crypto blog

What remains in the NFT market now that the dust has settled?

Over the last two years, nonfungible tokens (NFTs) have emerged as one of the most active and noticeable aspects of Web3. The data stored on blockchains by NFTs may be connected with files that include various forms of media, such as photographs, videos and audio. In certain instances, it can even be related to physical items. The owner of an NFT will often have ownership rights over the data, material or item connected with the token, and these tokens are typically purchased and traded on specialized markets. The rise of NFTs was meteoric in 2021, but it hasn’t been very steady since then, and it seems to have fallen sharply in 2022. Why NFTs exploded in popularity in 2021 In 2021, two of the most active markets for NFTs were collectible art projects and the video game industry. NFT...

Transit Swap ‘hacker’ returns 70% of $23M in stolen funds

A quick response from a number of blockchain security companies has helped facilitate the return of around 70% of the $23 million exploit of decentralized exchange (DEX) aggregator Transit Swap. The DEX aggregator lost the funds after a hacker exploited an internal bug on a swap contract on Oct. 1, leading to a quick response from the Transit Finance team along with security companies Peckshield, SlowMist, Bitrace and TokenPocket, who were able to quickly work out the hacker’s IP, email address and associated-on chain addresses. It appears these efforts have already borne fruit, as less than 24 hours after the hack, Transit Finance noted that “with joint efforts of all parties,” the hacker has returned 70% of the stolen assets to two addresses, equating to roughly $16.2 million. These...

DOJ objects to Celsius plans to reopen withdrawals and sell stablecoins

The Department of Justice (DOJ) has submitted an objection to Celsius’ motion to reopen withdrawals for select customers and sell its stablecoin holdings. The DOJ is asserting that the state of Celsius’ financials are lacking transparency, and that key decisions like this should not be considered until the independent examiner report has been filed. The move by the DOJ adds to the objections filed last week by the Texas State Securities Board, the Texas Department of Banking, and the Vermont Department of Financial Regulation. All three are opposed to Celsius selling its stablecoin holdings, asserting there’s a risk the firm could use the capital to resume operating in violation of state laws. In a Sept. 30 filing with the Bankruptcy Court for the Southern District of New York, a U.S. Trus...

Sam Bankman-Fried sheds light on how FTX would approach a Celsius bid

FTX founder and CEO Sam Bankman-Fried have shared details on how his firm would approach a buy-up of Celsius’ tassets. The comments come in light of FTX US snapping up bankrupt crypto lender Voyager Digital’s assets for $1.3 billion via auction last week and a recent report that FTX was considering a bid for Celsius’ assets as well. Responding to a tweet from BnkToTheFuture founder Simon Dixon alleging FTX was “raising finance at a $32Billion valuation” in order to buy Celsius’ assets at “cents on the dollar,” Bankman-Fried clarified that his firm’s bid is determined at “fair market price, no discounts.” You up for discussing a plan to make up the difference with equity? I have some ideas that will make the community very happy with the ...

Robert Kiyosaki calls Bitcoin a ‘buying opportunity’ as US dollar surges

Robert Kiyosaki, businessman and best-selling author of Rich Dad Poor Dad has called Bitcoin, silver and gold a “buying opportunity” amid the strengthening United States dollar and continued interest rate hikes. In an Oct. 2 Twitter post to his 2.1 million followers, the author noted the prices of the three commodities — sometimes referred to as “safe haven” assets — would continue getting lower as the U.S. dollar strengthens, proving its worth once the “FED pivots” and drops interest rates. BUYING OPPORTUNITY: if FED continues raising interest rates US $ will get stronger causing gold, silver & Bitcoin prices to go lower. BUY more. When FED pivots and drops interest rates as England just did you will smile while others cry. Take care — therealkiyosaki (@theRealKiyosa...

Music NFTs a powerful tool to transform an audience into a community

As one of the oldest entertainment industries in existence, the music business has experienced many technological advances that enhanced widespread adoption. The digitalization of music meant that artists could reach any audience across the world, and digital distribution gifted people with unlimited access to music. With these advances in distribution came some drawbacks in music monetization. The way musicians make money in a digital format has reduced margins from media or video revenue. Artists have been pushed back to generating revenue from offline endeavors like concerts and selling merchandise as the online landscape has been filled with intermediaries that take a piece of the pie. “Web3 and existing platforms help us build a new chapter of the music industry.” Takayuki Suzuk...

Bitcoin price starts ‘Uptober’ down 0.7% amid hope for final $20K push

Bitcoin (BTC) failed to hold $20,000 into the September monthly close as one trader eyed a final comeback before fresh downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader’s $20,500 upside target remains Data from Cointelegraph Markets Pro and TradingView showed BTC/USD staying lower after finishing the month at around $19,400. Capping 3% losses, the monthly chart failed to rally on Oct. 1, with BTC/USD down another 0.7% in “Uptober” so far, according to data from on-chain data resource Coinglass. BTC/USD monthly returns chart (screenshot). Source: Coinglass Dismal financial data from macro markets contributed to the lack of appetite for risk assets, and among crypto traders, the outlook remained gloomy. For popular Twitter account Il Capo of Crypto, a return ...

Ethereum Merge spikes block creation with a faster average block time

The Merge upgrade for Ethereum (ETH), which primarily sought to transition the blockchain into a proof-of-stake (PoS) consensus mechanism, has been revealed to have a positive impact on the creation of new Ethereum blocks. The Merge was considered one of the most significant upgrades for Ethereum. As a result of the hype, numerous misconceptions around cheaper gas fees and faster transactions plagued the crypto ecosystem, which was debunked by Cointelegraph. However, some of the evident improvements experienced by the blockchain post-Merge include a steep increase in daily block creation and a substantial decrease in average block time. Ethereum blocks per day. Source: YCharts On Sept. 15, Ethereum completed The Merge upgrade after successfully transitioning the network to PoS. On the same...

Terra could leave a similar regulatory legacy to that of Facebook’s Libra

New draft legislation on stablecoins in the United States House of Representatives proposed to impose a two-year ban on new algorithmically pegged stablecoins like TerraUSD (UST). The proposed legislation would require the Department of the Treasury to conduct a study of stablecoins similar to UST in collaboration with the United States Federal Reserve, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation and the Securities and Exchange Commission. An algorithmic stablecoin is a digital asset the value of which is kept steady by an algorithm. While an algorithmic stablecoin is pegged to the value of a real-world asset, it is not backed by one. The stablecoin bill has been in the works for several months now and has been delayed on numerous occasions. Tre...

Next few weeks are ‘critical’ for stock market and Bitcoin, analyst says

The stock market’s movements in the next few weeks will be critical for determining whether we are heading towards a short-term recession or a long term-one, according to forex trader and crypto analyst Alessio Rastani. During the October-December 2022 period, the analyst expects to see the S&P rallying. “If that bounces or rally fails and drops back down again, then very likely, we’re entering a long-term recession and something very close to similar to 2008”, said Rastani in the latest Cointelegraph interview. [embedded content] According to the analyst, such a recession could last until 2024 and would inevitably negatively impact the price of Bitcoin (BTC). Talking about the latest Pound sterling crisis, Rastani opined that its principal cause is the rally of...

Binance launches New Zealand-based offices following regulatory approval

Global cryptocurrency exchange Binance has registered with New Zealand’s Ministry of Business, Innovation and Employment and opened local offices in the country. In a Sept. 29 tweet, Binance said it was registered as a financial service provider in New Zealand, allowing residents to access services including spot trading, nonfungible tokens and staking. The move to the crypto-friendly Pacific nation followed regulators in Dubai, Abu Dhabi, Kazakhstan and Italy giving the green light for Binance to open an offshoot. “New Zealand is an exciting market with a strong history of fintech innovation,” said Binance CEO Changpeng Zhao. New Zealand! We are kiwis. https://t.co/UtxbVlvXFV — CZ Binance (@cz_binance) September 30, 2022 New Zealand lawmakers and regulators have largely not imposed strict...

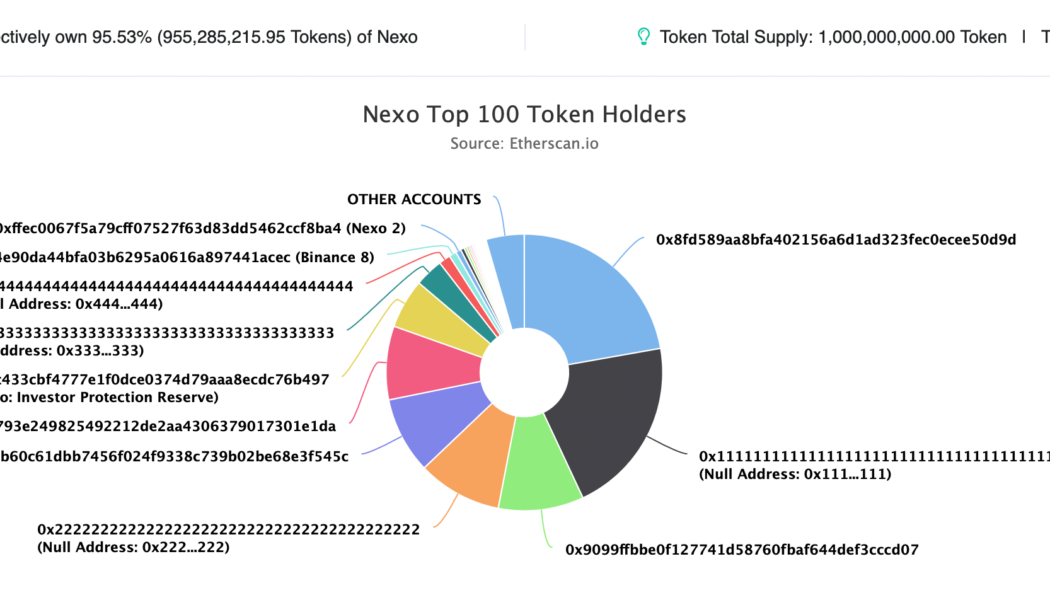

NEXO risks 50% drop due to regulatory pressure and investor concerns

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...