crypto blog

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

Ooki DAO members explore options in response to CFTC lawsuit

Members of the decentralized autonomous organization (DAO) called Ooki DAO have started looking into an appropriate response to the charges filed by the United States Commodities Futures Trading Commission (CFTC). On Sept. 22, the CFTC announced a $250,000 penalty and settlement with bZeroX, the creators of the decentralized lending platform bZx protocol which suffered from code exploits in 2020 that led to hundreds of thousands in losses. In addition to this, the CFTC also filed a lawsuit against Ooki DAO over similar alleged violations of digital asset trading laws. In response, Ooki DAO members started to discuss how they should respond to the lawsuit. The DAO identified three potential responses including allocating funds from its treasury toward hiring lawyers for the DAO members. The...

The Caribbean is pioneering CBDCs with mixed results amid banking difficulties

The Caribbean region is in a tough situation for banking. The 35 nations comprising the region face challenges common to many tiny economies, such as dollarization and dependence on foreign trade and remittances. In addition, the increasingly common banking practice called de-risking is taking a heavy toll. So, it is probably no coincidence that the region is also at the forefront of digital currency adoption. Carmelle Cadet, the founder and CEO of banking solutions company Emtech, is a native of Haiti who has experience working with central banks in Haiti and Ghana. Her company is also a member of the new Digital Dollar Project Technical Sandbox Program that is exploring aspects of a United States central bank digital currency (CBDC). Cadet spoke to Cointelegraph about her experienc...

Crypto startup to save iconic fiat money sculpture with 1M euros in funding

The paths of traditional finance and the cryptocurrency industry have intersected again, with a crypto startup coming to save the iconic “Euro-Skulptur” monument in Frankfurt. Frankfurt-based crypto startup Caiz Development will provide 1 million euros, or about $961,000, in funding over the next five years to rescue the famous sculpture depicting the symbol for the Euro. Announcing the news on Tuesday, Caiz said that the firm saw a good marketing opportunity in supporting the sculpture by obtaining unique exposure. Through the funding, the firm was able to put its product board next to the 14-meter-high art installation bearing 12 yellow stars, which represent the original members of the currency union. Euro monument and Caiz’s marketing program. Source: Caiz Development The iconic euro s...

Institutional appetite continues to grow amid bear market — BitMEX CEO

In a recent interview, BitMEX chief executive Alexander Höptner shared his thoughts about institutional investors who, in his view, still have an appetite for crypto and Ethereum. Speaking at the Token2049 conference in Singapore on Sept. 28, the crypto executive told Cointelegraph that there has not been a “single slowdown of institutional push into crypto” during this bear market. He added that institutions and finance industry players typically use bear markets for innovation. There is a lot more pressure to deliver in a bull market, but bear markets offer the luxury of more time. Höptner also commented that adoption for the finance industry has a long horizon which is why institutions will be buying and holding crypto assets while the opposite can currently be said for the retail secto...

Nexo ‘surprised’ by state regulators’ actions, says co-founder

Kalin Metodiev, the co-founder and managing partner of crypto lender Nexo stated his firm was “surprised” by the way in which eight state regulators publicly took action against it for securities violations. Earlier this week the California Department of Financial Protection & Innovation (DFPI) filed a desist and refrain order against Nexo’s Earn Interest Product, claiming the company was offering a security product that had not been cleared by the government for sale in the form of an investment contract. The DFPI also stated that it was joining regulators from seven other states in taking action against the company, including Kentucky, New York, Maryland, Oklahoma, South Carolina, Washington and Vermont. Speaking with Cointelegraph at Token2049, Metodiev explained that Nexo was caugh...

WSJ: Terraform Labs claims case against Do Kwon is ‘highly politicized’

Terraform Labs, the company behind the development of the Terra (LUNA) blockchain said South Korea’s case against its co-founder Do Kwon has become political, alleging prosecutors expanded the definition of a security in response to public pressure. “We believe that this case has become highly politicized, and that the actions of the Korean prosecutors demonstrate unfairness and a failure to uphold basic rights guaranteed under Korean law,” a Terraform Labs spokesman said to The Wall Street Journal on Sept. 28. South Korean prosecutors issued an arrest warrant for Kwon on Sept. 14 for violations of the countries capital markets laws, but Terraform Labs laid out a defense arguing Terra (now known as Terra Luna Classic (LUNC)) isn’t legally a security, meaning it isn’t covered by capital mar...

US lawmakers propose amending cybersecurity bill to include crypto firms reporting potential threats

United States Senators Marsha Blackburn and Cynthia Lummis have introduced proposed changes to a 2015 bill that would allow “voluntary information sharing of cyber threat indicators among cryptocurrency companies.” According to a draft bill on amending the Cybersecurity Information Sharing Act of 2015, Blackburn and Lummis suggested U.S. lawmakers allow companies involved with distributed ledger technology or digital assets to report network damage, data breaches, ransomware attacks, and related cybersecurity threats to government officials for possible assistance. Should the bill be signed into law, agencies including the Financial Crimes Enforcement Network and the Cybersecurity and Infrastructure Security Agency would issue policies and procedures for crypto firms facing potential cyber...

Genesis director to step down and move into advisory role

On Wednesday, Matthew Ballensweig, managing director of cryptocurrency broker Genesis, announced via Linkedin that he was formally leaving his post after over five years of tenure. Ballensweig is also the co-head of sales and trading. As told by Ballensweig, he has been transitioning his core responsibilities to a handful of trusted colleagues who will be taking the front-line role. “I am forever thankful to both Digital Currency Group [Genesis’ parent company] and Genesis for giving me the opportunity to build a capital markets business from the ground up. We built an eight-person company huddled in a small office in New York City back in 2017 to a sell-side trading behemoth doing billions in volumes in multiple countries today.” Ballensweig will stay with the firm...

JPMorgan’s CEO feels threatened by disruption in payment systems: Kevin O’Leary

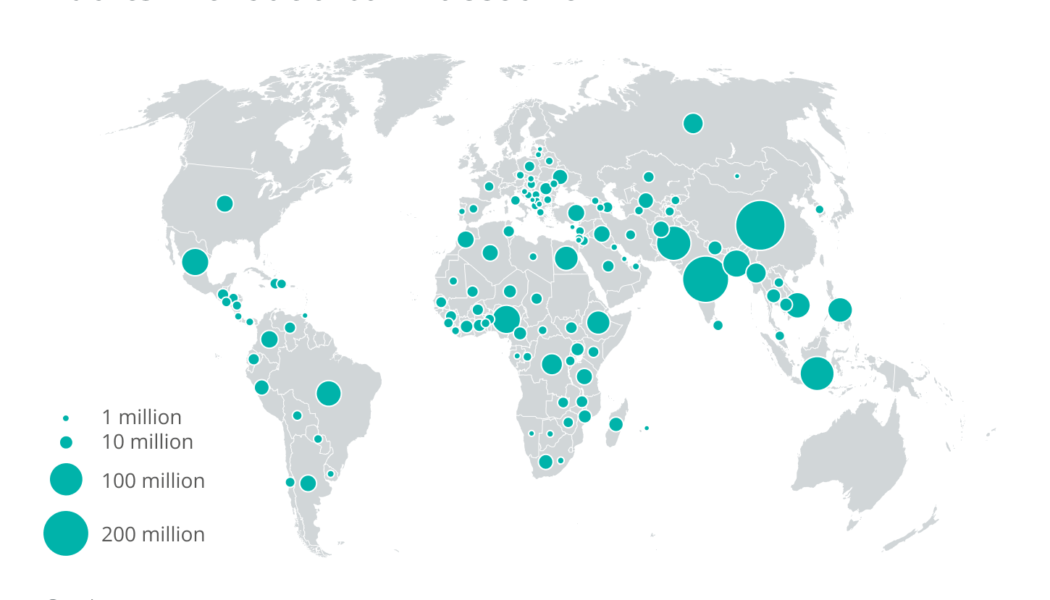

JPMorgan Chase’s CEO Jamie Dimon feels threatened by how the crypto space is disrupting the payment systems, stated the Shark Tank host and multi-millionaire venture capitalist Kevin O’Leary speaking at a Converge22 panel on Sept 28. O’Leary made his remarks after Dimon declared himself as a “major skeptic” on “crypto tokens, which you call currency, like Bitcoin,” referring to them as “decentralized Ponzi schemes” in his testimony to the United States Congress last week. Still on the panel, O’Leary explained that friction is one of the major problems in the traditional financial system and, plus, it’s how banks profit on transaction fees, adding that stablecoins could lead to a reduction in fees throughout the world. He stated: “...

Biden’s cryptocurrency framework is a step in the right direction

The White House released its first comprehensive framework this month for the Responsible Development of Digital Assets following President Joe Biden’s March 9 executive order. The order called for regulators to assess the industry and develop recommendations to safeguard investors while simultaneously promoting innovation. While more work is needed, the framework is a step in the right direction as it shows the willingness of regulators to provide the industry with the much-needed regulatory clarity it seeks. The framework’s recommendations addressed six key areas to protect market participants, offer access to financial services, and promote innovation. While Biden’s administration has focused more on just the protection of consumers in the industry in the past, it is encouraging t...