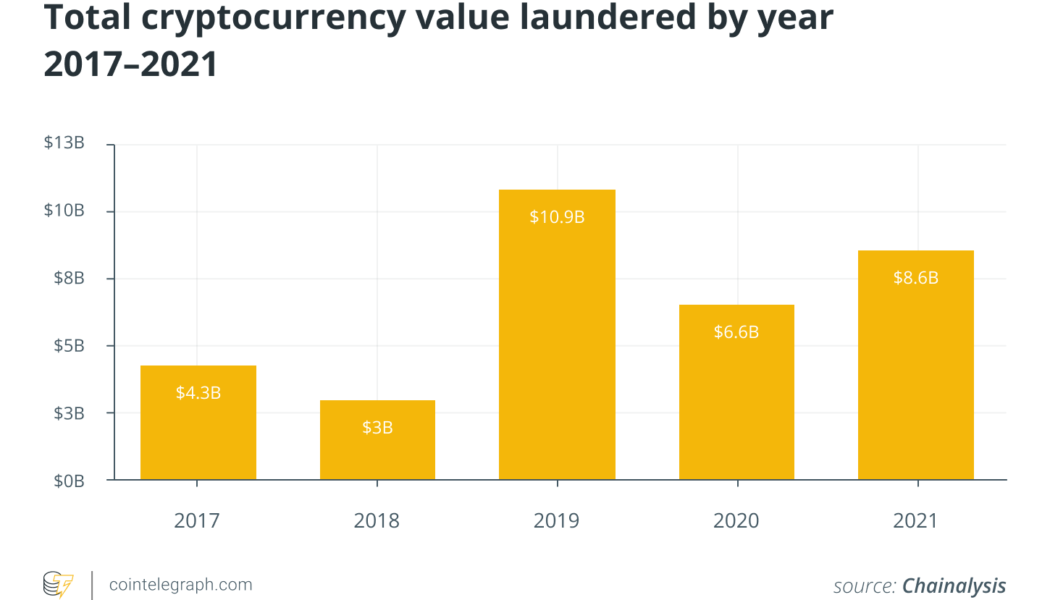

A proposal out of Stanford University to make crypto transactions reversible is adding a wrinkle to discussions of crime and fraud prevention. Researchers suggested that mutability — the ability to reverse blockchain transactions — would help prevent crime. One of the advantages of cryptocurrency is that it is possible for the market — individuals, traders and banks — to decide if reversibility is wanted. Not only would a new (reversible) cryptocurrency be able to test the acceptance or desire for reversible transactions, it would help to test the idea that reversibility reduces crime. Although cryptocurrency is not a tool of the dark web, it’s sometimes portrayed as such. Fraud, scams and other forms of crime do happen and are growing in proportion with the amount of money invested and th...

Russia blocks OKX website for alleged unreliable financial information: Reports

The website of crypto exchange OKX was blocked in Russia by the state media monitoring service Roskomnadzor on Oct. 4. The agency told the TASS news agency that the website was blocked at “the request of the Prosecutor General’s Office for the dissemination of unreliable socially significant information of a financial nature.” Roskomnadzor told local news outlet RBC that OKX had “published information related to the activities of financial pyramids, as well as information on the provision of financial services by persons who do not have the right to provide them” under Russian law. Although the website is blocked in Russia, it remains freely accessible through a VPN. According to another local report, the administration of the OKX Russian-language Discord channel stated, “We do not r...

Swiss data and analytics service Nuant prepares for the Q4 launch of the first unified platform for digital asset data, analytics & portfolio intelligence

Zug, Switzerland, 5th October, 2022, Chainwire Swiss-based digital asset data and analytics Fintech, Nuant, is launching a platform that solves a critical industry-wide portfolio management problem for institutional funds invested in digital assets: namely data fragmentation from exchange accounts, on-chain wallets, custodial wallets, on-chain data and market data by providing a single unified hub to manage, monitor and make accurate data-driven investment decisions for digital asset portfolios. For the first time, funds will now have access to accurate on-chain and market data, metrics, analytics and compliance tools for all current holdings as well as potential new assets into a portfolio, in one place, in real-time. The new service, which is targeted at digital asset portfolio managers,...

Talent Protocol supports the next generation of builders through the acquisition of Agora Labs

Lisbon, Portugal, 5th October, 2022, Chainwire Talent Protocol, the web3 professional community for high-potential builders, has acquired Agora Labs, a social token and NFT infrastructure platform for creators to build and scale their communities. The acquisition will not only integrate Agora’s tech stack and community into Talent Protocol, but also onboard its young talented founders, Matthew Espinoza (CEO) and Freeman (CTO) into the team. Despite being only a year old, Talent Protocol saw this acquisition opportunity as another way of working towards its mission of supporting the builders of tomorrow. The startup – founded by Pedro Oliveira, Filipe Macedo and Andreas Vilela – has been actively enabling ways of empowering talented tech professionals who have an entrepreneurial mindset and...

Crypto-friendly Ray Dalio steps back from Bridgewater’s $150 million fund

After 47 years in charge of the world’s largest hedge fund, Bridgewater Associates, its founder Ray Dalio has finished a leadership transition that began in February. He is no longer one of three co-chief investment officers but will remain a chief investment officer mentor and Operating Board member. As announced on Oct. 4 on Bridgewater’s corporate website, the firm and Dalio completed the necessary and required legal, regulatory and investor requirements to finish the transition procedure. From now on, the fund will be led by co-CEOs Nir Bar Dea and Mark Bertolini, and a pair of co-chief investment officers: Greg Jensen and Bob Prince. One of the most powerful figures in the global financial market, Dalio demonstrated a healthy evolution of his views on crypto. Back in 2017, he called B...

Nasdaq needs clear regulations to launch crypto exchange, says VP

Nasdaq, the American stock exchange, has no immediate plans of launching a crypto exchange until there’s better regulatory clarity from policymakers, said Tal Cohen, the company’s executive vice president. In an interview with Bloomberg, Cohen said that the retail side of the crypto market is fairly saturated and there are enough crypto exchanges catering to the needs of retail investors. He added that his firm would continue its focus on crypto custody services that were launched on Sept. 20. Cohen also shed some light on other crypto-related services that the exchange is working on, namely building execution capabilities on the platform to move and transfer assets. The world’s second-largest stock exchange might be hesitant to launch a crypto exchange in the United States, but the f...

Middle East and North Africa are fastest-growing crypto markets: Data

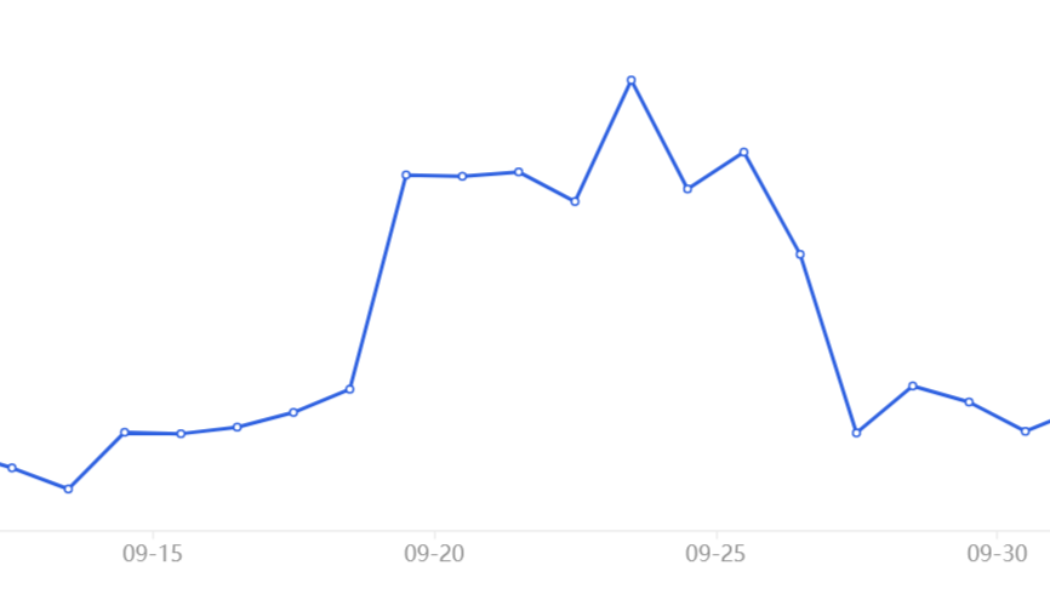

Emerging markets continue to forge their way into the crypto scene finding a plethora of use cases, especially in the combined Middle East and North Africa (MENA) region. A new report from Chainalysis reveals that the crypto market in the MENA region is the fastest growing in the world. Transaction volume in the MENA region reveals users received $566 billion in crypto in the time frame of July 2021 to June 2022. This is 48% more than the previous year. MENA is followed by Latin America and North America with a growth of 40% and 36%, respectively. This region is made up of approximately 22 countries which include emerging markets such as Morocco, Egypt and Turkey. In these countries, the usage of cryptocurrencies finds practical use cases in savings preservation and remittance payments. In...

Bitcoin still has $14K target, warns trader as DXY due ‘parabola’ break

Bitcoin (BTC) held $20,000 into Oct. 5 with trader targets still including a fresh high before rejection. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $21,000 upside target to precede new lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $20,470 on Bitstamp overnight before returning lower. The pair succeeded in maintaining the 2017 old all-time high as support, something on-chain analytics resource Material Indicators had hoped would endure as a positive sign. “BTC is still in a congested range,” it summarized in comments the day prior. “The retest of technical resistance at the 50-Day MA was rejected. Now I want to see a retest of support at the 2017 Top. Bulls may be losing momentum, but placed a buy wall at $20k to hold price up.” Material ...