crypto blog

Celsius’ co-founder Daniel Leon follows Mashinsky out as crypto exec flight continues

S. Daniel Leon, who cofounded Celsius with Alex Mashinsky in 2017, has quit his job as the bankrupt crypto lender’s chief strategy officer, CNBC reported Oct. 4, citing unnamed sources and an internal memo seen by the outlet. Bloomberg later reported receiving confirmation of Leon’s resignation from the company. Leon’s resignation comes one week after Mashinsky’s and is part of an apparently growing trend. Celsius filed for bankruptcy July 13, while it was under investigation by six American states and a month after freezing withdrawals. The company was reportedly $1.9 billion in debt at the time of its bankruptcy declaration. Mashinsky resigned Sept. 27, saying in a statement, “I regret that my continued role as CEO has become an increasing distraction, and I am very sorry about the diffi...

Three Arrows Capital fund moves over 300 NFTs to a new address

Starry Night Capital, a nonfungible-token (NFT)-focused fund launched by the co-founders of the now-bankrupt hedge fund Three Arrows Capital (3AC), has moved over 300 NFTs out of its address, according to reports. The Starry Night Capital was founded last year by Su Zhu and Kyle Davies, and pseudonymous NFT collector Vincent Van Dough. At the time, the fund planned to exclusively invest in “the most desired” NFTs on the market. Blockchain data provider Nansen on Oct. 4 on Twitter noted that the NFTs were reportedly shifted from a wallet associated with the fund, including “Pepe the Frog NFT Genesis,” which sold for 1,000 Ether (ETH) in October last year, worth $3.5 million at the time. Nansen said the NFTs previously collected by Starry Night Capital are...

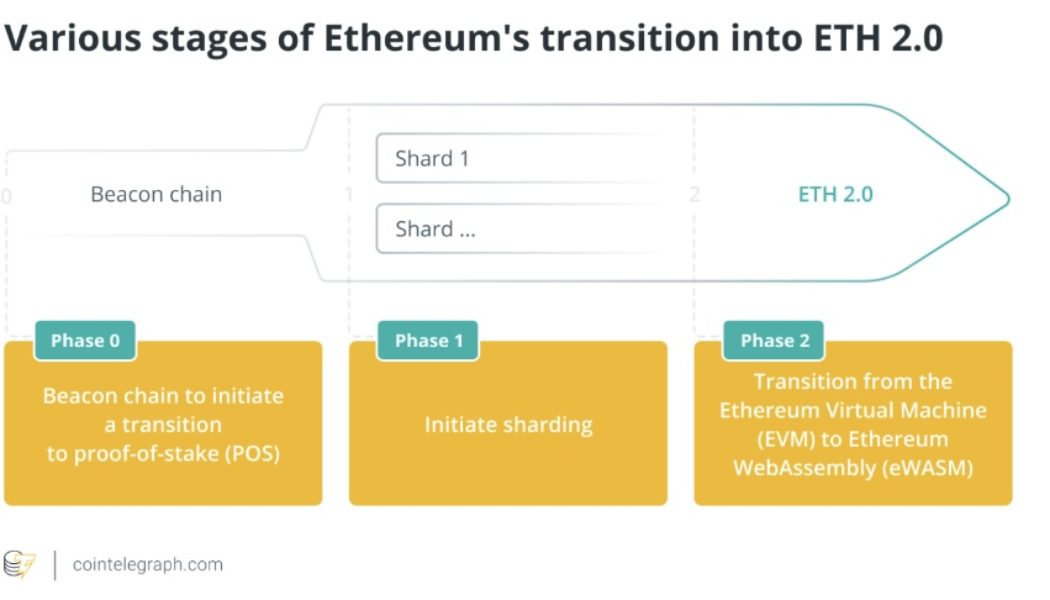

Federal regulators are preparing to pass judgment on Ethereum

Are regulators with the U.S. Securities and Exchange Commission gearing up to take down Ethereum? Given the saber-rattling by officials — including SEC Chairman Gary Gensler — it certainly seems possible. The agency went on a crypto-regulatory spree in September. First, at its annual The SEC Speaks conference, officials promised to continue bringing enforcement actions and urged market participants to come in and register their products and services. Gensler even suggested crypto intermediaries should break up into separate legal entities and register each of their functions — exchange, broker-dealer, custodial functions, etc. — to mitigate conflicts of interest and enhance investor protection. Next, there was an announcement that the SEC’s Division of Corporation Finance plans to add an O...

European Parliament members vote in favor of crypto and blockchain tax policies

Members of the Parliament of the European Union voted in favor of a non-binding resolution aimed at using blockchain to fight tax evasion and coordinate tax policy on cryptocurrencies. In an Oct. 4 notice, the European Parliament said 566 out of 705 members voted in favor of the resolution originally drafted by member Lídia Pereira. According to the legislative body, the resolution recommended authorities in its 27 member states consider a “simplified tax treatment” for crypto users involved in occasional or small transactions and have national tax administrations use blockchain technology “to facilitate efficient tax collection.” For cryptocurrencies, the resolution called on the European Commission to assess whether converting crypto to fiat would constitute a taxable event, depending on...

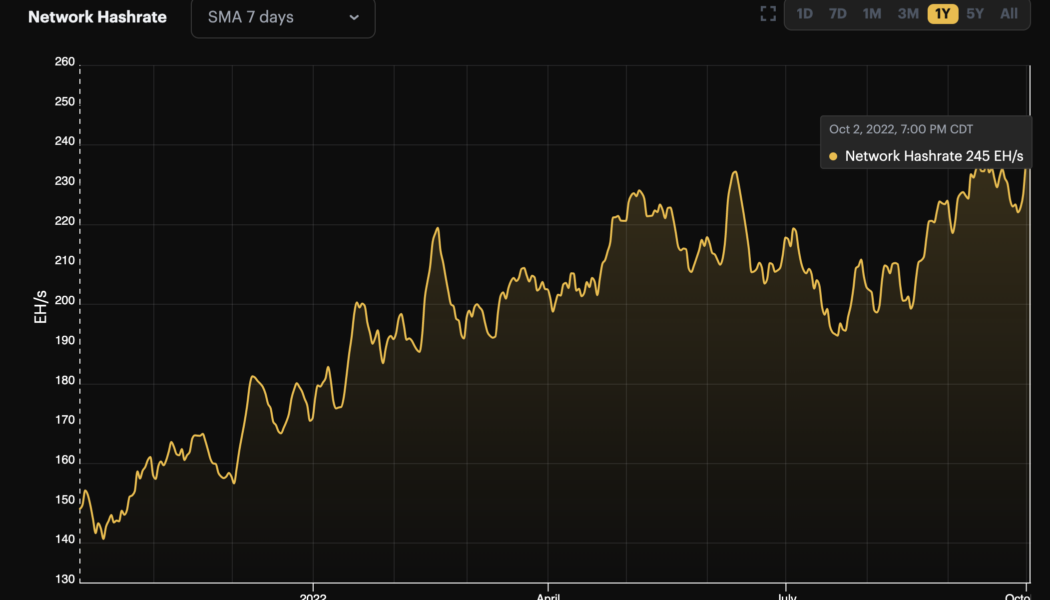

Bitcoin miner profitability under threat as hash rate hits new all-time high

The Bitcoin hash rate hit a new all-time high above 245 EH/s on Oct. 3, but at the same time, BTC miner profitability is near the lowest levels on record. With prices in the low $20,000 range and the estimated network-wide cost of production at $12,140, Glassnode analysis suggests “that miners are somewhat on the cusp of acute income distress.” Bitcoin network hash rate. Source: Hashrate Index Generally, difficulty, a measure of how “difficult” it is to mine a block, is a component of determining the production cost of mining Bitcoin. Higher difficulty means additional computing power is required to mine a new block. Utilizing a Difficulty Regression Model, the data shows an R2 coefficient of 0.944 and the last time the model flashed signs of the miners’ distress was during BTC...

Basel Committee: Banks worldwide reportedly own €9.4 billion in crypto assets

According to a new study published by the Basel Committee on Banking Supervision, a supranational organization responsible for setting the standards on bank capital, liquidity and funding, 19 out of 182 global banks supervised by the committee reported that theyowned digital assets. Combined, their total exposure to crypto is estimated to be €9.4 billion ($9.38 billion). In context, this represents 0.14% of the total risk-weighted asset composition of the 19 crypto-owning banks surveyed. When taken into account overall, cryptocurrencies only comprise about 0.01% of the total risk-weighted assets of all 182 banks under the Basel Committee’s supervision. Two banks made up more than half of the overall crypto-asset exposures, while four more comprised approximately 40% of the rema...

CFTC can issue summons through Ooki DAO’s help chat box, says judge

The United States Commodities Futures Trading Commission can serve members of the Ooki decentralized autonomous organization, or DAO, with summons through online communications, according to a federal judge. In an Oct. 3 order granting a CFTC motion, U.S. District Judge William Orrick said the commission could provide a copy of its summons and complaint through Ooki DAO’s help chat box as well as a notice on its online forum. The judge said the court’s decision was based on the CFTC effectively serving the Ooki DAO by providing the necessary documents. The CFTC filed a lawsuit against the Ooki DAO on Sept. 22, alleging the organization offered “illegal, off-exchange digital asset trading,” violated registration guidelines and broke provisions of the Bank Secrecy Act. The legal action came ...

Bitcoin price sees first October spike above $20K as daily gains hit 5%

Bitcoin (BTC) saw its first trip above $20,000 on Oct. 4 as traders expected familiar resistance to cap gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Multi-week dollar lows fuel Bitcoin bulls Data from Cointelegraph Markets Pro and TradingView showed BTC/United States dollar climbing prior to the Wall Street open, up over 5% in 24 hours. The pair had shaken off macroeconomic concerns at the start of the week, with trouble at Credit Suisse and the escalating Russia-Ukraine conflict failing to slow performance. Now, the short-term analysis focused on a run potentially topping out closer to $21,000 — as was the case late last month, as sell-side pressure at that level remained significant. “20500-21000 is a sell zone. If price gets there, which should, don’t be too bullis...

Latin Grammy Awards signs three-year contract for award show NFTs

This year’s 64th Latin Grammy Awards will have its first-ever nonfungible token (NFT) collection after the Latin Recording Academy signed a three-year contract for award show-related NFTs. The aforementioned partnership is between the Latin Recording Academy, which is behind the Latin Grammys, and OneOf, a Web3 music platform. Each collection, which will lead up to that year’s award show, will include drops highlighting Latin music. According to Manuel Abud, the CEO of the Latin Recording Academy, this is a new form of musical innovation and a way for fans to “own a piece of the Latin GRAMMYs:” “The Latin Recording Academy is committed to exploring innovative, new ways to celebrate excellence in Latin music and to connect music to other art forms in our culture, including visual and digita...

Ether exchange netflow highlights behavioral pattern of ETH whales

The exchange netflow of Ether (ETH) over the past couple of years highlights a behavioral pattern among Ether whales that market analysts believe is done to pump the price of the second-largest cryptocurrency. The “exchange netflow” is an indicator that measures the net amount of crypto entering or exiting wallets of all centralized exchanges. The metric’s value is simply calculated by taking the difference between the exchange inflows and the exchange outflows. Data shared by one of the pseudonymous traders of crypto analytic firm Cryptoquant indicates that ETH whales have consistently sent their holdings onto exchanges to raise the price of ETH and sell it at a higher market price. The Ethereum exchange netflow data confirmed the behavioral pattern among ETH whales and in...

Basel Committee crypto asset prudential treatment proposals get detailed responses

The comments period has ended for the Basel Committee on Banking Supervision (BCBS) “Second Consultation on the Prudential Treatment of Cryptoasset Exposures,” a document published in June 2022. International financial associations had a lot to say in response to it. Several did so at once in a joint 84-page comment letter released Oct. 4. In addition, there were a few lone voices, although they did not differ significantly in content from the conclusions made by the joint associations. All the commenters had the same basic message. Institute of International Finance (IIF) director of regulatory affairs Richard Gray, speaking on behalf of the joint associations working group that participated in the response letter, summed up the response when he told Cointelegraph in a stateme...